Foresight News brings you a quick review of the hot topics and recommended content of the week:

01 Open Letter from Hyperliquid Sparks Governance Controversy

"A Validator's Perspective: A Letter to the Hyperliquid Team"

02 AI Agent Landscape

"Top 10 Crypto AI Trends by 2025"

"Five Trends! The Tide of Crypto and AI Agent Convergence is Surging Here"

"The Soul of the AI Agent: Crypto Contracts"

"From AI Agents to AI L1: Virtuals, ai16z, and zerebro Dance Together"

"AI Gold Rush | Aiccelerate DAO: Accelerating the Development of Decentralized Open-Source AI"

03 Industry Insights

"Pantera Partner: Which DePIN Projects Have Real Revenue?"

"Usual Bonds Unanchored, RWA Stablecoins Face Volatility Test"

"a16z: 5 Indicators to Watch for Crypto Industry Development"

"Rate Hike Slowdown, Will the Crypto Market Enter Winter Again?"

"Five Catalysts, Will ETH See a Comeback This Year?"

"A Forbes Analyst Shares: Why a Traditional Value Investor Bets on Bitcoin?"

04 Project Observation

"MicroStrategy 2.0: Can Solv Become the On-Chain 'Bitcoin Wealth' Company?"

"Solayer Chain Quick Read: The Era of Millisecond Transactions Arrives?"

01 Open Letter from Hyperliquid Sparks Governance Controversy

On January 8th, Kam, an employee of node operator Chorus One, posted an open letter on social media, pointing out the many problems currently facing Hyperliquid. This statement quickly sparked a lot of discussion in the community about Hyperliquid's governance. Let's take a look at what this controversial open letter said.

《A Validator's Perspective: A Letter to the Hyperliquid Team》

This letter is written to the Hyperliquid development team, hoping the team can take the time to review this feedback on the management of the Hyperliquid Blockchain.

Key points:

- Due to the lack of open-source code, documentation, and dependence on centralized application programming interfaces (APIs), validators face major challenges, resulting in frequent imprisonment and unstable performance.

- The testnet incentive measures have spawned an Altcoin black market, benefiting large holders rather than fairly selecting validators.

- The validator rewards on the mainnet are too low to meet the high self-staking requirements, and the degree of decentralization is limited, as 81% of the staking shares are controlled by the foundation nodes.

- To compete with mainstream Layer 1 blockchains, Hyperliquid must increase transparency, reduce staking centralization, implement a fair validator selection process, and strengthen interaction with external validators.

02 AI Agent Landscape

Author Teng Yan predicts that by 2025, there will be at least 10 new crypto-AI protocols with a market capitalization of $1 billion or more. Recommended articles:

《Top 10 Crypto AI Trends by 2025》

Currently, crypto-AI tokens only account for 2.9% of the Altcoin market capitalization. But this situation will not last too long.

As AI covers everything from smart contract platforms to Memecoins, decentralized physical infrastructure networks (DePIN), as well as new primitives like agent platforms, data networks, and smart coordination layers, its parity with DeFi and Memecoins is an inevitable trend.

AI is the theme of this cycle, and many believe this will be a long-term field. The next year will be a critical period for the transition from Level 1 agents to Level 3 agents. Recommended articles:

《Five Trends! The Tide of Crypto and AI Agent Convergence is Surging Here》

DeFAI: The next wave of agents will prioritize practicality and value accumulation, and DeFAI (the convergence of DeFi and AI) may be the first category to achieve product-market fit (PMF).

Most agents are currently just meme coins without real utility. To further develop the agent field, the next wave of agents must be able to execute real use cases for us. The real growth opportunities will come from substantive value accumulation and agents capable of taking action. I believe the next year will be a critical period for the transition from Level 1 agents to Level 3 agents.

