Author: Wenser, Odaily

In just 3 days, the Aiccelerate dao project, which claimed to be "accelerating the integration of cryptocurrencies and artificial intelligence in a DAO organization", has gone from being the center of attention to being attacked by the masses, making one marvel at the speed of the crypto market and the sensitivity of market sentiment. As of the time of writing, the AICC token price is currently reported at $0.084, with a market cap of $92.5 million, a drop of over 75% from the high point of over $400 million.

At the same time, the operations of the "luxury team" of advisors behind the project have been inconsistent, and the community has also had mixed attitudes towards it. Odaily will summarize the AICC-related events in this article for readers to review.

A "Orchestrated Token Launch Drama": AICC's One-Day Speed Run

On January 10th, a tweet from Aiccelerate dao once again ignited market expectations for the AI Agent token, but unlike the more community-oriented tokens in the past, this project was more like a "VC-style orchestrated deal".

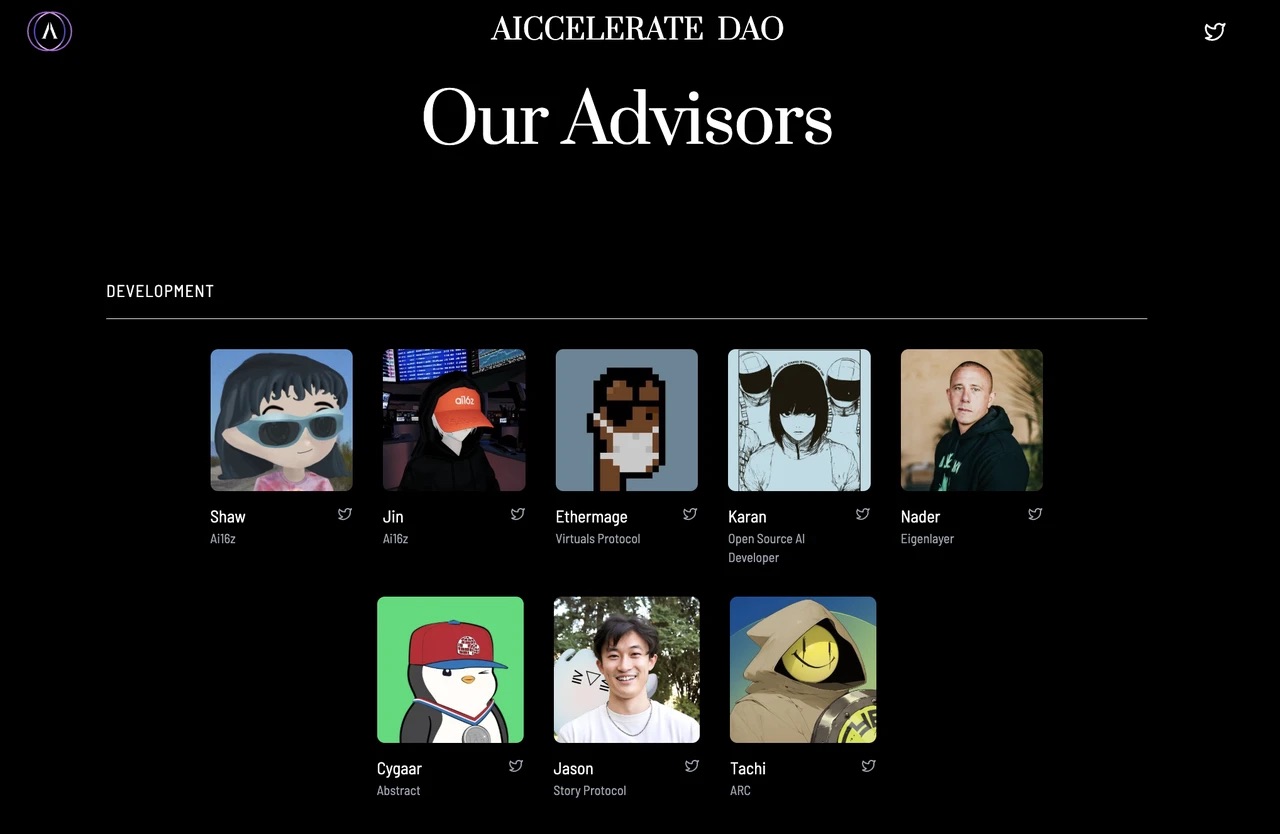

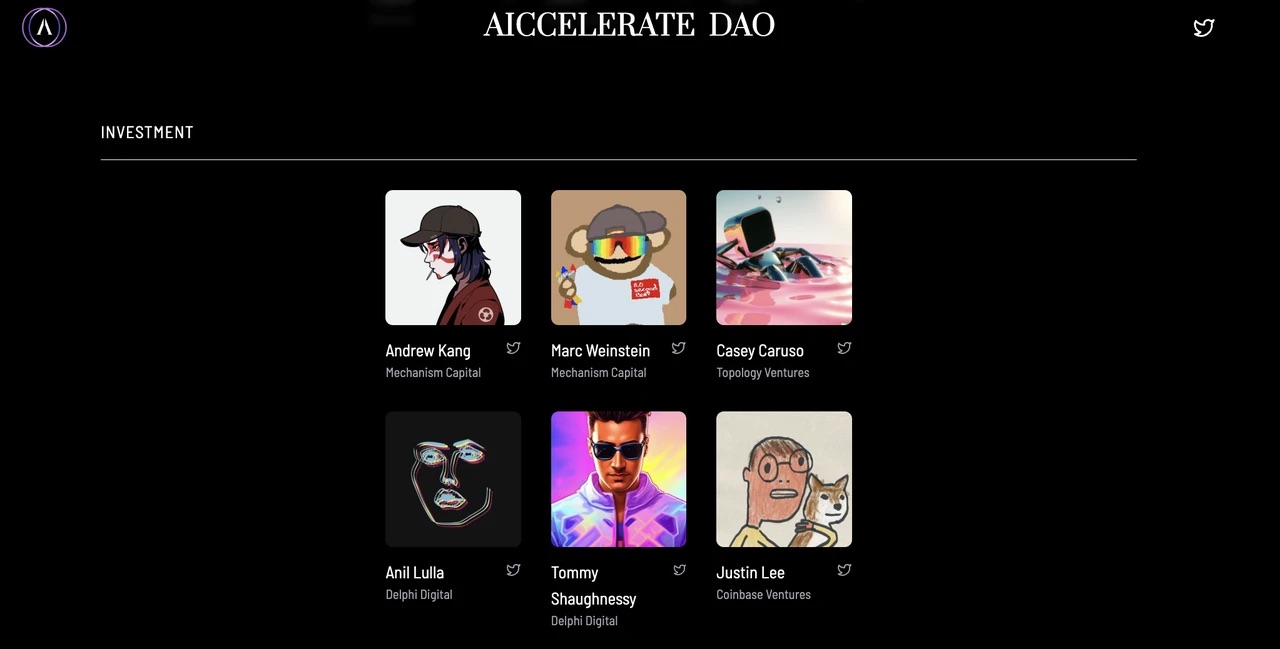

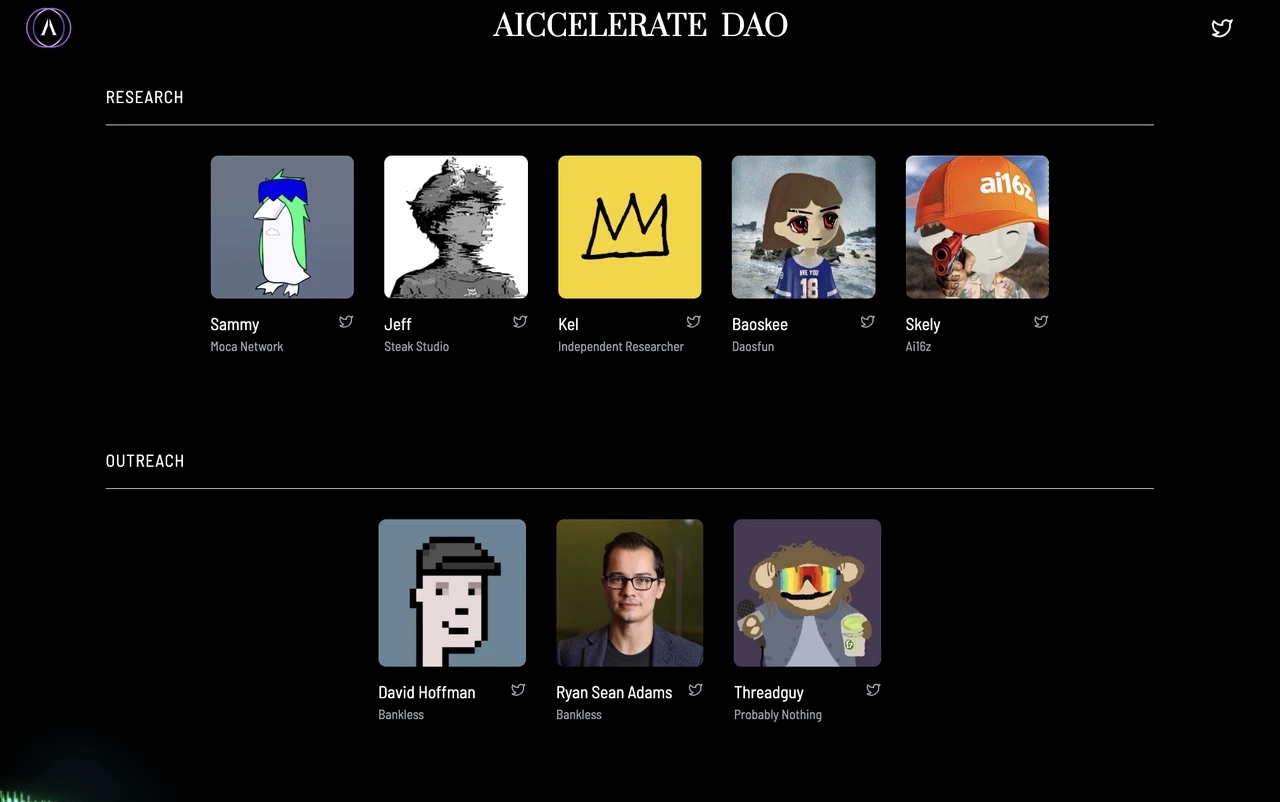

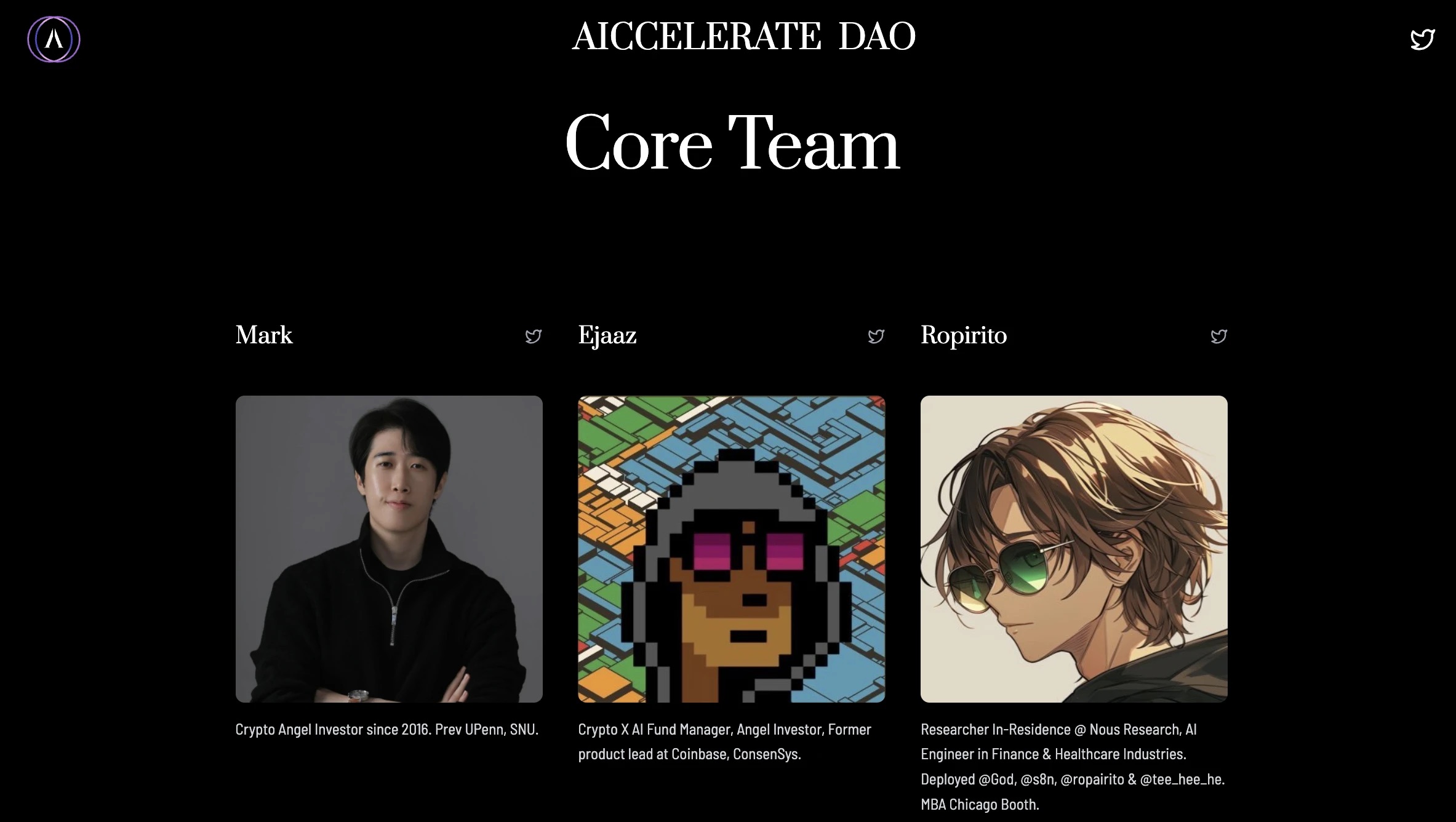

On January 9th, the project announced that the DAO will focus on promoting decentralized, open-source AI development and support high-potential projects in different ecosystems. In addition, Aiccelerate positions itself as a DAO