Author: Tyler

In the article "A Beginner's Guide to Registering and Using the SafePal Mastercard", I have shared detailed steps on how to open a SafePal & Fiat24 bank account and activate the Mastercard, helping many users successfully complete the account opening and card activation process.

However, after publishing the tutorial, I have also received a lot of feedback on the registration process, usage tips, and related issues, especially the precautions during the registration process, as well as how to use the SafePal bank account for overseas brokerage deposits and withdrawals, which are more advanced application scenarios.

Therefore, I have systematically reviewed and provided in-depth answers to these high-frequency questions, covering various aspects from the account opening threshold, security precautions, to derived usage scenarios. Whether you want to use this service for convenient daily consumption, or plan to use it as a bridge for more investment scenarios, I believe this article will help you better master the usage skills of the SafePal bank account and Mastercard.

List of specific questions:

Question: What are the thresholds and additional fees for opening a bank account and applying for a Mastercard?

Answer: For domestic users, there is no need for a VPN, and you can use your ID card or passport (Android recommends ID card, iOS recommends passport) to download the SafePal Wallet APP, with 0 threshold for account opening, 0 card issuance fee, 0 management fee / annual fee / monthly fee.

Question: What is the official download link for the SafePal APP?

Answer: The wallet's official website download link is: https://www.safepal.com/zh-cn/download

Question: What is the bank account and Mastercard that are issued?

Answer: It is a compliant bank account with Fiat24 Bank in Switzerland and a co-branded Mastercard. The Swiss bank account (Fiat24 bank account) allows users to obtain an independent IBAN account, supporting fiat currency deposits and withdrawals, bank transfers, currency exchange, and other regular banking services; the co-branded Mastercard can be used to bind Alipay/WeChat and other channels for online/offline consumption.

Question: What is the use of the SafePal bank account and Mastercard after they are issued? How can they be used?

Answer: The Mastercard can be used as a USDC-rechargeable "U-card" for domestic daily payments, convenient for small-amount consumption and withdrawals; the bank account can realize Euro and Swiss Franc bank transfers and remittances, as well as deposits and withdrawals for overseas brokers (Etoro, Fidelity, Tiger, etc.) and CEXs (Kraken, Bitstamp, Binance, etc.).

Question: Are there any security precautions?

Answer: This bank account and Mastercard are based on a Web3 architecture, and the following points should be noted:

- Wallet backup: It is essential to properly back up the wallet and ensure the safety of the seed phrase or private key, to avoid loss or leakage.

- On-chain address usage: This service is completely based on on-chain wallet addresses, and no mobile number or email is required when applying for an account.

- NFT ownership: The bank will mint an NFT for the user as proof of account ownership. Users need to ensure that this NFT is stored in a trusted wallet, avoid transferring or leaking it, as losing the NFT may affect the account ownership.

Question: If the wallet is compromised or lost (or you want to change the wallet), how to transfer the bank account and Mastercard?

Answer: If you want to switch wallets to use the banking function, first transfer all the asset tokens (USD24, CNH24, etc.) to the new wallet, then transfer the NFT to the same wallet, thereby achieving the purpose of switching wallets.

