Author: Edgy - The DeFi Edge

Compiled by: TechFlow

The goal of this cycle is to achieve life-changing returns.

If you want to achieve life-changing returns in this cycle, you need to construct your portfolio correctly. However, the performance of this cycle has been different from our expectations. The price of ETH has remained relatively stable around $3,200, and the broad Altcoin season we saw in the past has not yet materialized.

What's more surprising is that new investment trends emerge every few weeks. If you've been holding Goat or Zerebro (pioneers in the AI field) since last October, your performance may now be below the market average.

Therefore, adapting to market changes is crucial.

The new year is a good opportunity to re-evaluate and adjust your investment portfolio. I'd like to share how I plan my investment strategy, hoping to help you find the right approach for yourself. For me, dividing the portfolio into different "buckets" has been a very effective way to better manage risk while clarifying each goal.

It's important to note that I won't provide specific allocation ratios. Everyone has different goals and risk tolerance. For example, small-scale investors may be more inclined to take risks, while large-scale investors may be more focused on a conservative strategy.

What I'm sharing is a strategic framework to help you find the right investment approach for yourself.

Bucket 1: Multi-Year Reserves

Examples: Bitcoin, Ethereum, Solana

Goal: Achieve wealth growth through long-term holding, and hedge against fiat currency devaluation. This portion of the funds is to ensure that you can generate stable profits over a sufficiently long period. Regardless of market fluctuations, these tokens are core assets held across multiple cycles, and each cycle will make this investment bucket grow larger.

I consider this part of the funds as an "untouchable" reserve. Funds will flow into this investment bucket in each cycle, but never out. All profits will ultimately end up in this bucket.

In a bull market, you may feel FOMO. When you hear about a new token with huge potential, but find that you don't have any extra funds, you may be tempted to dip into this bucket:

"I'll sell some Bitcoin and jump into this new coin. Once it goes up 10x, I'll buy Bitcoin back!"

Such plans often fail to materialize. Even if you do make 10x, you may feel like a genius and continue to take risks, until you eventually give the money back to the market.

The core mission of this part of the funds is defense. No matter what happens in life, I won't have to start from scratch. The value of Bitcoin may reach $1 million in the future. You certainly don't want to regret selling Bitcoin to chase those shitcoins that ultimately go to zero.

In the past, I used to allocate Bitcoin and Ethereum equally in this investment bucket. But later I changed my strategy and now lean more towards Bitcoin. The reason is simple: Bitcoin, as a digital gold, is irreplaceable, while Ethereum faces challenges from multiple directions each cycle. It not only has to compete with other smart contract platforms, but also needs to solve its own scalability issues and complex ecosystem.

Most of the reserve funds are stored in cold wallets, and I also use about 30% of the funds for DeFi yields and potential airdrops. For example, I earn yields on BTC through @SolvProtocol while also pursuing airdrop opportunities. And my ETH is used for liquidity mining as $mETH on @0xMantle.

Measure of success: At the end of each market cycle, I will measure my investment performance by the growth in the size of this investment bucket. The goal is clear: continuously accumulate Bitcoin and prepare for the future.

Bucket 2: Cycle Conviction Holds

Examples: Virtuals, Hyperliquid, Solana, Sui, Pendle, etc.

Goal: Choose the assets you truly believe in. Many people lose money because of frequent trading and excessive rotation, and the focus of this part of the portfolio is on long-term holding to avoid these issues.

These assets are your most conviction-driven choices, which you won't waver even if the price drops 25%. They are usually the core assets of the hottest narratives in each cycle.

Start positioning in the early stage of the cycle, hold these assets throughout the cycle, and gradually take profits as the prices rise. Completely exit these positions before the bear market arrives, and then look for opportunities to re-enter during the bear market.

It's worth noting that adjusting the strategy is normal. I originally listed ai16z as a long-term hold for this cycle, but recently I decided to liquidate it, even though it was supposed to be a long-term asset. The reason is simple: I don't want to deal with the unpredictable behavior of the founders anymore.

The key is: maintain strong conviction, but be flexible in responding to changes.