that emphasizes both investment and development. Its main mission is to drive innovation in the so-called "AI Agent" field. The DAO aims to establish a collaborative community composed of top developers from multiple frameworks, and the list of developer advisors includes Andreessen Horowitz founder Shaw, Virtuals Protocol core contributor EtherMage, EigenLayer developer relations manager Nader Dabit, and Story Protocol co-founder Jason Zhao, as well as Abstract core contributor Cygaar; the investor advisors include Andrew Kang and Marc Weinstein from Mechanism Capital, Justin Lee from Coinbase Ventures, and Anil Lulla from Delphi Digital; the research advisors include Baoskee, the founder of daos.fun, and Skely from Andreessen Horowitz; and the outreach advisors include Bankless DAO founder David Hoffman, co-founder Ryan Sean Adams, and well-known crypto KOL Threadguy.

Developer Advisor List

Investor Advisor List

Research and Outreach Advisor List

AICC Core Team List

Prior to this, the off-market price of the AICC token presale whitelist had soared to over $1,000, but there was still no real market. However, thanks to the reputation and past performance of the core team and the advisory team in the cryptocurrency industry, the market's expectations for the token have also been rising, and many believe that the returns will be at least 20x.

But people still underestimated the FOMO sentiment in the market on the only recent hot spot in the AI token sector.

