As the seasons change, the splendor is renewed. On the occasion of bidding farewell to the old and welcoming the new, officially releases its 2025 roadmap to the users, developers, community, and other ecosystem partners who have been supporting us, showcasing the latest development plans for 2025.

As a public chain that has been online for less than a month, is still very young. We are grateful for the support and trust of every user, community, and partner. In the short months since the launch of , we have delivered a satisfactory performance. During the testnet phase, has cumulatively completed over 25.816 million transactions, with more than 870,000 registered wallet addresses, an average block time of 2 seconds, gas fees as low as 0.1 Gwei, 50 projects successfully deployed, and 300,000 community members actively participating. In less than a month after the mainnet launch, it has already attracted 11 projects for successful deployment, with a cumulative on-chain transaction volume of 980,000, and has been predicted by many media and institutions as the with the greatest growth potential in 2025.

The native token of the ecosystem, HSK, has also been listed on major exchanges such as , , , , , and in November 2024. Within less than a month of the TGE launch, it has achieved a peak increase of 270%.

The vision of is to become the bridge connecting and , bringing assets into , providing with richer assets and application scenarios, while also applying the innovative asset issuance methods of to , liberating the liquidity of traditional assets, and ultimately forming a new world where and are seamlessly integrated and connected.

Centered on this vision, is building compliant on-chain financial infrastructure along the tracks of , , , and stablecoins, aiming to create financial infrastructure and a full-stack solution that connects and . This not only reflects the unique competitive advantage of but also demonstrates the mission and determination of as an industry pioneer.

In 2025, the vision of continues to evolve and be implemented as planned. Though the dream is distant, if pursued, it can be achieved; though the wish is arduous, if persisted, it can be fulfilled.

**Technical Breakthroughs: Introducing the "Smart Escape Capsule" Security Mechanism and Multi-Tiered DAO Governance Mechanism**

**Security Mechanism: Smart Escape Capsule**

In the development of technology, solutions have brought unprecedented scalability, but they have also introduced new security challenges. At the beginning of 2025, proposed the "Smart Escape Capsule" mechanism, introducing revolutionary security guarantees to the ecosystem. This mechanism synchronizes the state Merkle tree to at fixed interval blocks, providing the ultimate guarantee for asset security. When the network or protocol encounters abnormalities, the smart contract will automatically trigger the protection mechanism to ensure that user assets can be safely and quickly withdrawn to the mainnet. This innovative design provides users with unprecedented asset security assurance, eliminating the concern of "asset black holes" in .

**Governance Mechanism: Multi-Tiered DAO**

The governance mechanism of is built on a well-thought-out multi-tiered architecture. Our is not just a voting system, but a complete risk prevention and decision-execution system. The Security Committee is responsible for rapid response to potential security threats, while the Technical Audit focuses on in-depth analysis and verification. This layered governance structure ensures both professionalism in decision-making and sufficient flexibility. Through staking mechanisms and reputation systems, we have established an effective incentive model to ensure that each participant receives rewards commensurate with their contributions. A fair and transparent dispute resolution mechanism also provides a solid foundation of trust for the entire ecosystem.

By closely integrating these two core mechanisms, is redefining the security standards and governance models of . We not only provide users with unprecedented asset security guarantees, but also build a truly decentralized and sustainable ecosystem. Here, security is no longer an option, but a core feature embedded in the protocol architecture; governance is no longer just talk, but a reality guaranteed by clear mechanisms and incentives.

**Product Innovation: Launching the veHSK Liquidity Staking Mechanism to Realize the Value Capture of HSK**

As the market evolves and user needs continue to change, the traditional staking reward model has gradually revealed some limitations. For example, although the annualized yield is relatively high, the liquidity of the staked assets is poor, and users cannot enjoy the gains brought by other protocols on the chain, which poses new challenges for users seeking higher returns and liquidity flexibility.

To solve this problem, has decided to further improve the staking platform by introducing the innovative veHSK mechanism, making staking not just a simple reward model, but a dynamic and expandable ecosystem that can bring more stable and diverse earning options for users.

