This week, there were several important events and developments in the Bit cryptocurrency field. These include Binance listing three AI agent tokens, Grayscale revealing 39 assets to be considered for investment products, and the inclusion of Donald Trump's crypto ball prior to his inauguration.

XRP also reached a 6-year high, having a cascading impact on the Bit market. JPMorgan predicted a $14 billion market for XRP and Solana ETFs.

Binance Successfully Lists 3 AI Agent Tokens

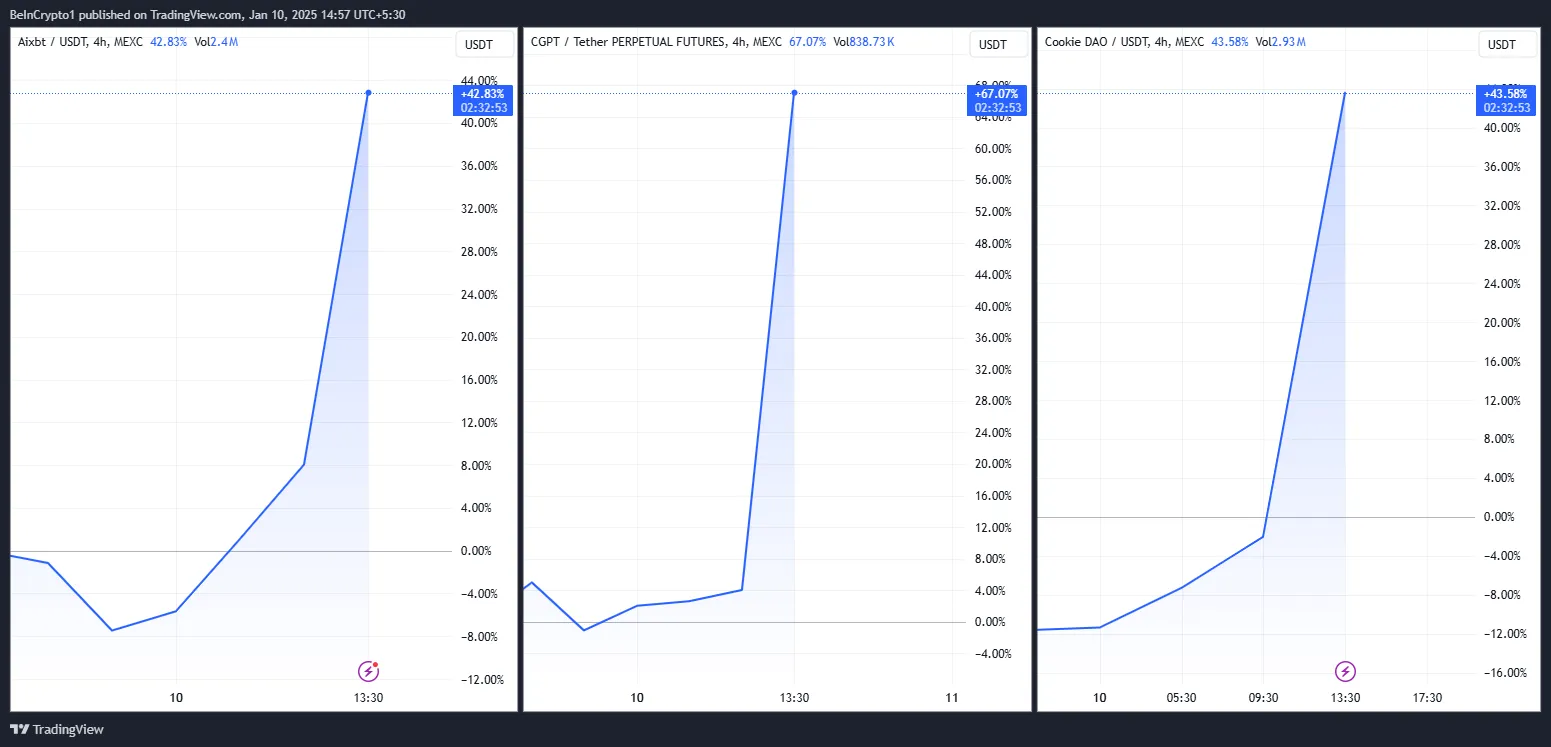

Binance, one of the world's leading Bit exchanges, listed three new AI agent tokens on January 10th. The company also allowed fee-free trading for the three tokens: aixbt (AIXBT) from Virtuals, ChainGPT (CGPT), and Cookie DAO (COOKIE). Immediately after listing, all three assets surged over 40%.

Many influential voices in the Bit industry are becoming increasingly positive about AI agents. For example, yesterday OKX Ventures identified AI agents as a key investment area for 2025. Nvidia's CEO argued that AI agents could become a multi-trillion dollar industry.

The performance of these three tokens demonstrates the high interest in AI agents within the Bit community.

Grayscale Reveals 39 Altcoins Under Investment Consideration

Grayscale, a major ETF issuer, published a broad list of new Bit investment options, including memecoins and AI tokens.

They are considering adding a total of 39 altcoins to their digital asset lineup eligible for investment. These are divided into five categories: currencies, smart contract platforms, finance, consumer and culture, and utilities and services.

"This list may change within the quarter as some multi-asset funds are rebalanced and new single-asset products are launched." - Grayscale stated.

Grayscale has previously added new Bit offerings in this manner. For example, in October last year they posted 35 tokens, but not all were officially included.

Several assets like KAS, APT, ARB, TIA were included in both lists. The differences between the two lists show Grayscale's shifting priorities.

While Grayscale has placed higher priority on AI agents in recent months, some sectors like memecoins, real-world assets (RWA), and DePINs are also gaining importance.

