Author: Tulip King, Head of Technology at MessariCrypto

Compiled by: TechFlow

Investment Strategy: Alpha First

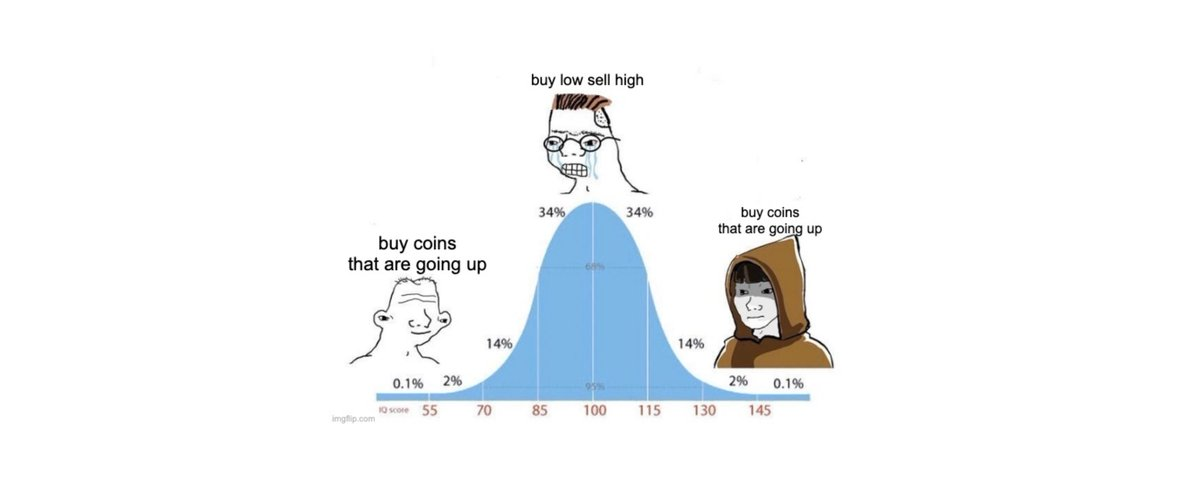

Let the market tell you which coins are performing well and which are not. Buy the coins that have already confirmed strength, and sell the ones that are underperforming. You don't need to be the first to enter, just make sure you're not the last to leave.

Invest time and effort. Find the coins that contradict your assumptions and dive deep into the reasons behind them.

Operate independently. If you rely on copy-trading, the end result is often not ideal.

The market is always right, and traders need to go with the flow

Indeed, contrarian trading often leads to higher returns. In an ideal world, everyone would like to buy at the lowest point and sell at the highest. However, this is not a realistic approach. If investors can more calmly adapt to market trends, many unnecessary losses can be avoided. For example, chasing the coins that have surged 40% in a single day, while decisively selling the ones that have fallen more than 10% for several consecutive days.

The market never makes mistakes: The market's movements are always correct - it is only the individual's perspective that is wrong. This means that regardless of how you think the market should behave, the real market trends are the undeniable facts.

Profitability is the correct validation: Judging correctness is not about predicting market trends, but about profitability. Even if a trader's assessment of the market direction is correct, poor execution or timing can still lead to losses. True "correctness" lies in profitable trades, not just theoretical predictions.

You'll find that investors like Saylor (Michael Saylor, founder of MicroStrategy) will make large purchases even at price highs.

Instead of trying to predict market reversals, it's better to learn the strategies of successful traders: identify and follow the strong areas of the market. This includes: daring to buy the assets that have already risen significantly, quickly cutting losses when market sentiment changes, and avoiding trying to average down losing positions.

Excellent traders focus more on risk management, rather than being obsessed with the correctness of their judgments. This means: taking profits when there are opportunities, not stubbornly holding on during major drawdowns, and being willing to re-enter the market when conditions improve.

@slingdeez: "Gosh, in the past year I've probably experienced a six-figure 'roller coaster' about 15 times, always treating unrealized gains as if they were already in my pocket.

In fact, even if I had chosen to take profits at the time, I could have bought back the same tokens at a lower price later. But I always fell into a kind of self-deception, and almost every time, others started taking profits, and my capital was back to square one.

Although my overall performance is still not bad, I have indeed been a bit self-deceptive. But it's no big deal."

