Author: @Web3_Mario

Summary: This week, the cryptocurrency market experienced relatively large fluctuations, and the price trend also formed an M-shaped pattern. These all indicate that as Trump's inauguration on January 20th is getting closer, the capital market has quietly begun to price in the opportunities and risks of his election, which means that the "Trump effect" driven by emotions that has lasted for 3 months is officially coming to an end. So what we need to do now is to extract the focus of the short-term market game from the many confusing information, so as to make a rational judgment on the changes in the market trend. Therefore, in this article, the author, as a non-financial professional enthusiast, will share his own observation logic, hoping to be helpful to everyone. In general, the author believes that in the short term, the prices of many high-growth risk assets, including the TRON market, will continue to be suppressed, because the rise in long-term U.S. Treasury yields has had an adverse impact on them, and the reason for this situation is that the market is pricing in the U.S. debt crisis.

Macroeconomic indicators remain strong, and inflation expectations have not shown a significant increase, so they have little impact on the current price trend

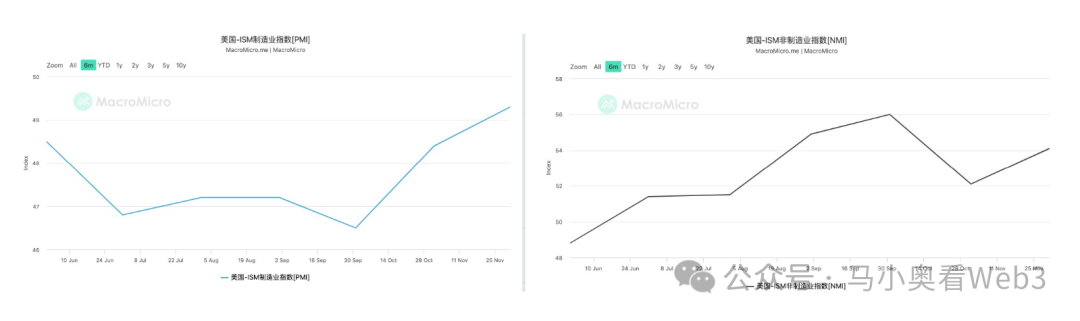

First, let's look at the factors that have led to the short-term price weakness. Last week, many important macroeconomic indicators were released, let's take a look at them one by one. First, let's look at the U.S. economic growth-related data, the ISM manufacturing and non-manufacturing purchasing managers' indices have continued to rise, and since the purchasing managers' index is usually a leading indicator of economic growth, this suggests that the U.S. economic outlook in the short term is relatively positive.