First 'Crypto Ball' to Be Held Before Trump Inauguration

Trump's newly appointed AI and Bit czar, David Saxe, plans to host the inaugural Bit ball. This black-tie event saw strong demand, with lower-tier $2,500 tickets selling out.

Several major companies such as Coinbase, Sui, Mysten Labs, Metamask, Galaxy, Ondo, Solana, and MicroStrategy sponsored the event.

"This exclusive event features a $100,000 VIP ticket and a $1 million private dinner package with Trump. Major sponsors like Coinbase, MicroStrategy, and Galaxy Digital signal the transition to a pro-Bit US administration." - Mario Nawfal wrote on X (formerly Twitter).

After his election victory in November, Trump promised wide-ranging pro-Bit reforms in the US. The President-elect is not expected to attend personally, but other pro-industry figures will. Trump is also anticipated to sign a pro-Bit executive order on his first day in office.

Ripple (XRP) Reaches All-Time High of $3.39

Ripple's altcoin XRP reached its highest price in 7 years, triggering several changes across the broader Bit ecosystem. XRP-based memecoins like ARMY, PHNIX, LIHUA recorded impressive gains thanks to XRP's loyal supporters.

XRP outperformed other Bits last week, sparking optimism. This morning, XRP's trading volume exceeded $20 billion, triggered by speculation that Trump will support the US stockpiling of not just Bit, but various assets.

JPMorgan Forecasts $14 Billion Market for XRP, SOL ETFs

Analysts at the major investment bank JPMorgan argued that the ETF market for XRP and SOL could reach $14 billion. The analysts predicted that the XRP ETF would be more profitable of the two, but concluded that both ETFs have a high likelihood of SEC approval by 2025.

"The key question here is the uncertainty around investor demand for additional products and whether new Bit ETP launches will be meaningful." - JPMorgan analysts including Kenneth Washington.

At the beginning of this year, Ripple CEO Brad Garlinghouse argued that an XRP ETF is inevitable, and this prediction is becoming increasingly likely.

SEC Chairman Gary Gensler is expected to resign from his position, along with the CFTC Chairman, both of whom will be replaced by industry advocates. Financial regulation in the United States will become more crypto-friendly.