Around 10 a.m. on January 11th, after the fundraising was completed, AICC quietly went live on-chain, with its market cap once reaching over $400 million; an hour later, its price had already soared to $0.21, with a market cap of $230 million, and later exceeded $370 million, becoming another "AI sector speed run". According to media reports, AICC raised a total of 943 SOL, worth about $175,000, of which about $75,000 came from the project's "VIPs" - the co-founders and advisory team; the remaining $100,000 came from other insiders, each of whom had previously pledged to invest up to 2 SOL at most.

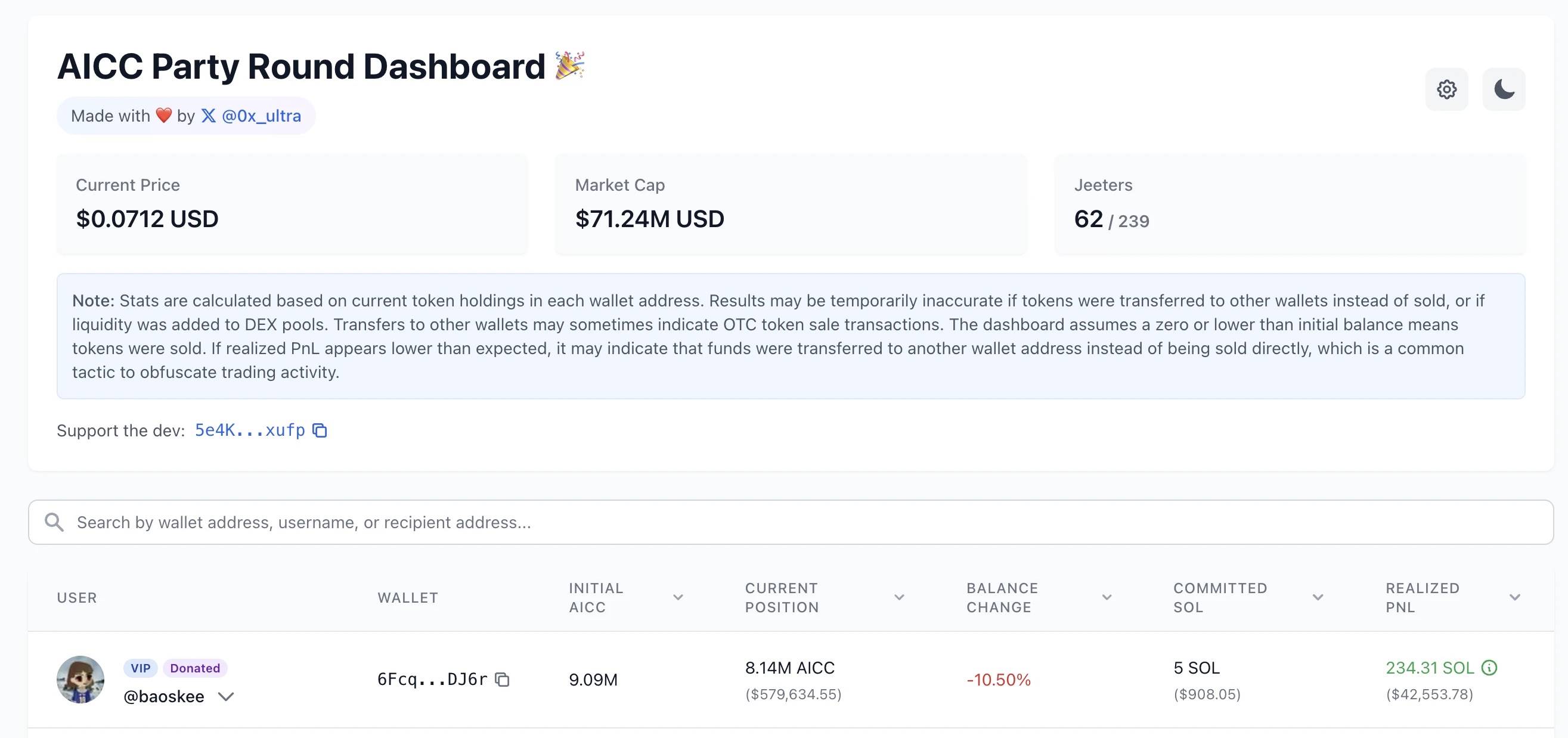

As a result, the AICC price has achieved over 1000x gains compared to the fundraising price; and according to data provided by @0x_ultra, the top 5 profitable addresses in the AICC internal market have already made a total profit of over $1.31 million, with these 5 addresses only investing a total of 4.5 SOL, resulting in a profit rate of about 7907x. In addition, according to the data panel, the number of AICC profit-taking sellers has reached as high as 62 out of a total of 239 addresses, accounting for 25.9%.

AICC Token Dump Data Statistics Panel

The rapid dump and sell-off by the "insiders" has also quickly focused the market's attention on the key issue of token distribution.

The Crypto Microcosm Behind AICC: VIP Dump, Advisor Responses, Ecosystem Donations

As the AICC price skyrocketed, there were many who took profits, and the parties involved also expressed their different attitudes, which can be seen as a "crypto microcosm".

VIP Dump: Human Nature Cannot Withstand the Test of Thousands of Times Returns

After the AICC token went live, Bankless Ventures quickly sold 10% of the token allocation. After being questioned and criticized by the community, David Hoffman, the public face of Bankless, and co-founder Ryan Sean Adams had to give a positive response:

