Author: Harvey C

Monad Ecosystem Guide Series (Introducing native projects in the Monad ecosystem)

Monad Ecosystem Guide: Native DEX/Perp Preview

Monad is a high-performance, EVM-compatible Layer 1 blockchain with high throughput and low latency. Its technical foundation solves the long-standing problems in traditional staking, such as liquidity constraints and low capital efficiency, by supporting the development of innovative liquid staking solutions, providing users with a more efficient staking experience.

The native liquid staking projects in the Monad ecosystem, including Magma, Kintsu, and aPriori, leverage Monad's unique architecture to provide advanced functionalities and achieve seamless integration. These protocols aim to enhance liquidity, improve staking efficiency, and offer a more user-friendly staking experience.

Magma plans to introduce a DAO-based liquid staking protocol, using Distributed Validator Technology (DVT) to improve security and decentralization, and expand its application scope beyond the existing Ethereum implementation. Kintsu focuses on composability, aiming to enable staked assets to interact with DeFi applications and participate in the Monad network. Meanwhile, aPriori integrates Miner Extractable Value (MEV) strategies in its design to optimize staking rewards and position itself as a native Jito alternative for Monad.

This report explores in detail the technical architecture, innovative mechanisms, and unique value propositions of these Monad native liquid staking protocols, aiming to provide developers and crypto users with a comprehensive analysis to help them understand and participate in the latest developments in the Monad ecosystem.

The second part of the report focuses on introducing other Monad native decentralized exchange (DEX) projects, to complement the content covered in the previous report. It's important to note that these two reports only cover the publicly disclosed projects. Many other excellent projects have not yet released more detailed information, and we will provide more in-depth introductions in subsequent articles.

Native Liquid Staking Projects:

Magma @MagmaStaking is a DAO-owned liquid staking protocol developed by Hydrogen Labs within the Monad ecosystem, aiming to improve the fairness of token distribution through ecosystem airdrops and maximize the performance of the Monad network. It also introduces the first Distributed Validator Technology (DVT) outside of Ethereum.

Key features of Magma:

gMONAD Liquid Staking: Magma allows Monad token holders to stake their tokens and receive the liquid staking token gMONAD, which represents the staked assets. This allows users to earn staking rewards while maintaining liquidity to participate in other DeFi activities within the Monad ecosystem.

Distributed Validator Technology (DVT): As the first DVT outside of Ethereum, Magma is committed to enhancing the security and decentralization of the network. By distributing validator responsibilities across multiple participants, this design reduces the risk of single points of failure and promotes a more robust staking infrastructure in the Monad network.

Delegate to Top Validators: Magma optimizes staking rewards and network security by delegating the staked MONAD tokens to the top-performing validators in the network. This strategy aims to align incentives and leverage the expertise of established validators.

MEV Rewards: Monad validators compete in Magma's auctions for block space, generating MEV rewards. These rewards are shared with the stakers, thereby increasing their annual percentage yield (APY).

Fair Token Distribution through a Points Program: Magma adopts a Points Program to ensure the fairness of token distribution. Participants can accumulate Magma points to become part of the decentralized liquid staking DAO of the Monad community. This method promotes a balanced distribution of governance rights by rewarding contributors and encouraging ecosystem participation.