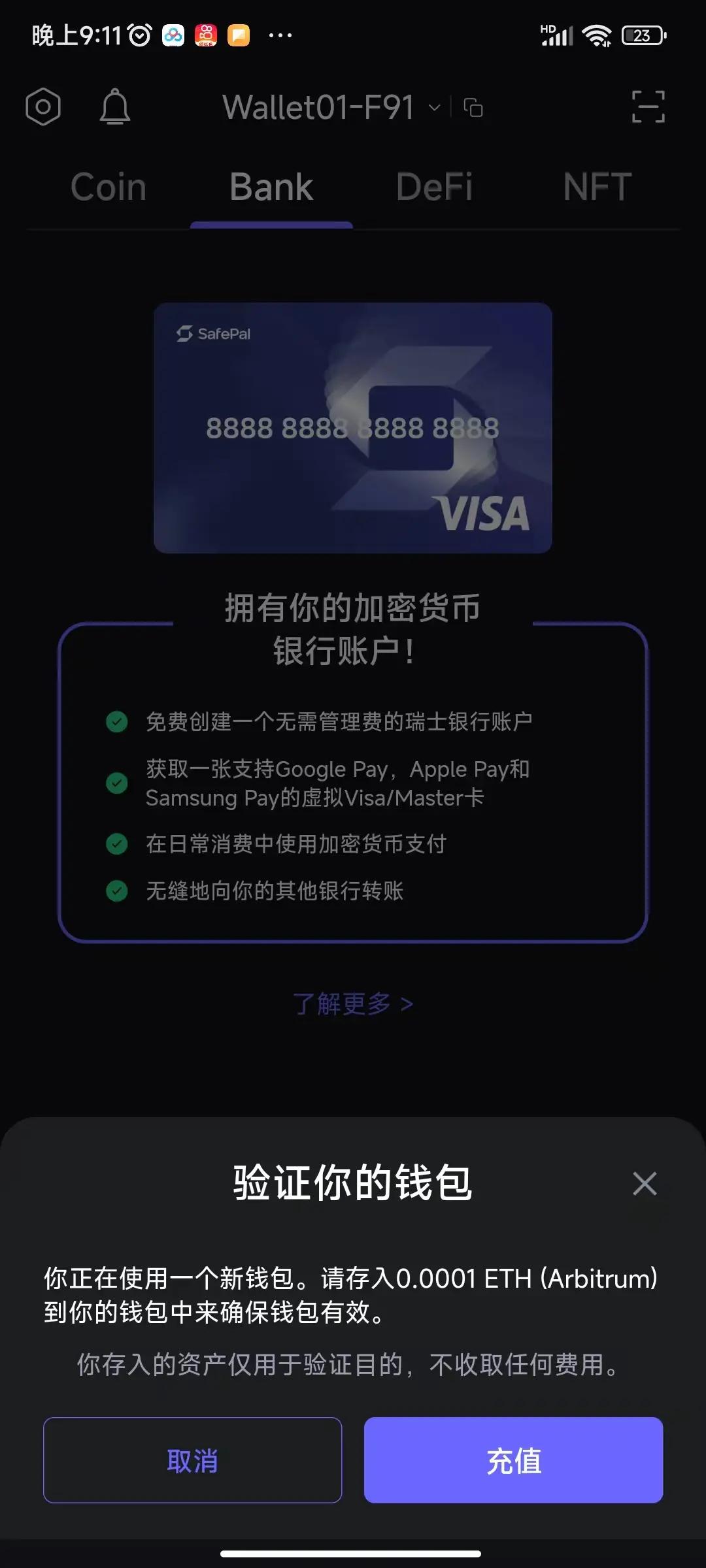

Question: Do I need to transfer ETH first when opening an account? Is it a registration fee?

Answer: Since the recharge process needs to be done on the Arbitrum network, you need to ensure that your wallet has enough Arbitrum ETH to pay the Gas fee, 0.0001 ETH is enough (less than $0.5), which is mainly for the Gas fee in the account opening process, and there is no additional fee.