On January 6th, OpenAI CEO Sam Altman stated that he is confident he has found the method to build AGI (Artificial General Intelligence), and predicts that by 2025 we may see the first batch of AI agents "join the workforce" and substantially change corporate output. The author believes this is not an exaggeration, but a new chapter in the progress of AI. Recommended articles:

《The Soul of the AI Agent: Crypto Contracts》

Another great appeal of the AI Agent+Crypto combination is that it perfectly integrates game theory.

Game theory is essentially the science of decision-making, studying the strategic choices and equilibria of various parties in interest conflicts. The cryptocurrency ecosystem is the best stage for the application of game theory. The interactions between miners, investors, and developers are essentially a multi-party game, and the blockchain protocol guides the behavior of the parties through mechanism design. For example, in the Bitcoin network, miners compete for computing power to obtain rewards, and the protocol rules ensure the security and decentralization of the network.

AI agents are far more than just chatbots. Especially at the intersection of Crypto and AI, a new narrative - AI Layer 1 (AI L1) - is quietly emerging. Recommended articles:

《From AI Agents to AI L1: Virtuals, ai16z, and zerebro Dance Together》

The "Layer1" here is not a public chain, but refers to the foundational layer of AI technology, covering the basic technology stack and frameworks of AI agents, and even including AI agent token launch platforms like pump․fun, which can capture huge value from their tokens.

ai16z has become the leader in the AI agent field with the excellent performance of its Eliza agent framework. In the past month, Eliza has performed brilliantly on the GitHub trending list, rising to the top of the trending list, adding 6,532 new stars, and accumulating a total of 9,600 stars.

On January 10th, although the Crypto and AI markets were generally sluggish, a DAO called Aiccelerate DAO, an AI investment and development DAO, attracted widespread attention. So what is the appeal of this DAO, which is supported by advisors such as ai16z co-founder Shaw, Virtuals Protocol contributor #001 Ethermage, and Story Protocol co-founder Jason? Recommended articles:

《AI Gold Rush | Aiccelerate DAO: Accelerating the Development of Decentralized Open-Source AI》

Aiccelerate DAO is a DAO focused on accelerating the development of decentralized open-source AI. It aims to drive innovation by harnessing the power of the convergence of AI and crypto technology, and to build an ecosystem that supports and develops decentralized open-source AI projects.

Aiccelerate DAO has been operating for over two months, with team members coming from leading open-source AI teams or having previously worked at Coinbase and ConsenSys. The founding partners of Aiccelerate DAO include crypto OG Mark, @cryptopunk7213, and @ropirito. Among them, Mark previously studied computer science and economics at the University of Pennsylvania and Seoul National University, and is currently a member of the ai16z token economics working group, and is active in the NFT, Crypto x AI, and Meme fields; @cryptopunk7213 has worked at Coinbase and ConsenSys; @ropirito is a maintainer and partner at ai16z.

Industry Insights

In the previous crypto cycle, many projects targeted the huge market opportunities presented by DePIN, but when their core products failed to gain sufficient appeal on both the supply and demand sides, they turned to the cryptocurrency token economics. However, among the surviving projects, many companies have spent time building infrastructure, and they have achieved sustainable profitability by solving existing problems, without relying on the flywheel effect of the token economy. Let's take a look at some of these cases.

《Pantera Partner: Which DePIN Projects Have Real Revenue?》

Traditional global positioning systems (GPS) often lack the precision required for advanced applications, which require centimeter-level rather than meter-level accuracy. The Geodnet network's solution has increased the positioning accuracy by 100 times compared to traditional GPS technology.

Revenue Model

- Data Licensing: Selling geospatial data to commercial clients.

- Node Participation Fees: Fees related to mining machine installation and usage.

- Partnerships: Collaborating with industries like agriculture and autonomous driving systems to integrate Geodnet network services into existing workflows.

In 2024, the Geodnet network reported revenue growth of over 500% year-over-year, reaching $1.7 million.

On January 9th, the liquidity-staked token USD0++ in the Usual project suffered a sell-off after the Usual announcement. Meanwhile, in the RWA stablecoin camp, some players are also experiencing varying degrees of de-pegging, reflecting a change in market sentiment. This article analyzes this phenomenon.