In the staking system of , veHSK is not just a "derivative" of staking, but a token generated based on staking HSK, with multiple uses and significant advantages. After users stake HSK to generate veHSK, they can obtain a series of additional rights:

● **Higher Yield Rates**: As an "upgraded" version of staking, veHSK allows users to not only obtain stable basic rewards, but also earn higher additional returns through participating in liquidity provision, lending, and other applications. This part of the income comes from the platform's revenue growth and broader ecosystem participation.

● **Increased Governance Weight**: veHSK holders will receive additional voting rights in platform governance. Through veHSK, users not only enjoy economic benefits, but also have a greater say in key decisions such as platform development direction and parameter settings. This mechanism enhances the decentralization of the platform and ensures that the interests of users and the platform are more closely aligned.

● **Liquidity Incentives and Market Efficiency**: In the future ecosystem design, the introduction of veHSK will play a more important role in liquidity pools. By combining veHSK with protocols, users can not only enjoy the fixed income from staking, but also participate in market liquidity provision to earn transaction fees and liquidity incentives. This mechanism not only improves the utilization efficiency of assets, but also enhances the vitality and diversity of the ecosystem.

Compared to traditional staking methods, has brought users higher flexibility and earning potential by combining veHSK with liquidity protocols. By staking HSK to generate veHSK, users can transfer it to the platform's liquidity pools and be compatible with other protocols, injecting funds into the entire ecosystem. This not only solves the liquidity problem of traditional staking, but also allows users to participate in more types of applications.

For example, under the veHSK system, holders can convert their staked veHSK into liquidity assets to participate in protocol activities. In this way, veHSK holders can earn rewards from trading and lending activities, thereby maximizing their investment returns. This mechanism, by combining staking, liquidity, and governance, provides users with multiple earning models, thereby forming a more sustainable and diversified economic system.

Furthermore, the liquidity of veHSK can also be further enhanced through smart contracts to interact with other protocols, further improving user capital efficiency. In this process, the platform not only can provide high-liquidity investment opportunities for veHSK holders, but also enhance its own market performance, improving user asset liquidity and market participation.

As the seasons change, the splendor is renewed. On the occasion of bidding farewell to the old and welcoming the new, officially releases its 2025 roadmap to the users, developers, community, and other ecosystem partners who have been supporting us, showcasing the latest development plans for 2025.

As a public chain that has been online for less than a month, is still very young. We are grateful for the support and trust of every user, community, and partner. In the short months since the launch of , we have delivered a satisfactory performance. During the testnet phase, has cumulatively completed over 25.816 million transactions, with more than 870,000 registered wallet addresses, an average block time of 2 seconds, gas fees as low as 0.1 Gwei, 50 projects successfully deployed, and 300,000 community members actively participating. In less than a month after the mainnet launch, it has already attracted 11 projects for successful deployment, with a cumulative on-chain transaction volume of 980,000, and has been predicted by many media and institutions as the with the greatest growth potential in 2025.

The native token of the ecosystem, HSK, has also been listed on major exchanges such as , , , , , and in November 2024. Within less than a month of the TGE launch, it has achieved a peak increase of 270%.

The vision of is to become the bridge connecting and , bringing assets into , providing with richer assets and application scenarios, while also applying the innovative asset issuance methods of to , liberating the liquidity of traditional assets, and ultimately forming a new world where and are seamlessly integrated and connected.

Centered on this vision, is building compliant on-chain financial infrastructure along the tracks of , , , and stablecoins, aiming to create financial infrastructure and a full-stack solution that connects and . This not only reflects the unique competitive advantage of but also demonstrates the mission and determination of as an industry pioneer.

In 2025, the vision of continues to evolve and be implemented as planned. Though the dream is distant, if pursued, it can be achieved; though the wish is arduous, if persisted, it can be fulfilled.

**Technical Breakthroughs: Introducing the "Smart Escape Capsule" Security Mechanism and Multi-Tiered DAO Governance Mechanism**

**Security Mechanism: Smart Escape Capsule**

In the development of technology, solutions have brought unprecedented scalability, but they have also introduced new security challenges. At the beginning of 2025, proposed the "Smart Escape Capsule" mechanism, introducing revolutionary security guarantees to the ecosystem. This mechanism synchronizes the state Merkle tree to at fixed interval blocks, providing the ultimate guarantee for asset security. When the network or protocol encounters abnormalities, the smart contract will automatically trigger the protection mechanism to ensure that user assets can be safely and quickly withdrawn to the mainnet. This innovative design provides users with unprecedented asset security assurance, eliminating the concern of "asset black holes" in .