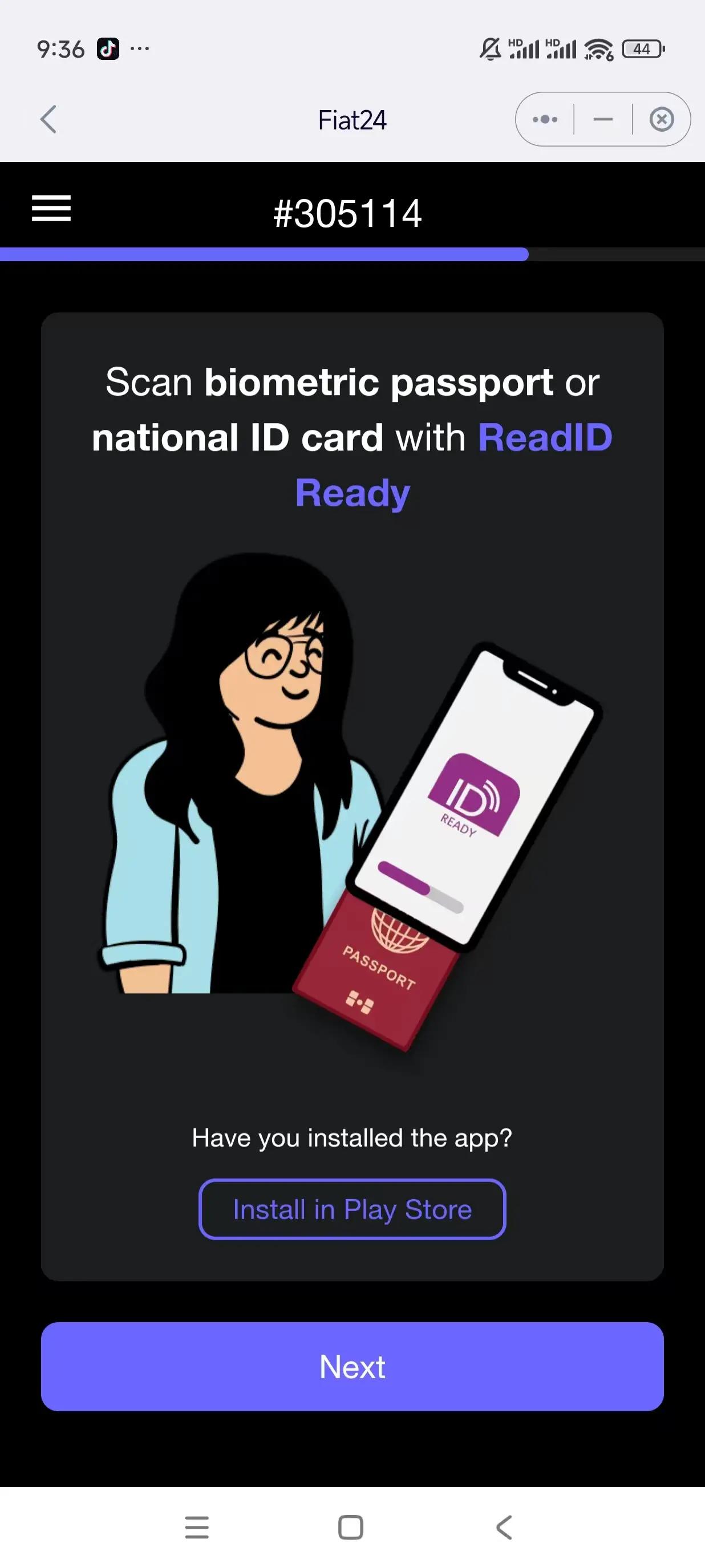

Question: What does this page mean?

Answer: As required, download ReadlD Ready and then click "Next" to automatically jump to the next step.

Question: In the account registration process, during the identity verification step, the phone prompts that NFC is not supported, what to do?

Answer: If your phone supports NFC, turn on the NFC switch first, then re-enter the ID card mini-program, otherwise it may be identified as unsupported; if your phone does not support NFC, you need to use a phone with NFC.

Question: How to solve the problem of black screen or unable to display during the registration process?

Answer: It is recommended to try several times. If it is a network problem, try switching to a mobile network (turn off WiFi). If it still doesn't work, try again at a different time or with a different device, and restart the device if necessary.

Question: What does the "An email will be sent once completed" prompt mean? How long do I need to wait?

Answer: Wait for the review, be patient for the review result.

Question: If the user accidentally closes the Fiat24 account, how to restore it?

Answer: According to the bank's official prompt, the account cannot be restored after it is closed. You can try to register a new address, or contact the bank for consultation: service@fiat24.com

