Author: Alex Thorn, Gabe Parker, Galaxy; Compiled by Wuzhu, Jinse Finance

Foreword

2024 was a glorious year for the cryptocurrency market, with the launch of a spot Bitcoin ETP in January and the election of the most crypto-friendly president and Congress in US history in November. Overall, the liquid cryptocurrency market increased in market capitalization by $1.6 trillion in 2024, a year-over-year growth of 88%, reaching $3.4 trillion. Bitcoin alone added $1 trillion in market value, reaching nearly $2 trillion for the year. The crypto narrative in 2024 was driven on one hand by the meteoric rise of Bitcoin (accounting for 62% of total market gains), and on the other hand by memes and AI. For most of the year, meme coins were the hot cryptocurrencies, with the majority of on-chain activity happening on Solana. In the second half of the year, tokens operated by AI agents became the focus in the post-Bitcoin crypto space.

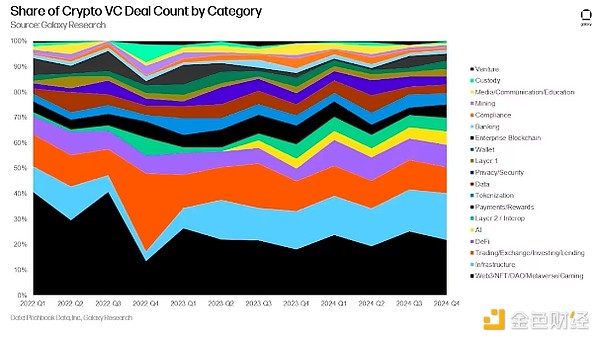

Crypto venture capital remained challenging in 2024. The dominant Bitcoin, meme, and AI agent themes were not particularly well-suited for venture capital. Memecoins can be launched with just a few clicks, and Memecoins and AI agent coins exist almost entirely on-chain, leveraging existing primitive infrastructure. Industries that were hot in the previous market cycle, such as DeFi, gaming, metaverse, and NFTs, either failed to capture market attention or have already been built, requiring less capital, making new startups more competitive. Crypto infrastructure and gaming have largely been built out and are now in a later stage, and may face competition from entrenched traditional financial intermediaries as regulatory expectations change under the new administration. There are signs that new monetary primitives may become an important driver of new capital inflows, ranging from the immature to the very nascent: stablecoins, tokenization, DeFi-TradFi integration, and the intersection of crypto and AI stand out.

Macroeconomic and broader market forces also continue to provide headwinds. The high interest rate environment continues to put pressure on the venture capital industry, with allocators less willing to take on further risk on the risk curve. This phenomenon squeezes the entire venture capital industry, but the crypto venture capital space may be particularly impacted given its risk profile. Meanwhile, large generalist venture firms still largely avoid the space, perhaps still cautious after a few high-profile venture firm failures in 2022.

Therefore, while significant opportunities exist for the future, whether through the revival of existing primitives and narratives or the emergence of new primitives and narratives, crypto venture capital remains competitive and subdued compared to the frenzy of 2021 and 2022. Trading and investment capital have increased, but the number of new funds has stagnated, with less capital allocated to venture funds, creating a particularly competitive environment favorable for founders in valuation negotiations. More broadly, venture activity remains well below the levels of previous market cycles.

However, the increasing institutionalization of Bitcoin and digital assets, the growth of stablecoins, and the new regulatory environment may ultimately portend some form of DeFi-TradFi convergence, also bringing new opportunities for innovation, and we expect to see a meaningful resurgence of venture activity and interest by 2025.

