Embarking on the journey to build the anchor for the future of on-chain finance in 2025.

Author: shaofaye123, Foresight News

If 2017 was the first year of public chains and 2020 was the golden age of DeFi, then 2024 was undoubtedly the year of the comprehensive rise of on-chain finance. This year brought not only technological innovation, but also a fundamental reshaping of the efficiency, transparency, and liquidity demands of traditional architectures. What is needed is not only an increase in TPS, but also a comprehensive optimization of capital efficiency and liquidity. Public chains need to truly flow, which is reflected in the growth of developer activity, the increase in new user attention, and the acceleration of capital turnover. Mantle Network, with its unique modular design, efficient capital utilization, and thriving ecosystem, has become a true "liquidity public chain". This article will take you back to 2024 and analyze the rise of the Mantle public chain.

Technological Innovation Drives Rapid Development

The foundation of on-chain finance lies in efficiency and reliability, and the realization of all this cannot be separated from the strong support of the infrastructure.

Among the many public chains, Mantle, based on a modular design, has solved many bottleneck problems of the traditional monolithic chain structure and provided a new answer to the blockchain's triangular dilemma. Through the advantages of its modular architecture, Mantle has realized the layered design of the blockchain, separating the data availability layer, the consensus layer, and the execution layer. This design not only greatly improves the system's flexibility and scalability, but also provides a highly efficient and stable underlying support for Mantle to build a "liquidity public chain".