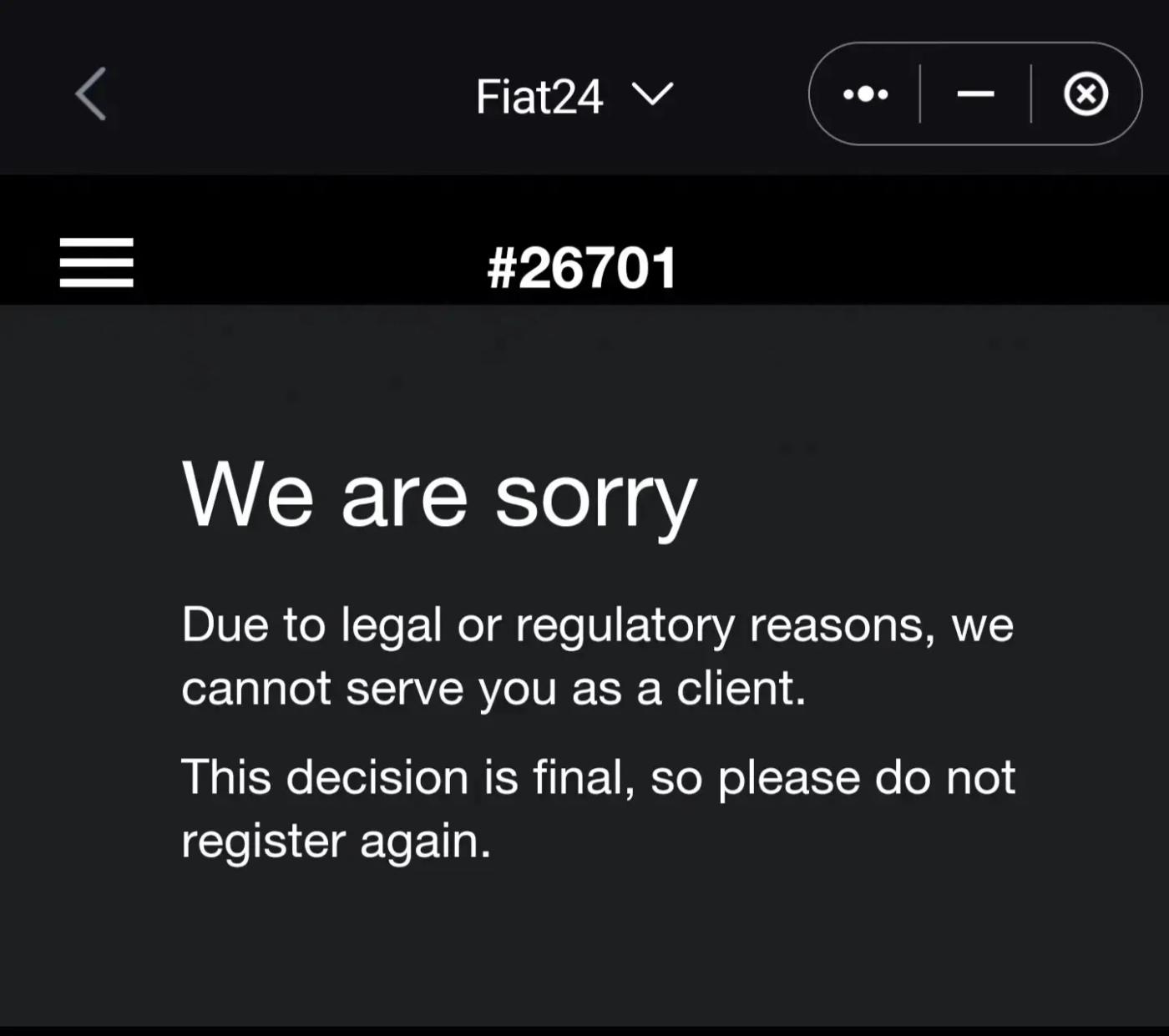

Question: What if the page shows that risk control has not passed?

Answer: Currently, the priority is to suggest using a family member's identity to register again; the main reasons for being risk-controlled are: the name is the same as a PEP (Politically Exposed Person) or a sanctioned person; the address is the same as a blacklist address, has interacted with a blacklist, the personal information is on the blacklist of other banks, the GPS location is in a high-risk area. Overseas banks all have such a list, usually to avoid risks, they will require more materials for secondary review.

Question: If the SafePal registration is rejected, can I still register for similar Mastercard services like imToken/TokenPocket?

Answer: The underlying bank is the same Fiat2424, just with different fees and other experiences, so if you are rejected, you cannot reapply.