**Governance Mechanism: Multi-Tiered DAO**

The governance mechanism of is built on a well-thought-out multi-tiered architecture. Our is not just a voting system, but a complete risk prevention and decision-execution system. The Security Committee is responsible for rapid response to potential security threats, while the Technical Audit focuses on in-depth analysis and verification. This layered governance structure ensures both professionalism in decision-making and sufficient flexibility. Through staking mechanisms and reputation systems, we have established an effective incentive model to ensure that each participant receives rewards commensurate with their contributions. A fair and transparent dispute resolution mechanism also provides a solid foundation of trust for the entire ecosystem.

By closely integrating these two core mechanisms, is redefining the security standards and governance models of . We not only provide users with unprecedented asset security guarantees, but also build a truly decentralized and sustainable ecosystem. Here, security is no longer an option, but a core feature embedded in the protocol architecture; governance is no longer just talk, but a reality guaranteed by clear mechanisms and incentives.

**Product Innovation: Launching the veHSK Liquidity Staking Mechanism to Realize the Value Capture of HSK**

As the market evolves and user needs continue to change, the traditional staking reward model has gradually revealed some limitations. For example, although the annualized yield is relatively high, the liquidity of the staked assets is poor, and users cannot enjoy the gains brought by other protocols on the chain, which poses new challenges for users seeking higher returns and liquidity flexibility.

To solve this problem, has decided to further improve the staking platform by introducing the innovative veHSK mechanism, making staking not just a simple reward model, but a dynamic and expandable ecosystem that can bring more stable and diverse earning options for users.

In the staking system of , veHSK is not just a "derivative" of staking, but a token generated based on staking HSK, with multiple uses and significant advantages. After users stake HSK to generate veHSK, they can obtain a series of additional rights:

● **Higher Yield Rates**: As an "upgraded" version of staking, veHSK allows users to not only obtain stable basic rewards, but also earn higher additional returns through participating in liquidity provision, lending, and other applications. This part of the income comes from the platform's revenue growth and broader ecosystem participation.

● **Increased Governance Weight**: veHSK holders will receive additional voting rights in platform governance. Through veHSK, users not only enjoy economic benefits, but also have a greater say in key decisions such as platform development direction and parameter settings. This mechanism enhances the decentralization of the platform and ensures that the interests of users and the platform are more closely aligned.

● **Liquidity Incentives and Market Efficiency**: In the future ecosystem design, the introduction of veHSK will play a more important role in liquidity pools. By combining veHSK with protocols, users can not only enjoy the fixed income from staking, but also participate in market liquidity provision to earn transaction fees and liquidity incentives. This mechanism not only improves the utilization efficiency of assets, but also enhances the vitality and diversity of the ecosystem.

Compared to traditional staking methods, has brought users higher flexibility and earning potential by combining veHSK with liquidity protocols. By staking HSK to generate veHSK, users can transfer it to the platform's liquidity pools and be compatible with other protocols, injecting funds into the entire ecosystem. This not only solves the liquidity problem of traditional staking, but also allows users to participate in more types of applications.

For example, under the veHSK system, holders can convert their staked veHSK into liquidity assets to participate in protocol activities. In this way, veHSK holders can earn rewards from trading and lending activities, thereby maximizing their investment returns. This mechanism, by combining staking, liquidity, and governance, provides users with multiple earning models, thereby forming a more sustainable and diversified economic system.

Furthermore, the liquidity of veHSK can also be further enhanced through smart contracts to interact with other protocols, further improving user capital efficiency. In this process, the platform not only can provide high-liquidity investment opportunities for veHSK holders, but also enhance its own market performance, improving user asset liquidity and market participation.Building a Vibrant Developer Ecosystem

Ecosystem and users are the two key factors that determine whether a public chain can ultimately succeed, and the innovation and contributions of developers lay the foundation for the prosperity of the ecosystem and the growth of the user base.