Initially, David Hoffman said: "(I) agree that Bankless Ventures should not have sold the tokens - it was an impulsive mistake, we have already bought back all the sold tokens and restored the full amount, and we are discussing a self-imposed vesting schedule."

Subsequently, David Hoffman posted another image (narrated from the perspective of co-founder Ryan Adams) to respond to the "AICC dump incident". Ryan said that he and the other Bankless co-founder David Hoffman had each invested 5 SOL in their personal capacity, and Bankless Ventures had also invested 2 SOL as a fund, with GP Ben Lakoff being responsible for the investment. Later, Bankless Ventures sold 8% of the fund's shares (which have now been bought back), and Ryan said that he and David were unaware of the sale, and that Ben, who was not well-informed about Aiccelerate's situation, made the sale based on a trading mindset. This was a huge mistake, and the first time such a thing has happened, and Ben is also very sorry about it. Ryan further clarified that he and David have never sold their personal shares.

"I didn't know they would do that, and when I found out, I immediately expressed my disgust at such behavior," Aiccelerate dao co-founder Ejaaz Ahamadeen wrote on X about Bankless Ventures' sale.

Although the dump was later clarified, the market and community's trust in Bankless has plummeted.

Advisor Responses: Andreessen Horowitz Founder Shaw Angrily Denounces AICC as a Vampire Attack, Claims to Have Been Exploited and Deletes Post

In this AICC token launch controversy, Andreessen Horowitz founder Shaw, who has recently been highly focused on by the market due to the AI Agent wave, is undoubtedly at the center of the storm.

Previously, Shaw had written that he had donated half of the AICC tokens to the Andreessen Horowitz DAO, and 20% to other contributors. "Seeing 5 SOL turn into $2 million is crazy," but he still acknowledged the criticism and said, "I hope Daos.fun will do some kind of vesting or locking in the future, so the launch will feel fairer."

