<p );'>

Author: Techub Exclusive Interpretation

Writer: Babywhale, Techub News

How long does it take to reach a market capitalization of 0 to 80 billion? The answer was given by Donald Trump, the incoming US president: 31 hours. Of course, while using the token price to calculate the market value may not be a method recognized by everyone, it is undeniable that Trump's team has created a record in the Web3 field that may be unparalleled before and after. But this record may not have any benefits other than proving Trump's businessman nature of not getting up early without profit.

Everyone should have already understood the story of these three days. Trump posted a tweet on X about issuing the "Official Trump Meme", and it began to rise amid doubts that "X may have been hacked". But as the tweet was not deleted for a long time, and Eric Trump, the son of Trump, confirmed it, the market finally determined that the Meme token called TRUMP was indeed issued by the Trump family.

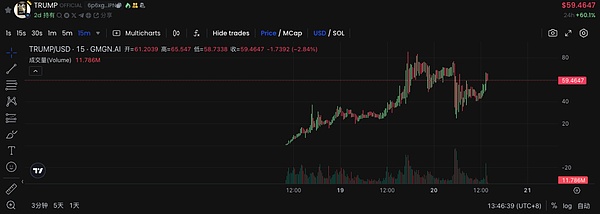

The subsequent plot development may have overturned the expectations of everyone, both inside and outside the Web3 industry. With a total of 1 billion tokens and only 20% released, the TRUMP price began to soar. According to GMGN data, the token price rose from the initial $0.18 on Saturday 10:00 to around $80 at around 17:00 yesterday, completing an impossible task over the weekend.

Presidential Coin Issuance Causes Controversy

The birth of TRMUP has allowed many investors to profit handsomely over the weekend, and major exchanges including Binance also launched TRUMP's spot trading last night, which may be one of the important driving forces to push its price to at least a stage high.

From the perspective of making money, the US president issuing a Meme is undoubtedly a recognition and support for Meme itself and Web3, and it has also rewarded the chain Meme players who are glued to the computer every day. In fact, the issuance of TRUMP was obviously preceded by a lot of preparatory work, with projects or work such as Meteora and Moonshot providing more or less help. Moonshot also said it had gained 400,000 new users in two days, and its App had once topped the Apple Store.

But from another perspective, most of the onlookers inside and outside the industry have given negative reviews:

An article in Bitcoin Magazine made very direct criticism, saying "this is nothing more than a self-serving pump-and-dump scam, an unethical act, and the investors (or should we say 'fans') who participate in it are extremely foolish." The author stated that he believes Trump will not allow Bitcoin to compete with the US dollar, which is precisely the original meaning of Bitcoin's existence, and hinted that if Trump really supports Web3, he should not focus on treating Web3 as a "casino".

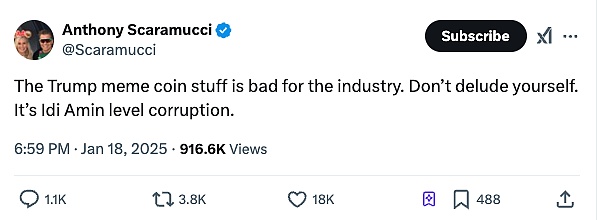

The founder of SkyBridge believes that Trump's behavior is not beneficial to the industry and supports calling it "corrupt behavior".

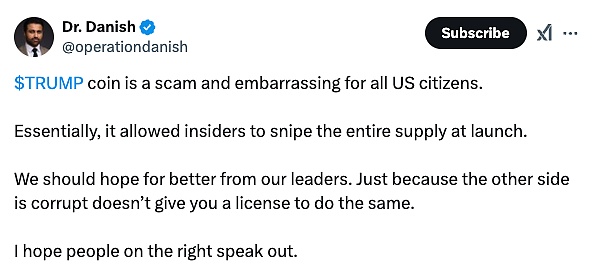

Even a doctor with 1.5 million followers on Youtube stood up and said: "The corruption of another president does not mean you can do the same thing".

Technology Should Be Free, But Not Disorderly

Musk once joked in a program that the animal protection organization came to him, asking SpaceX to evaluate the impact of rocket debris on whales, sharks and other creatures that may fall into the sea. They even specifically caught a seal and put headphones on it to let it hear the noise they thought the rocket launch would affect seals, in order to refute the animal protection organization's view.

Silicon Valley tech giants have long been critical of over-regulation, which may also be the main reason Musk decided to set up the government efficiency department "D.O.G.E". US tech giants have always advocated relaxing regulations on technology to improve innovation capabilities, which is understandable, but weak regulation does not mean no rules, otherwise "freedom" will become "disorder".

In the author's understanding of the current large number of Altcoins without any prospects, an important point is that the US regulatory authorities have never clearly defined what the tokens issued by these projects are. If they are a kind of securities in a sense, representing the equity of the project, then what is the equity of the project operating company? If there is no way to define the actual meaning of these tokens, it will be difficult for large funds to be truly willing to invest based on the value of the project itself.

On the other hand, should the amount of tokens held by the project party be disclosed regularly? Should the financial status of the foundation be disclosed like financial reports? Should the project party's sale of the tokens they hold be disclosed? Should the market manipulation behavior of exchanges, market makers, and so-called whales be regulated?

These are some very basic questions, but it is unclear whether they have found them to be unsolvable problems or are unwilling to solve them, after all, a market without any regulation other than pure fraud is the best tool for capital predation, just like the early financial market.

In the current market, the actual definition of Altcoins is unclear, and the price is completely unrelated to the value of the project itself. Since this is the case, it is not unreasonable for retail investors to choose to engage in on-chain PvP.

There is nothing wrong with Trump issuing a coin in itself. If it can set an example and clarify many of the ambiguous issues in the crypto world, or make everything transparent, then issuing a coin is also understandable, after all, the US does not have a law prohibiting the act of issuing coins. But the problem lies in the fact that this seemingly "casual" Meme token issuance behavior seems to be telling everyone: you can all issue coins at will.

No need for any rules, no need for any transparency, just simply state your plan, and you can even mention in the disclaimer that no class action can be filed. In this way, the behavior of using IP to issue coins and then rug pull also seems to have no problem, and there is no legal prohibition on the issuer selling the tokens they hold.

It is worth noting that this was previously considered illegal behavior by the SEC, such as misleading investors, but has been broken by Trump's "leading by example" behavior.

Of course, it is too early to draw a conclusion for the next four years based solely on the issuance of a Meme token. Web3 should not be restricted by overly strict regulations, but some basic concepts should also be defined to lay a foundation for more capital to invest based on the value of the project itself. Meme is one of the unique cultures of Web3, but not the whole of Web3, nor the most important part.