In 2025, the global economy is like a poker game where bets have not yet been made. Every flip of a card may change the fate of the winner. The International Monetary Fund (IMF) predicts that global GDP growth will reach 3.3%, slightly higher than the previous year, but still lower than the peak before the epidemic. Behind the seemingly mild recovery, there are uncertainties and variables - geopolitical undercurrents, central bank policy tests, and divergent capital flows, all of which make this game full of suspense.

On the other hand, the crypto market is not alone. As the expectation of the Fed's interest rate cut gradually heats up, global capital is re-examining the charm of risky assets. Will Bitcoin become the next "trump card"? Will the growth of stablecoins set off a new round of capital frenzy? Will Web3 projects take the opportunity to rise and become the innovation engine of emerging markets? History has proved that the crypto market and the macro economy have never been parallel worlds, but rather like a pair of players who play against each other and achieve each other.

This is not a peaceful economic recovery, but a capital gamble that is destined to be full of reversals. The question is, which side are you willing to bet on?

Macroeconomic Cycle Analysis: The Global Economic Chess Game in 2025

Driving force behind global economic recovery

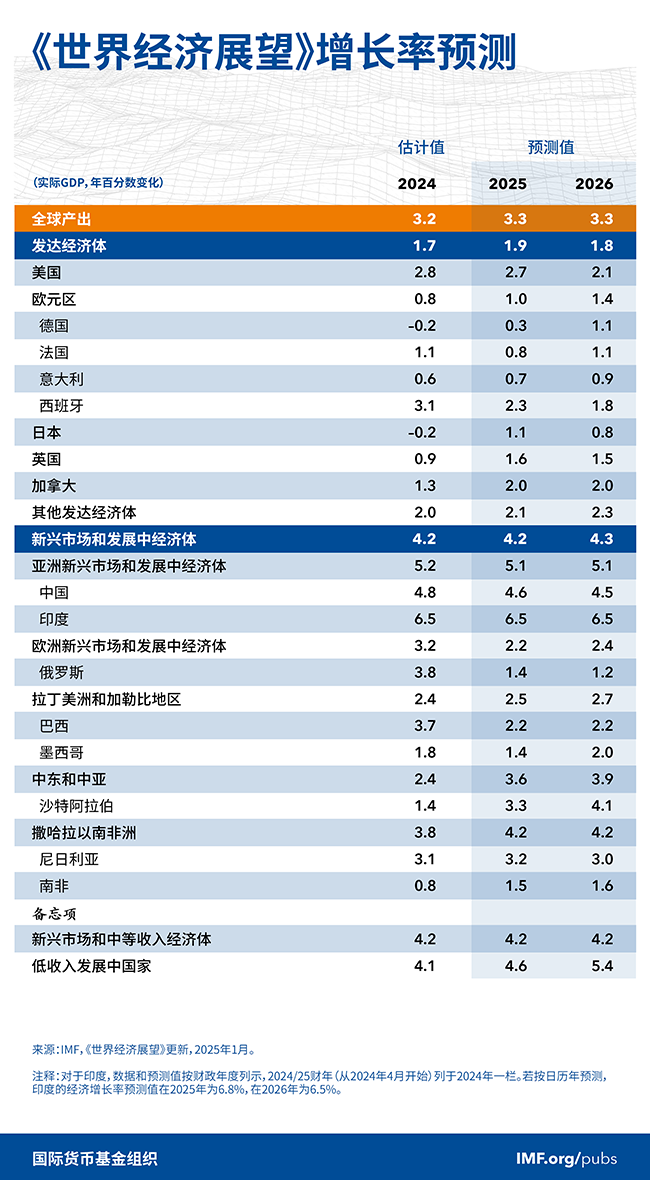

In 2025 and 2026, the global economy seems to be moving forward cautiously on the growth line of 3.3%. Although this growth rate is slightly higher than that in 2024, it is still lower than the historical average of 3.7% from 2000 to 2019. In short, this is not a drama of "after the cold winter comes spring", but more like a state of "getting over this hurdle first".

The IMF's forecast also reflects the subtle dynamics of the global economy - the US economy has taken part of the recovery with an upward revision of its growth rate, but the downward revision of the growth rates of other major economies has obviously lagged behind. At the same time, global inflation has finally shown signs of cooling down, and is expected to fall to 4.2% in 2025 and further to 3.5% in 2026. However, compared with emerging markets and developing economies, developed economies are expected to bring inflation back to target levels earlier.

But don’t rush to be optimistic, as the risk of differentiation is still a lingering shadow. In the short term, the strong growth momentum of the United States may continue for a while, while other countries are struggling to survive amid policy uncertainty and economic challenges. Especially at the critical stage of global inflation reduction, if we are not careful, policy interference may shatter the central bank’s easing plan and bring more pressure on fiscal and financial stability.

In the face of this economic "balancing act", countries need to find a reasonable point between inflation and growth, rebuild economic buffers, and accumulate capital for the next round of challenges. More importantly, strengthening multilateral cooperation and structural reforms is not only a solution to the current problems, but also a new path for medium- and long-term growth.

In the United States, potential demand in the economy remains strong, thanks to a significant wealth effect, a relatively accommodative monetary policy stance, and a friendly financial environment. In 2025, the U.S. economy is expected to grow by 2.7%, 0.5 percentage points higher than the October forecast. This adjustment reflects the continued impact in 2024, as well as positive signs such as labor market resilience and stronger investment activity. By 2026, growth is expected to gradually fall back to potential.

Eurozone growth is expected to pick up in 2025, but at a slower pace than previously expected. The growth rate was revised down by 0.2 percentage points to 1.0% due to geopolitical tensions and weak manufacturing. In addition, political and policy uncertainties continue to weigh on market sentiment. Looking ahead to 2026, domestic demand is expected to strengthen as financial conditions gradually ease and confidence improves, with growth likely to rise to 1.4%.