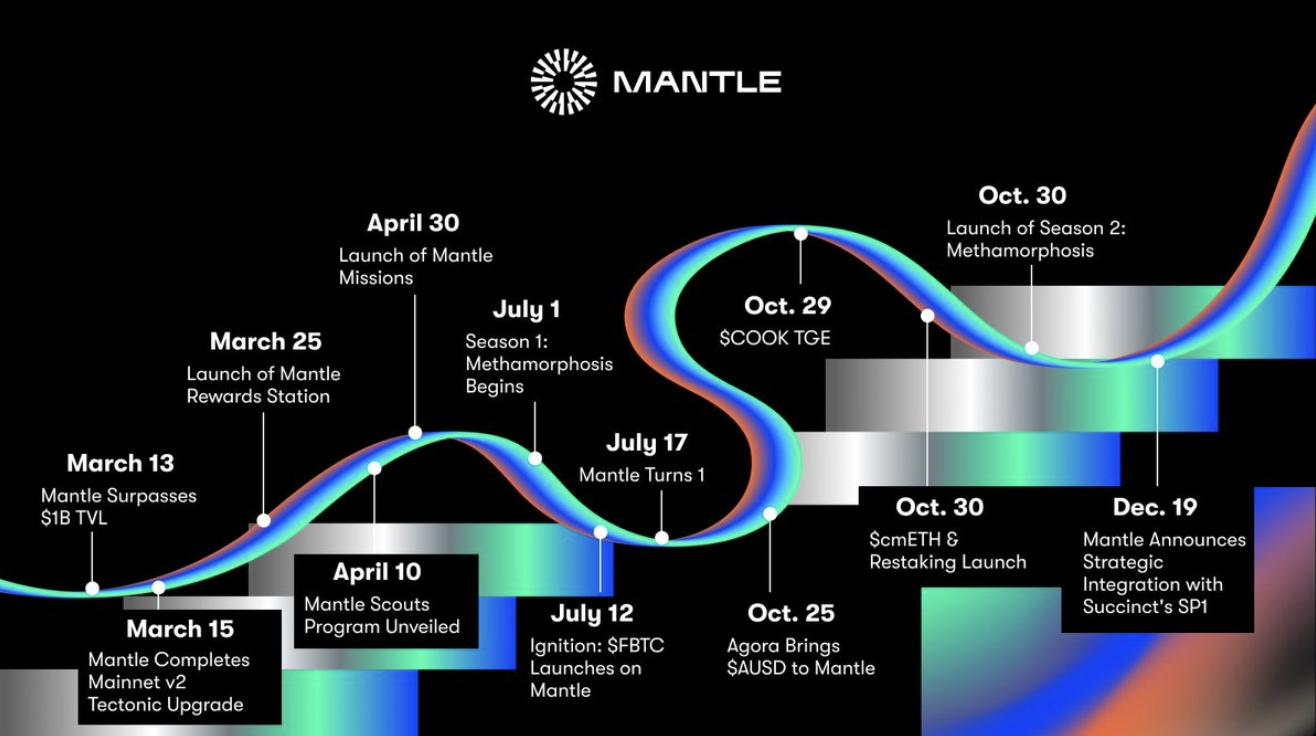

In 2024, Mantle Network had two major developments in the technical field worth noting, which laid the foundation for improving the capital utilization efficiency of the Mantle network.

- Mantle became the first Layer 2 public chain to adopt EigenDA. EigenDA is a data availability solution that allows Mantle to only submit the necessary state root to the Ethereum mainnet, while storing a large amount of transaction data in the EigenLayer. This greatly reduces the cost problem caused by the high Calldata fees of OP Rollup, and improves the data processing efficiency. This allows Mantle to maintain low latency and high throughput even during peak transaction periods, providing a stable technical foundation for on-chain finance applications.

- Mantle integrated zero-knowledge proof (zk-proof) technology on the Optimism OP Stack framework. The introduction of this technology not only enhances the on-chain privacy protection capabilities, but also greatly shortens the transaction confirmation time, pushing the performance of the Layer 2 network to a new level. Through the strategic integration of Succinct SP1, its bridging capability will be improved by 168 times, and transactions can be completed within one hour, realizing institutional-level asset settlement. This laid the foundation for Mantle to further promote the improvement of capital efficiency in the on-chain economy.

It is through the modular architecture and continuous iteration of technology that Mantle can always maintain a leading position in hardware support, cross-chain compatibility, and performance optimization, while providing convenience for developers and simplifying the development process, further compatible with more tools. It is this long-term approach to technology that has created endless possibilities for the prosperity of on-chain finance.

The On-Chain Economy is Thriving

Technology is the foundation, but the true value of the on-chain economy lies in the activity of users and the flow of capital, which is the core indicator for measuring the prosperity of the public chain economy. Supported by Mantle's strong technical support, the on-chain economic data has shown a steady growth trend.

Macro Review of On-Chain Data: Exponential Short-Term Outbreak, Linear Long-Term Growth

Compared to other major public chains, Mantle's data performance in 2024 was quite impressive. It has continued to achieve positive inflows in both users and capital, with steady growth in various indicators.