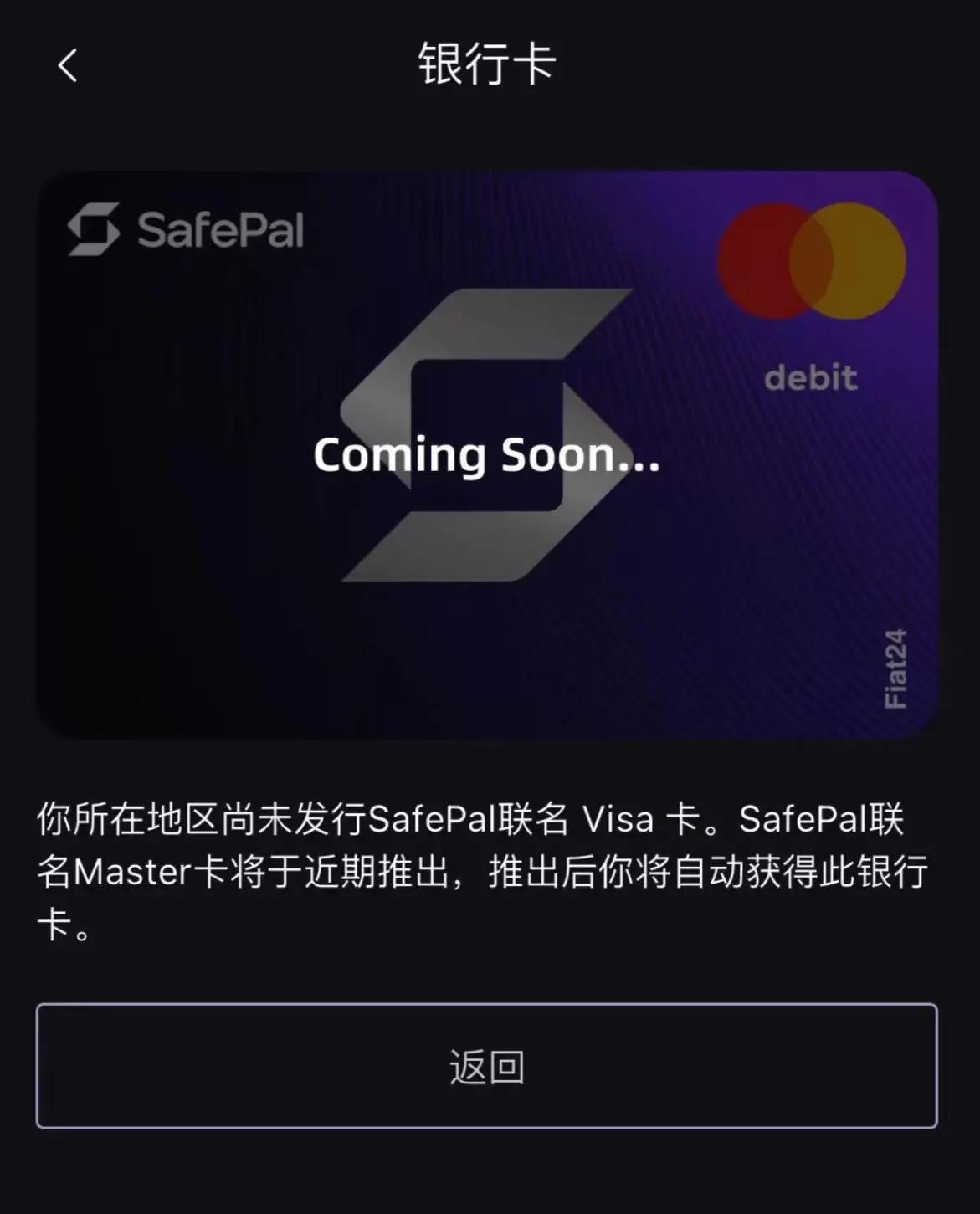

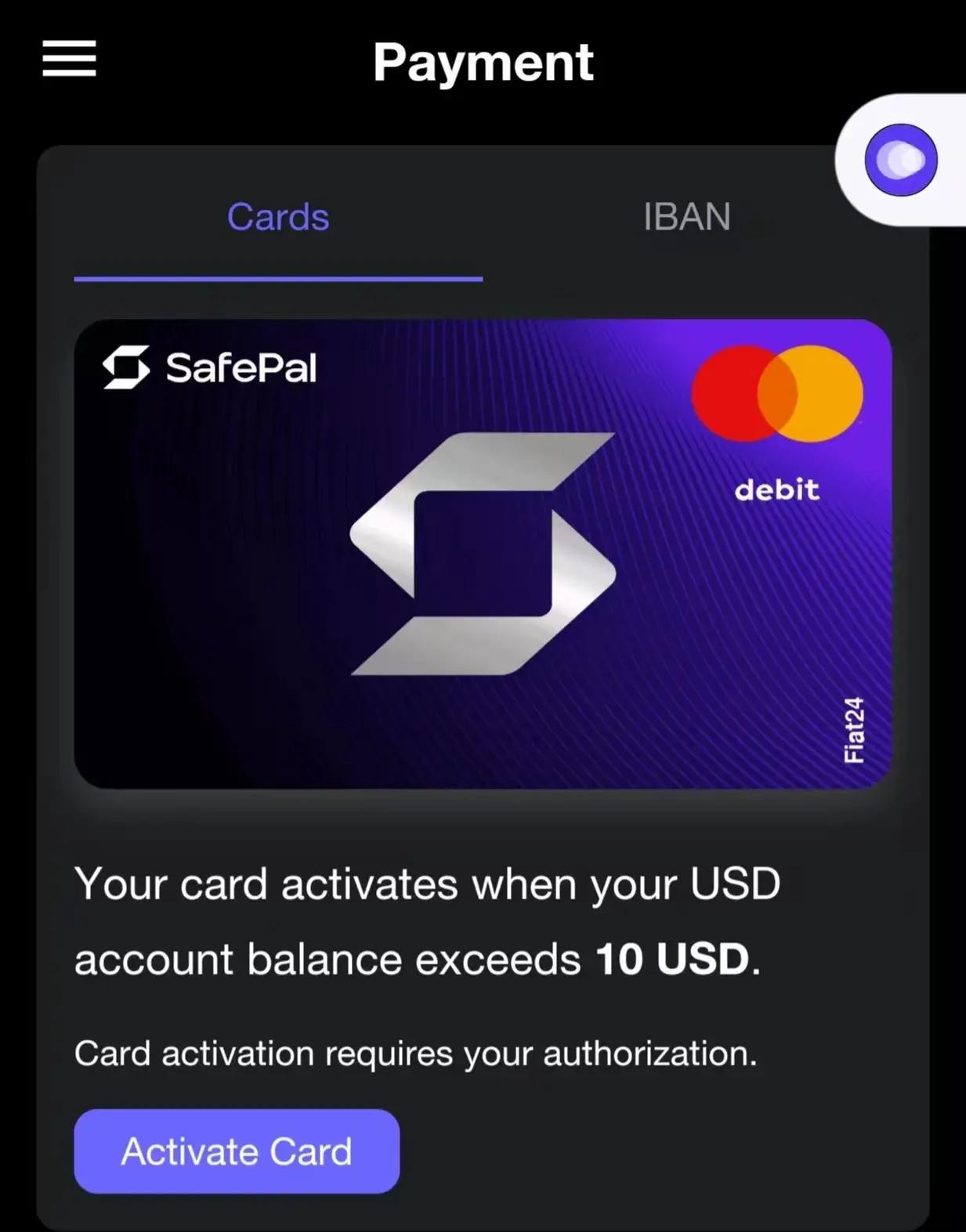

Question: After the account registration is successful, when applying for the Mastercard, the image below is displayed, what does it mean?

Answer: The account has been successfully opened, and the card needs to be manually issued. Be patient for 1-2 days, then go to the "Bank" page and click "Bank Card" to activate the Mastercard.

Question: Is there a physical card?

Answer: There is no physical card for now, but binding Alipay/WeChat and bank account transfers are not affected.

Question: What are the overall fees and wear and tear when using this Mastercard?

Answer: There are only recharge fees (long-term free, 100% instant rebate, can be viewed in "Level" - "Total Reward") + exchange fees (no exchange fees when using RMB domestically). Currently, with the exchange rate, the actual wear and tear is also around 1%, and it is even smaller on weekdays, because there is no quote on weekends, so it is recommended to recharge USDC to RMB, USD, etc. on weekdays.