In emerging market and developing economies, growth performance in 2025 and 2026 is expected to be consistent with that in 2024. China’s 2025 forecast is revised up slightly by 0.1 percentage point to 4.6%, mainly due to the carryover effect from 2024 and the fiscal stimulus package launched in November, which partially offset the negative impact of trade uncertainty and the downturn in the real estate market. By 2026, economic growth is expected to stabilize at 4.5% as trade policy becomes clearer and the labor supply adjusts. India’s economic growth is expected to remain at 6.5% in 2025 and 2026, in line with its potential growth rate.

Growth in the Middle East and Central Asia is expected to accelerate, but at a slower pace than previously forecast, mainly due to a 1.3 percentage point downward revision in Saudi Arabia’s 2025 growth forecast as a result of the extension of OPEC+ production cuts. Growth in Latin America and the Caribbean is expected to increase slightly to 2.5%, but major economies in the region may face slowing pressures. The economic recovery in Sub-Saharan Africa will accelerate in 2025, while growth in emerging and developing economies in Europe is expected to slow.

Case Study: China Economic Stimulus 2023-2024

Since 2023, Hong Kong has been positioned by the Chinese government as a policy testbed for crypto assets, attracting international capital through more relaxed regulation. Data shows that Hong Kong's stablecoin trading volume increased by 32% in 2024, and the number of active addresses on the chain doubled. This shows that emerging markets are not only the destination for traditional financial capital inflows, but are also gradually becoming a new growth point for the crypto market.

Analysis: With the increase of capital inflows from emerging markets, Web3 projects may take this opportunity to enter a wider user group, especially in the DeFi and GameFi tracks. At the same time, the loose policy in Hong Kong, China provides a liquidity entrance for regional funds, and the crypto market may seek new growth points in the Asian market.

Outlook for the Federal Reserve's Monetary Policy: The Game Between Rate Cuts and Market Expectations

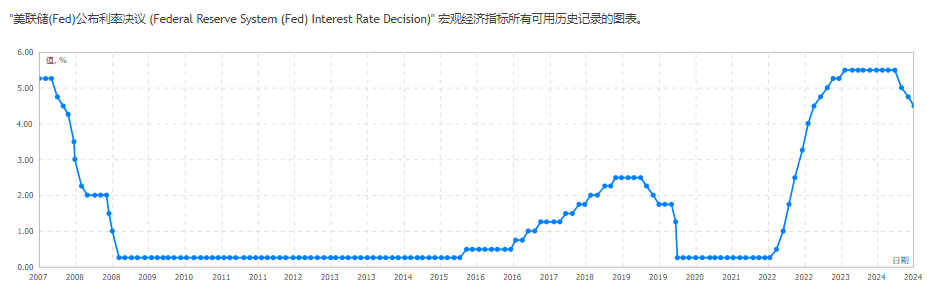

In 2025, the Federal Reserve's monetary policy has become the focus of the global economy and financial markets. After experiencing a high interest rate environment in 2023-2024, the market generally expects that the Federal Reserve may start a cycle of interest rate cuts, and the continued decline in inflation provides potential space for this. However, the pace and intensity of interest rate cuts still depend on the performance of economic fundamentals.

Core inflation expectations (CPI)

Data from the Bureau of Labor Statistics

In December 2024, the core CPI annual rate was 2.9%, close to the target range set by the Federal Reserve, while the data in January 2025 fell further to 3.2%, lower than market expectations. Nevertheless, inflation data still needs to decline further to provide sufficient policy space for the Federal Reserve to cut interest rates.

Interest rate level and market expectations

Data from the Board of Governors of the Federal Reserve System

According to the dot plot forecast of the Federal Reserve System Committee, most members support two interest rate cuts in 2025. The current interest rate is 4.5%, and it is expected to drop to 4%-4.25% by the end of the year. Historical data shows that the Fed's interest rate policy has a direct and lasting impact on the market, and its decision is based on the following key indicators:

- Inflation level : Core CPI and PCE data reflect price stability.

- Labor Market : Employment data, represented by the unemployment rate, is key to assessing the health of the economy.

- Economic Growth : Measures overall economic activity through GDP performance.

