Author: DavidNage, Venture Capital PM ARCA

Compiled by: Shaofaye123, Foresight News

Nvidia CEO says the era of 'AI Agentics' has arrived, calling it a new field with "trillions of dollars in business opportunities".

Before Huang Renxun made the above remarks, user interest had already shifted towards Web3 AI agents in Q4 2024, which have been gradually developing by leveraging the infrastructure and frameworks provided by Web3 and AI.

On January 2, various Web3 AI agents achieved significant breakthroughs in market capitalization: Ai16zDAO reached $2.6 billion through the Eliza framework, and Virtuals reached $5 billion through the GAME framework. Four days later, ARC reached $450 million through the RIG framework, and Zerebro reached $783 million through the Zerepy framework. On January 12, the total market value of Solana agents in the Cookie framework's 1,210 agents reached $7.5 billion, and Base reached $5.5 billion, with a total market value exceeding $13 billion.

Considering the trillions of dollars in business opportunities and the growth of this field so far, what level can the market value of Web3 AI agents reach in the future? At the same time, the market share of traditional AI companies (such as OpenAI, Anthropic, Meta, etc.) also needs to be taken into account to analyze the potential market share and development timeline of Web3 AI agents.

Analysis of AI Technology Adoption

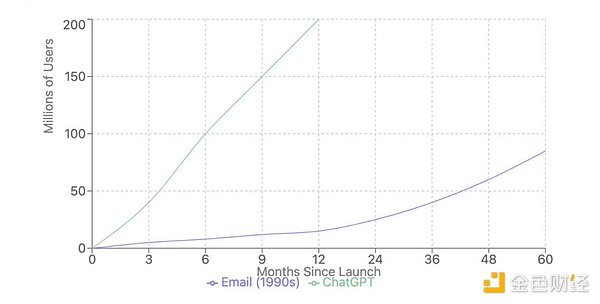

Since the birth of email, it took 35 years for 1 billion people to have email addresses. However, since the launch of ChatGPT in November 2022, its current monthly active users (MAU) have already reached nearly 200 million. The following technology adoption curve can be referenced:

Currently, there are about 4.8 billion unique email addresses globally, and ChatGPT users account for about 4.2%, even though its growth was initially slowed by factors such as language limitations and computing resources.

Calculated at the current rate of about 14 million new users per month, if the growth rate doubles (due to factors such as wider access permissions and competitive drivers) to 28.6 million new users per month, the total new users in the next 24 months will reach:

28.6 million × 24 months ≈ 686M

Added to the existing 200 million users, by 2026, the total number of ChatGPT users is expected to approach 886 million.

Assuming by 2026:

Paid users: 886M × 0.10 (conversion rate) = 88.6 million paid users

Monthly revenue: 88.6 million × $20 = $1.77 billion / month

Annual revenue: $1.77 billion × 12 = $21.24 billion / year

Using a 5x price-to-sales ratio (P/S Ratio) for valuation, and referencing a premium multiple, this would give ChatGPT a market value of around $100 billion (latest private market valuation of $157 billion). Huang Renxun stated that AI agents could be a trillion-dollar opportunity. Assuming ChatGPT captures 15% of this total market size, there would still be $850 billion in market space left to be captured.

The question then is: how much of this market share can Web3 AI agents capture?

Web3 Market Share Analysis

We can apply the "Bitcoin to Gold ratio" to the AI agent market. Currently, Bitcoin's market cap is about 10.9% of the total gold market value. If Web3 AI agents can capture a similar market share as the Bitcoin/Gold ratio:

$850 billion × 10.9% = $92.65 billion (potential size of the Web3 AI agent market).

However, there are some factors that may indicate Web3 AI agents could have an even higher market share:

Advantages of Web3 Agents:

Decentralized infrastructure: The decentralized network infrastructure already exists and can be directly leveraged.

Token incentive mechanisms: Token-based reward mechanisms promote user and developer participation.

Smart contract automation: Efficient automation through smart contracts.

Integrated payment functionality: Payment functions are seamlessly integrated into the Web3 ecosystem.

Data sovereignty and ownership: Users can truly own and control their own data.

Unique Capabilities of Web3 Agents:

Tokenized agent ownership: Allows users to own a stake in the agent through tokens.

DAO (Decentralized Autonomous Organization) integration: Seamless integration with DAOs for community-driven governance and decision-making.

Composability with DeFi: Web3 agents can seamlessly integrate with decentralized finance applications to expand their functionality and value.

Given these unique advantages of Web3 AI agents, their market share could be higher than the Bitcoin to Gold ratio. If we assume the following three scenarios:

Low expectation: 10.9% (Bitcoin/Gold ratio) = $92.65 billion

Medium expectation: 20% = $170 billion

High expectation: 30% = $255 billion

The potential of the Web3 agent market may go far beyond this, especially as these advantages are further explored and fully leveraged.

Conclusion

The emergence of Web3 AI agents represents the convergence of two transformative technologies.

ChatGPT has reached 200 million monthly active users in just two years, providing an important reference benchmark for the accelerated adoption of AI technology. Using the conservative baseline of 10.9% from the "Bitcoin to Gold market cap ratio" and applying it to the estimated $850 billion AI agent market opportunity (excluding ChatGPT's share), the potential market size for Web3 AI agents could reach $92.65 billion. Given the inherent advantages of Web3, such as decentralized infrastructure, token-based incentive mechanisms, smart contract automation, and integrated payment systems, its market share could be even higher. A 20% market share is a reasonable expectation, supporting a $170 billion market size.

Furthermore, the unique capabilities of Web3 agents in terms of tokenized agent ownership, DAO integration, and composability with DeFi, allow them to fully leverage the rapid adoption trajectory of AI technology and the existing infrastructure of blockchain technology. Therefore, this field has the potential to be one of the biggest beneficiaries of the convergence of AI and blockchain technologies.