On January 13, Bit (BTC) briefly fell below the $90,000 mark, reaching a low of $88,900, a drop of nearly 7%. According to the latest Bitfinex Alpha report, this decline was mainly due to macroeconomic uncertainty, which will be accompanied by a significant reversal in market sentiment.

Table of Contents

ToggleReversal of ETF fund flows

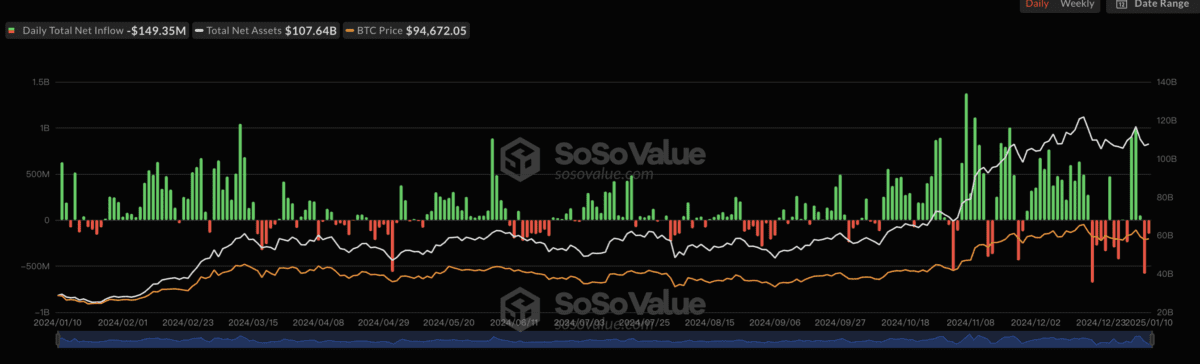

The report indicates that the fund flows of Bit (BTC) ETFs are showing a weakening of market sentiment. Over the past 12 trading days, there have been 7 days of net outflows.

Although the market performed well at the beginning of the year, attracting nearly $1 billion in inflows on January 3 and January 6, there were significant net outflows of $718 million on January 8 and January 10.

These fund movements are closely related to macroeconomic pressures, particularly the continued rise in US government bond yields and the Federal Reserve's (Fed) policy stance.

Rising government bond yields create dual pressure

At the same time, the US 10-year government bond yield recently reached 4.79%, a new high in 14 months, creating dual pressure on Bit (BTC). On the one hand, the higher yield attracts institutional investors to shift towards safer and income-generating assets such as government bonds; on the other hand, the tightening of the financial environment reduces market liquidity and diminishes the appeal of speculative assets.

Against this backdrop, institutional investors are adjusting their portfolios, favoring low-risk assets over volatile, non-yielding assets like Bit (BTC). Additionally, the rise in borrowing costs also reduces the likelihood of capital inflows into the cryptocurrency market, further exacerbating the downward pressure on Bit (BTC) prices.

Bit (BTC) and US stocks are closely correlated

Historical data shows that Bit (BTC) prices tend to reflect macroeconomic changes more quickly than stocks, due to its higher volatility and sensitivity to liquidity changes. For example, the stock market may take months to digest the rise in government bond yields, while Bit (BTC) usually reflects these changes within a few weeks.

Furthermore, the price trend of Bit (BTC) remains closely correlated with the US stock market, particularly the S&P 500 index (SPX). The report indicates that the correlation between Bit (BTC) and SPX is typically strongest in the first quarter, suggesting that Bit (BTC) may continue to follow the overall trend of the stock market.

Regulatory reform expectations provide support

Despite macroeconomic pressures, the recent resilience of Bit (BTC) can be partly attributed to the market's optimistic expectations of potential regulatory reforms. The incoming US President Donald Trump's advocacy for a more crypto-friendly policy has boosted market confidence, providing some support for the risk asset market.

Currently, Bit (BTC) prices are fluctuating around the critical support level of $90,000, and the market may enter a range-bound consolidation phase. Under the multiple pressures of rising government bond yields, hawkish Federal Reserve signals, and ETF fund outflows, the cryptocurrency market may face challenges.

However, Bit (BTC)'s resilience relative to traditional stocks suggests that it remains attractive, especially as the regulatory framework becomes clearer. Investors need to be patient and wait for potential positive developments in policies and market sentiment, while addressing macroeconomic headwinds.