Therefore, in the development of the ecosystem, HashKey Chain has always placed developers at the core. At the technical level, HashKey Chain relies on OP-Stack technology to provide developers with high-performance infrastructure and a complete toolchain, simplifying the deployment and construction process and quickly realizing the transformation from ideas to products. In addition, to help developers build the HashKey ecosystem, HashKey Chain has also launched generous Grant incentives and ecosystem resource support for developers, utilizing the multi-channel advantages of the entire HashKey Group ecosystem and its partners, global investment layout, and rich blockchain project experience to provide early support for developers and quality projects, and achieve the cold start of projects.

On December 11, 2024, HashKey Chain launched a $50 million Atlas Grant program to deeply explore quality projects in the Web3 field and provide comprehensive empowerment, achieving exponential growth in the application layer and on-chain users of HashKey Chain. The first phase of the Atlas Grant prize pool is $10 million in HSK Tokens, and the recipient project teams will receive non-dilutive financial support, technical guidance, cooperation opportunities, and opportunities to participate in hackathons.

The application period for the first phase of the Atlas Grant is from December 10, 2024 to January 10, 2025, and the list of winners will be announced on January 20. As of now, more than 100 projects have applied for the first phase of the Atlas Grant, and the application link is: https://github.com/orgs/HashkeyHSK/discussions/new?category=session-1。

In 2025, HashKey Chain will successively launch the second, third, fourth, and fifth phases of the Atlas Grant in Q1, Q2, Q3, and Q4, with each phase providing $10 million worth of HSK as incentives for quality developers. We hope to grow together with developers and jointly build a prosperous and open Web3 ecosystem, creating phenomenal application products that can have real traffic on multiple mainstream public chains, while achieving exponential growth in the application layer and on-chain users of HashKey Chain.

