Introduction

On the evening of January 15, the release of the Consumer Price Index (CPI) data by the U.S. Bureau of Labor Statistics (BLS) triggered a violent fluctuation in the price of BTC. BTC surged rapidly after the CPI data was released, breaking through from $96,000 to around $100,000, even reaching over $100,000 in the early hours of today, with a maximum increase of 4.1%. According to Coinglass data, the total contract liquidation volume on the network reached $348 million within 24 hours, of which the short position liquidation amount was $226 million. This wave of increases not only allowed BTC to regain its psychological price level, but also made the market sentiment tend to be greedy.

Although the price of BTC has declined slightly in the following hours, as of the time of writing, the price of BTC is stable at around $99,486, down about 1.84% from the highest point within 24 hours. This volatility has made the market highly uncertain about the short-term trend of BTC, and experts believe that the market sentiment has been released to a certain extent, but it is still possible to enter a consolidation period.

Ethereum Hits a New High of $3,400, with a Generally Bullish Market

At the same time, Ethereum has also seen a strong upward trend. The market reaction to the CPI data release also had a positive impact on Ethereum. Ethereum broke through $3,400 last night, with a maximum increase of nearly 6.7%. As of the time of writing, the price of Ethereum is $3,399.6. Although the increase of BTC is relatively large, the performance of Ethereum is still eye-catching, attracting the attention of many investors.

Market Sentiment Changes After CPI Release, U.S. Stocks and BTC Rise in Sync

According to data from the U.S. Bureau of Labor Statistics, the core CPI excluding food and energy rose to 3.2% in December 2023, lower than the market expectation of 3.3% and down from the previous value of 3.3%. This is seen as an indication that U.S. inflation is slowing, making investors optimistic about the future economic outlook. After the CPI data was released, U.S. stocks also saw a significant increase, with the Nasdaq index, which is highly correlated with BTC, rising 2.45%, and the Dow Jones Industrial Average rising by more than 700 points at one point.

The optimistic market sentiment has driven the price of BTC to rise, and many traders have become confident in the forecast that the Federal Reserve may cut interest rates twice in 2025, in contrast to the previous pessimistic expectation that the Fed would only cut interest rates once or not at all in 2025.

Multiple Analysts Predict: BTC May Reach $249,000 in 2025

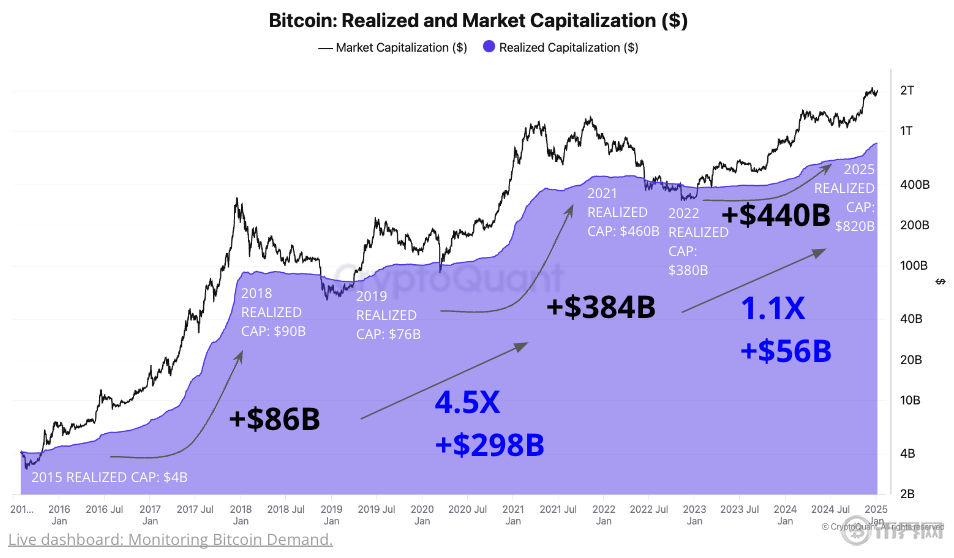

In addition to the short-term market fluctuations, analysts also hold an optimistic attitude towards the long-term prospects of BTC. A report released by the on-chain analysis platform Cryptoquant predicts that, benefiting from favorable economic and political conditions, the price of BTC may reach the range of $145,000 to $249,000 by 2025. The report points out that the inauguration of the Trump administration may bring a large amount of capital inflow into the BTC market, and it is estimated that about $520 billion in new capital will enter this market by 2025.

This prediction is consistent with other optimistic BTC expectations in the market, and some analysts even predict that BTC may reach the $1 million mark. This change will consolidate BTC's position as a key asset in the global financial market and further promote its widespread acceptance as an investment choice for institutions and retail investors.

After the Decline in BTC Price, Market Sentiment is Divided

Although the price of BTC has surged recently, the market sentiment is not entirely bullish. Analyst Benjamin Cowen pointed out that BTC may face a critical turning point in the next few weeks. If the $90,000 support level cannot be maintained, BTC may experience a correction and consolidation phase similar to August 2023.

Currently, the price of BTC is still maintained around $99,547, but many traders in the market believe that the current price may only be a temporary rebound, and the future trend is still uncertain. According to Binance's trading data, although 55.22% of traders are still long on BTC, more and more investors are taking a cautious attitude towards the short-term trend of BTC.

Conclusion

Although the increases in BTC and Ethereum after the CPI release are impressive, the uncertainty in the market still exists. In the coming months, policy changes by the Trump administration and the Federal Reserve's monetary policy are likely to have a profound impact on the cryptocurrency market. Whether BTC can break through $100,000 and maintain an upward trend still needs close attention to future market trends and policy changes.

Currently, the price of BTC is maintained around $99,547, and its future price trend may be affected by support and resistance levels. If the support level can be solidified, BTC is expected to continue to rise; if the price falls below the key support, the market may enter a consolidation period, and investors should remain vigilant.