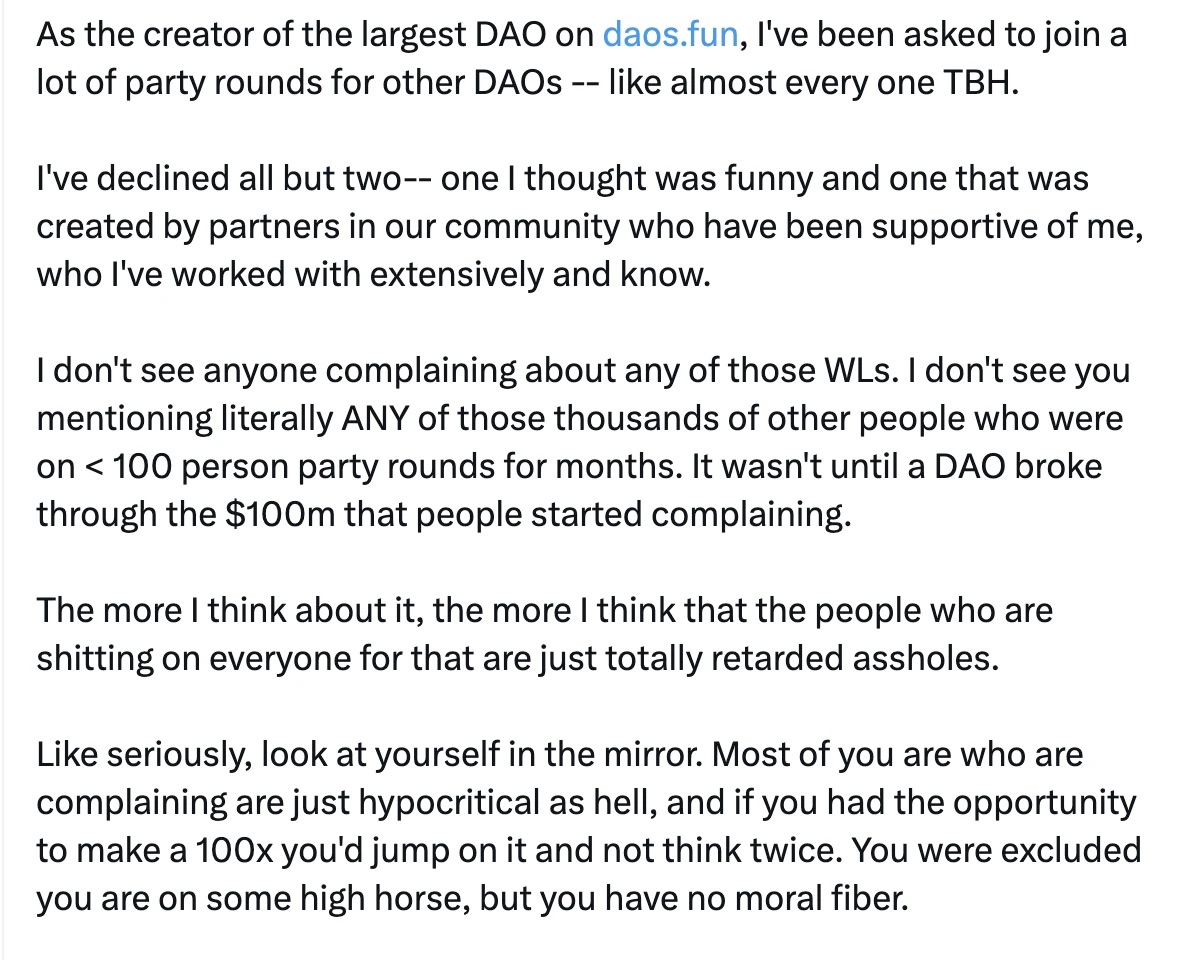

Here is the English translation:It seems that the criticism from the ai16z DAO community and other crypto communities was too harsh, so Shaw published a long article around 3 AM this morning to fight back. The main points are: As the creator of the largest DAO organization on daos.fun, Shaw did not previously endorse other projects on daos.fun, and only supported 2 projects - one that he found interesting (Odaily note: this should be the Ai pool project METAV that previously raised over 30,000 SOL), and another created by a community partner called AICC. Furthermore, he was angry about the AICC token release because the entire project felt like a vampire attack, with his name and DAO brand being exploited. Nevertheless, AICC is still a fair game that followed the platform rules of daos.fun, but the whitelist distribution mechanism meant that most people did not benefit, so it was attacked. He stated that he is now withdrawing from meme coins because this culture is toxic, with a group of "cancel culture babies" pretending to be avant-garde and anti-awakening. Finally, Shaw said that from now on, he will only interact with AI professionals and real Builders. This tweet has now been deleted.

