Bitcoin engaged in a fierce battle between bulls and bears last night, once reaching $89,110, forcing many short positions to be liquidated. However, there was a significant rebound afterwards, and as of the time of writing, it is reported at $94,786, having fully recovered yesterday's decline, once again demonstrating strong resilience.

Currently, based on the trading activity, if it can firmly stand above $95,000, it is expected to pave the way for the $100,000 level as an important price point; but on the other hand, if coin falls again and fails to defend the $89,000 level, it is feared that it may further explore the $85,000 level.

coin Exchange Reserves Hit New 7-Year Low

However, according to data from Coinglass, as of January 13, the coin balance in exchange wallets has dropped to 2.19 million, a new low since June 2018.

This data is usually seen as a sign that coin investors are more inclined to transfer coins to wallets for long-term holding, indicating a bullish signal.

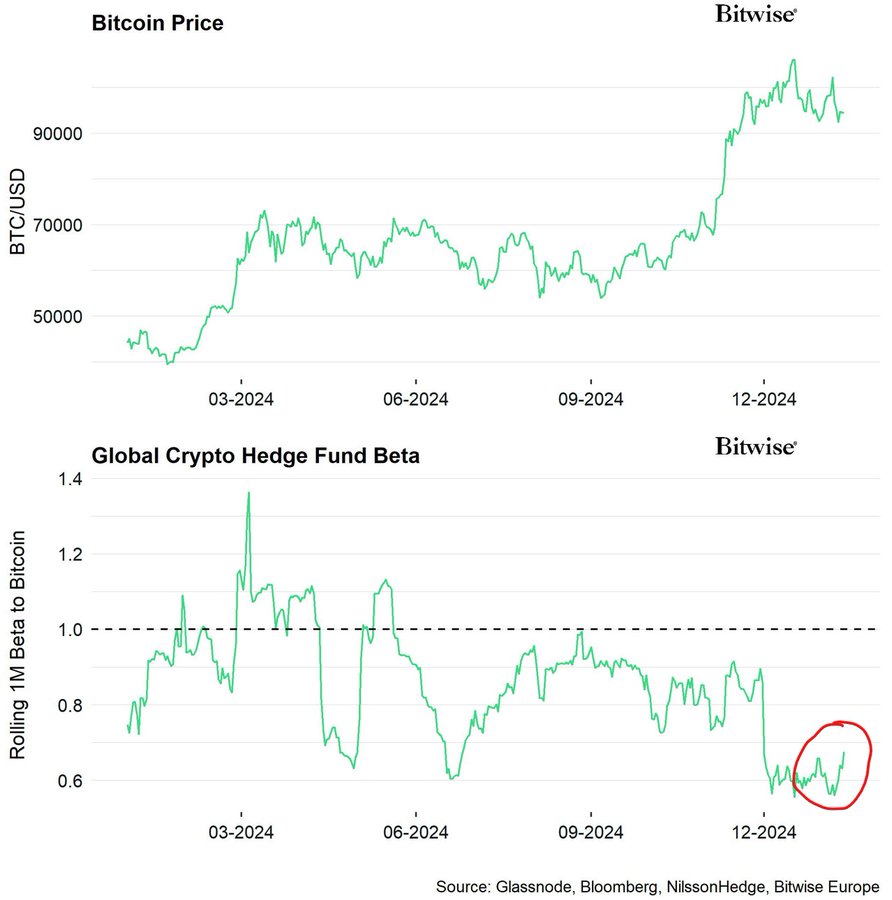

On this, Bitwise research chief André Dragosch stated that the continuous decline in coin exchange reserves may be due to the continued buying by institutional investors:

Global cryptocurrency hedge funds are continuing to buy coin as it dips.

Analyst: coin to Reach Peak in Mid-2023

Regarding the future outlook of coin, crypto analyst and trader dave the wave posted on social platform X yesterday (13th) stating that based on technical indicators, coin still has room for further upside, and is expected to reach the peak of this bull market cycle in mid-2023:

The coin bull market peak suggestion is: when the 1-year moving average reaches the middle of the LGC channel, that signals the price has reached its peak.

Additionally, crypto analyst Rekt Capital recently stated that the current coin correction may have reached its final stage:

The first price discovery correction for coin is currently underway, which typically lasts 2-4 weeks, and the current pullback has now lasted around 4 weeks. So from a historical perspective, this adjustment should be in its final stages.

Meanwhile, Bloomberg ETF analyst Eric Balchunas also posted stating that the current coin correction is only temporary, and the biggest risk facing coin is a decline in the US stock market:

I've been saying the biggest risk to coin is a US stock market decline, the cost of being a "risk-on" asset, with both upsides and downsides.

But Trump may work hard to ensure US stocks rise, so personally I'm not worried about short-term pullbacks.