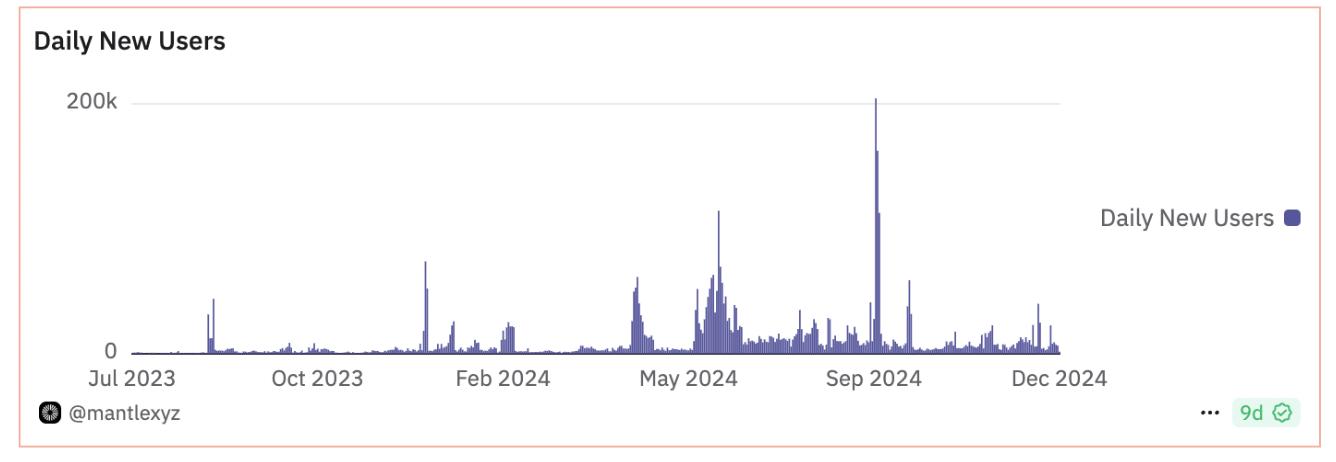

- Daily Active Users. In 2024, Mantle's daily active users exceeded 45,000, and the overall user activity experienced a large-scale outbreak in early May, reaching a peak in October with over 200,000 daily active users. This represents a 5-fold increase compared to less than 20,000 daily active users in 2023. In addition, Mantle has also organized various activities such as AI, DeFi, and GameFi to help the ecosystem development.

- New User Growth. Mantle's daily new user growth has been constantly increasing in 2024. In June, there was a sustained growth, and in September the daily new users exceeded 200,000, with a cumulative new user growth of 4.3 million. As of December 21, the total number of users exceeded 5 million, representing a more than 10-fold increase compared to 2023. Mantle is constantly attracting users to participate in the construction of the ecosystem.

- Operational Activity. Mantle has also been continuously expanding its influence on social media, with over 800,000 Twitter followers currently, and high activity on Telegram and Discord, with over 400,000 community members and over 10,000 daily active users on Discord. Offline, Mantle has cumulatively held 112 events, successfully expanding its product footprint to regions like Latin America, and accelerating its globalization process.

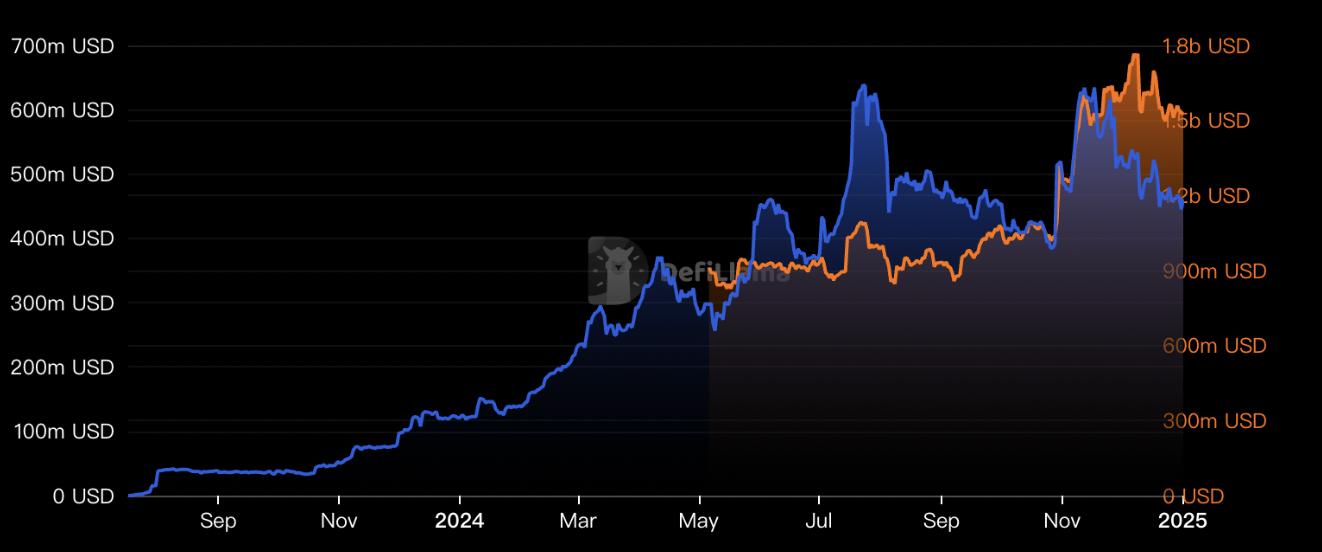

- Total Value Locked (TVL). By the end of 2024, Mantle's total locked value reached $2 billion, ranking among the top Layer 2 networks. In December 2023, Mantle's TVL was only around $200 million, but by April 2024 it had reached nearly $1.5 billion, an increase of over 700% in just 4 months. Since then, its TVL has steadily increased, reflecting not only users' trust in the Mantle ecosystem, but also the strong appeal of on-chain finance products.