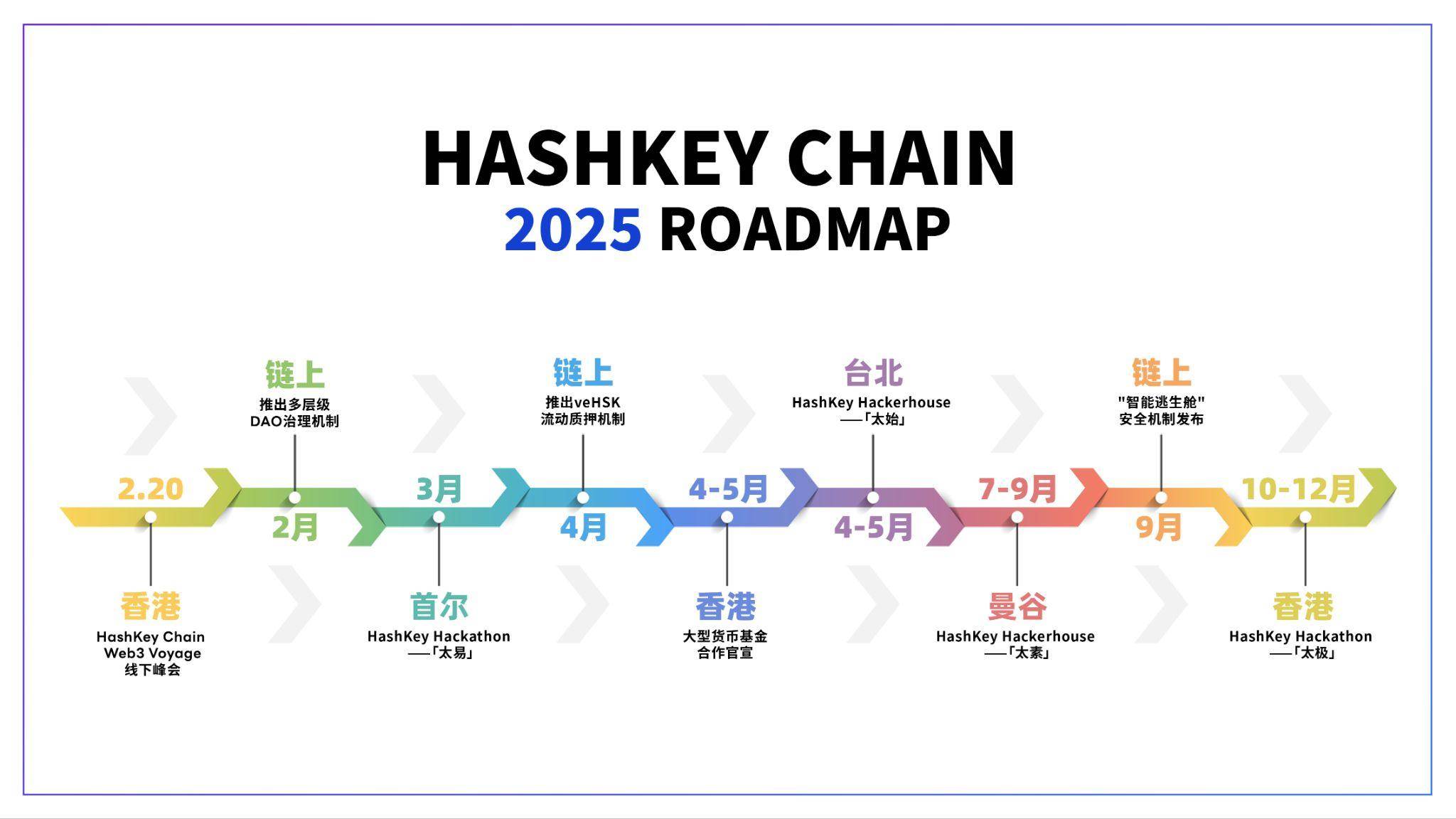

In addition to the massive Grant incentives, HashKey Chain has also launched the first developer activity series inspired by ancient Chinese philosophy. This series of activities is inspired by the five stages of cosmic generation in ancient Chinese philosophy: "Taichu, Taiyi, Taishi, Taisu, Taiiji", and has designed a complete progressive innovation framework covering the full journey of developers from idea inspiration to results implementation. This series of activities includes three Hackerhouses and two Hackathons, providing developers with unprecedented comprehensive support in terms of technical support, ecosystem resources, and cultural inspiration.

The first HashKey Hacker House was successfully held in Hong Kong on December 22, 2024, attracting the participation of hundreds of excellent developers and project teams from around the world, not only showcasing the technical capabilities and market insights of global developers, but also establishing an image of innovation and trust for HashKey Chain in the global developer community. In 2025, HashKey Chain will hold 4 Hackathons/Hackerhouses in South Korea, Taiwan, Japan, and Thailand: "Taiyi", "Taishi", "Taisu", and "Taiiji". We welcome excellent developer teams from around the world to compete in the Hackathons and strive for generous prizes and investment opportunities.

Continuously Empowering BTCFi, RWA, and PayFi, Building Bridges between Web2 and Web3

HashKey Chain is building compliant on-chain financial infrastructure along the tracks of BTCFi, PayFi, RWA, and stablecoins, with the aim of creating financial infrastructure that connects Web2 and Web3 and a full-stack Web3 solution.

1. BTCFi (Bitcoin Financial Applications)

Over the past two years, the crypto industry has undergone earth-shaking changes, especially in the Bitcoin ecosystem, which has presented new ecosystem characteristics. This is reflected not only in the emergence of BTC Layer 2 networks that carry TVL, on-chain BTC players seeking passive income, and the influx of traditional compliant institutions massively buying Bitcoin after the approval of Bitcoin spot ETFs, but also in the gradual formation of an ecosystem and infrastructure around these players and groups.

The heat of the Bitcoin ecosystem has also driven the rapid development of the BTCFi ecosystem, with the total market size of BTCFi reaching nearly $50 billion by the end of 2024. The TVL of the Bitcoin network is about $2 billion (including Layer2 and sidechains), accounting for only 0.1% of the total Bitcoin market capitalization, while Ethereum is 15.7% and Solana is 5.6%. We believe that BTCFi still has the potential to grow tenfold.

In 2025, HashKey Chain will issue a wrapped BTC (Wrapped BTC) asset - HashKey BTC on the mainnet, and while ensuring the absolute security of user assets, bring stable and attractive on-chain returns to BTC holders, unleashing the trillion-dollar market potential of BTCFi. HashKey BTC will use an over-collateralized mechanism to ensure the security of the network and avoid systemic risks.