Bucket 3: Short-Term Trading

Goal: Short-term trading is your main source of high returns, but it also comes with greater volatility. Focusing on the hottest areas in the market is the key to success.

Currently, I don't think there will be a broad Altcoin market where all assets rise simultaneously. The reason is that there are too many token types in the market, and the liquidity is insufficient. This phenomenon is called "Altcoin dispersion".

Therefore, it is particularly important to choose the hottest areas in the market. In this cycle, we have already seen the strong performance of memecoins and A.I. agents.

My approach is as follows:

Identify 1-2 of the strongest performing areas;

Find the most promising projects in these areas;

Transfer profits to BTC or stablecoins to lock in gains.

How to identify the hottest areas? To be honest, experienced investors can often sense the trends through the "atmosphere" of the market. However, there are now some tools that can help us quantify these trends.

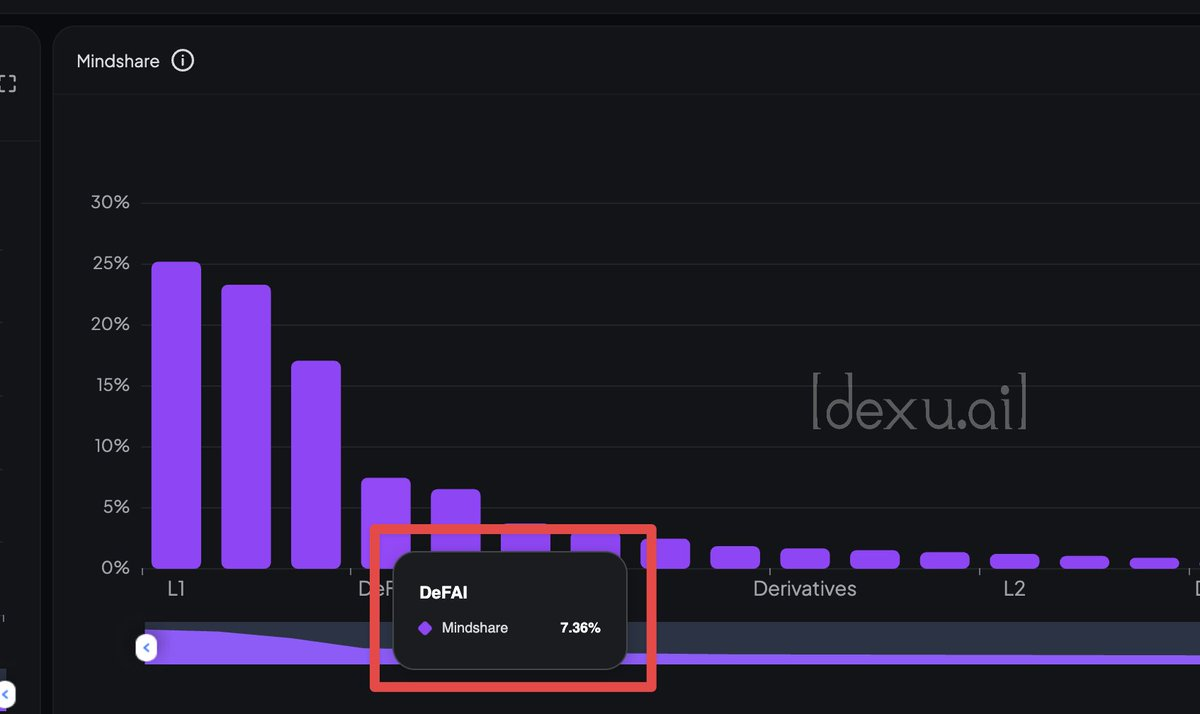

For example, @_kaitoai is a paid tool, while @_dexuai is free and highly efficient.

The data shows that A.I. agents have been performing well since November 11, 2024. You don't need to enter the market as soon as the trend emerges, just act decisively when the market signals are clear.

Someone may argue, "These A.I. agents are just repackaged ChatGPT."

Maybe, maybe not.

But as long as the market is willing to give me profits, I will seize the opportunity, rather than waste time on social media arguing for the sake of opposing.