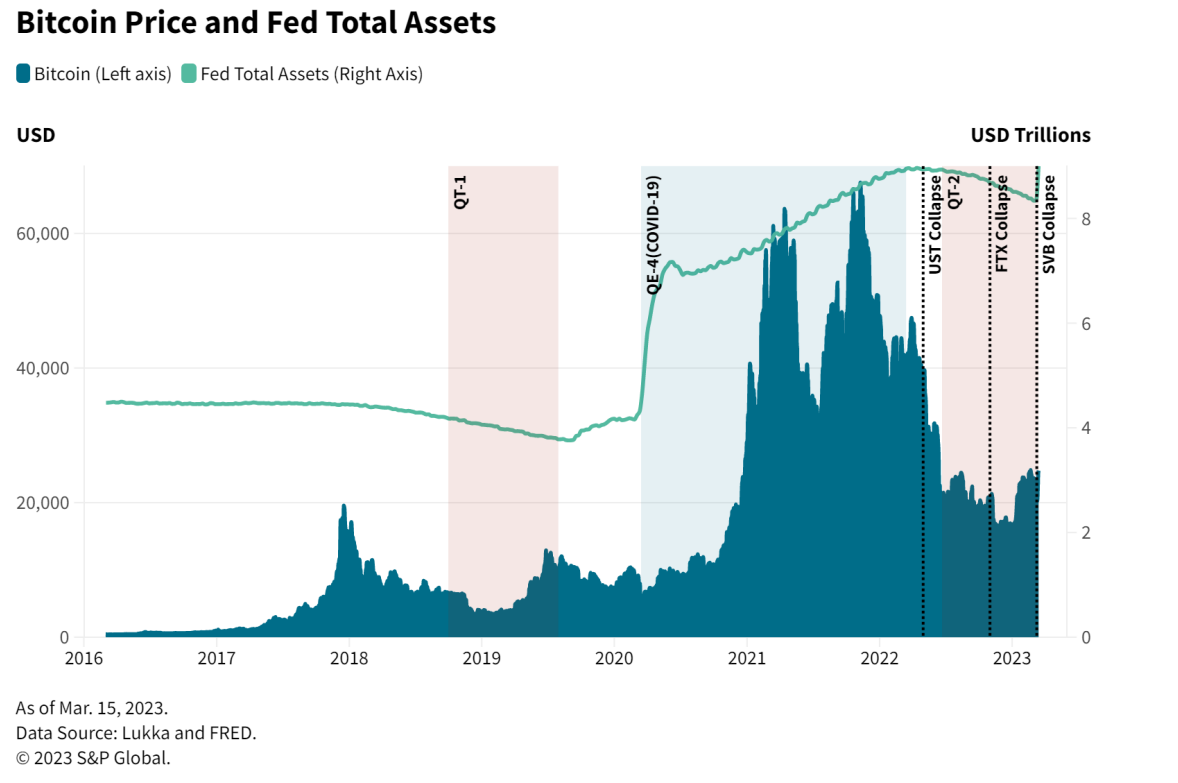

Historical correlation between Bitcoin price and interest rates

In 2020-2021, the Fed's low interest rate policy pushed BTC/USD up more than 400% in one year. If the interest rate cut cycle starts in 2025, the crypto asset market may usher in similar capital inflows again. However, this correlation will be constrained by factors such as the speed of inflation decline and the performance of the job market.

analyze

The Fed's rate-cutting cycle usually reduces the cost of funds and improves the risk appetite of institutional and retail investors, which creates new opportunities for capital inflows into Bitcoin and other crypto assets. However, the magnitude and pace of rate cuts will depend on whether core inflation can maintain its downward trend. If inflation rebounds in the short term, the Fed may adopt a more cautious strategy, which will have a suppressive effect on the pace of recovery in the crypto market.

Inflation and employment: indicators of economic health and capital flows

The Fed's monetary policy is highly dependent on the dynamic performance of inflation and employment data. Currently, the US labor market has shown some resilience, but also shows signs of slowing growth.

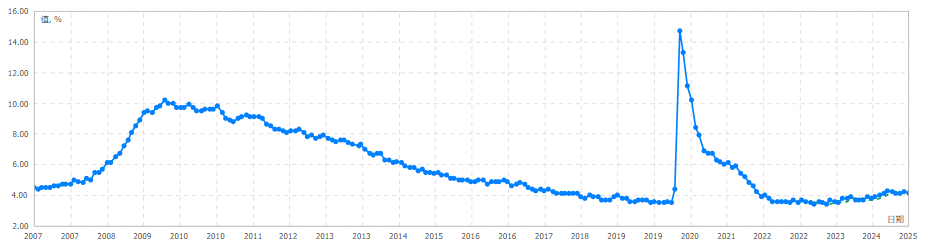

unemployment rate

Data source: Bureau of Labor Statistics

In December 2024, the U.S. unemployment rate was 4.1%, and is expected to drop slightly to 4.0% in January 2025. Although the unemployment rate is at a low level, some structural problems, such as the incomplete recovery of the labor force participation rate, remain potential risks to the economy.

Core PCE annual rate

Data source: Bureau of Economic Analysis

The core PCE annual rate is expected to be between 2.3% and 2.5% in 2025, a slight decrease from 2.6% in 2024. The PCE index is regarded by the Federal Reserve as a major inflation measurement tool because it dynamically reflects changes in consumer behavior. A further decline in this indicator indicates that inflationary pressure has eased, which will help the Federal Reserve's decision to cut interest rates.

On-chain data and crypto markets

Glassnode data shows that the on-chain transaction activity in the crypto market is positively correlated with inflation data. When the core PCE falls below 2.5%, the on-chain transaction volume usually achieves a month-on-month growth of 15%-20%, indicating that inflation relief can directly increase market participation and investment activity. The decline in inflation will facilitate the return of funds to the crypto market, but consumer and investor sentiment still needs further observation.

analyze

The Fed’s monetary policy adjustments directly affect global capital liquidity, and the crypto market is particularly sensitive to monetary policy changes due to its high-risk and high-return characteristics. The following are the specific transmission paths:

- The benefits of lower funding costs: interest rate cuts will directly reduce borrowing costs and increase institutions’ willingness to allocate to high-risk assets (including Bitcoin and Ethereum). On-chain financial ecosystems (such as DeFi) are expected to usher in a new round of growth in TVL.

- Resurgence in stablecoin demand: Slowing inflation will boost confidence in dollar-pegged stablecoins such as USDC and USDT. These stablecoins, as bridges for global capital flows, will further boost cross-border payments and on-chain transaction volumes.

- Increased risk appetite: Loose monetary policy often leads to an increase in investors’ risk appetite, driving the activity of MEME, NFT, GameFi and AI-driven tracks. Especially with the decline of PCE, these tracks may attract more users and funds.

- Strengthening of safe-haven properties: With inflation falling but macro uncertainty increasing, Bitcoin's role as "digital gold" will be further highlighted. The market may increase its allocation to BTC to hedge against systemic risks.

The impact of macroeconomics on traditional financial markets

U.S. stock and bond markets: differentiation of capital safe havens

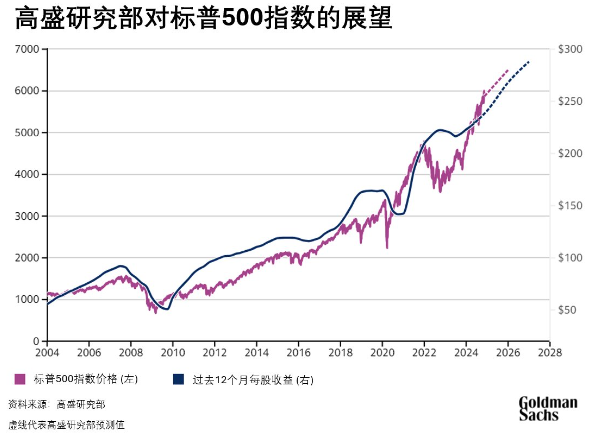

In 2024, the S&P 500 index outperformed market expectations, closing at 5,132 points, up more than 15% from the end of 2023, achieving an annual increase of 20%+ for the second consecutive year, the first time since the 1990s. The price-to-earnings ratio has also increased significantly, increasing by 25% in the past two years to 21.7 times, indicating that the market has become more dependent on profit growth.