《Usual Bond De-pegging, RWA Stablecoins Undergo Volatility Test》

In the volatile crypto market environment, the fluctuations in market liquidity (for example, the underlying asset of RWA - US Treasuries have seen some discounts in recent volatility) and the implementation of mechanisms have dampened investors' expectations, leading to a frenzy of investor sell-offs in the USD0/USD0++ Curve pool, with the pool offset reaching 91.27%/8.73%, and the APY on the Morpho USD0++/USD0 lending pool also soaring to 78.82%. Prior to the announcement, USD0++ had long maintained a premium over USD0, which may have been due to the 1:1 early exemption option provided by USD0++ during the pre-listing trading period on Binance, maximizing the airdrop benefits for users before the protocol launch. After the mechanism was clarified, investors began to flow back to the more liquid native token.

This event has had a certain impact on USD0++ holders, but the majority of USD0++ holders came for the USUAL incentives, have long holding periods, and the price fluctuations have not fallen below the bottom price, reflecting a panic sell-off.

a16z has listed 5 crypto industry data metrics to watch closely by 2025.

《a16z: Insights into Crypto Industry Development, 5 Metrics You Need to Watch》

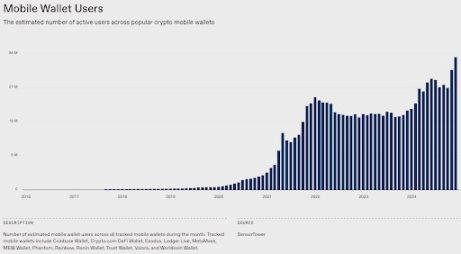

To kickstart the next wave of crypto user growth, we need to bring the user experience closer to Web2 applications. Mobile wallets will play a key role: there are hundreds of millions of "passive" crypto holders (those who own crypto but don't transact on-chain frequently) who could be converted to active users. To achieve this, developers need to continue building new consumer applications, and consumers need wallets to participate in them.

Last month, the number of mobile wallet users reached a new high, surpassing 35 million for the first time. This growth was driven by the increasing user numbers of well-known wallets like Coinbase Wallet, MetaMask, and Trust Wallet, as well as the push from some new entrants like Phantom and World App.

Macroeconomic liquidity is having an increasingly greater impact on the crypto market.

《Slower Rate Hikes, Crypto Market Entering Another Winter?》

The correlation between Bitcoin and the S&P 500 index has rebounded to 0.88, indicating that the two markets have re-synchronized, marking a reversal of the previous divergence trend (since Trump's election, Bitcoin has risen 47% while the S&P 500 index has only risen 4%).

Bitwise's European research head Andre Dragosch attributed the resurfacing correlation to macroeconomic factors, including the Federal Reserve's revised rate hike forecast and the strengthening US dollar, which continue to put pressure on cryptocurrencies and traditional markets. Although Bitcoin has strong on-chain support, its performance is increasingly influenced by broader market trends, suggesting potential short-term risks.

Matrixport's chart report indicates that fluctuations in global liquidity may put some pressure on Bitcoin, as historical data shows that changes in liquidity typically lead Bitcoin price trends by about 13 weeks. With the US dollar strengthening after Trump's re-election, global liquidity denominated in US dollars has begun to tighten, suggesting that Bitcoin may enter a consolidation phase in the near term.

Ethereum has faced a lot of criticism this year, with a lackluster ecosystem, and compared to the DeFi and Non-Fungible Token (NFT) boom in the previous cycle, innovation this round has been rather flat, which is reflected in the coin price. Will 2025 be Ethereum's comeback year?

《Five Catalysts, Will ETH See a Comeback This Year?》

Observing the dynamics of long-term holders is one way to gain insight into the market. Continuous and significant sell-offs by long-term holders often indicate that the coin price is approaching a top, while increased buying by long-term holders when the price experiences a significant drop or when the future outlook is more positive suggests a high sell-low, buy-high pattern.