Question: What does this page mean? Do I need to pay a $10 fee?

Answer: When activating the bank card, a minimum of $10 verification is required (0 fee, just verification), you can recharge 10 USDC to the "Recharge" entry as $10, and this fee will remain in your own account without being charged.

Question: After the card is successfully issued, how to recharge the on-chain stablecoin (U) to US dollars, RMB, etc. that the Mastercard can use?

Answer: It supports recharging USDC to US dollars, RMB, Euros, and Swiss Francs, but you need to make sure that the USDC being recharged is the version based on the Arbitrum network, to avoid recharge failure or asset loss.

Question: How to bind Alipay/WeChat to the SafePal Mastercard?

Answer: After activating the SafePal Mastercard, you need the card number, expiration date, and 3-digit security code to bind to WeChat or Alipay.

Question: What are the transaction/consumption limits?

Answer: The transaction limit (remittance, exchange, consumption) of the SafePal bank account in the domestic region is $100,000/month;

When binding Alipay/WeChat for daily consumption (their respective limits for international cards):

- WeChat is 3,000 RMB/transaction, 3,000 RMB/day, 15,000 RMB/year;

- The minimum single payment amount for Alipay is 0.1 RMB, the maximum single payment amount is not more than 3,000 RMB, and the maximum annual cumulative payment amount is not more than the equivalent of 10,000 USD (about 70,000 RMB).

Question: Is there a risk of funds being deposited?

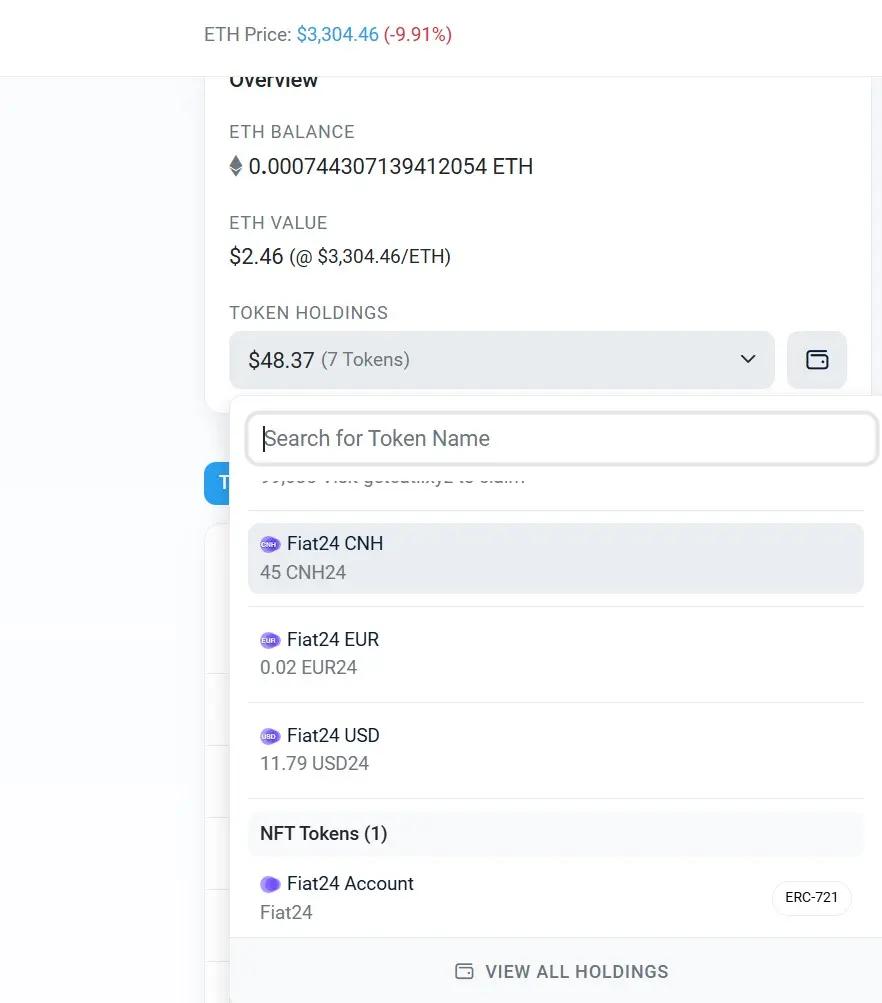

Answer: The US dollars (USD) / Chinese yuan (RMB) / Euros (EUR) / Swiss francs (CHF) in the SafePal bank account are RWA tokens issued by Fiat banks based on the Arbitrum network, so our balances and spending are actually transparent throughout, ensuring that no third party can misappropriate or custodize the funds.

Question: Can USD24, CNH24 and other fiat currency tokens be directly exchanged for USDC?