In 2025, US stock valuations may face adjustment pressure, with the main driving factors including:

- Trade policy impact : The new administration’s targeted tariff policy could have a volatile impact on market sentiment and trade-related industries.

- Market structure shift : Analysts expect the market's leading power to shift from large technology stocks to broader sectors. Cyclical growth industries, increased merger and acquisition activities and potential regulatory relaxation will become new drivers of the market.

- Stable job market : The unemployment rate remains around 4%, which helps support risk appetite and consumption levels.

Expectations and data

Annual return of the S&P 500 Index: According to Goldman Sachs' forecast, it is expected to be 10% in 2025, a decline from the previous two years.

10-year Treasury yield: expected to drop from 4.2% in 2024 to 3.8%-4.0% (data source: Bloomberg)

Bitcoin and U.S. Stock Correlation

Data shows that the correlation between Bitcoin and the S&P 500 index is about 0.4, showing significant linkage especially when the market recovers (data source: MacroMicro).

- Analysis: If the bond market becomes less attractive due to interest rate cuts, some funds may turn to the crypto market to seek higher returns. At the same time, if the stock market performs poorly, Bitcoin's safe-haven properties as "digital gold" may further attract capital inflows.

Signals from the commodity market: gold, crude oil and risk aversion

In 2025, the commodity market may continue to send signals of inflation and risk aversion. Gold is expected to remain high, while the increased volatility of crude oil prices may become an important indicator for macroeconomic observation.

Gold Price

According to the World Gold Council, the gold price is expected to fluctuate between $2,600 and $2,900 per ounce in 2025. The main drivers of gold's strong performance include:

- Geopolitical uncertainty drives safe-haven demand.

- Gold's stability attracts more investors during periods of falling inflation.

Crude oil prices

According to EIA data, international crude oil prices may face downward pressure due to supply and demand adjustments, and the average price is expected to be lower than US$75 per barrel in 2025. This price level mainly reflects the slowdown in global economic growth and adjustments in energy consumption demand.

Gold and Bitcoin Correlation

Data from MacroMicro

Data shows that during periods of high risk aversion, the correlation between Bitcoin and gold once reached 0.6 (data source: MacroMicro).

Analysis: Gold’s strong performance may further consolidate Bitcoin’s status as “digital gold”, while the stability of crude oil prices will help curb inflationary pressures, which will indirectly benefit the risk appetite of the crypto market.

Summarize

Macroeconomic changes are gradually reshaping the landscape of traditional financial markets:

- U.S. stock and bond markets: As interest rates fall, the bond market may become a safe haven, while valuation pressure on U.S. stocks may cause funds to seek higher-yield investment opportunities, including crypto assets.

- Commodity Markets: Gold’s safe-haven qualities strengthen its correlation with Bitcoin, while stable crude oil prices underpin moderate growth in the global economy.

For the crypto market, these macro signals suggest that capital flows may tilt toward high-value store assets such as Bitcoin, while also creating more opportunities for other high-risk crypto assets.

Differentiation and new opportunities in the global crypto market

United States: Changes in regulatory direction and market impact

As the heart of the global cryptocurrency market, the US policy direction not only directly affects the domestic market rules, but also has a profound impact on global investor confidence and capital flows. After entering 2025, the US regulatory policy began to show unprecedented complexity: there are both promotions for innovation and strong regulatory measures for risks. In particular, Trump's return to power has injected more uncertainty and potential opportunities into the crypto industry.

ETF Breakthrough: A Milestone for the Crypto Market

In January 2024, the U.S. market witnessed an important breakthrough in the field of cryptocurrency: Bitcoin spot ETFs from several heavyweight institutions were approved. This event not only marks the further integration of traditional finance and the cryptocurrency market, but also sends a clear signal that crypto assets are gradually being accepted by the mainstream financial system.

Data shows that after the launch of BlackRock and Fidelity's Bitcoin ETF, it attracted more than US$5 billion in capital inflows within three months, becoming one of the financial products with the largest capital inflows in the world.

Another important signal related to ETFs is the deep participation of institutional investors. Traditional financial giants such as JPMorgan Chase and Goldman Sachs have included crypto assets in their multi-asset portfolios. This trend shows that the U.S. market is transforming from retail-driven to institutional-led, and cryptocurrencies are gradually becoming a "legal" asset allocation tool.

Policy changes in the U.S. market will directly affect the global crypto market through capital flows and technological innovation. For example, U.S. Bitcoin ETF products have begun to attract cross-border investors in Europe and Asia, further driving demand for similar products in these regions.

Regulatory complexity and potential risks

Although the progress of ETFs has injected vitality into the market, the overall situation of cryptocurrency regulation in the United States remains confusing. The SEC filed lawsuits against several unregistered securities tokens in 2024 and imposed heavy fines on exchanges, which showed its "tough" side in regulation. However, under the promotion of the Trump administration, the SEC has also shown an open attitude towards innovation, such as speeding up the review and approval process for Web3 technology.

This "hot and cold" regulatory situation actually exposes the following potential risks:

- Policy discontinuity: Frequent changes in the SEC chairman may lead to policy uncertainty. For example, the new chairman may adopt a completely different balance strategy between supporting innovation and protecting investors, which may have an impact on market expectations.

