Author: Nancy Lubale, CoinTelegraph; Translator: Wuzhe, Jinse Finance

Bitcoin has fallen 3% in the past 24 hours and 8% in the past week. However, market analysts say this BTC decline in January is not uncommon. Therefore, the bull market may recover, according to a key technical indicator, Bitcoin's price could peak in mid-July 2025.

BTC/USD daily chart. Source: Cointelegraph/TradingView

Bitcoin price may peak in the summer

Data from Cointelegraph Markets Pro and TradingView shows that after a significant rise in 2024, Bitcoin has been in a four-week price consolidation range, ultimately reaching a new all-time high of $108,268 on December 17.

Bitcoin trader and analyst Dave the Wave says that since then, the Bitcoin price has fallen 14% from these record levels, but the 52-week simple moving average (SMA) indicates that Bitcoin still has room to rise.

While various studies and data have made different forecasts in recent weeks, Bitcoin has previously followed the logarithmic growth curve (LGC) pattern, which suggests that once the 52-week SMA reaches the middle band of the channel, the BTC price will peak.

In a January 13 X post, Dave the Wave said that Bitcoin's price "has previously peaked when the one-year moving average touched the midpoint of the LGC channel".

"This suggests #BTC will peak mid-year."

BTC/USD weekly chart. Source: Dave The Wave

However, the chart shows that historically, prices have peaked a few days or months before or after the moving average crosses the LGC midline. For example, in 2013, the price peaked on December 13, the same day the 52-week SMA gave the BTC top signal.

In 2017, BTC peaked on December 17, but the peak signal came a month later on January 15, 2018. And in the 2021 bull cycle, when Bitcoin reached a peak of $69,000 on November 10, the 52-week SMA signal came several months earlier on May 3.

Therefore, the peak of Bitcoin in 2025 may occur a few days to a few months before or after the one-year SMA crosses the LGC midline, expected to happen sometime in mid-July.

Dave the Wave noted that the less steep one-year moving average means "the market is maturing".

Bitcoin price correction enters "final stage"

Meanwhile, crypto analyst Rekt Capital said the ongoing Bitcoin price consolidation is part of the "first price discovery correction" occurring between the 6th and 8th weeks of the parabolic phase. These corrections last 2-4 weeks.

"The current drawdown has now lasted 4 weeks," Rekt Capital said in a January 11 X analysis, adding:

"So from a length perspective, history suggests this correction should be entering its final stage."

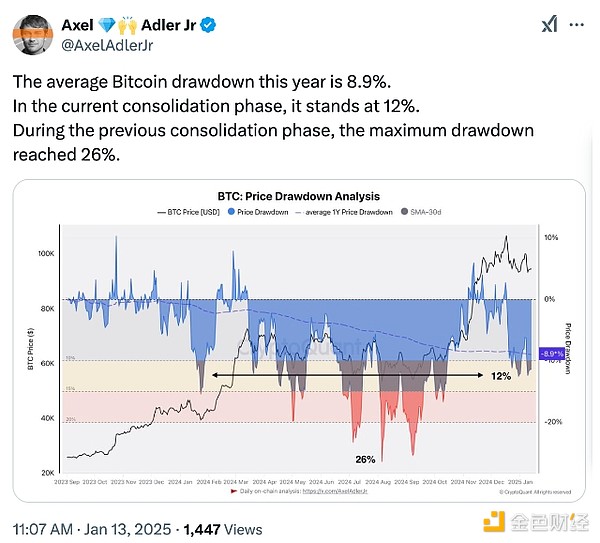

Analyst Axel Adler Jr. said the current Bitcoin decline is not as severe as previous consolidation phases, when BTC fell over 26% from July 29 to August 5, 2024.

Analysts say this relatively mild correction at the start of the year is common in the years following a halving.

Meanwhile, veteran trader Peter Brandt shared a chart showing BTC may be forming a head and shoulders (H&S) pattern on the daily chart, which could lead to three possible outcomes.

For the first outcome, Brandt said BTC could confirm the pattern, complete the trend, and reach the H&S pattern's target, which is below $77,000.

The other two outcomes are the price completing the pattern but failing to reach the target, leading to a bear trap or "evolving into a larger pattern".

BTC/USD daily chart: Possible H&S pattern. Source: Peter Brandt

Additionally, Bitcoin analyst Bitcoin Munger has found large buy orders on Binance between $85,000 and $92,000, and he wonders if the Bitcoin price will drop to fill these buy orders or rise to fill the $110,000 sell orders.

"Be prepared for either scenario, as I believe $110,000 will come regardless."