Summary

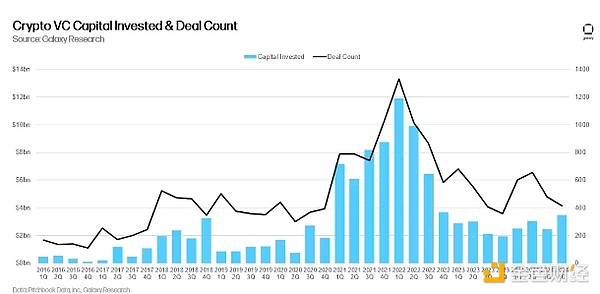

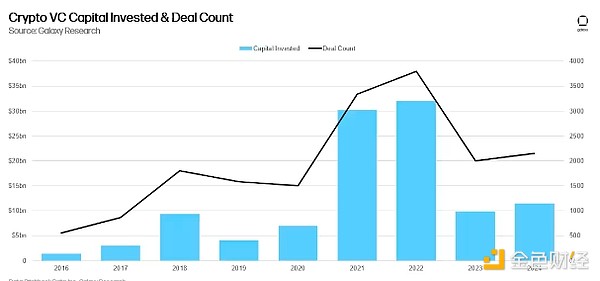

In Q4 2024, venture capital invested $3.5 billion into crypto and blockchain startups (up 46% QoQ) across 416 deals (down 13% QoQ).

For the full year 2024, venture capitalists invested $11.5 billion into crypto and blockchain startups across 2,153 deals.

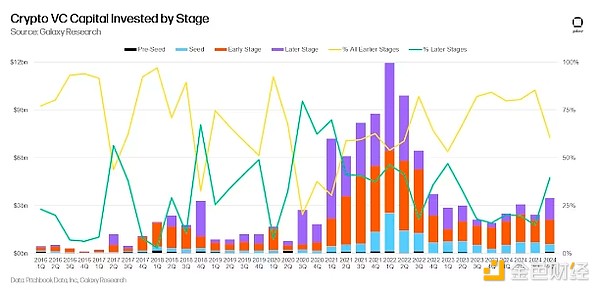

Early-stage deals captured the majority of capital invested (60%), while later-stage deals accounted for 40% of investment capital, a significant increase from 15% in Q3.

Median valuations for deals increased in Q2 and Q3, with crypto-specific deals growing faster than the overall venture market, but remained flat QoQ in Q4.

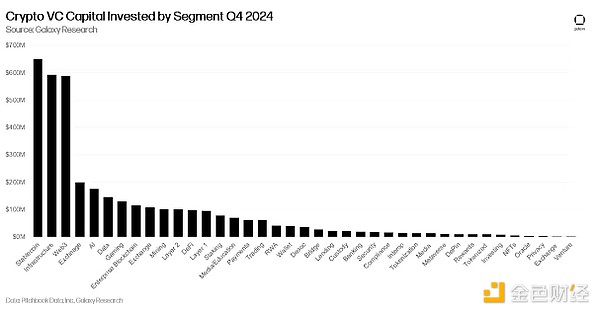

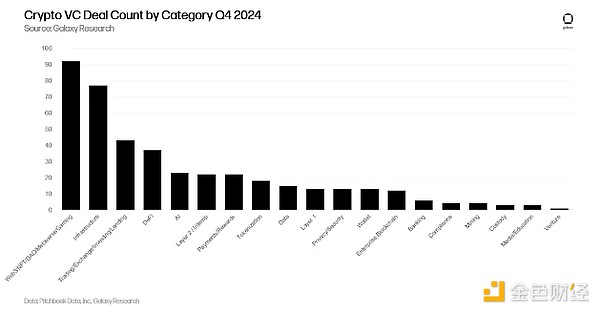

Stablecoin companies raised the most capital, led by Tether's $600 million raise from Cantor Fitzgerald, followed by infrastructure and Web3 startups. Web3, DeFi, and infrastructure companies accounted for the most deals.