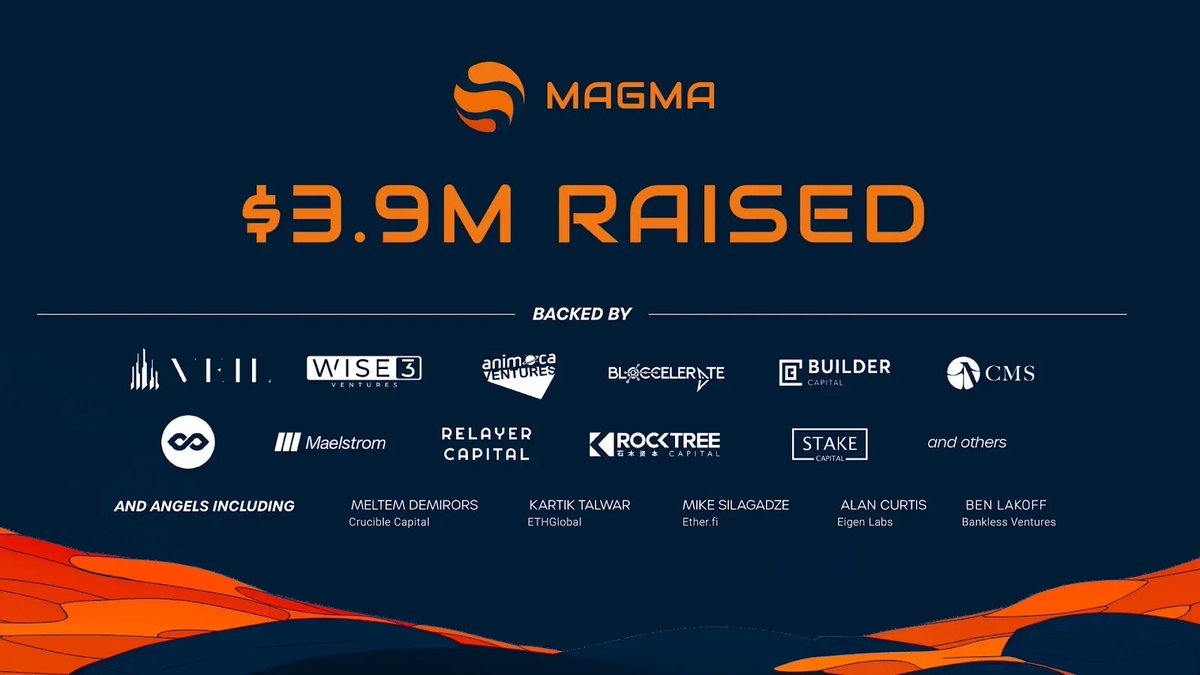

In October 2024, Magma announced the completion of a $3.9 million seed round, with investments from Bloccelerate, Animoca Ventures, CMS Holdings, Maelstrom, Veil VC, Builder Capital, Infinity Ventures, RockTree Capital, Wise3 Ventures, Stake Capital, and Relayer Capital. The round also attracted participation from several angel investors, including Meltem Demirors, Kartik Talwar, Mike Silagadze, Alan Curtis, and Ben Lakoff. The funds will be used to support the development of Magma's liquid staking platform and its Miner Extractable Value (MEV) architecture, enhancing the functionality and efficiency of the Monad network. Additionally, Magma plans to collaborate with Ether.fi to explore cross-staking integration on Monad, further expanding the ecosystem.

Magma's Liquid Layer Theory aims to extend the economic security of Monad by leveraging liquid staking pools. These mechanisms not only strengthen the network's security but also propagate it to the interoperable layer. Through these innovations, Magma aims to provide a comprehensive and user-centric liquid staking solution that encourages community participation and contributes to the security and growth of the Monad ecosystem.

Kintsu @Kintsu_xyz is a next-generation liquid staking protocol built on the Monad blockchain, aiming to enhance liquidity, accessibility, and user engagement in the Proof-of-Stake (PoS) ecosystem.

Key features of Kintsu:

sMONAD and Capital Efficiency: Users who stake their MONAD tokens through Kintsu will receive sMONAD in return. These Liquid Staking Tokens (LSTs) not only represent the staked assets but also accrue staking rewards over time. Unlike traditional staking, sMONAD maintains liquidity, allowing users to participate in various DeFi activities while continuing to earn staking rewards.

Enhanced Liquidity and Composability: Kintsu's LSTs can be seamlessly integrated into DeFi protocols, gaming platforms, and other dapps within the Monad ecosystem. This composability enables users to maximize the utility of their staked assets, fostering a more dynamic and interconnected DeFi environment. Lending Platforms: sMONAD can be used as collateral in lending protocols, improving capital efficiency and providing users with additional earning opportunities. Decentralized Stablecoins: sMONAD is an ideal collateral for decentralized stablecoins on Monad, contributing to the stability and growth of the DeFi ecosystem. Centralized Limit Order Book (CLOB) DEXs: Kintsu's LSTs enhance the liquidity and trading efficiency of CLOB DEXs, promoting better price discovery and reducing trading slippage.

Decentralized Validator Registry: Kintsu maintains a decentralized validator registry to ensure that staking is distributed among a diverse set of network participants, thereby enhancing the security and decentralization of the network.