- Transaction Volume. Not only has the TVL continued to grow, but Mantle's total on-chain transaction volume has also reached nearly 140 million this year, with a daily peak of 2.2 million transactions. The growth in network transaction volume has truly made Mantle a liquidity public chain.

- Ecosystem Richness. Mantle has also paid great attention to ecosystem building, always keeping an eye on market trends and focusing on application development. The dApp richness is high, with over 250 dApps, among which GameFi, DeFi, and AI applications have seen particularly significant growth.

With a series of growing data, Mantle has delivered a satisfactory report card for 2024. These data not only validate its technical capabilities, but also strongly reflect the effectiveness of its on-chain finance ecosystem layout.

The Core Assets of On-Chain Finance: Mantle's Yield-Bearing Product Matrix

The growth of this series of on-chain data is inseparable from the improvement of the yield mechanism. Behind the overall data explosion, it is the result of Mantle team's continuous optimization of products. This year, Mantle has launched a series of yield-bearing assets and innovative products around the demand for on-chain asset efficiency and security, building its unique on-chain finance ecosystem.

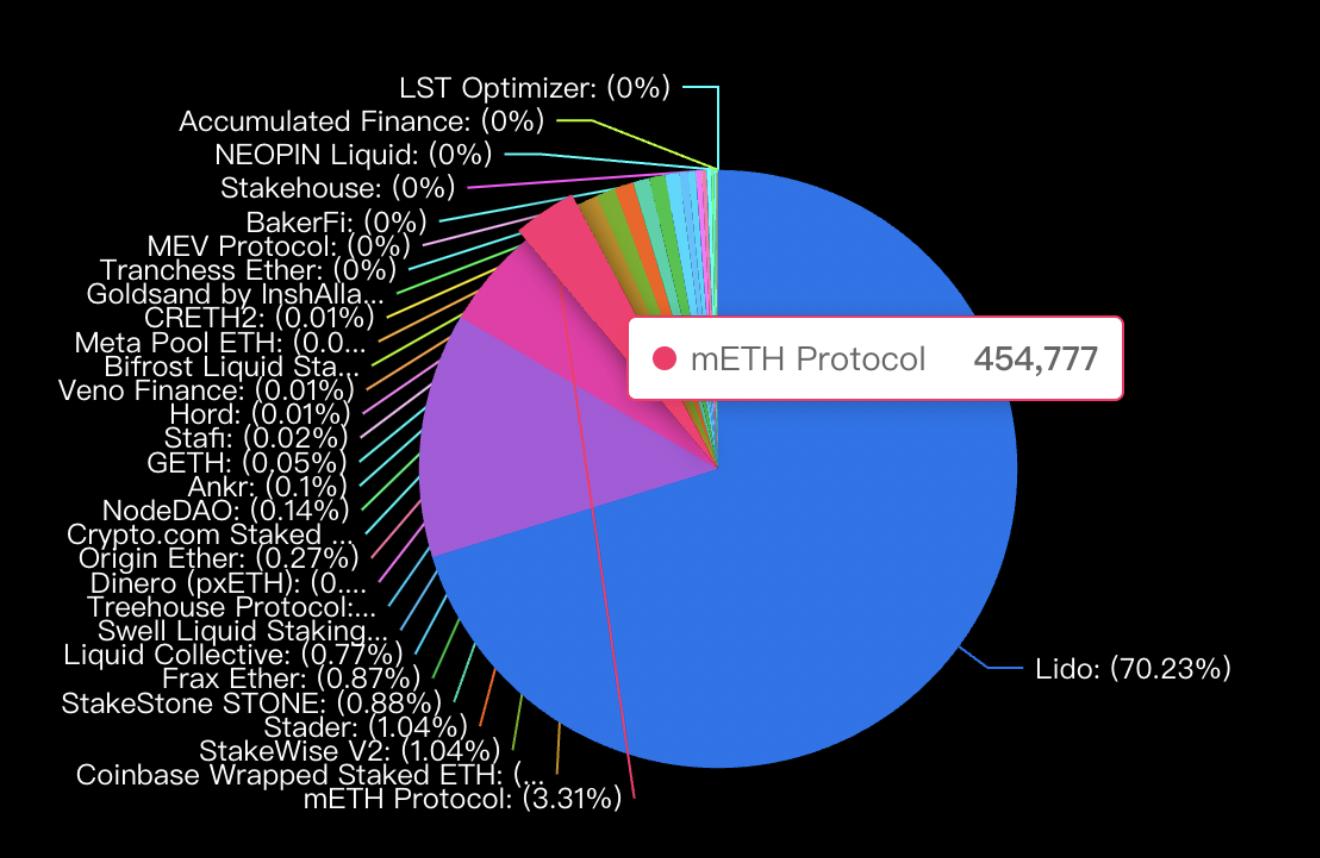

- mETH: A new yield pool model. In Q1 2024, Mantle launched mETH, a new yield pool model based on liquidity staking. Through mETH, users can stake ETH on-chain and receive higher annualized yields (stably above 6%). This has driven a significant increase in TVL, reaching $1.8 billion in just one year, making it the 4th largest Ethereum LSD product. In addition, leveraging its mature ecosystem, Mantle has expanded the liquidity scenarios for mETH holders, who can participate in various DeFi activities without having to unstake. This model not only greatly improves the yield efficiency of on-chain assets, but also injects stronger appeal into Mantle's user ecosystem.