Answer: No, there is no exchange trading pool for USD24 and others on-chain, but they are 1:1 pegged to fiat currencies, which can be understood as a Fiat24 accounting token that achieves transparent transactions on-chain.

Question: How are the Gas fees paid now?

Answer: Recharging, authorizing, and currency exchange are how we personally pay Gas, but it's very low, averaging a few cents per transaction; for daily card-bound consumption transactions, the bank pays the Gas, and users don't need to pay.

Question: What is the registered address of Fiat24 Bank?

Answer: The registered address of Fiat24 is Bellerivestrasse 245, 8008 Zurich, Switzerland.

Question: What are the advantages compared to a regular U card?

Answer: It has higher security than a regular U card, as it is essentially a personal named Swiss bank account.

Question: What payment methods are supported now?

Answer: Alipay, WeChat (show QR code to pay), Google Pay, Samsung Pay are supported; Apple Pay will be launched soon.

Question: How to get a refund during the beta testing period?

Answer: The refund process is longer during the beta testing period, and will be arranged manually in January when it officially launches; after the beta ends, an automated process will be used.

Question: Why does the WeChat payment binding fail sometimes?

Answer: WeChat payment may fail if not using the QR code, it is recommended to use the QR code payment or use Alipay instead.

Question: Some users find they can't bind WeChat, what's the reason?

Answer: It's WeChat's risk control, can only follow the guidance to operate.

Question: Some users get a prompt when binding Meituan payment: the bank feedback that the card has risk... What's the reason and how to solve it?

Answer: Meituan's risk control for external cards is relatively strict, it is recommended to bind Alipay/WeChat, Meituan can also pay through these channels.

Question: For domestic consumption, is it more suitable to recharge USDC into Chinese yuan (RMB) or US dollars (USD)?

Answer: It is recommended to recharge in RMB first to save the exchange fee; of course, you can also recharge in USD, and the deduction will automatically exchange (with a 1% exchange fee) - you can compare if using USD, how much the actual loss will be, because USDC is 1:1 USD, it just depends on the exchange rate used during payment.

Question: In the "Recharge" section, when exchanging USDC for fiat currency, is it the real-time exchange rate?

Answer: The bank will adjust according to the real-time exchange rate.

Question: Why is there a big difference in the RMB recharge exchange rate between weekends and weekdays?

Answer: The bank said the Spread will widen on weekends because there are no quotes then, so it's recommended to exchange on weekdays.

Question: How to check the personal ID after registration?

Answer: Personal ID: In the "Account" section, the 5 or 6 digits after the "#".

Question: If I didn't fill in the invitation code at the beginning, can I fill it in later?

Answer: Yes, you can fill it in later. Within 7 days after the account is successfully opened, go to "Level" -> "Invitation" -> "My Inviter" to fill in 244274.

Question: What are the benefits of filling in my invitation code?

Answer: The 3-month commission-free period for SafePal Mastercard/bank account recharging will be adjusted to permanent 0 commission, so users can use it with confidence; users who open an account and apply for a card through the exclusive invitation code "244274" can receive a free official SafePal hardware wallet X1 (only need to pay a small shipping fee), worth $69.9.

Question: How to get the hardware wallet? Is it free?

Answer: Sync your ID with me, just pay a small shipping fee, to prevent scammers (domestic warehouse, official direct delivery, the X1 hardware wallet is at the bottom of the image).

Question: Can I use this card to activate X/GPT membership?

Answer: X, GPT, etc. can all be used, but GPT has stricter requirements, requiring the IP address to be compliant, so a Swiss VPN is needed when making payments (GPT's rule, you can only pay at the card issuer's location).

Question: What if the card expires?

Answer: The bank has an update process, no need to worry.

Question: Can this card only be used for consumption, not for withdrawal?