Integration with Automated Market Makers (AMMs): Kintsu's sMONAD can be used in AMMs on the Monad network, improving liquidity pools, reducing slippage, and enhancing trading efficiency. This integration not only creates higher yields for liquidity providers but also provides a more efficient market environment for traders. Kintsu's innovative architecture offers users a new way to participate in PoS on the Monad blockchain, while its efficient liquidity management and decentralized design inject new vitality and possibilities into the entire DeFi ecosystem.

In July 2024, Kintsu successfully completed a $4 million seed round led by Castle Island Ventures. Other participating institutions include Brevan Howard Digital, CMT Digital, Spartan Group, Breed VC, CMS Holdings, and Animoca Ventures. The round also attracted the participation of several prominent angel investors, including Alex Matthews and Ross Trachtman from Brevan Howard Digital, Marin Tvrdic from Lido, and Robinson Burkey from the Wormhole Foundation.

Kintsu provides a comprehensive solution to the many limitations of traditional staking, such as lack of liquidity and inability to fully participate in DeFi activities, allowing users to retain flexibility and earning potential while staking their assets. By deeply integrating with the Monad ecosystem, the launch of Kintsu further enhances the vitality and efficiency of the Monad network, injecting new momentum into the development of Monad's DeFi ecosystem.

is a liquid Staking protocol in the native Monad ecosystem, exploring the combination of MEV optimization and liquid Staking solutions. This approach aims to enhance network performance, potentially reduce Gas fees, and provide a sustainable incentive mechanism for validators.

The core features of aPriori:

MEV-based liquid Staking: aPriori combines liquid Staking with MEV optimization, aiming to bring higher returns to validators and Stakers. By more efficiently capturing MEV, aPriori hopes to improve overall returns while contributing to the economic stability of Monad.

Efficient MEV market: aPriori is committed to creating an MEV market to reduce network congestion and spam transactions. By optimizing transaction ordering, the project aims to enhance the user experience while promoting a more transparent and efficient MEV extraction method, potentially benefiting the entire ecosystem.

High-performance architecture: Leveraging Monad's high-throughput and parallel EVM environment, aPriori's innovative architecture provides scalability and performance to meet the growing user demands.

Integration with DeFi applications: aPriori's liquid Staking token (LST) aims to facilitate interoperability with other DeFi applications in the Monad ecosystem. This approach not only enhances liquidity but also provides users with more opportunities to utilize their Staked assets.

In July 2024, aPriori announced the completion of an $8 million seed round led by Pantera Capital, bringing its total funding to $10 million. This round of financing followed a Pre-seed round co-led by Hashed and Arrington Capital, and the funds will be used for team expansion, strengthening security measures, and fostering community engagement.

The institutional participants in this seed round include ABCDE Capital, Chorus One, CMS Holdings, ConsenSys, Everstake Capital, Flow Traders, Laser Digital (Nomura), Manifold Trading, OKX Ventures, Selini Capital, Staking Facilities, and Vessel Capital. The angel investors include Adam Jin, Alex Esin, Hongbo Tang, Karthik Raju, Marc Tillement, Mike Silagadze, Nom, Paul Kim, Rex, Robinson Burkey, Spencer Noon, Tim Wang, TN Lee, and Zano Sherwani.

aPriori is committed to driving the development of Staking protocols through Monad's parallel execution environment, while optimizing MEV and Staking rewards. By addressing the technical and economic inefficiencies of traditional Proof-of-Stake (PoS) systems, aPriori positions itself as a contributor to the Monad ecosystem. Its design aligns with Monad's high-performance capabilities, aiming to bring tangible benefits to Stakers, validators, and the broader Monad DeFi community.

More native Monad DEX projects:

Perpl @perpltrade is a fully on-chain DEX developed within the Monad ecosystem, aiming to leverage Monad's parallel EVM architecture to enhance trading efficiency. By providing deep liquidity, fast trade execution, and settlement, Perpl is committed to addressing the speed and efficiency issues typically faced by traditional DEXes, while maintaining a focus on decentralization and security.

The core features of Perpl:

Deep liquidity and efficient pricing: Perpl uses a native pricing engine to promote a competitive on-chain market dynamic, providing traders with the best prices. This approach aims to encourage more on-chain asset issuance and community-centric distribution, thereby improving overall market efficiency.

High performance and scalability: Leveraging Monad's parallel EVM architecture, Perpl utilizes the blockchain's high throughput and low latency characteristics to achieve fast trade execution and settlement. This infrastructure aims to support a scalable trading environment, efficiently handling large transaction volumes.