It's clear that Shaw was also deeply hurt in this AICC token issuance incident: on the one hand, his reputation was damaged; on the other hand, he suffered emotional trauma. And this naturally stems from his choice to support the AICC project.

Part of Shaw's deleted tweet

Ecological Donations: Story Co-founder, ARC Founder Choose to Give Back to the Project

The other "VIPs" who profited from the crash are a bit different. Story Co-founder Jason Zhao and the founder behind the Arc project chose to reinvest their earnings back into their own ecosystems.

Jason Zhao wrote that he will donate all of his personal AICC tokens (worth about $1.78 million) to the construction of open-source AI projects on Story and other blockchains. He will donate the first $1 million of his life in the form of AICC tokens to high-quality teams building open-source projects, which will support Story's vision of a general AI IP system while also advancing AI development. The donations will be based on project milestones and the process will be fully transparent, with all tokens used for research purposes.

Tachi, the founder of Playgrounds behind the Arc (AI Rig Complex) project, also wrote that the team has already allocated 100% of their AICC tokens directly to the Arc Treasury to ensure all tokens serve the long-term interests of the community. The team also plans to use 30% of the AICC tokens to create an AICC/ARC liquidity pool, which will generate fees that will be returned to the Arc Treasury. These fees will help fund ecosystem initiatives, incentivize developer contributions, and further enrich the Complex. The remaining 70% of AICC tokens have been locked in a custodial contract, with the Arc Treasury as the beneficiary, and will be linearly vested over the next year.

Compared to other beneficiaries, these two approaches are undoubtedly more sophisticated and can be considered a win-win choice.

Official Response: Firmly Committed to AI Agent Development, Token Funds Secure

In the face of this dramatic series of events, the Aiccelerate DAO has also issued its own statement.

Directly Addressing Community Concerns, Solving Problems Positively

Around 1 AM, Aiccelerate DAO posted that "We have noted the community's questions and controversies, and hope to positively resolve these issues. Transparency and trust are at the core of our values, and we are fully committed to building lasting products, not quick wins. To strengthen this commitment: 1. The core team will implement vesting structures for individual allocations, and are in discussions with advisors to execute the same, to align with the long-term success of this DAO; 2. We are actively developing the first AI Agent (Research Agent) and creating architecture to support a broader vision, which we will share more about in the coming weeks; 3. We want to reiterate that 100% of the DAO treasury funds will be used for DAO investments and the community. We will persist in the long run, please stay tuned for further updates."

DAO Funds Have Been Transferred to a Secure Wallet, No Tokens Sold or Lost

In the afternoon, the Aiccelerate DAO official posted again, stating that the DAO funds have been transferred to a secure wallet, and no tokens have been sold or lost. As part of preparing for the long road ahead, actions will be taken to protect the treasury in a safe and compliant manner, reiterating that no funds have been sold or lost, and publishing the relevant wallet addresses.

Conclusion: The Appearance of VC Whales Announces the Second Half of the AI Agent Token Race

According to GMGN data, as of the time of writing, the AICC price has fallen below $0.07 to $0.0677, a drop of around 45% in 24 hours; its market cap has also fallen to $74.5 million, a drop of nearly 80% from the previous high of $370 million.

In addition to the impact of the overall market downturn, the dramatic development path of AICC has also become a major factor in its poor price performance. But looking at the narrative development trajectory of this year, if AICC and Aiccelerate DAO can successfully launch their own AI Agent product or even development framework in the future, they may still have some price rebound potential.

In any case, the emergence of AICC, which is supported by the daos.fun platform and has gathered many crypto celebrities, KOLs and industry figures, has proven one thing: the space left for wild community projects in the AI Agent token track is also shrinking, and the second half of the AI Agent and its token projects need new narratives or growth points to gain market liquidity.