In addition, HBTC will provide yields above the market average, packaging lending yields, liquidity mining yields, re-pledging yields, and HashKey platform point incentives into a comprehensive yield for HBTC holders, and actively screening quality projects to help users avoid risks, building a safe and open BTCFi ecosystem on the chain, allowing BTC players and institutional investors to use our BTCFi financial derivatives assets based on compliance and security.

2. RWA (Real-World Assets on-Chain)

According to The Defiant, the total market value of RWA reached a historic high of $14 billion in December 2024. Tokenized private credit and tokenized government bonds are the two largest segments of this market, accounting for $9.5 billion and $3 billion respectively, together accounting for 89% of the entire on-chain RWA domain. Since the beginning of 2024, the RWA market size has grown by 66%, indicating strong interest from institutional investors.

The RWA track is driven by the "Massive Adoption" narrative, with the key factors driving its significant market growth including the trend of traditional financial asset tokenization and investors' demand for higher liquidity and transparency.

As a global financial hub, Hong Kong provides a favorable environment for RWA tokenization innovation. HashKey Chain, based in Hong Kong, aims to bring high-quality financial products from traditional financial institutions into the blockchain world, starting from compliance.

In December 2014, HashKey Group partnered with Cinda Asset Management to launch the first STBL project issued by a Hong Kong financial institution. Hash Blockchain Limited ("HashKey Exchange") served as the initial distributor of the short-term asset-backed liquidity note token STBL issued by Cinda Asset Management. In the future, Cinda Asset Management also plans to expand the STBL issuance to HashKey Chain and introduce innovative incentive mechanisms to expand the investor base.

The underlying assets of STBL are AAA-rated money market fund (MMF) investment portfolios. Each STBL has a face value of $1 and can be transferred 24/7, with the daily accrued interest automatically distributed to professional investors' wallets in the form of newly issued tokens on each monthly distribution date.

In 2025, HashKey Chain will support developers to achieve tokenization of traditional assets such as real estate, commodities, and art, promoting asset liquidity and market transparency, and injecting new momentum into the practical application of blockchain technology.

3. PayFi (Payment Finance Solutions)

PayFi, short for Payment Finance, is an innovative new concept that combines payment and finance, with the core emphasis on "instant transactions" to improve the efficiency of speculative trading and various financial operations.

Traditional payment systems rely on banks and third-party institutions as intermediaries, leading to high fees and slow settlement. PayFi, on the other hand, achieves peer-to-peer payments through blockchain, eliminating the high transaction fees of intermediaries. At the same time, the automatic execution of smart contracts ensures the security, transparency, and impartiality of the payment process.

HashKey Chain can provide developers with underlying technical support, helping them create secure and efficient payment solutions and drive the digital transformation of the global payment system.

4. Stablecoins

As a medium of exchange connecting Web2 and Web3, stablecoins have a wide range of application scenarios in real life,

Hong Kong currently has a strict regulatory system for issuers of fiat-backed stablecoins, requiring issuers to ensure that fiat stablecoins are fully backed by high-quality and highly liquid reserve assets. Currently, only licensed fiat stablecoin issuers, recognized institutions, licensed corporations, and licensed virtual asset trading platforms can provide stablecoins. As one of the first licensed trading platforms in Hong Kong serving retail users, HashKey Exchange has reached cooperation plans with companies like Circlepay and Allinpay International to issue Hong Kong dollar stablecoins. By 2025, there will be more compliant stablecoin issuers issuing regional stablecoins on the HashKey Chain.

Through the construction of the stablecoin ecosystem, HashKey Chain is promoting the practical application of blockchain technology in cross-border payments and decentralized finance, improving global transaction efficiency.

In 2025, the competition landscape of new public chains will still be fierce. As one of the over 200 Ethereum Layer 2s, HashKey Chain needs to find its own path to stand out. Backed by the HashKey Group, HashKey Chain has advantages in compliance, global ecological resources, and the two-way bridge relationship with Web3 entities. Furthermore, what sets us apart from other Layer 2s is that HashKey Chain was not created just for the sake of launching a chain, but driven by real demand. Our ultimate goal is to achieve large-scale application of Web3 in real life, helping developers create Web3 applications with over 1 billion users, and integrating Web2 assets into Web3, ultimately forming a new world where Web2 and Web3 are seamlessly connected.