- FBTC: On-chain financialization of BTC. As the core asset of the crypto market, the application of BTC in on-chain finance scenarios has long been limited. Mantle, through collaboration with top-tier institutions Mirana, Ant Alpha, and Galaxy Digital, has launched FBTC. FBTC is a full-chain Bitcoin asset, pegged 1:1 to BTC, and provides cross-chain bridge and trading functions on the Ethereum and Mantle networks, thereby enhancing the accessibility and utility of Bitcoin. Since its launch in July, FBTC has provided support for multiple ecosystems such as Babylon, Solv Protocol, and PumpBTC, with a TVL of $1.23 billion. This innovative BTC asset not only has extremely high security and credibility, but also provides strong support for on-chain lending, trading, and other financial scenarios.

- Enhanced Index Fund: Bridging the gap between traditional and on-chain. As an enhanced index fund launched by Mantle, this compliant, institutional-level product connects traditional finance and on-chain finance, providing a liquidity entry point for institutional investors. Through this index fund, Mantle is gradually breaking the isolation of on-chain finance and paving the way for more traditional capital to enter the blockchain field.

Ecosystem Gradually Enriched

In the development of on-chain finance, Mantle is well aware that while technology and capital are important, what truly determines the vitality of a public chain is the continuous emergence of high-quality applications within its ecosystem, which is inseparable from the sustained efforts of developers. Over the past year, Mantle's ecosystem has gradually expanded into multiple areas such as decentralized finance (DeFi), GameFi, the NFT market, and emerging AI applications, forming a diversified and vibrant on-chain economic ecosystem.

- Increased Developer Activity. The prosperity of any public chain is inseparable from developers, and Mantle's attractiveness to developers is reflected not only in the friendliness of its technology, but also in its comprehensive investment in the ecosystem. Mantle's testnet incentive program launched in mid-2024 attracted over 5,000 developers globally, who deployed 12,000 smart contracts, with the testnet's daily transaction volume exceeding 1 million. In 2024, Mantle sponsored and hosted over 25 hackathons and six exclusive Sozu Haus events globally. This not only provided valuable data for Mantle's technical improvement, but also provided fertile ground for the innovation and implementation of on-chain applications.