Enhanced user experience (UX): Perpl focuses on user experience, combining speed, efficiency, and intuitive interfaces to cater to the needs of both novice and experienced traders, simplifying navigation and trade execution.

Composability and transparency: Perpl's open architecture design aims to facilitate seamless integration with other DeFi protocols, promoting ecosystem composability. This openness not only enhances transparency but also provides developers with the opportunity to build innovative financial products on top of Perpl.

Perpl adheres to the "no shortcuts" principle, prioritizing decentralization, security, and user-centric design. By integrating with Monad's parallel EVM, Perpl aims to address the challenges associated with centralized order matching and multi-signature control protocols, striving to build a trustless and highly resilient trading environment.

Perpl aims to drive the development of the Monad DEX ecosystem, providing a fully on-chain solution with deep liquidity, fast execution, and intuitive user experience at its core. Leveraging Monad's blockchain infrastructure, Perpl positions itself as a new benchmark for decentralized trading platforms, aiming to offer traders an efficient and reliable alternative to traditional exchanges.

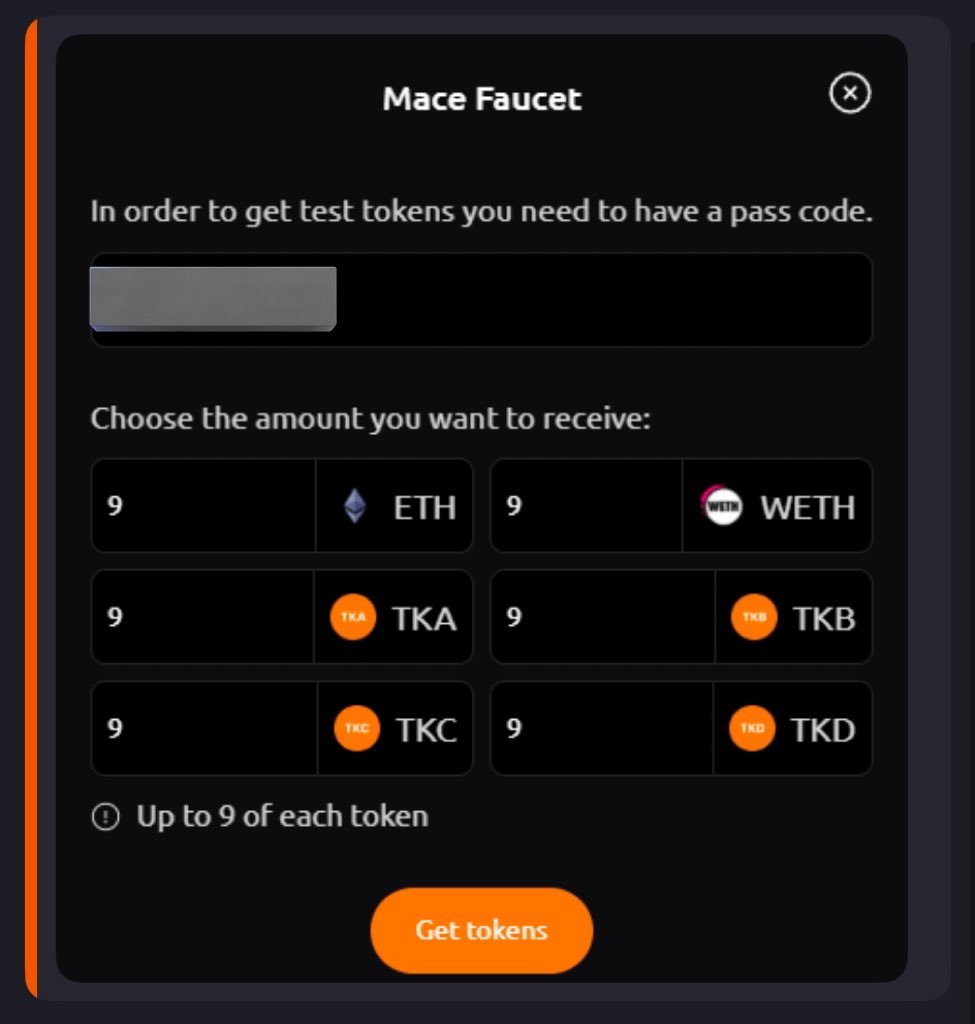

Mace @mace_ag is the first native DEX aggregator on the Monad ecosystem, aiming to revolutionize the DeFi space by enhancing trading efficiency, liquidity sourcing, and user experience.

