Author: Brenden Rearick; Source: Cointelegraph; Translated by: W3C DAO

Grayscale executives say that while the crypto industry saw "two big wins" last year with spot crypto exchange-traded funds and the victory of Republican Donald Trump in the US election, 2025 may see a "lot of small wins".

A Lot of "Small Wins"

Grayscale Research Chief Investment Officer Zach Pandl said in a recent webinar: "This year, I expect the industry to achieve dozens of small wins." He pointed to increased institutional adoption of Bitcoin, more comprehensive legislation from Congress, and the potential of Bitcoin.

In an interview with Ric Edelman, founder of the Digital Assets Council of Financial Professionals, on January 15, Pandl also said that believing Bitcoin could reach $500,000 by 2030 is not "completely crazy".

Increased Institutional Adoption

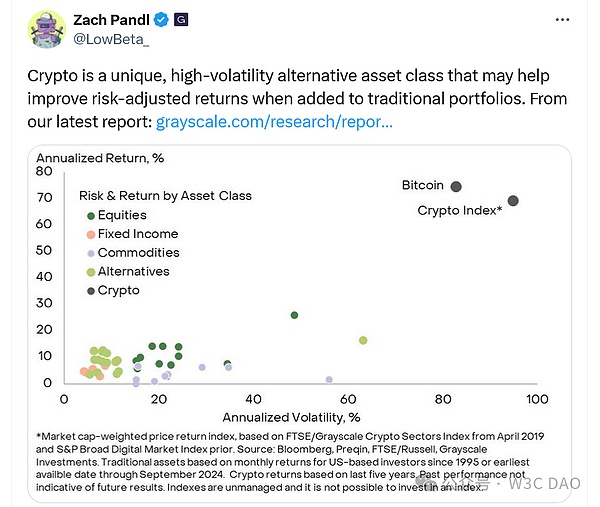

Pandl said increased institutional adoption may come from pension funds and endowments, as he has been meeting with more fund managers interested in crypto, who have largely ignored the industry for the past decade.

"For the past 10 years, they've been able to ignore it, dismiss it, or put it aside, but now they all recognize they can't do that anymore."

Pandl explained that many pension funds and endowments have started the process of incorporating crypto assets into their portfolios, with some fund approvals potentially taking just 6 to 12 months.

Pandl said some portfolio managers have already allocated up to 5% of their funds to crypto, though they are still "in the experimental stage".

For example, according to the Financial Times, pension funds in Wisconsin and Michigan in the US have become among the largest holders of US-listed crypto-focused funds, while some pension fund managers in the UK and Australia have made small allocations to Bitcoin through funds or derivatives in recent months.

UK pension consultancy Mercer has also received a flood of inquiries, with trustees not wanting to be left in the dark about the hot asset class. Most pension funds have turned to the regulated US spot Bitcoin or Ethereum ETFs approved last year.

In the UK, pension consultancy Cartwright has facilitated the first Bitcoin transaction, with a small undisclosed pension scheme directly investing around £1.5 million in Bitcoin, hoping to plug funding gaps through outsized returns.

Australia's AMP pension fund manager has also used Bitcoin to boost returns. AMP senior portfolio manager Steve Flegg said that while crypto assets are high-risk and novel, their scale and potential cannot be ignored, so AMP's portfolio has made a modest allocation to Bitcoin futures.

Additionally, Pandl expects sovereign wealth funds outside the US to increase their crypto investments in the coming months.

Others

Pandl also discussed the huge potential for Ethereum in institutional adoption, calling it one of the most important open-source software projects ever.

Pandl added that decentralized finance, real-world assets, and AI tokens may also attract institutional attention from private equity.

Pandl's optimism was expressed five days before the inauguration of the new US president, who is expected to lead the most crypto-friendly government to date.