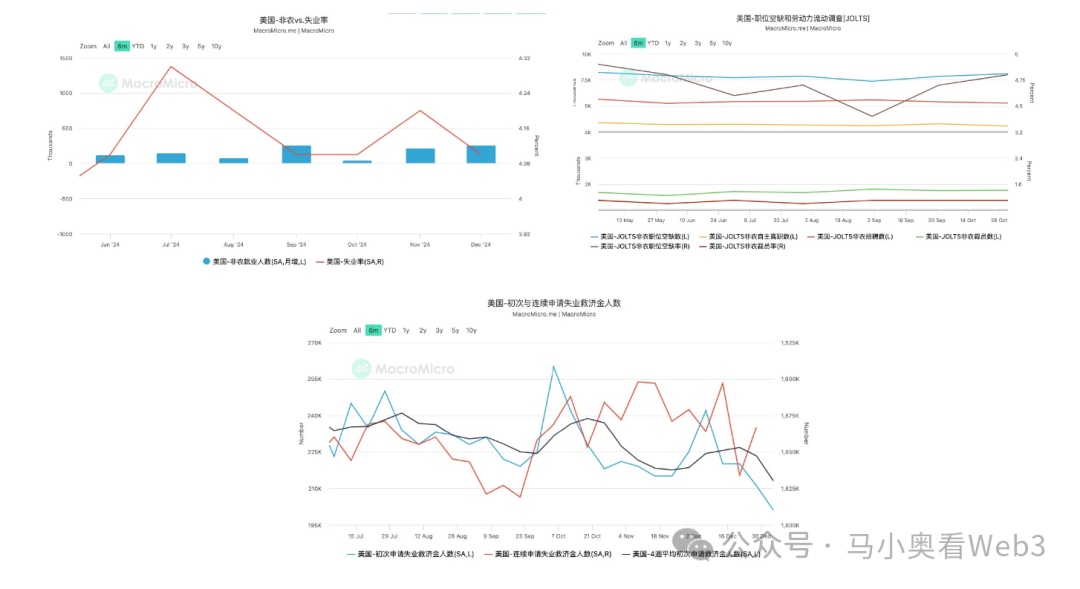

Next, let's look at the job market situation. We will extract four data points for observation: non-farm employment, job openings, the unemployment rate, and the number of initial jobless claims. First, non-farm employment increased from 212,000 last month to 256,000, far exceeding expectations, and the unemployment rate also declined, from 4.2% to 4.1%. At the same time, the JOLTS job openings also showed a significant increase, reaching 809,000. And from the more micro perspective of the number of initial jobless claims, it has continued to decline, which indicates that the outlook for the job market performance in January is also relatively optimistic. All of this suggests that the U.S. job market is currently maintaining strength, and a soft landing seems to be a foregone conclusion.

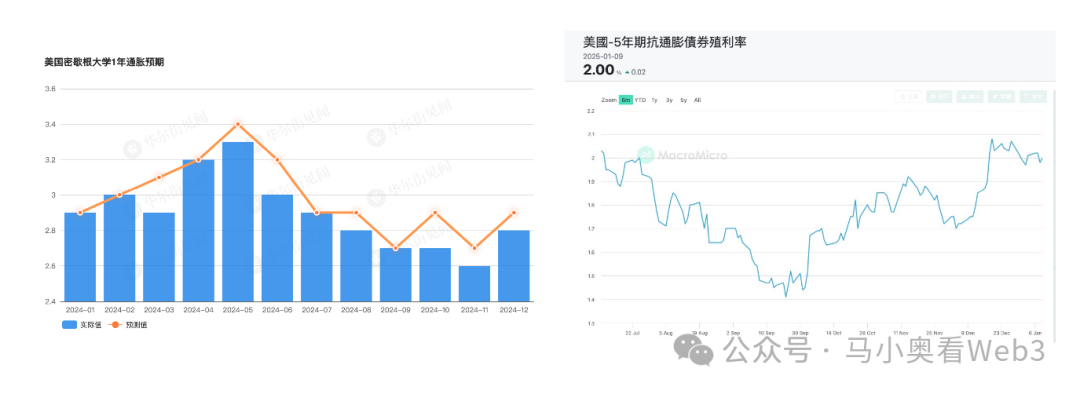

Finally, let's look at the inflation performance. Since the December CPI data needs to be released next week, we can observe the performance of the University of Michigan 1-year inflation expectation in advance. Compared to November, this indicator has shown a certain rebound to 2.8%, but it is still within the reasonable range of 2-3% defined by Powell. Of course, the specific development is still worth watching. But from the changes in the yield of the anti-inflation bond TIPS, the market does not seem to be overly panicked about inflation.

In summary, the author believes that from a macroeconomic perspective, there are no obvious problems in the U.S. economy at present. Then, let's identify the core reason for the decline in the market capitalization of high-growth companies.

The continuous rise in medium and long-term U.S. Treasury yields, the bear steepening pattern, and the market pricing of the U.S. debt crisis

Let's also look at the changes in U.S. Treasury yields. From the yield curve, we can see that over the past week, the long-end yields of U.S. Treasuries have continued to rise, with the 10-year Treasury yield rising by 20 basis points at one time, which can be said to further exacerbate the bear steepening pattern of the Treasury market. We know that the rise in Treasury yields has a greater suppressive effect on the prices of high-growth stocks than on blue-chip or value stocks, and the core reason is:

1. Impact on high-growth companies (usually technology companies, emerging industries):

Increased financing costs: High-growth companies rely on external financing (equity or debt) to support business expansion. The rise in long-term yields increases the cost of debt financing, and equity financing also becomes more difficult, as investors demand a higher discount rate for future cash flows.

Valuation pressure: The valuation of growth companies is highly dependent on future cash flows (FCF). The rise in long-term yields means a higher discount rate, leading to a decrease in the present value of future cash flows, and thus putting downward pressure on corporate valuations.

Shift in market preference: Investors may shift from high-risk growth stocks to more stable, dividend-paying value stocks, which puts pressure on the stock prices of growth companies.

Constraints on capital expenditures: High financing costs may force companies to reduce R&D and expansion spending, affecting long-term growth potential.

2. Impact on stable companies (consumer, utilities, pharmaceuticals, etc.):

Relatively mild impact: Stable companies usually have strong profitability and stable cash flows, and rely less on external financing, so the impact of rising interest rates on their operations is relatively small.

Increased debt repayment pressure: If there is a high debt ratio, the rise in financing costs may increase financial expenses, but stable companies generally have stronger debt management capabilities.

Decreased dividend attractiveness: The dividend yield of stable companies may compete with bond yields. When Treasury yields rise, investors may turn to bonds with higher risk-free returns, putting pressure on the stock prices of stable companies.