We've all been through this.

Price trends are the only truth in the market. When your positions are losing, the market is actually telling you that your trading logic may be flawed. The wise strategy is to accept small losses, rather than continuing to hold and incur larger losses.

When your holdings experience a clear pullback, it's important to stop and reflect: Is this a trend in the overall market? Has the market focus shifted to other coins? Have I overlooked some information? Most importantly, you need to ask yourself: Is it necessary to endure this decline? When the market is inconsistent with your assumptions, stay humble and re-examine your logic, adapting to the constantly changing market environment.

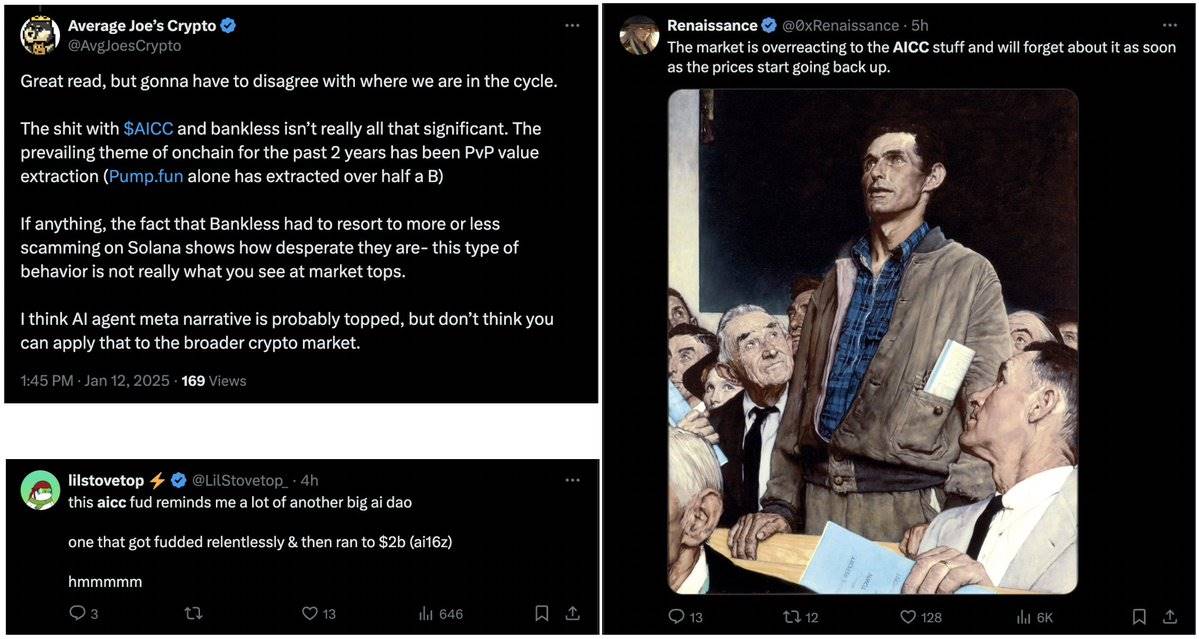

Market Signals: The AICC Case Study

AJC is a savvy investor and my friend, and I just want to highlight our different perspectives on the market interpretation.

The current market reaction to AICC provides an important lesson about market psychology. The key points are: If your interpretation of AICC differs from the market's, you need to face two possibilities and take immediate action:

The market is right, and your judgment is wrong

The market is selling off for other reasons you haven't identified

In either case, contrarian trading is risky. If you can't explain the reason for the price drop, it's also difficult to judge when the decline will stop. As Buffett said, "You only find out who's been swimming naked when the tide goes out" - if you can't understand the market's movements, you'll be exposed to unseen risks.

Let go of obsession and adapt flexibly to market changes

In the ever-changing cryptocurrency market, there is only one asset that can truly be "held long-term without the need to monitor": BTC. This is not an extremist view, but a pragmatic judgment based on Bitcoin's unique position. As digital gold, Bitcoin has unparalleled network effects, true decentralization, and widespread institutional acceptance. In other areas of digital assets, active management is not only recommended, but a mandatory survival skill.

Although ai16z has recently attracted a lot of attention, the market has been hinting for weeks that the focus should shift to DeFAI.

