Author: Sam Ruskin, Messari Research Analyst; Translator: Jinse Finance xiaozou

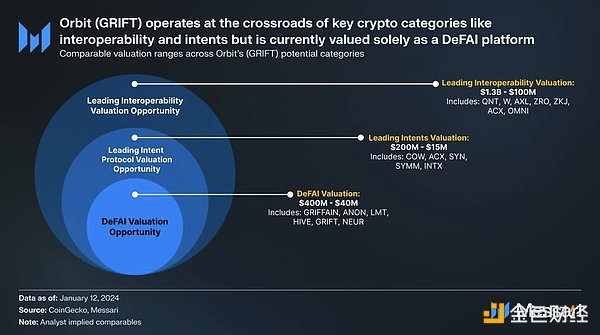

The DeFAI protocol Orbit (GRIFT) connects key crypto areas such as interoperability and intent, but is still only seen as a DeFAI platform, with its agent-solver network developed by SphereOne, which could become an important competitive moat.

Currently, Orbit is valued at $70 million, up 63% this week, Orbit meets the demand in the areas of DeFAI, intent and interoperability, but it seems that people only see it as a DeFAI platform.

Sphere Labs is the design company of Orbit (GRIFT), which has recently become very popular due to the DeFAI trend, but they have been developing intent DeFAI infrastructure for over a year.

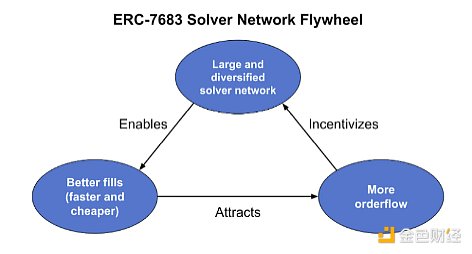

Intent allows users to trade without smart contracts, such as swaps, staking or liquidity management, which are all competed to be executed by solvers. Intent abstracts on-chain operations and bridges complexity across chains (such as Solana and Ethereum).

Intent can provide support for DeFi in the chain-abstracted world, but there are also some risks:

Order flow: Exclusive control of the Ethereum order flow leads to centralization of power, making censorship, rent-seeking and MEV attacks possible, undermining decentralization and fairness.

Trust: Dependence on intermediaries sets a high entry barrier for new intent architectures, limiting the innovation and competition needed to improve execution quality.

Opacity: Intent architectures often require users to relinquish control of their on-chain assets, and the permissioned mempool adds another layer of opacity. The risk is the formation of a system with unclear user expectations, while the potential threats to the ecosystem are overlooked.

SphereOne has emerged at the right time: they have created a multi-agent solver network with all the functionality of a typical solver network, but with much less baggage.

Agent solvers typically have the following characteristics:

-Near-infinite scalability

-Can be seamlessly automated

-Not prone to MEV participation

-Able to balance token liquidity more optimally and transparently

-More cost and resource efficient

Intent may be the most practical DeFAI use case.

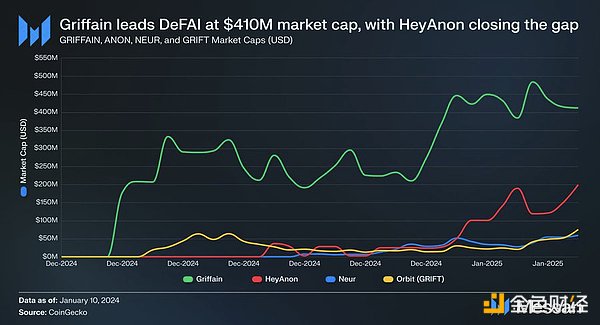

First-mover advantage is crucial for DeFAI. We've seen griffain and Hey Anon maintain a lead over other tokens. Apart from basic natural language interface products, there is little innovation in DeFAI, and it seems to be ready to be disrupted.

As major tech/AI companies like OpenAI, Google and Amazon are all exploring their own agents, I think any natural language interface/chatbot is not a viable moat. Choosing a successful DeFAI protocol requires deeper research into specific tools, deep DeFi integration, and developer velocity.

The agent solver network is not without risks, such as:

-Initial latency is low, reasoning capability is poor.

-Given the general opacity of intent, a certain degree of trust is still required.

-If malicious actors flood the network with false intents, there are security risks.

These risks (low latency, poor reasoning, trust requirements, security risks, etc.) are common to most AI projects. So I hope some projects that provide solutions for mainstream frameworks can have a trickle-down effect on smaller platforms like Orbit.

Orbit and SphereOne's goal is to cover the entire intent and transaction stack, integrating cross-role agent frameworks like CoW DAO, Across and solver networks (e.g. 1inch, Fractal, Rizzolver).

As more and more agents start to manage funds and on-chain transactions in the next one or two years, deeper DeFi integration and more robust on-chain infrastructure will be crucial. Orbit is ahead in both areas, and is almost unrivaled in on-chain infrastructure.