Inflation transmission effect: If the rise in interest rates is accompanied by rising inflation, companies may face cost pressure, but stable companies usually have stronger cost pass-through capabilities.

Therefore, it can be seen that the rise in long-term Treasury yields has a very obvious impact on the market capitalization of companies like TRON. Then the key question is to identify the core reason for the rise in long-term Treasury yields in the context of the rate cut.

First, we need to introduce the calculation model of the nominal yield of Treasuries as follows:

I = r + π + RP

Where I represents the nominal yield of Treasuries, r is the real interest rate, π is the inflation expectation, and RP is the term premium. Here we need to explain further. The real interest rate reflects the true return of the bond, not affected by market risk aversion and risk compensation, and directly reflects the time value of money and the potential for economic growth. π refers to the average inflation expectation in society, which can usually be observed through CPI or the yield of inflation-protected bonds (TIPS). Finally, RP is the term premium, which reflects the compensation for interest rate risk that investors demand, when investors believe that the future economic development is uncertain, they will require a higher risk premium.

In the analysis of the first part, we have clearly stated that the current U.S. economic development remains healthy in the short term, and from the TIPS yield, we can also observe that inflation expectations have not shown a significant rise, so the real interest rate and inflation expectations are not the main factors driving the rise in nominal yields in the short term. Therefore, the problem has been focused on the "term premium" factor.

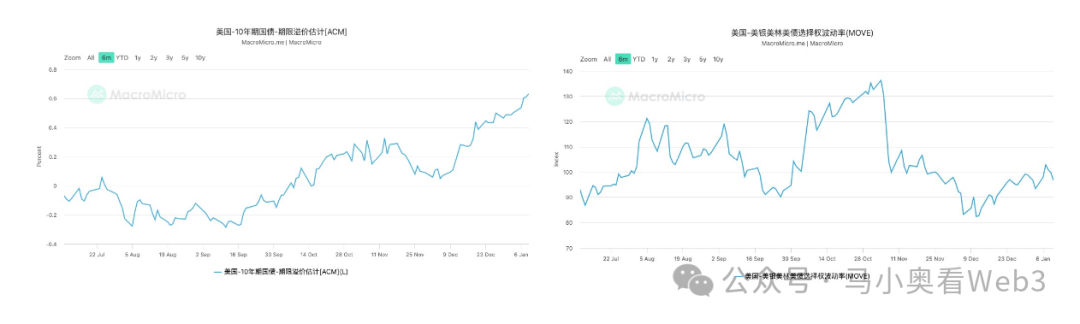

Observations on the term premium, we have chosen two indicators, the first is the ACM model's estimate of the term premium level in US Treasuries. It can be seen that over the past period, the term premium of the US 10-year Treasury has shown a significant upward trend, and from a numerical perspective, this factor is the main driver of the rise in US Treasury yields. The second is the Merrill Lynch US Treasury Option Volatility Estimate, also known as the MOVE index, and it can be seen that over the recent period, the volatility has not undergone drastic changes, and under normal circumstances, the MOVE is more sensitive to the implied volatility of short-end rates, as it carries a larger weight. From this set of data, we can draw a conclusion that the market is currently not sensitive to the risk of volatility in short-end rates, and we know that short-end rates are mainly influenced by the Federal Reserve's decisions, so it can be said that the market has not priced in the potential policy changes of the Federal Reserve, and therefore the recent panic over the 2025 Federal Reserve rate decision direction is not a direct factor, however, the continuous rise in term premium indicates that the market is concerned about the long-term development of the US economy, and based on the current economic hotspots, this is clearly focused on concerns about the US fiscal deficit problem.

So it is clear that the market is currently pricing in the potential debt crisis risk in the US after TRON's inauguration. Therefore, in the coming period, observing political information and the views of stakeholders is still necessary to consider their positive or negative impact on debt risk, which will make it easier to judge the trend of the risk asset market. For example, last week's news of TRON's announcement to consider declaring a national economic emergency in the US, as under a state of emergency, the IEEPA can be used to formulate new tariff plans. This act unilaterally authorizes the President to manage imports during a national emergency. Therefore, the constraints and resistance to tariff adjustments will be further reduced, and this undoubtedly amplifies the concerns about the potential trade war impact that has already eased somewhat, but in terms of the most direct impact, the increase in tariff revenue will undoubtedly have a positive impact on US fiscal revenue, so the author believes that the impact will not be very severe. On the contrary, the progress of its tax cut legislation and how to cut government spending are the focus that deserves the most attention in the entire game, and the author will also continue to follow up on this.