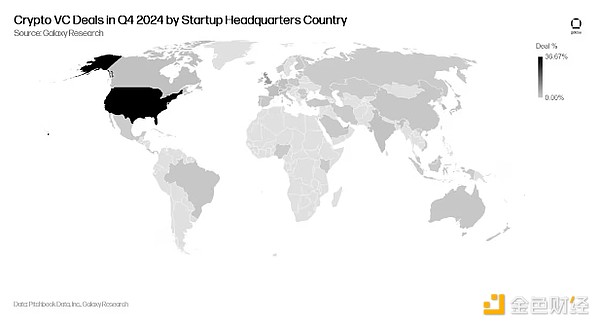

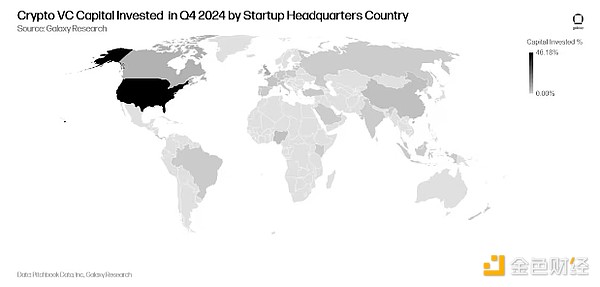

In Q4, the majority of investment went to startups headquartered in the US (46%), with Hong Kong-based companies accounting for 17% of total investment capital. In terms of deal count, the US led with 36%, followed by Singapore (9%) and the UK (8%).

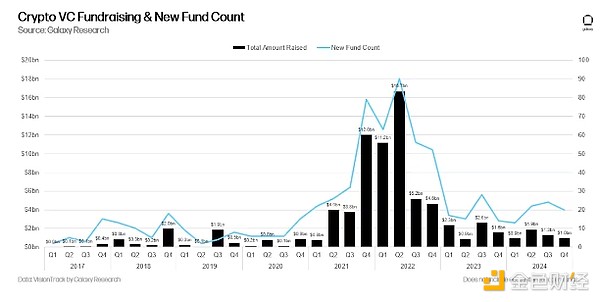

On the fundraising side, interest in crypto-focused venture funds declined to $1 billion among 20 new funds.

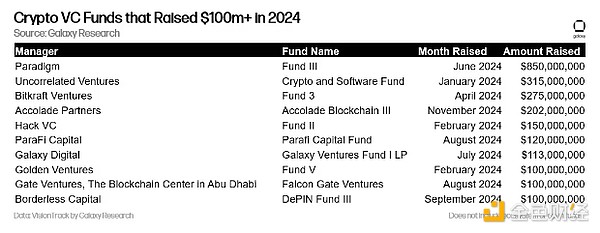

In 2024, at least 10 crypto venture funds raised over $100 million.

Venture Capital

Deal Count and Investment Capital

In Q4 2024, venture capitalists invested $3.5 billion into crypto and blockchain-focused startups (up 46% QoQ) across 416 deals (down 13% QoQ).

Cumulatively through 2024, venture capitalists have invested $11.5 billion into crypto and blockchain startups across 2,153 deals.

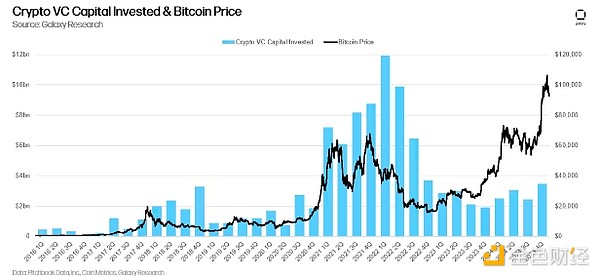

Investment Capital and Bitcoin Price

In previous cycles, there was a multi-year correlation between the Bitcoin price and capital invested into crypto startups, but this correlation has been struggling to recover over the past year. Bitcoin has seen a significant rally since January 2023, while venture activity has struggled to keep pace. Weak allocator interest in crypto venture and broader venture, combined with a crypto market narrative that favors Bitcoin over many of the 2021 hot themes, can partially explain this divergence.

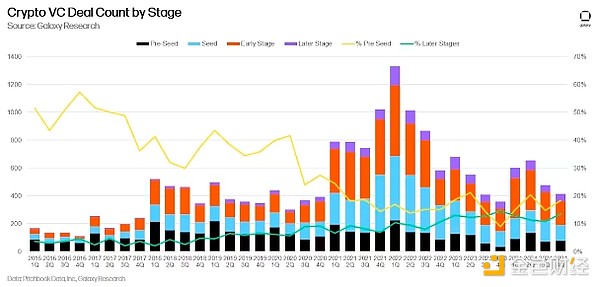

Stage-Based Investing

In Q4 2024, 60% of venture capital was invested into early-stage companies, while 40% went to later-stage companies. Venture firms raised new capital in 2024, while crypto-native funds may still be able to draw from their large fundraises from a few years ago. Capital has been increasingly flowing to later-stage companies since Q3, which can partially explain Tether's $600 million raise from Cantor Fitzgerald.