Imagine understanding industry development as surfing. I'm always looking for bigger waves, ready to catch the next opportunity.

For example, I've always believed that A.I. agents will fundamentally transform DeFi. This is because the learning curve of DeFi is too steep, and the user experience (UX/UI) is also very unfriendly.

In the past few months, I've chosen to invest in the MODE network, as they have unique advantages in this area. Even before DeFAI (the combination of DeFi and AI) became a hot topic, they had already explored this direction in depth.

However, my investment logic is loyal to the trend, not to a specific protocol - my goal is to find the "horse" that runs the fastest in each field.

When @DanieleSesta launched @HeyAnonai, I judged it to be a faster "horse", so I promptly adjusted my portfolio.

Why did I do this? Because in the previous market cycle, I witnessed him successfully propel two protocols to a market capitalization of $1 billion. He not only has an extraordinary ability to drive protocol value, but also exhibits an unyielding competitive spirit, and this focus has made him a formidable force worth watching.

(It should be noted that I have no intention of making any negative comments about the MODE network. I believe their development progress has already surpassed most DeFAI projects, and they may perform even better in the future. But I hope that by sharing these stories, this article will not just remain at the theoretical level.)

In the cryptocurrency field, the key to making money is not what you think will rise, but what you judge others will think will rise. This is the core idea of the "Keynesian beauty contest" - the collective expectations of the market are the key to determining prices.

From the chart below, we can see that DeFAI is gradually gaining market attention. Therefore, I believe this narrative still has great potential and is worth continuing to follow and explore.

In short-term trading, I usually focus on the following key points:

Maintain a high degree of attention to emerging fields. I am always fascinated by new categories, which is why AI Agents are so intriguing. Currently, new use cases for AI are emerging endlessly, making it almost impossible to accurately assess their value. For example, the combination of AI Agents and the metaverse, or an AI tool specifically designed to find system vulnerabilities.

As of January 15, 2025, DeFAI (the combination of DeFi and AI) is a brand new field. If greater opportunities arise in the coming months, I will decisively adjust my strategy to seize that wave.

The importance of rapid iteration. In the crypto field, user attention is extremely short-lived, even likened to the "memory of a goldfish". Therefore, the team's update speed is crucial. The ability to iterate quickly is a key factor for a protocol to maintain market attention.

Stick to beliefs or chase trends? Simply put, trading can be divided into two styles:

The first is belief-based trading. You lay the groundwork in advance through in-depth research and build confidence in a project. Then you wait for other investors in the market to gradually discover this opportunity. This was also my strategy for the GAME project. I bought it very early and patiently held it for a few weeks until its price started to explode.

However, this approach also has risks. When the price remains sideways for a long time, you may wonder whether you are a far-sighted genius or a "fool" who misjudged the situation.

The second is to chase market momentum. When a project suddenly explodes, you quickly follow the trend and ride the wave. This approach is also effective. Both have their advantages, and the key is to find the strategy that suits you best. In this process, keeping a trading log is very helpful. Through long-term data accumulation, you can discover your own trading patterns and summarize the situations in which you are more likely to succeed.

Finally, you need to figure out which areas you are best at in your investments. I don't like to spend time in the "trench warfare" digging up projects with a market cap of less than $1 million, as that's not suitable for me.

Based on my experience, my most successful strategy is to find protocols with a market cap between $5 million and $25 million, and then hold them until their market cap exceeds $100 million. This is my way, but everyone's strengths are different. Perhaps you have more insights into the higher-risk, higher-return "Degen" (speculative) investments.

In my trading, I follow these principles:

I take profits early.

I usually take profits when the gains reach around 3x.

If a project performs exceptionally well, I will increase my investment in it.

The Fourth Bucket: Stablecoins

Stablecoins play an important role in the investment portfolio, with the following main uses:

Reduce volatility: Stablecoins can help stabilize your investment portfolio. After all, if you invest entirely in high-risk tokens, a 40% drop in assets in a single day can be difficult to bear. Stablecoins allow you to remain calm during market fluctuations and continue to participate in the game.