- Strong Foundation Support. As a key player, Mantle Labs focuses on providing developers with full-chain support from technology to market. Under the support of Mantle Labs, some star projects such as Agni Finance and Yield Boost have risen rapidly, with Agni Finance achieving a daily trading volume of over $200 million within just one month of launch. In addition, the Mantle Scouts program has also played an important role in promoting ecosystem development. In the first quarter of 2024, Mantle onboarded 16 high-quality projects, including FIDE AI, Allora, and Thetanuts.

- Powerful Partnerships. Mantle actively collaborates with high-quality projects in the industry, and these partners provide momentum for Mantle's vision of on-chain finance. Mirana Ventures provides Mantle's ecosystem with financial and resource support; Eigenlayer brings more solid technical support to Mantle's ecosystem; Catizen enhances user stickiness and activity in Mantle.

Diversified Applications Emerging. Data shows that Mantle currently has over 250 decentralized applications (dApps), covering areas such as DeFi, GameFi, NFT, and AI. Among them, there are 101 DeFi applications and 105 infrastructure applications, as well as 21 GameFi applications. DEXes like Agni Finance and Merchant Moe provide users with efficient trading services, and a large trading volume is starting to flow in. Games like Catizen and MetaCene offer users interesting asset appreciation methods, and developers have also seen their excellent performance, further increasing user activity. As Mantle's ecosystem applications become more diverse, its on-chain economy is developing in depth. From financial products to entertainment applications, and the continuous expansion into emerging fields, Mantle's ecosystem diversification not only attracts users and developers, but also provides more investment opportunities for institutional capital.

The increasingly rich ecosystem is the key to Mantle's growth from a public chain to a core force in on-chain finance.

MNT: The Return of Value Tokens

As the core token of the Mantle ecosystem, the performance of MNT is an important indicator of its development potential.