- Centralization risk: With the deep involvement of large institutions, the flow of funds in the crypto asset market is becoming more and more centralized. Once a giant company encounters a liquidity crisis, it may trigger a chain reaction similar to the 2008 financial crisis.

Trump's Administration: Opportunities and Challenges Coexist

Trump's coming to power has brought new variables to the US crypto market. During the campaign, he repeatedly mentioned the need to "reshape financial rules" and showed strong support for crypto assets. The market generally expects that the Trump administration may introduce the following major policies:

- Promote more relaxed tax policies: Reduce capital gains taxes on crypto assets to attract more retail investors.

- Reduce government selling pressure: Slow down or stop the sale of Bitcoin held by the US government.

- Bitcoin Strategic Reserve: Incorporate Bitcoin into the strategic reserves of state or federal governments.

- Encourage innovation: Establish special funds to support the development of technologies such as decentralized finance (DeFi) and zero-knowledge proof (zk-proof).

- Combat the outflow of overseas liquidity: Through a regulatory coordination mechanism, reduce the flow of U.S. funds to offshore markets such as Singapore and Dubai.

However, Trump's policy direction may also bring some negative effects. For example, his economic policies have always favored large enterprises, which may put start-ups at a disadvantage in the competition. In addition, an overly loose environment may lead to market overheating and the accumulation of systemic risks.

Future Scenario Prediction: Two Possibilities for the US Crypto Market

- Optimistic scenario: If the Trump administration successfully implements policies and the SEC remains friendly to innovation, the United States may consolidate its leadership in the global crypto market. By the end of 2025, the market value of crypto assets in the U.S. market is expected to exceed 50%, and the price of Bitcoin may reach more than $200,000 due to the continued inflow of institutional funds.

- Pessimistic scenario: If the policy direction fluctuates or the market faces systemic risks due to excessive concentration, the US's dominant position may be weakened. At that time, markets such as Singapore and Hong Kong may take advantage of the situation to rise, and the share of funds in the US market will fall below 30%.

China: Policy uncertainty and market opportunities

China was once one of the leading forces in the global cryptocurrency market, but it once withdrew from the stage due to tightened regulation. Since the total ban on ICOs (initial coin offerings) in 2017, China has adopted a strict blockade policy on the crypto market, but policy uncertainty has failed to completely suppress the market's activity. At the end of 2024, some intriguing signals appeared in China's crypto industry, especially the relaxation of policies in Hong Kong as a test field, which injected new liquidity into the global market.

Policy uncertainty: from comprehensive suppression to cautious opening

While mainland China’s ban on cryptocurrency trading and mining remains in effect, Hong Kong has taken an important step towards the crypto industry’s recovery in 2024. Hong Kong has introduced a comprehensive licensing system for cryptocurrency exchanges and encouraged large financial institutions to pilot blockchain asset management.

Data shows that as of the end of 2024, the number of licensed exchanges in Hong Kong has increased to 7, and nearly 40% of their users are from mainland China.

This policy shift not only released the potential market demand within China, but also provided a new way for international capital to enter the Chinese market. The trading volume, mainly Bitcoin and Ethereum, dominated the Hong Kong exchange. At the same time, the daily trading volume of the stable currency USDT broke the historical record. Hong Kong has become a symbol of China's "limited return" in the crypto market.

Indirect participation: the driving force behind global liquidity

Although China has adopted a strong regulatory policy on cryptocurrencies, its indirect role in the global crypto market cannot be ignored. First, Chinese companies and capital continue to be deeply involved in the crypto industry through offshore markets. Data shows that the proportion of funds from mainland China entering the global market through Hong Kong, Singapore and other places has reached more than 20%, especially in the field of stablecoins.

Secondly, China's blockchain technology application is in a leading position globally. The central bank's digital currency (digital RMB) has completed three rounds of international pilots in 2024, covering 15 countries including Russia and the UAE. This technology export not only consolidates China's position in the global financial technology field, but also lays the groundwork for possible policy shifts in the future.

Hong Kong Experimental Field: The Balance Between Policy and Market

Hong Kong's policy experiment shows that China is re-evaluating the potential of the crypto market. By allowing crypto assets to operate in a regulated environment, the Chinese government is trying to balance the potential of decentralized technologies with the need for financial system stability. This "limited opening" model may provide a reference for future policies in mainland China.

For example, the tax incentives introduced by the Hong Kong Special Administrative Region Government in 2017 provided substantial relief to blockchain companies, especially in the Web3-related field. This move attracted many international players including Circle and Animoca Brands, making Hong Kong a new center for the Asian crypto market.

Potential participation

- Possibility of further policy opening: With the successful operation of the Hong Kong model, mainland China may conduct cautious policy pilots in some areas. For example, in the field of on-chain supply chain finance and cross-border payments, the government may allow wider application of blockchain technology.

- Global liquidity impact : If China can release more capital flows through the window of Hong Kong, the global cryptocurrency market value may exceed US$3 trillion in the first half of 2025. This will directly increase the value of mainstream assets such as Bitcoin and Ethereum, while promoting the recovery of projects closely linked to the Chinese market (such as TRON).

- Technology export and industrial layout: In the next few years, China may deeply participate in the global encryption market by promoting digital RMB and cross-border blockchain solutions. This strategy can not only ease the pressure of international financial sanctions, but also reshape the ecology of the encryption industry through technology export.

Policy uncertainty in the Chinese market is both a risk factor and a potential growth driver for the global crypto market. From a total ban to indirect participation through Hong Kong, China is exploring a path that can both maintain financial stability and use crypto technology to drive economic growth. For investors, paying attention to policy changes in the Hong Kong market, the progress of technology exports, and possible policy pilot directions will be key to formulating investment strategies in the future.

South Korea: New regulations and the wave of compliance

South Korea has always been an important hub in the global cryptocurrency market. Its active investor groups and huge trading volume make it the core of the Asian crypto market. However, this prosperous market is also accompanied by considerable risks, with illegal transactions, money laundering and fraud being common. In response to this challenge, the South Korean government has continuously introduced stringent regulatory policies in recent years, trying to guide the market towards a more standardized and transparent development path.