The cryptocurrency market requires a unique mindset: deep understanding of the market, coupled with the ability to adjust strategies at any time. Successful traders always maintain the "professional vigilance" that Andy Grove spoke of - a state of continuous reflection, where every position is questioned, every assumption is re-examined, and every gain is treated as potentially temporary. This is not pessimism, but a clear-eyed recognition of reality - in this market, the pace of narrative changes may be faster than the updates on Discord.

In the cryptocurrency realm, the most dangerous trap is not leverage or poor entry timing, but emotional attachment to positions. We've all seen cases where traders become "die-hard" when losing, investors double down because they've tied their personal identity to a failed assumption, or community members become stubborn in the face of changing market conditions, rather than acknowledging reality. This "emotional obsession" can be far more destructive to capital than any smart contract vulnerability.

To succeed in this market, you need to be "always online", gathering information from multiple channels, and also possess emotional management skills to objectively analyze information without being swayed by existing biases. Your beliefs should be firm enough to take action, but also flexible enough to quickly adjust when market conditions change. See yourself as a surfer observing the waves, rather than a captain trying to control the ocean.

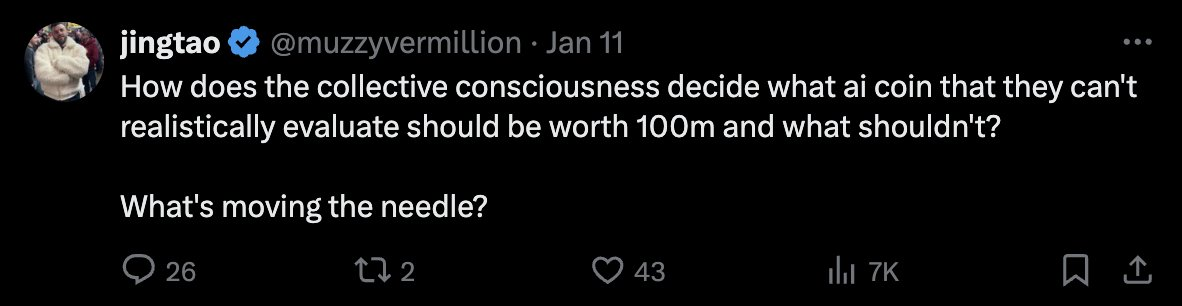

@muzzyvermillion: "Why does the collective consciousness think some AI tokens that can't be realistically valued at $100 million, while others don't? What's really driving the market changes?"

The key for successful traders: go with the flow and adjust the framework in a timely manner.

The most successful cryptocurrency traders have one thing in common: their views are very clear, but these views are like a loose garment that can be taken off at any time when the market sends different signals. They know that in the crypto market, "correctness" is not about clinging to unchanging beliefs, but about the ability to maintain continuous attention and rapid adaptation.

Remember that every investment other than Bitcoin requires active management, constant verification, and humility to admit mistakes when market conditions change. In this dynamic market, beliefs should be treated as hypotheses to be verified, not faiths to be clung to.