On the deal side, the proportion of pre-seed deals has ticked up slightly, remaining healthy compared to previous cycles. We track the pre-seed deal ratio as a proxy for the robustness of entrepreneurial activity.

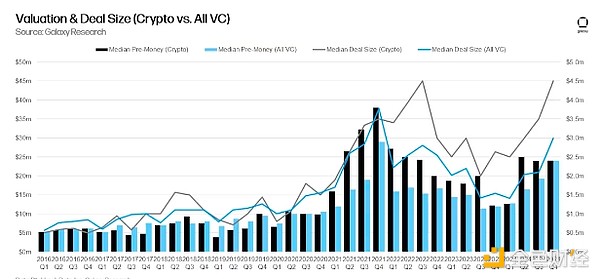

Valuations and Deal Sizes

In 2023, valuations of venture-backed crypto companies plummeted, reaching their lowest levels since Q4 2020 in Q4 2023. However, with Bitcoin setting new all-time highs, valuations and deal sizes started rebounding in Q2 2024. In Q2 and Q3 2024, valuations reached their highest levels since 2022. The growth in crypto deal sizes and valuations in 2024 was consistent with the broader venture market, though the crypto rebound was more pronounced. In Q4 2024, the median pre-money valuation for deals was $24 million, with an average deal size of $4.5 million.

Investment Categories

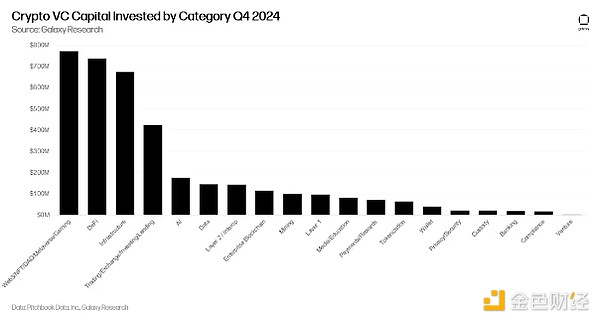

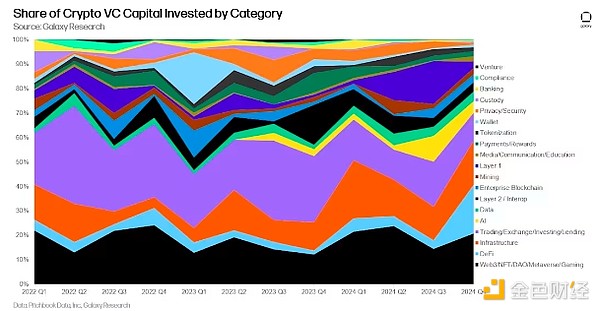

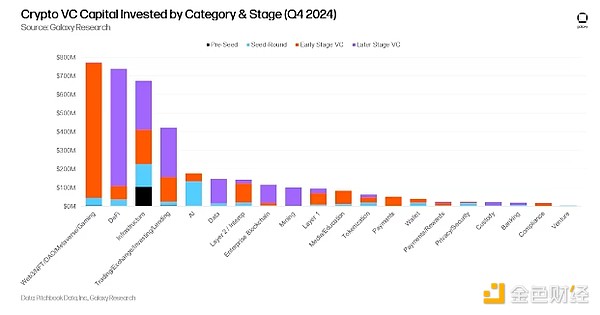

Companies and projects in the "Web3/NFT/DAO/Metaverse/Gaming" category raised the largest share of crypto venture capital in Q4 2024 (20.75%), totaling $771.3 million. The three largest transactions in this category were Praxis, Azra Games, and Lens, which raised $525 million, $42.7 million, and $31 million, respectively. The dominance of DeFi in the total crypto venture capital is attributed to the $600 million transaction between Tether and Cantor Fitzgerald, the latter of which holds a 5% stake in the company (the stablecoin issuer is classified as our advanced DeFi category). Although this transaction is not a traditional venture capital structured deal, we have included it in our dataset. Excluding the Tether transaction, the DeFi category would rank 7th in terms of investment in Q4.

