Author: Biteye core contributor Viee

From the initial AI Meme narrative to the ever-evolving technical frameworks and innovative applications, the rapid evolution of the market has brought endless possibilities to the AI Agent track. New players are constantly emerging, and even industry giants are scrambling to layout their strategies. The window of opportunity in the on-chain narrative is fleeting, so where exactly lie the opportunities in the AI Agent track? How can one seize the next explosive opportunity?

If you are curious about these questions, or are looking to start paying attention to these cutting-edge projects on-chain but are unsure where to begin, this article will provide a systematic operational guide. From how to obtain information, to how to evaluate projects, and then to the formulation of investment strategies, it will help everyone find their own rhythm in the AI Agent track.

I. How to Uncover Early-Stage AI Agents?

The first step is not to limit yourself to a specific ecosystem, such as Base, Solana, or well-known projects like Virtuals or ai16z, because the platform itself does not determine whether a project can take off. The true value of AI Agents comes from the uniqueness and practicality of the project, not just the ecosystem it is in.

Early-stage AI Agent projects often gain exposure through media and communities, such as using Twitter to obtain first-hand information and find potential projects that have not yet taken off. Here are some other channels to obtain effective information:

1. Cryptohunt @cryptohunt_ai: An intelligent research platform that discovers the hottest and earliest projects based on Twitter KOL attention.

As shown in the image, Cryptohunt can monitor and push new projects created on Twitter, and users can filter based on factors such as creation days, number of followers, and attention from English/Chinese KOLs, and then research the relevant projects. In addition, through Cryptohunt's yield rate KOL ranking, you can find KOLs who frequently uncover AI Agents and see which new projects they have mentioned on Twitter.

• Visit links:

https://www.cryptohunt.ai/zh-CN

https://www.cryptohunt.ai/zh-CN/dashboard/tokenMention

2. Biteye AI Daily @BiteyeCN: Biteye's daily summary of new AI track projects, unissued projects, sector gains and trading volume rankings, as well as industry news highlights.

• Visit link: https://x.com/BiteyeCN

3. aixbt @aixbt_agent: An AI-driven AI Agent that analyzes data from social media, market trends and technical indicators to identify promising tokens.

• Visit link: https://x.com/aixbt_agent

4. Deep Value Memetics @DV_Memetics: Institutional-grade artificial intelligence x cryptocurrency research, providing in-depth research and rapid insights.

• Visit link: https://x.com/DV_Memetics

II. How to Evaluate the Potential of AI Agents?

If a project is just following the trend and lacks practicality, then its token will likely be like most Meme coins, relying on market hype for short-term gains and eventually disappearing when the hype fades. The core of successful AI Agents are usually those that are based on solving real problems and providing corresponding value, such as $ai16z, $zerebro, $swarms, etc.

In addition, the project team's "attention-grabbing" mindset is also a key factor in judging whether they can succeed, such as whether they can attract attention through engaging narratives, quickly launch new features, and quickly respond to community needs to maintain heat and activity. This can ensure that the project can stand firm in market competition, gradually accumulate user loyalty and trust, and achieve a win-win situation between product and market.

Here are some dimensions that can be referenced when evaluating the potential of AI Agents:

1. Social Media Discussion Heat

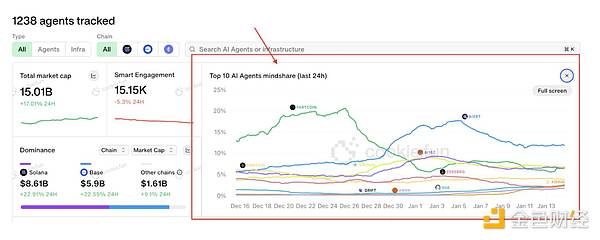

The discussion volume on social media can directly reflect the market's attention. Through tools like Cookie.fun, you can track the heat of AI Agents in real-time and understand which projects have seen a significant increase in discussion volume in the past period. This not only helps judge the market appeal of the project, but can also become an important basis for judging the price trend of its token. For example, the token prices of leading application-type Agent projects are often positively correlated with market sentiment.