Provide "ammunition" for buying the dips: Reviewing past bull markets, the market has never been a straight upward trend, and there will always be opportunities for corrections. Having stablecoins on hand allows you to seize these opportunities.

Earn yields: Currently, the annualized yield (APY) of stablecoins is around 15-20%, which can also be a considerable income. I personally recommend @0xfluid as a yield tool.

I will divide stablecoins into two categories:

Permanent yields: This part is the stablecoins I have extracted from the market, and I plan to permanently exit the crypto market. You can use them for yield farming or directly convert them to fiat currency. This ensures that you won't give back all your profits in a single cycle.

Temporary yields: This part is the funds I temporarily store after profiting from certain assets, waiting to find new investment opportunities. To facilitate management, you can use different stablecoins to distinguish them, such as storing permanent yields in USDC and temporary yields in USDT, or transferring all permanent yields to Fluid.

Diversification is key: In the last cycle, we all witnessed the unexpected events of some stablecoins, so it is crucial to diversify and hold different types of stablecoins (such as USDC, USDT, sUSD, and even some asset-backed stablecoins). At the same time, distributing them across different yield platforms can also reduce risks.

Other Suggestions

"Put all your eggs in one basket, but watch that basket closely." This phrase can be interpreted in various ways. I don't concentrate all my funds in a single protocol, but I am currently focusing my main efforts on the field of AI Agents.

Additionally, whenever I see someone talking about "buying the dips" while investing in more than 25 protocols, I can't help but laugh. You need to have genuine conviction in a direction. Otherwise, even if you hit on one project, the overall impact on your assets will be negligible.

I believe holding 5-7 tokens is the optimal strategy. When I choose a token, I go all-in: actively participating in its Discord or Telegram groups, following the updates on the protocol, founders, and team, and listening to all relevant podcasts.

If you hold more than 15 tokens, it becomes difficult to delve deeply into each project. This may also indicate a lack of confidence in your own investments.

Don't ignore market trends. My greatest successes often come from decisively entering the market when token prices start to soar. Winners tend to keep winning. So how do you judge whether you're just a "bagholder"? It's actually quite simple.

Ask yourself, did you buy because of FOMO or based on the recommendation of an opinion leader (KOL), or because you've done in-depth research and established your own conviction? Does the protocol have enough progress and catalysts to continue attracting market attention?

The market rotation is extremely fast. Nowadays, the first-mover advantage is not as strong as it used to be. For example, GOAT and Zerebro initially occupied market dominance, but eventually lost their leading positions. If a protocol has a first-mover advantage, you need to assess whether its advantage is "sticky" enough. Is its moat strong enough?

Take AIXBT as an example, it does have a first-mover advantage, but its market penetration and mindshare far exceed other Alpha bots. I greatly appreciate their approach of developing most of the technology in-house, which makes it harder for competitors to replicate their achievements and seize the market.

Design an investment portfolio for a bear market. Clearly define your investment goals, then work backwards to achieve them. For example, you could choose 30% Bitcoin (BTC) and 70% Stablecoins. In any case, you must lock in profits gradually when the market is rising.

Reevaluate your portfolio. Your portfolio may be filled with ineffective assets, such as some "Moonbags" or tokens you have an emotional attachment to. Ask yourself, what would your portfolio look like if you were to build it from scratch?

Remember, holding on to an asset is essentially the same as buying it again every day.

"When to convert cryptocurrencies into fiat?" When you need to. I don't often convert cryptocurrencies into fiat currency, usually only when I need to pay taxes or when the proportion of crypto assets is too high compared to traditional financial (TradFi) assets.

My goal is to keep my crypto assets generating returns for me. I maintain a low cost of living, and my company (The DeFi Edge) pays me a fixed monthly salary, so I don't easily interrupt the compounding growth of my assets.

My goal is to keep my crypto assets generating returns for me. I maintain a low cost of living and receive a monthly salary from my company (The DeFi Edge), so I can avoid interrupting the compounding growth process.

That's all I have to share. If you're interested in certain topics and want to learn more, please let me know, and I can write more detailed articles.

Thank you for reading!