In Q4 2024, the share of crypto startups building Web3/NFT/DAO/Metaverse and infrastructure products in the quarterly crypto venture capital total increased by 44.3% and 33.5% quarter-over-quarter, respectively. The increase in capital allocation as a percentage of total capital deployment is mainly attributed to a significant decline in crypto venture capital allocation to Layer 1 and crypto AI startups, which have decreased by 85% and 55% respectively since Q3 2024.

If we break down the broad categories in the above chart, crypto projects building stablecoins raised the largest share of crypto venture capital in Q4 2024 (17.5%), totaling $649 million across 9 tracked deals. However, Tether's $600 million deal represented the majority of the capital invested in stablecoin companies in Q4 2024. Crypto startups developing infrastructure were the second-largest recipients of venture capital in Q4 2024, raising $592 million (16%) across 53 tracked deals. The three largest crypto infrastructure deals were Blockstream, Hengfeng Group, and Cassava Network, raising $210 million, $100 million, and $90 million, respectively. Following crypto infrastructure, Web3 startups and exchanges were the third and fourth largest recipients of crypto venture capital, raising $587.6 million and $200 million, respectively. Notably, Praxis was the largest Web3 deal and the second-largest deal of Q4 2024, raising a staggering $525 million to build an "internet-native city".

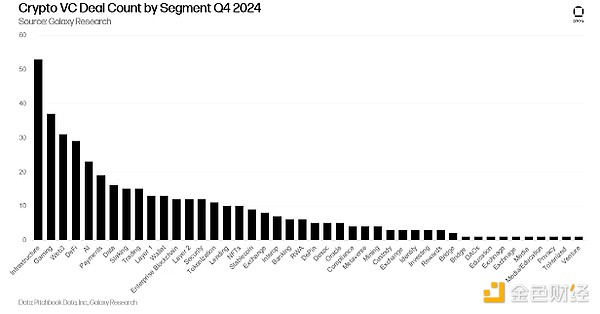

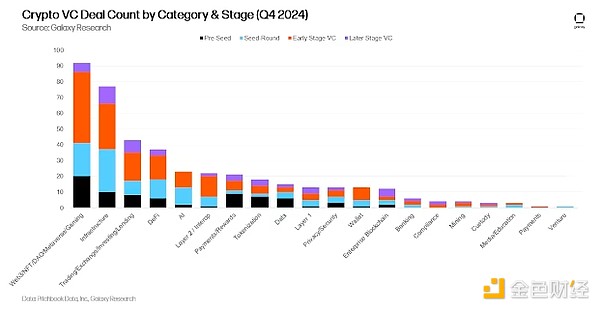

In terms of deal count, Web3/NFT/DAO/Metaverse/Gaming accounted for 22% of deals (92 deals), with 37 gaming deals and 31 Web3 deals being the driving factors. The largest gaming deal in Q4 2024 was Azra Games, which raised $42.7 million in a Series A round. Infrastructure and Trading/Exchange/Investment/Lending followed closely with 77 and 43 deals, respectively, in Q4 2024.

Projects and companies providing crypto infrastructure ranked second in deal count, accounting for 18.3% (77 deals) of the total, up 11 percentage points quarter-over-quarter. Following crypto infrastructure, projects and companies building trading/exchange/investment/lending products ranked third in deal count, accounting for 10.2% (43 deals) of the total. Notably, crypto companies building wallets and payments/rewards products saw the largest quarter-over-quarter increases in deal count, at 111% and 78%, respectively, although these startups only accounted for 22 and 13 deals in Q4 2024.

Breaking down the broad categories in the above chart, projects and companies building crypto infrastructure had the most deals (53) across all sectors. This was followed by crypto companies in gaming and Web3, which completed 37 and 31 deals, respectively, in Q4 2024, nearly the same order as Q3 2024.