The wave of compliance: the two-way interaction of policy and market

On January 15, the Financial Services Commission (FSC) of South Korea began discussing the formulation of the second phase of the crypto regulatory framework and plans to draft relevant legislation in the second half of 2025. The meeting focused on improving the transparency of cryptocurrency transactions and the accountability of stablecoin issuers. FSC Vice Chairman Kim So-young said that the new framework will take a comprehensive and systematic approach, covering service providers, crypto users and markets, and refer to international regulatory practices to strengthen reserve asset management and user redemption rights.

Earlier, at the end of 2024, South Korea launched what it called the "strictest cryptocurrency bill in history", including the following core requirements:

- User real-name system: All exchanges must implement strict user real-name authentication to ensure the legitimacy of the source of funds.

- Reserve disclosure: The exchange stores more than 80% of user assets in cold wallets and separates them from its own funds. The exchange is required to disclose user asset reserves regularly and submit financial audit reports.

- Investor protection mechanism: The exchange needs to establish a special fund to compensate users for losses caused by hacker attacks or system failures.

Data shows that the introduction of these policies has a direct impact on the market structure. The number of user registrations of South Korea's three major exchanges, Upbit, Bithumb and Korbit, fell by about 15% in the short term, but trading volume gradually recovered in 2025. In particular, Upbit's transparent reserve disclosure system has attracted more institutional investors to enter the market, and its trading volume once hit a record high.

Short-term shocks and long-term opportunities

In the early days of the policy, the market generally expressed concerns about the future of exchanges. Some small exchanges were forced to close or move to regions with looser regulations due to their inability to meet strict compliance requirements. However, in the long run, these regulations have laid a more stable foundation for the industry.

For example, the South Korean government requires exchanges to exchange all cryptocurrencies for fiat currencies through local banks. This move not only improves the security of funds, but also strengthens the linkage between cryptocurrencies and the traditional financial system. Data shows that the total volume of cryptocurrency transactions in South Korea accounts for 13% of the world, especially the Korean won trading pair of Bitcoin and Ethereum has become one of the most active trading pairs in the world.

Impact of the New Regulations on Projects and Investors

Promoting local projects

Although the strict regulatory environment has put pressure on small exchanges, it is an opportunity for high-quality projects. The South Korean government strongly supports the application of blockchain in areas such as supply chain, medical data and digital identity. In 2025, the South Korean government plans to allocate US$1 billion for blockchain innovation projects, including R&D support for five local blockchain startups.

Adjustments to investor behavior

The implementation of the new regulations has also had a profound impact on investor behavior. Traditionally, Korean investors prefer highly volatile crypto assets such as memecoins or small-cap tokens. However, the tightening of policies has made investors more inclined to trade mainstream assets (such as Bitcoin, Ethereum) and tokens related to government-backed projects. This change in risk appetite has made the market more rational and attracted more attention from international capital.

The wave of compliance in the Korean market has not only changed the rules of the local market, but also had a spillover effect on the Asian and even global markets. For example, after seeing the improvement in transparency in the Korean market, Japanese exchanges have followed suit and disclosed their reserves. This trend has improved the overall standardization of the Asian market and attracted more institutional investors.

At the same time, South Korea, Singapore and Hong Kong have formed a "three-legged" pattern in the crypto market. As important nodes in the Asia-Pacific region, the capital flow and policy interaction between these markets have further promoted the position of the Asian market in the global crypto market.

The compliance process of the Korean market shows that strict supervision does not mean a weakening of market vitality, but may pave the way for long-term development. By the end of 2025, it is expected that the compliance of the Korean market will attract more international capital to enter the market, and the transaction volume may increase by 20%-30%. In addition, the Korean government's continued investment in blockchain technology will bring more innovation opportunities to local projects.

Investors should pay close attention to government-supported projects and the policy orientation behind them at this stage, while evaluating the impact of the Korean market on regional capital flows. Under this new wave of regulations, the Korean market may become a model for the standardized development of the global crypto industry.

Japan: Policy support and institutional entry

In the Asian crypto market, Japan has always played the role of a rule maker and steady promoter. As early as 2017, Japan became the first country in the world to formulate a comprehensive legal framework for cryptocurrencies. In recent years, its government's supportive policies and the deep involvement of institutions have gradually integrated crypto assets into the mainstream economy. In 2025, Japan is transforming its institutional advantages into regional competitiveness, providing a dual driver of stability and innovation for the global market.

Policy support: leading compliance and innovation

In 2024, the Financial Services Agency (FSA) of Japan adopted a series of policy revisions to further clarify the legal status and regulatory framework of crypto assets, including:

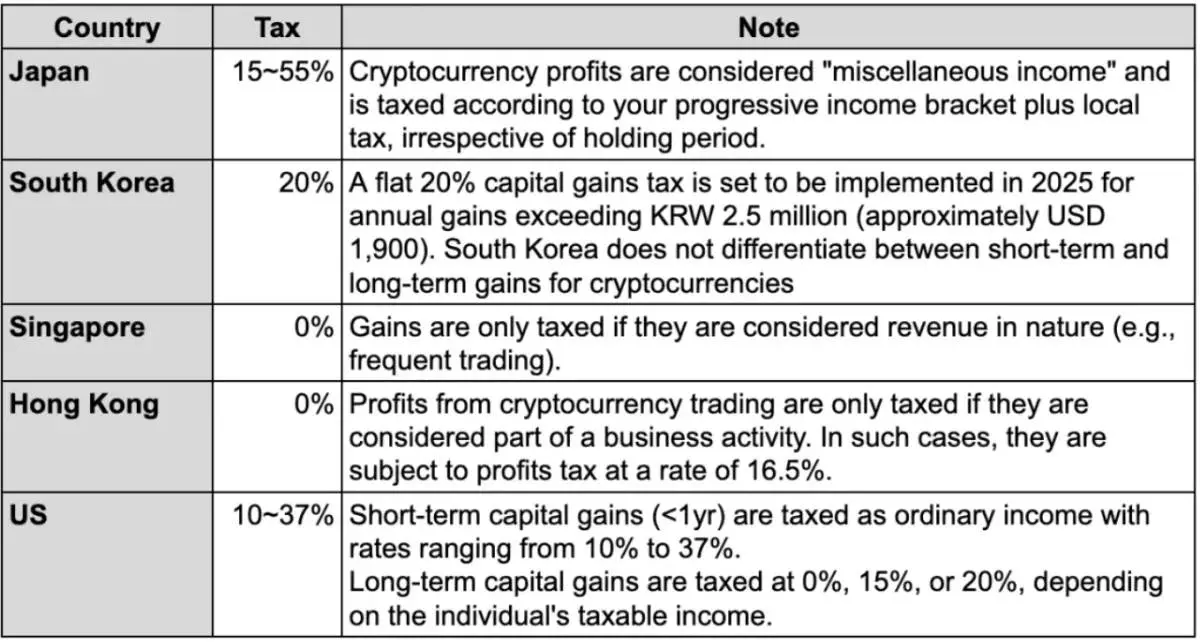

- Lower tax burden: The tax on crypto asset profits for individual investors has been reduced from 55% to 20%, which is in line with the tax rate in the stock market. This measure has greatly attracted the interest of retail and institutional investors.

- Relaxation of institutional asset allocation ratios: Banks and pension management companies are allowed to allocate up to 5% of their portfolio assets to cryptocurrencies and related funds.

- Support Web3 infrastructure: launch the "Digital Economy Revitalization Plan" and set up special funds to support the development of NFT, GameFi and Metaverse.

The introduction of this series of policies not only demonstrates the forward-looking nature of the Japanese government in the crypto industry, but also consolidates its stable image in the international market. Data shows that the share of the Japanese yen in global crypto transactions will rise to 11% in 2024, second only to the US dollar and the euro.

Institutional entry: dual drive of capital and technology

In recent years, large Japanese institutions have significantly accelerated their layout in the field of crypto assets. Mitsubishi UFJ Financial Group (MUFG) not only launched its own stablecoin, but also cooperated with local blockchain projects to develop cross-border payment solutions. Another giant, Nomura Holdings, focuses on DeFi protocol investment and development through its subsidiary Laser Digital.

At the same time, the progress of Japanese companies in the fields of NFT and GameFi is also remarkable. Giant companies such as Sony and Nintendo have begun to explore the integration of NFT technology into their gaming ecosystems. Sony launched the world's first digital asset market based on NFT technology at the end of 2024, and plans to further promote this model in 2025. This not only brings a new experience to players, but also promotes the mainstreaming of NFT technology.

The institutional advantage of the Japanese market lies in its highly transparent and systematic regulatory environment, which provides a sense of security for institutions and retail investors. Compared with South Korea and Hong Kong, Japan's regulatory framework is more mature and more competitive in attracting international capital.

In addition, the activity and innovation of the Japanese market have also had a radiating effect on regional markets. For example, many projects in the Southeast Asian market are emulating Japan's technical specifications and compliance standards while seeking support from Japanese investors. Data shows that Japanese investors' investment in Southeast Asian Web3 projects increased by nearly 50% in 2024.

By the end of 2025, the Japanese market is expected to attract more international funds, especially global institutions seeking a stable investment environment. The share of the yen in crypto transactions may further increase to 15%. At the same time, with the advancement of the "Digital Economy Revitalization Plan", the global competitiveness of the NFT and GameFi fields will also be greatly enhanced.

For investors, the Japanese market provides a relatively stable policy environment and a clear growth direction. Paying attention to the trends of large local institutions, innovative projects supported by the government, and the linkage effect with the Southeast Asian market will become the key to obtaining investment returns in the Japanese crypto market.

Emerging markets: Growth potential in Southeast Asia and Latin America

In the global crypto market, emerging markets play an increasingly important role. Southeast Asia and Latin America have become new growth points in the crypto market with their unique economic environment, rapidly developing digital infrastructure and strong market demand. They are not only a paradise for investors, but also a testing ground for technological innovation, injecting fresh vitality into the global market.

Southeast Asia: Technological innovation and user growth go hand in hand

Southeast Asian countries, with their young user structure and digital trends, have become one of the regions with the highest cryptocurrency adoption rates. According to a report by Chainalysis, the Philippines, Vietnam and Thailand will rank among the top three in global cryptocurrency adoption rates in 2024. In the Philippines in particular, more than 20% of adults hold some form of crypto assets, far higher than the global average.

Behind this trend is the active adoption of blockchain technology in the field of cross-border payments by Southeast Asian countries. For example, Thailand's SCB (Siam Commercial Bank) launched a cross-border payment solution based on Ripple, which greatly reduced the cost and time of cross-border remittances. Vietnam has created more scenarios for the practical application of crypto assets through e-commerce platforms that support cryptocurrency payments.

In addition, support for Web3 technology in Southeast Asia is also emerging. The Indonesian government launched the "Web3 Innovation Plan" in 2024, providing financial subsidies and tax incentives, attracting a large number of local developers and international projects. Companies such as Binance and Animoca Brands are also actively investing in the region to promote the popularity of DeFi and NFT projects.

Latin America: Stablecoins and a breakthrough in financial inclusion

The cryptocurrency market in Latin America presents another feature: the widespread use of stablecoins. In the context of economic turmoil and high inflation, residents of Latin American countries regard stablecoins as a hedge tool. Data shows that in 2024, the volume of stablecoin transactions in Brazil increased by 150%, with USDT dominating.