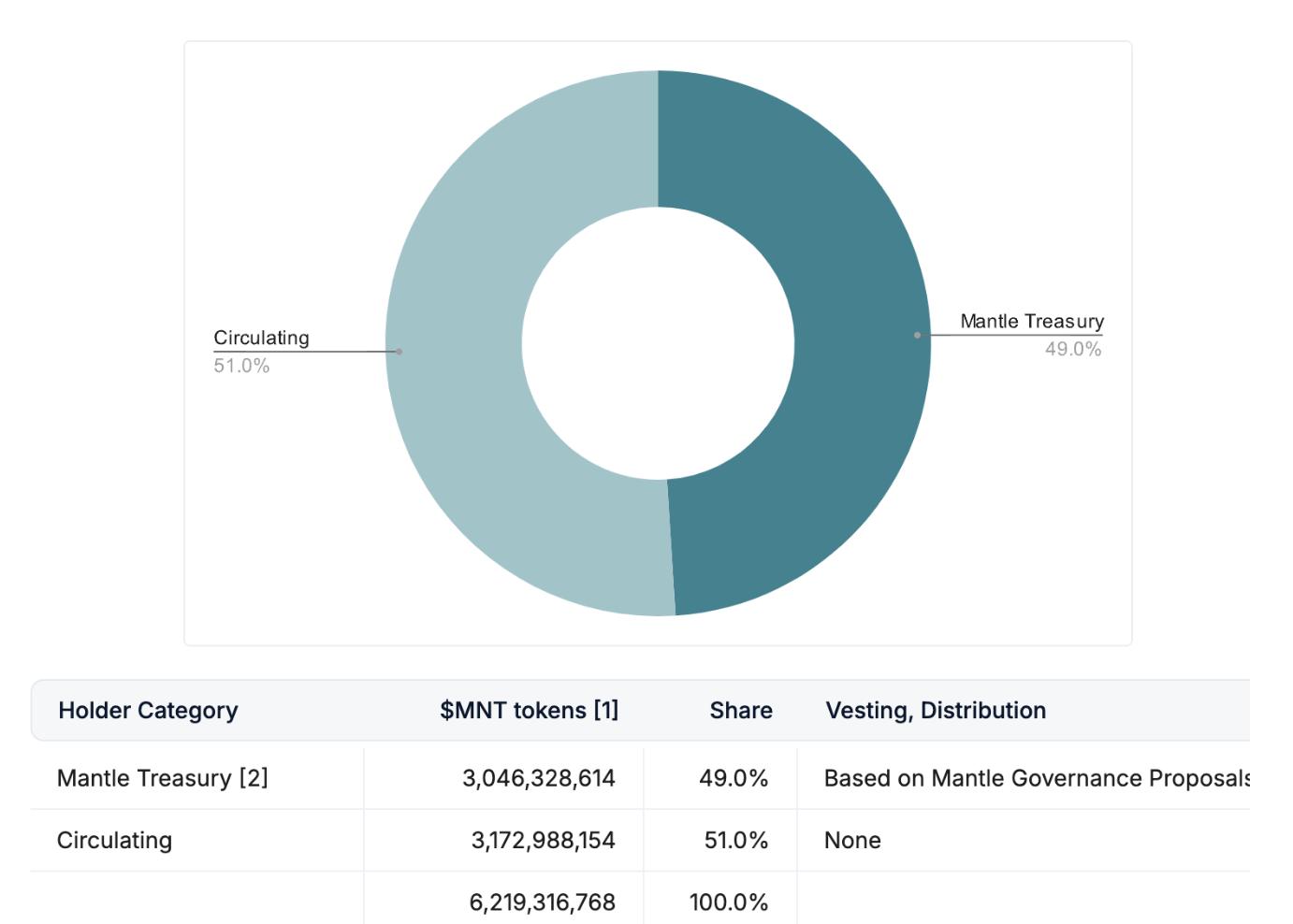

As the governance token and value carrier of the Mantle ecosystem, MNT is deeply tied to the development of the on-chain finance ecosystem. Its value comes from the core asset portfolio held by the Mantle Treasury, as well as the growing use cases in the ecosystem.

Mantle is the only project with a Treasury holding over $1 billion in mainstream assets and managed by Token holders, with its Treasury generating over $50 million in profits this year. In addition to mainstream assets, the Mantle Treasury also holds tokens such as mETH, FBTC, and Ethena, as well as equity. These assets provide a solid value foundation for MNT, and also give MNT a certain "floor" price property. Furthermore, MNT is not only a governance tool, but also the "pickaxe" for users to participate in the development of on-chain finance. MNT can not only be used to pay gas fees, but its holders can also participate in governance and earn rewards through staking, while developers can also use MNT for on-chain deployment and ecosystem interaction. Benefiting from the prosperity of the Mantle ecosystem and the influx of capital, the actual application scenarios of MNT are constantly increasing, and its value logic is becoming clearer.

The economic model of MNT is also extremely stable, with all non-circulating MNT stored in the Treasury, and no future unlocking. It can only be used through community voting, avoiding the risks of market inflation and value dilution. In contrast, many other projects have experienced price fluctuations due to token unlocking, while MNT, with its "clean" token structure, stood out in 2024. Its market capitalization exceeded $4 billion, with an investment return rate of over 300%, making it one of the public chain tokens with the greatest growth potential in the market. In addition to the long-term high investment return rate, MNT tokens can also be used for Bybit Launchpool participation and Mantle's interest-bearing product matrix, with the actual application scenarios constantly increasing.

Conclusion

Looking back on 2024, Mantle has carved out its own space with a combination of technological innovation, ecosystem prosperity, and capital operations. From EigenDA to zk-proof, from the on-chain ecosystem to the product matrix, each step has laid a solid foundation for the future of on-chain finance.

Looking ahead to 2025, Mantle has the determination to further deepen its on-chain finance layout, and the ambition to explore more emerging fields. As a rising public chain star, Mantle's potential has just begun to be tapped, and what Mantle represents is not only the rise of a public chain, but the arrival of a new era of on-chain finance.