The data shown in the chart indicates that long-term BTC holders have been reducing their holdings, which may suggest that some long-term investors have reached their profit-taking zone. In contrast, the Ethereum data appears more optimistic. The total proportion has risen from less than 60% in the middle of the year to over 80% at the highest, and has since seen some pullback.

Forbes analyst Taesik Yoon, in explaining why he is betting on Bitcoin, said, "The reason is simple - my sons think it has value."

《Forbes Analyst Recounts: Why Did an Old-School Value Investor Bet on Bitcoin?》

At that time, my eldest son had two more years before graduating from high school. Why is this important? Because my purpose of investing in Bitcoin is not to get rich overnight. It is part of my financial planning, which involves providing college education funds for my two sons. Assuming they both attend a traditional four-year university and do not receive any financial assistance, paying for their higher education will be the largest expense we have before retirement, much more than the remaining mortgage on our next major expenditure.

I know that reading this, some people will undoubtedly find my reasons for buying Bitcoin absurd. This does indeed go against the principles I believe in as a value investor. If I'm wrong, this will be the most expensive lesson my eldest son and I have ever had. But it won't lead to our financial bankruptcy, as my cryptocurrency holdings make up a small portion of our family's total investment portfolio, and even if they were to be completely wiped out, it wouldn't cause a major loss. It also shouldn't jeopardize our ability to pay for our children's education, as we've also been making more traditional investments for their higher education, just like many other families.

However, the size of my cryptocurrency holdings is also not small, and if I'm right, they will make this heavy financial burden feel lighter. I may no longer be the carefree gambler I was in my youth. But even for an old-fashioned value investor like myself, the potential for massive gains is hard to resist.

Project Observation

MicroStrategy's growth logic is based on its unique financial leverage in both the traditional market and the Altcoin market, using external capital to amplify the growth rate of the company's assets and improve shareholder returns. Unfortunately, MicroStrategy's Bitcoin reserve model still has some limitations, as it has not fully utilized the dynamic return potential of the Bitcoin reserve. It is against this background that the emergence of the Solv protocol has opened up a new path for Bitcoin asset management. Recommended article:

《MicroStrategy 2.0: Can Solv Become the On-Chain "Bitcoin Wealth" Company?》

Solv represents a breakthrough innovation in the on-chain management of Bitcoin reserves, using the Staking Abstraction Layer (SAL), SolvBTC, and SolvBTC.LST (Liquid Staking Tokens) to enable retail and institutional investors to obtain diversified yield opportunities without sacrificing liquidity, seamlessly integrating Bitcoin into the DeFi ecosystem.

At the same time, compared to other homogenized projects in the BTCFi track, this project also exhibits some unique advantages, especially in terms of liquidity integration and asset management innovation.

Compared to other projects, Solv's key advantage lies in its introduction of a more efficient yield generation mechanism within the Bitcoin ecosystem, as well as further optimization of user experience and fund management through the Staking Abstraction Layer (SAL) and cross-chain yield aggregation platform. Within this framework, Solv has launched four SolvBTC LSTs: SolvBTC.BBN (Babylon), SolvBTC.ENA (Ethena), SolvBTC.Core, and SolvBTC.JUP (Jupiter Exchange on Solana).

This week, the Solana ecosystem re-staking project Solayer unveiled its 2025 roadmap. Recommended article:

《Solayer Chain Quick Read: The Era of Millisecond Transactions is Coming?》

According to the Solayer Chain Lightpaper, Solayer Chain achieves infinite scalability of a single-state Blockchain by distributing workloads between dedicated hardware and clusters, while maintaining a global atomic state.

Solayer claims that through SDN (Software-Defined Networking) and RDMA (Remote Direct Memory Access) connections, it can achieve 100 Gbps while maintaining atomic state. Solayer InfiniSVM offloads to hardware circuits and kernels across ingress, ordering, scheduling, banking, and storage, achieving 1ms transaction confirmation.