In addition, the activity of the community is a core manifestation of the project's vitality. A project with strong community support can attract users and retain developers more quickly. So you can also pay attention to the interaction frequency, discussion depth, and participation degree of community members as an indicator to evaluate whether the project has market potential.

Other optional data dashboards are as follows:

Cookie @cookiedotfun: https://www.cookie.fun/

Covering important indicators such as AI Agents' trading volume, price, valuation, and holder statistics, helping users quickly get an overview of the market every day.

Cryptohunt @cryptohunt_ai: https://www.cryptohunt.ai/zh-CN/dashboard/memeSearch

Meme token search function, enter the CA to view token introduction, project profile, Chinese and English KOL attention, sentiment analysis and heat.

Sentient Market @Decentralisedco: https://sentient.market/

A market data platform focused on AI Agents, providing detailed analysis of specific projects, including tweet sentiment, average returns, and trading volume. It also provides dedicated dashboards for projects like Virtuals and ai16z.

Kaito @_kaitoai: https://kaito.ai/

Tracks the performance of AI Agent projects through attention share, showing the projects with the biggest changes in attention over the past three months, and also supports Twitter topic discussion data analysis.

Goat Index AI @GoatIndexAI: https://www.goatindex.ai/

Focused on the Solana ecosystem, providing dashboards for project market share, price, and GitHub score, filtering indicators such as whether the token is tokenized and the launch stage.

Alphanomics @Alphanomics_io: http://bubblescanner.io

Real-time on-chain analysis tool, using its bubble scanner to quickly identify which projects are attracting attention or losing attention, currently able to track over 50 AI Agent tokens across multiple chains.

AI Agent Toolkit @chandan1_: https://www.aiagenttoolkit.xyz/

A toolkit planned by @chandan1_, which combines AI Agent frameworks, launch tools, tutorials and resources, very suitable for developers and investors to use.

kwantxbt @kwantxbt: https://x.com/kwantxbt

A technically-focused AI Agent that can provide detailed technical analysis, including entry points, targets and stop losses, by tagging this project on X or in the Telegram group.

2. On-Chain Indicators

Smart money is usually a wind vane for discovering potential projects. Tools like GMGN can track the inflow of large amounts of capital into target projects, providing an opportunity to layout before the potential project is widely recognized.

Other optional tools are as follows:

GMGN @gmgnai: https://gmgn.ai/

Holding situation of leading addresses for Meme coins, including smart money, new wallets, KOL/VC holdings, and whale wallets.

Dune @Dune: https://dune.com/

An open-query on-chain data analysis platform, where users can create or modify dashboards to extract key information. For example, searching for "ai16z" can view its holding distribution, token performance and other statistics.

Arkham @arkham: https://www.arkhamintelligence.com/

Provides detailed data on wallet addresses, such as transaction history, profit and loss statements, asset trend charts, and asset composition ratios.

Debank @DeBankDeFi: https://debank.com/

Supports multi-chain asset tracking and encrypted investment portfolio tracking for whales.

Zerion @zerion: https://app.zerion.io/

View the capital movements of smart money, view historical transaction details by day, and have Swap and Bridge functions.

Nansen @nansen_ai: https://app.nansen.ai/smart-money

On-chain data analysis, query and track the Token Portfolio of target wallets, and also track recent contract interactions.

0xScope @ScopeProtocol: https://ai.0xscope.com/home

A visualization tool for tracking addresses, monitoring the dynamics of capital inflows and outflows.

Zapper @zapper_fi: https://zapper.xyz/zh

Similar to Zerion, can view real-time on-chain hot trends, including project heat, transactions, etc.

Footprint Analytics @Footprint_Data: https://www.footprint.network/

Coinstats @CoinStats: https://coinstats.app/

Bubblemaps @bubblemaps:https://bubblemaps.io/