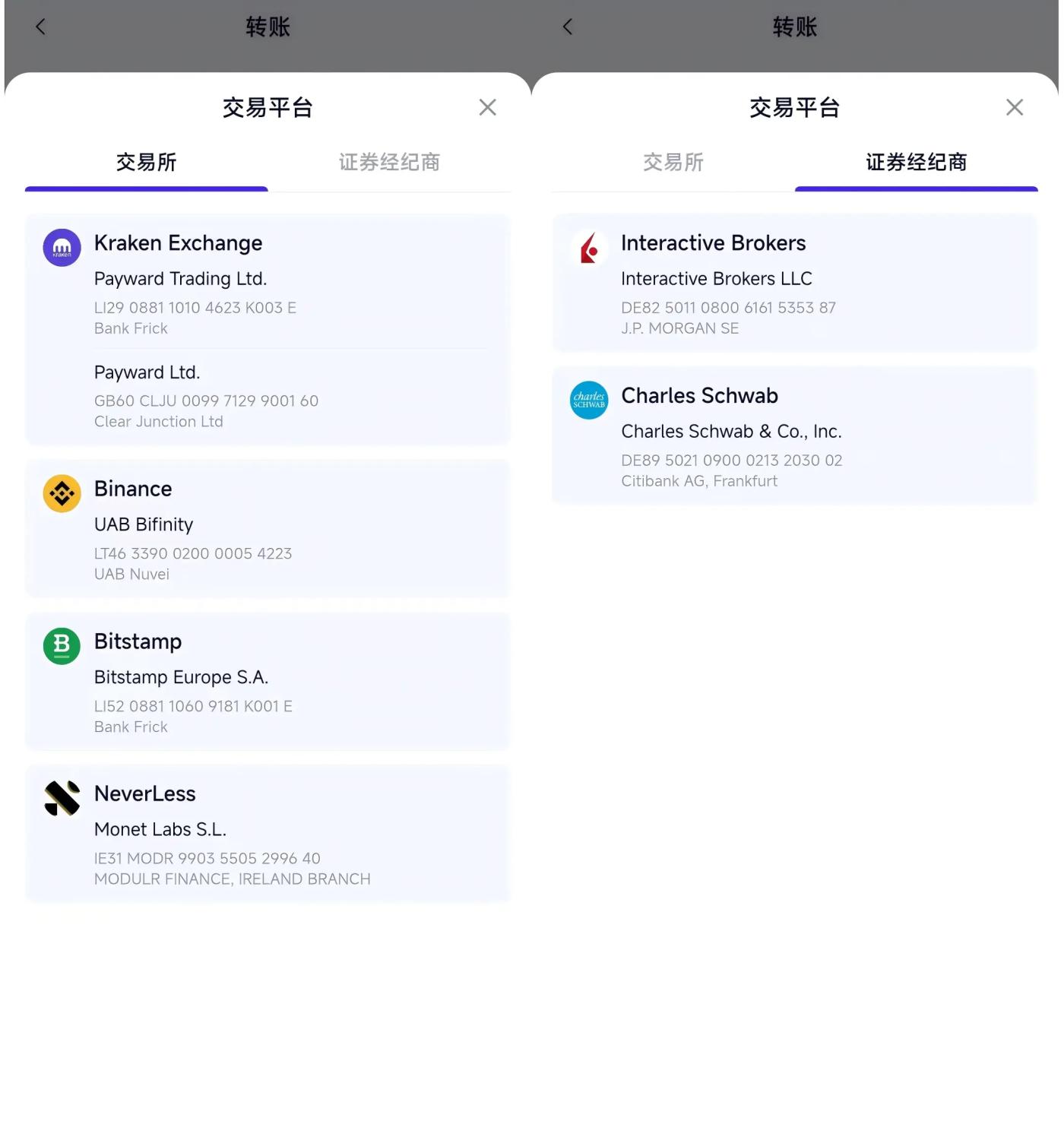

Answer: SafePal is a combination of a bank account and a bank card, the bank card is for consumption, and the bank account has transfer function (can directly transfer Euros and Swiss francs). Currently, there is no way to directly transfer RMB to a domestic bank, but you can transfer through a third-party platform like Wise, as well as deposit into overseas brokers (Etrade, Schwab) and CEXs (Kraken, etc.).

Question: How to use the SafePal bank account to deposit funds now?

Answer: Currently in mainland China, if you want to deposit funds using the SafePal bank account, first purchase Euro cash through the bank's cross-border foreign exchange business, then transfer the funds to the SafePal bank account, and then in the "Bank" service page's "Buy USDC" you can deposit the funds as USDC.

Question: Can I deposit in RMB?

Answer: Not recommended, and actually not necessary either, this card is mainly used for U consumption, as well as transferring U to Euros etc. to deposit into overseas brokers.

Question: How to withdraw from the SafePal bank account?

Answer: For withdrawal, if you want to withdraw directly as Euros, you can do so according to the IBAN to transfer to the SafePal Euro account; if you want to withdraw directly to a domestic bank, you generally need to use Wise as an intermediary.

Question: What currencies can the SafePal bank account transfer? Is there US dollars?

Answer: It's important to note that currently only Euros and Swiss francs are supported for cross-bank transfers, in the "Transfer" section, click "Contacts" to make transfers (bank remittances, broker deposits and withdrawals, etc.), with 0 cross-bank fees; but you cannot add contacts yourself for now, the other party needs to transfer to you first, then you can see them as a contact (you can check your personal remittance receiving information in "Recharge" - "Wire Transfer").

Question: What overseas brokers and CEXs can I deposit into?

Answer: Any non-banking institution that supports Euro deposits (supports IBAN) can theoretically be used - currently Etrade and Schwab both support direct Euro deposits via IBAN, you can go to the "Bank" service page of SafePal, "Transfer" - "External Transfer" at the bottom, click on the exchange/broker icon to enter, select the corresponding institution, wire transfer Euros to complete the deposit. For other brokers like Futu and Tiger, you can theoretically use Wise as an intermediary to complete the deposit as well.

Question: How long does it take to deposit into brokers like Etrade?

Answer: Based on personal experience, it takes about 3-5 hours on a business day, and at most 1 business day.