The core features of Mace:

Comprehensive liquidity aggregation: Mace aims to integrate liquidity from multiple sources within the Monad ecosystem, providing users with efficient trade execution and reduced slippage solutions. By scanning various liquidity pools, Mace seeks to identify the best trade routes and automatically distribute orders across multiple pools to enhance price efficiency.

Cost-optimized off-chain computation: Mace utilizes a Rust-based backend system to perform computationally intensive operations off-chain, aiming to reduce on-chain Gas fees. This approach, by processing trade calculations off-chain and only executing the final optimized path on-chain, may enhance transaction speed and ensure computational accuracy.

Integration with CEX liquidity: Mace uses a request-for-quote (RFQ) system to introduce off-chain liquidity from centralized exchange market makers. This feature is designed for large-asset high-value trades, aiming to improve capital efficiency and provide tighter spreads.

Parallel EVM execution on Monad: Leveraging Monad's parallel EVM architecture, Mace aims to achieve simultaneous processing of multiple trades, providing fast execution and minimizing latency. This parallel processing approach seeks to maintain excellent performance even during network congestion.

Mace's Points Program aims to cultivate an active community by rewarding user engagement on the platform. The protocol places a strong emphasis on security, employing a smart contract system to efficiently execute optimized trade paths. Additionally, Mace plans to launch a governance token to encourage community participation and create potential long-term value for token holders.

Backed by Monad's technical infrastructure, Mace aims to become a significant contributor to the Monad DeFi ecosystem, striving to provide users with a simplified, efficient, and cost-conscious trading experience.

is a DEX built on Monad, aiming to provide a platform for token swapping, liquidity provision, and participation in token issuance activities. Monadex, through the introduction of gamification elements and user-friendly features, is committed to making decentralized exchanges more engaging and accessible, targeting both experienced traders and blockchain newcomers.

The core features of Monadex:

AMM with customizable features: Monadex's automated market maker (AMM) design supports customizable fee tiers, allowing pool creators to adjust fees based on the specific characteristics of the pool. Additionally, liquidity providers (LPs) can provide liquidity using a single token, simplifying the process and lowering the entry barrier. Monadex also supports multi-asset swaps, allowing users to trade multiple other assets with one asset, or vice versa, enhancing trading flexibility.

Gamified lottery system: Monadex has integrated a lottery system into its AMM, where users can obtain lottery tickets through token swaps and participate in weekly prize drawings. This feature aims to add an element of fun and interactivity to the trading experience.

Governance and community-driven: Monadex is positioned as a community-centric exchange, committed to aligning with user values and the culture of Monad. Its governance framework aims to empower the community to influence the platform's evolution, driving an ecosystem-centric development model.

Monadex aspires to become a crucial liquidity hub within the Monad ecosystem, providing convenient tools to help new users and developers more easily integrate into the ecosystem. By incorporating gamification features, offering flexible liquidity options, and fostering community engagement, Monadex is committed to creating a more interactive and accessible decentralized exchange experience.