Investment by Stage and Category

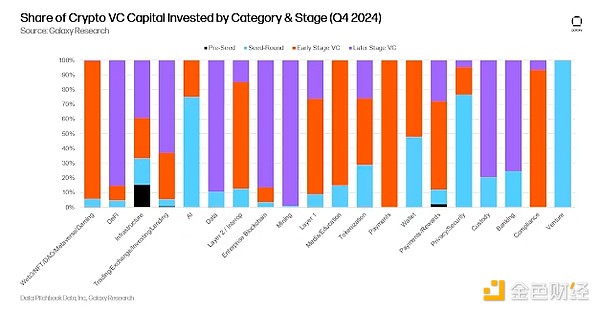

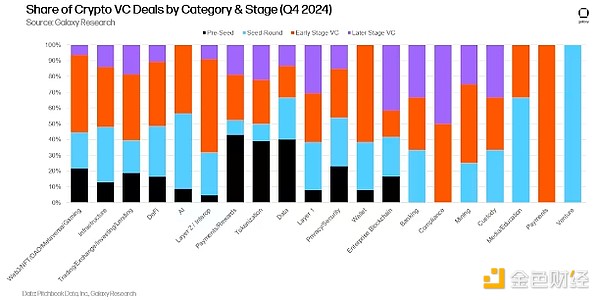

Segmenting investment capital and deal count by category and stage provides a clearer picture of which types of companies are raising capital in each category. In Q4 2024, the vast majority of capital in Web3/DAO/NFT/Metaverse, Layer 2s, and Layer 1s went to early-stage companies and projects. In contrast, a significant portion of crypto venture capital invested in DeFi, Trading/Exchange/Investment/Lending, and Mining went to later-stage companies. This is to be expected given the relative maturity of the latter compared to the former.

Analyzing the distribution of investment capital across stages within each category can reveal the relative maturity of different investment opportunities.

Similar to the crypto venture capital invested in Q3 2024, a significant portion of the deals completed in Q4 2024 involved early-stage companies. The crypto venture capital deals tracked in Q4 2024 included 171 early-stage deals and 58 later-stage deals.

Examining the stage breakdown of deals within each category can provide deeper insights into the different stages of each investable category.

Investment by Geography

In Q4 2024, 36.7% of deals involved companies headquartered in the United States. This was followed by Singapore (9%), the United Kingdom (8.1%), Switzerland (5.5%), and the United Arab Emirates (3.6%).

Companies headquartered in the United States captured 46.2% of all venture capital, down 17 percentage points quarter-over-quarter. As a result, the venture capital allocation to startups headquartered in Hong Kong increased significantly to 17.4%. The United Kingdom accounted for 6.8%, Canada for 6%, and Singapore for 5.4%.

Cohort Investments

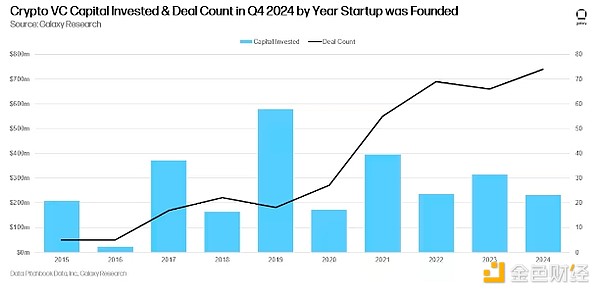

Companies and projects founded in 2019 captured the largest share of capital, while those founded in 2024 had the most deals.