The Power of Independent Thinking

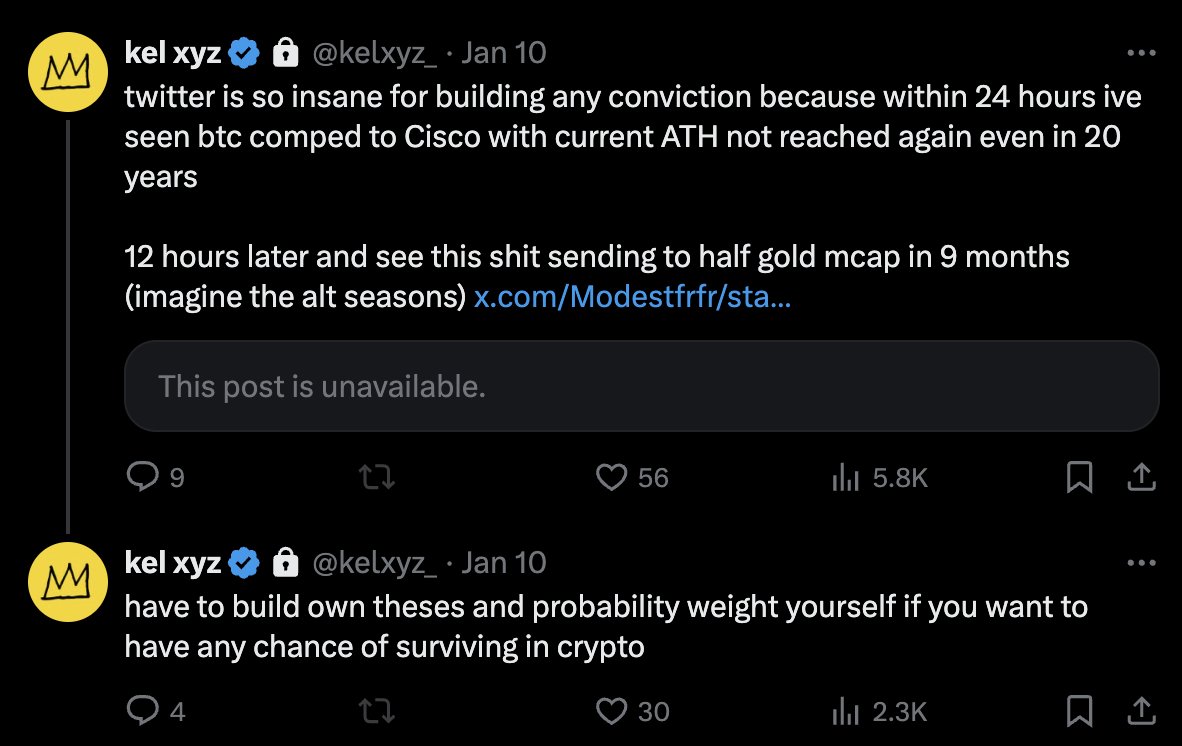

In the Crypto Twitter echo chamber, every price fluctuation triggers countless conflicting interpretations. In this environment, the ability to think independently becomes increasingly rare and precious. People often mistake information gathering for analysis and following opinion leaders for gaining insights. However, at the end of the trading day, only your own name will be written on your profit and loss statement.

@kelxyz_: "It's so hard to build convictions on Twitter. Within 24 hours, I've seen someone compare BTC to Cisco and claim the current all-time high may never be reached again for 20 years. Yet, just 12 hours later, someone else predicts BTC will reach half the market cap of gold in 9 months (imagine if an Altcoin had that kind of run)."

"If you want to survive in crypto, you have to build your own investment thesis and assign probabilities to it."

Form your own perspective and become an independent thinker in the market.

In the cryptocurrency market, the market doesn't care which famous accounts you follow or which "Alpha groups" (elite communities providing market insights and trading opportunities) you've joined. The market will only react based on supply and demand, fear and greed, and the collective behavior of participants based on their own beliefs. This is why blindly copying trades is so dangerous - if you don't understand the underlying logic, you'll never know when to exit, when to add more, or, more importantly, when the original trading logic has become invalid.

Writing is one of the most powerful tools for developing market insights. The process of writing forces you to clarify your thoughts. When you try to articulate your market logic in writing, those seemingly reasonable vague ideas will be exposed to obvious flaws. Only through clear expression can these logics withstand rigorous scrutiny. This also explains why top traders and investors like George Soros and Howard Marks are often influential writers.

@RyanWatkins: "It feels great to write again."

Messari's Secret: Writing Sharpens Thinking.

The reason Messari has become a breeding ground for top talent in the crypto space is its culture of regular research and writing. This habit is not just about recording ideas, but a process of honing one's thinking. Every research paper, every market analysis, forces the author to test their views, delve into the core logic of market dynamics, rather than just scratching the surface.

The key to success in the market is not finding a "mentor" worth following, but cultivating your own voice. Start writing, even if it's just for yourself. Document each of your trades, explain the logic behind them, and reflect on your mistakes. Publicly challenge your own assumptions and engage in discussions with others. Be brave to change your views when new information emerges. The goal of success is not to be always right, but to think clearly and independently.

"Don't imitate others' voices, cherish your own. Develop it, nurture it." - Rick Rubin

In a narrative-driven market, those who can independently construct and analyze narratives often have a significant advantage. Your writing doesn't need to be polished or widely popular - it just needs to be authentic and insightful. It is through this process that vague market intuitions can gradually evolve into actionable trading logic, and ordinary market participants can step by step become market leaders.