The US Bit spot exchange-traded fund (ETF) was officially approved by the US Securities and Exchange Commission (SEC) on January 10, 2024 and began trading on January 11. According to data compiled by SoSoValue, these 12 Bit spot ETFs have accumulated a large amount of capital inflows over the past year, with a total net inflow of $36.22 billion as of January 10 this year.

In addition, the assets under management of these Bit spot ETFs have reached $107.64 billion, accounting for 5.74% of the total Bit market capitalization.

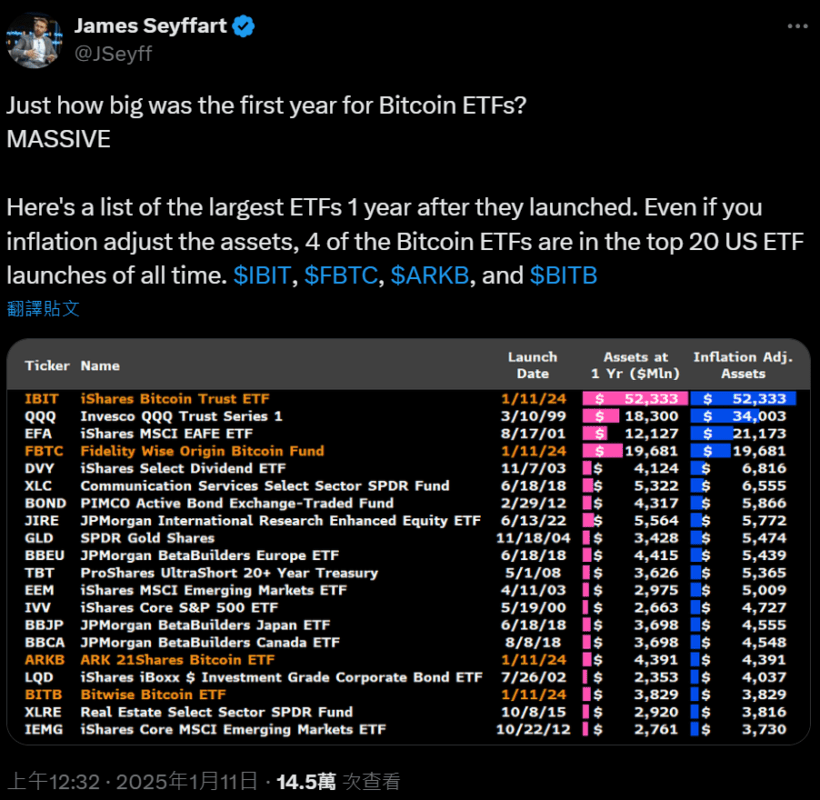

Bloomberg analyst James Seyffart discussed the market performance of the US Bit spot ETFs a year after their launch on the social platform X, sharing a list of the top 20 ETFs with the largest assets under management issued in the US within a year, which included 4 Bit ETFs, including IBIT issued by BlackRock, FBTC by Fidelity, ARKB co-issued by ARK Investment and 21Shares, and BITB by Bitwise.

The data shows that IBIT even surpassed the popular NASDAQ 100 ETF (ticker: QQQ) to become the ETF with the largest assets accumulated within a year (about $52.33 billion). Seyffart added that even the two ETFs launched by relatively smaller issuers (ARK Investment, 21Shares and Bitwise) have "only" about $4 billion in assets under management, but they have still successfully ranked among the top 20 historically, "which is crazy."