Crypto Venture Capital Fundraising

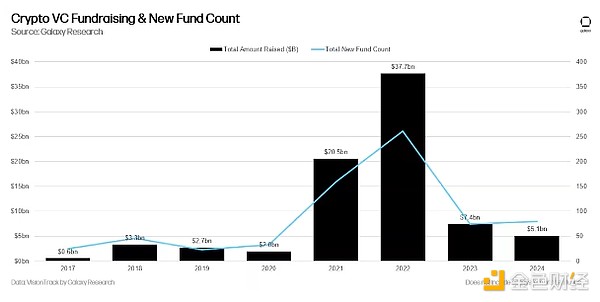

Fundraising for crypto venture funds remains challenging. The macroeconomic environment and crypto market turmoil in 2022 and 2023 have made some allocators reluctant to commit to crypto venture investors at the same levels as in 2021 and early 2022. By early 2024, investors broadly expect interest rates to decline significantly in 2024, though rate cuts do not start until the second half of the year. Total capital allocated to venture funds has continued to decline quarter-over-quarter since Q3 2023, even as the number of new funds raised for the full year 2024 has increased somewhat.

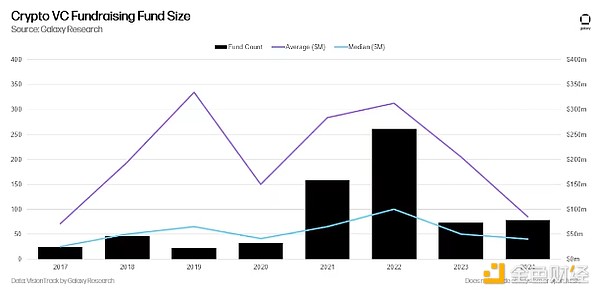

On an annualized basis, 2024 is the weakest year for crypto venture fundraising since 2020, with 79 new funds raising $5.1 billion, far below the frenzy of 2021-2022.

While the number of new funds has increased slightly year-over-year, the decline in allocator interest has also resulted in smaller fund sizes raised by venture firms, with 2024 median and average fund sizes reaching their lowest levels since 2017.

At least 10 crypto venture funds actively investing in crypto and blockchain startups raised over $100 million for new funds in 2024.

Summary

Sentiment is improving and activity is increasing, though both remain well below previous highs. While the liquid crypto asset markets have recovered significantly from the lows of late 2022 and early 2023, venture activity remains far below prior bull markets. The bull markets of 2017 and 2021 demonstrated a high correlation between venture activity and liquid crypto asset prices, but over the past two years, activity has remained depressed while crypto currencies have rebounded. The venture slowdown is due to a variety of factors, including the "barbell market" placing Bitcoin (and its new ETFs) at the center stage, and the marginal net new activity coming from Meme coins, which are difficult to fund and of uncertain longevity. Enthusiasm is building for projects at the intersection of AI and crypto, and expected regulatory changes may open doors for opportunities in stablecoins, DeFi, and tokenization.

Early-stage deals continue to lead the way. Despite headwinds for venture, the ongoing interest in early-stage deals bodes well for the long-term health of the broader crypto ecosystem. The later-stage cohort made progress in Q4, largely due to Cantor Fitzgerald's $600 million investment in Tether. Nevertheless, entrepreneurs continue to find investors willing to back new innovative ideas. We believe projects and companies building stablecoins, AI, DeFi, tokenization, L2, and Bitcoin-related products will perform well in 2025.

Spot ETPs may put pressure on funds and startups. High-profile investments by US allocators into spot Bitcoin ETPs suggest that some large investors (pensions, endowments, hedge funds, etc.) may be accessing the industry through large liquid vehicles rather than turning to early-stage venture.Interest in a spot Ether ETP has also started to pick up, and if this continues, or if new ETPs covering other Layer 1 blockchains are launched, demand for DeFi or Web3 sub-sectors may flow to ETPs rather than venture capital complexes.

Fund managers still face a challenging environment. While the number of new funds raised in 2024 increased slightly year-over-year, the total capital allocated to crypto venture funds was slightly lower than 2023. Macroeconomic headwinds continue to pose challenges for allocators, but significant changes in the regulatory environment may reignite allocator interest in the space.

The US continues to dominate the crypto startup ecosystem. Despite a very complex and often hostile regulatory regime, US-based companies and projects still account for the majority of deals completed and investment capital. The new presidential administration and Congress will be the most crypto-friendly in history, and we expect the US's dominance to increase, especially if certain regulatory matters are solidified as expected, such as a stablecoin framework and market structure legislation, which would allow traditional US financial services firms to seriously consider entering the space.