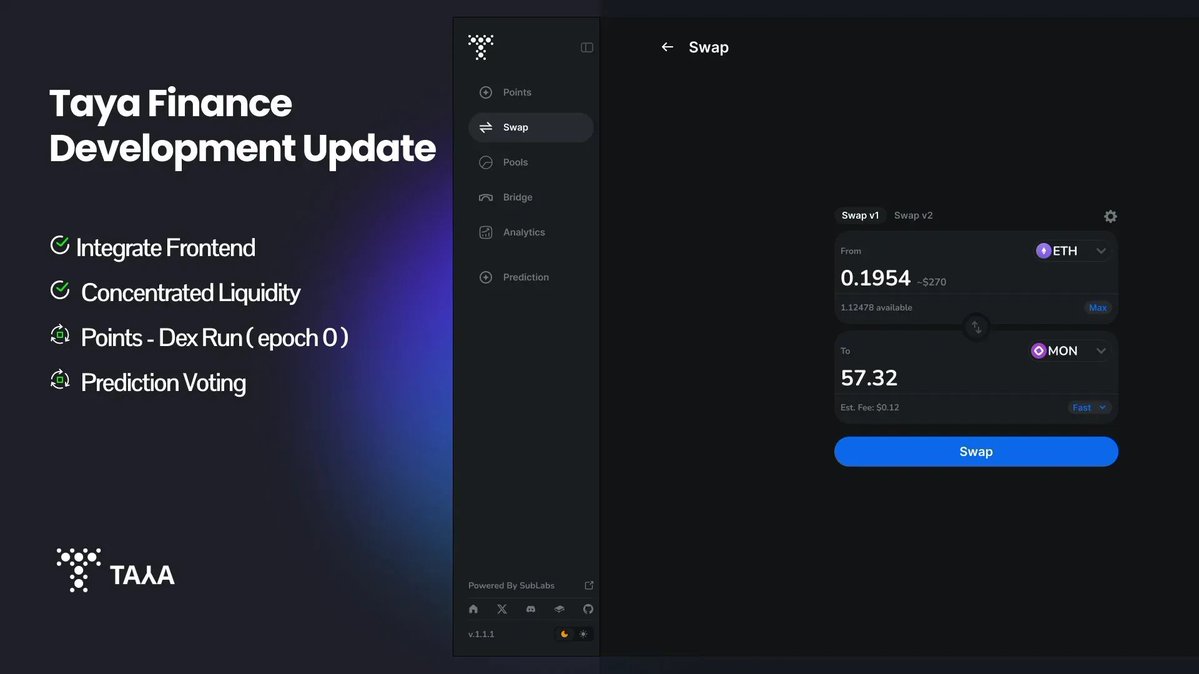

is an EVM-compatible AMM decentralized exchange (DEX) that supports both concentrated liquidity market maker (CLMM) and traditional AMM models. By integrating a liquidity aggregator, TayaSwap aims to provide deeper liquidity for DeFi assets, thereby enhancing trading efficiency and user experience.

The core features of TAYA:

Prediction markets and voting functionality: TAYA introduces a design based on the pm-AMM model, specifically tailored for prediction market and related voting mechanisms. This model aims to enable seamless and fair prediction activities within the platform.

Customizable DeFi solutions: TAYA's architecture supports user-customized financial products, applicable to various use cases, such as Memecoins, KOLs (Key Opinion Leaders), and trading bots.

DApp-as-a-Service (DaaS): TAYA provides a platform that allows users to create customized exchanges without programming skills. This feature aims to help users easily build custom exchanges, integrate with other platforms, and manage assets more efficiently.

TAYA aims to leverage Monad's high-performance blockchain infrastructure to provide a scalable and user-friendly DeFi platform. By focusing on customizable solutions and innovative features, TAYA hopes to establish its prominent position within the evolving Monad DeFi ecosystem.

Octoswap @OctoSwapDex is a DEX built on the Monad ecosystem, dedicated to providing a secure, efficient, and user-friendly token swap and liquidity provision platform. Its mission is to make DeFi more accessible and fun, while emphasizing community-driven development and gamification features.

The core features of OctoSwap:

Instant token swaps: OctoSwap allows users to seamlessly exchange tokens with just a few clicks. The platform's streamlined process ensures fast, secure, and easy transactions, providing accurate pricing and low trading costs.

Liquidity mining: Users can contribute liquidity to OctoSwap's liquidity pools by adding tokens, earning rewards generated from the platform's trading fees. This feature incentivizes liquidity providers, enhancing the overall liquidity and user engagement on the platform.

Gamified DeFi experience: OctoSwap introduces unique gamification features, aiming to make DeFi more fun and interactive. While the specific details are yet to be revealed, the platform emphasizes community involvement and plans to integrate elements that can reward user engagement and loyalty.

Leveraging Monad's high-performance infrastructure, OctoSwap utilizes the speed and security of the blockchain to provide a powerful DeFi platform. Its user-centric design and commitment to community-driven development make OctoSwap an important participant in the evolving DeFi ecosystem.

Conclusion

Monad's native staking ecosystem is undergoing significant development, with projects like Magma, Kintsu, and aPriori exploring liquid staking solutions that leverage Monad's high-performance capabilities. These projects aim to meet user demands by improving the user experience, enhancing capital efficiency, and introducing innovative staking mechanisms. As these plans progress, they are poised to make important contributions to the evolution of DeFi and network security on the Monad network.

We welcome more Chinese builders to explore Monad's technological innovations and join our ecosystem. Here are the relevant links and communities for Monad, feel free to reach out to us at Gmonad.