The CryptoQuant survey shows that more than 60% of cryptocurrency investors are aged 25-44, mostly with university degrees and prefer the Binance trading platform.

A recent survey conducted by the on-chain analysis firm CryptoQuant has painted a comprehensive picture of the global cryptocurrency investor community. The "Crypto Survey 2024: Behavior and Exchange Usage" report, published on January 15, reveals that the majority of cryptocurrency investors are young, highly educated, and prefer to trade spot on the Binance exchange.

The survey, with the participation of 17,566 people, provides deep insights into the demographics, investment behavior, and exchange usage trends in the cryptocurrency market.

The Profile of the Modern Cryptocurrency Investor

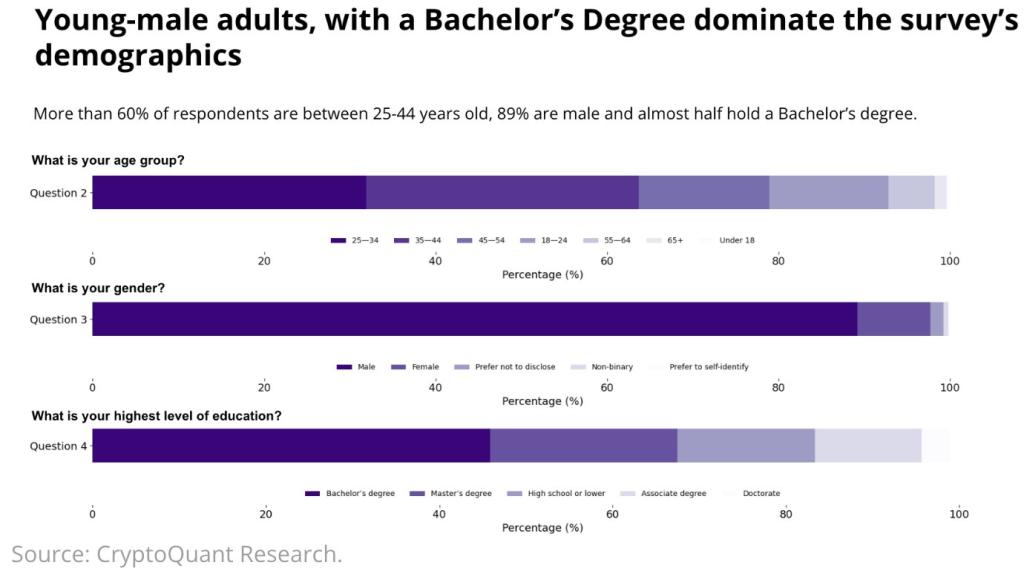

The survey results show that 61% of cryptocurrency investors are between the ages of 25 and 44, with the 25-34 age group accounting for the highest percentage (35%), followed by the 35-44 age group (26%). This indicates a significant interest in digital assets among the younger generation. Additionally, nearly half of the survey participants hold a bachelor's degree, and 28% have a postgraduate degree.

The data suggests that cryptocurrency investors tend to have a high level of education, enabling them to access and analyze complex information. However, the space still lacks diversity, with men accounting for 89% of the participants and women making up only 11%.

Financially, most investors reported spending less than $10,000 per year on cryptocurrency investments, indicating the dominance of retail investors in the market. Geographically, Asia leads with 40% of users, followed by Europe (29%) and North America (10%). This geographic distribution reflects the varying levels of cryptocurrency adoption and acceptance around the world.

The survey also sheds light on how investors make their investment decisions. 22% rely on their own research, while 16% trust influencers or social media personalities. The influence of friends, communities, and media is relatively lower. This trend suggests a shift towards more independent and personalized sources of information in cryptocurrency investment decision-making.

Spot trading remains the most popular form of trading, with 76% of users preferring it over derivatives or staking. Only 28% utilize yield-generating products like staking and farming. This indicates a focus on holding and short-term trading rather than seeking passive income.

Binance is the most preferred exchange, with 53% of survey participants stating it as their primary platform. The exchange is also highly regarded for its profitability, with 51% of investors reporting their largest gains from Binance. Furthermore, 48% of participants hold the majority of their assets on Binance. The dominance of Binance can be attributed to its user-friendly interface, diverse product offerings, and competitive trading fees.

Other exchanges like Bybit, OKX, and Bitget are preferred by full-time traders, while Coinbase and Kraken attract part-time traders. Binance dominates in Asia, Africa, and South America, while Coinbase leads in North America.

The survey also reveals that 83% of participants monitor or avoid exchanges with legal issues. Binance is seen as the most compliant exchange by 32% of participants, followed by Coinbase at 14%.

Bitcoin remains the most sought-after cryptocurrency, followed by Ethereum, layer-2 scaling solutions, and Decentralized Finance (DeFi). Bitcoin is also the top choice for generating profits, preferred by 18% of participants. Ether, Solana, and XRP follow suit. This affirms the strong positions of Bitcoin and Ethereum in the cryptocurrency market.