In addition to stablecoins, cryptocurrencies have also played an important role in financial inclusion. Large numbers of unbanked populations in countries such as Argentina and Venezuela directly participate in the global economy through crypto wallets. Brazil’s official blockchain network, PIX Chain, combines decentralized finance (DeFi) with the national financial system, providing a new financial service model for the world.

Technology and policy: a unique path for emerging markets

What Southeast Asia and Latin America have in common is that their market development is not entirely dependent on government policies, but is more driven by market demand. For example, more than 60% of the cryptocurrency trading volume in the Philippines comes from overseas remittances, which is the result of a large number of overseas workers seeking low-cost solutions. In Brazil, supply chain payments between companies and financing needs of small and medium-sized enterprises are being met through blockchain technology.

At the same time, the policy environment in these regions is gradually improving. Mexico introduced new crypto regulations at the end of 2024 to encourage startups to use blockchain technology to solve the pain points of traditional finance. The Association of Southeast Asian Nations (ASEAN) has taken an important step in developing cross-border blockchain standards.

Future Outlook: Global Influence of Emerging Markets

In 2025, cryptocurrency adoption in emerging markets is expected to grow another 20%-30%. These regions are not only a source of funding and user growth, but also an incubator for technological innovation and new business models. Especially in the fields of Web3 and DeFi, emerging markets may become a key fulcrum for global layout.

For investors, emerging markets offer unique opportunities with high growth and high risk. Paying attention to local policy dynamics, infrastructure construction progress, and user adoption will help investors better seize potential opportunities in these markets.

Macroeconomic Transmission Mechanism to Web3 and Crypto Markets

The relationship between the crypto market and the macroeconomy is becoming increasingly close. From interest rate policies to global capital flows to geopolitical uncertainties, the macroeconomic environment is profoundly affecting the development of Web3 and crypto assets through a variety of mechanisms. This transmission mechanism is not direct, but rather shapes the cyclical and structural changes in the market through the interweaving of multiple dimensions such as risk preferences, capital flows, and technological evolution.

1. How does the Fed’s policy affect crypto assets?

As the core driver of the global capital market, the Fed's monetary policy naturally extends its influence to the crypto market. The interest rate hike cycle in 2022 and 2023 directly led to a sharp adjustment in the prices of risky assets. The prices of mainstream cryptocurrencies, including Bitcoin and Ethereum, fell by more than 50% at one point. However, when the Fed began to slow down the pace of interest rate hikes in 2024 and hinted that it might cut interest rates in 2025, the crypto market rebounded quickly.

The logic behind this phenomenon is:

- Liquidity driven: As a risky asset, the crypto market is highly correlated with loose liquidity. When interest rates fall, liquidity in the market increases, and investors are more inclined to pursue high-return risky assets, pushing up cryptocurrency prices.

- Inverse correlation of the US dollar index: Data shows that Bitcoin and the US dollar index (DXY) have a clear negative correlation. When the US dollar strengthens, global capital flows back to the United States, and the crypto market is impacted; when the US dollar weakens, assets such as Bitcoin become more attractive and become a safe haven option for investors.

2. Shift in investors’ risk preferences

Macroeconomic changes also indirectly affect the internal structure of the crypto market by changing investors’ risk appetite. Take decentralized finance (DeFi) as an example. When the global economy enters a period of low growth or uncertainty, risk aversion rises and DeFi’s TVL tends to show a downward trend. When the economy picks up and risk appetite rises, funds will flow back into high-yield DeFi protocols and emerging tracks.

DeFilama: DeFi TVL & Stablecoin MC

Specific manifestations include:

- The correlation between interest rate changes and TVL: During the 2023 interest rate hike cycle, DeFi's TVL shrank from nearly US$200 billion at its peak to less than US$40 billion; and as interest rate hikes slowed, TVL began to rebound in 2024 and has now returned to US$120 billion.

- Diversification of capital flows: In addition to DeFi, AI-driven Web3 applications have become the new favorite of capital. For example, the capital inflows of AI Agent and DeSci have increased significantly, showing the market's strong interest in technology-driven tracks.

3. Stablecoin Market: A Direct Window into Fed Policy

As an asset pegged to the U.S. dollar in the crypto market, the market size of stablecoins is closely related to the liquidity of the U.S. dollar. Data shows that the on-chain circulation of USDT and USDC increased by about 20% in 2024, with a total market value of nearly $200 billion, partly because the uncertainty of the global economy has driven the demand for U.S. dollar stablecoins.

However, interest rate cuts may bring new challenges to the stablecoin market: in a low-interest rate environment, the attractiveness of US dollar stablecoins relative to high-yield DeFi protocols may weaken.

4. Feedback loop between technology and funding

The macro-economy also indirectly promotes the iteration of Web3 technology by affecting the flow of funds. For example, when rising interest rates lead to increased capital costs, many high-risk, high-investment technology projects (such as Layer 2 expansion and zk-proof) may slow down their development progress due to insufficient financing. On the contrary, a loose liquidity environment creates conditions for technological breakthroughs.

Data shows that in 2024, the ecological development of Layer 2 technology ushered in an explosive period, and its locked-up volume increased by 200% annually. This phenomenon is a typical manifestation of the indirect promotion of macro-easing policies on the field of innovation.

The impact of macroeconomics on Web3 and the crypto market is not a one-way process, but a complex two-way feedback process:

- Short-term transmission: Fed policies directly affect market prices through liquidity, interest rates, and capital flows.

- Medium- and long-term feedback: Macroeconomic changes shape technological development and market structure, providing new opportunities and challenges for the industry.

Last words

After a comprehensive review of the changing global economy and crypto markets, 2025 will undoubtedly be a critical turning point for the crypto industry. The moderate recovery of the global economy and the flexible response of various countries' policies have paved the way for breakthrough growth in the crypto market. In particular, the expectation of the Fed's interest rate cut, Trump's coming to power, and the enthusiasm of emerging markets for Web3 projects have injected unlimited possibilities into this year.

Crypto assets are no longer just marginalized players in the capital market, but are gradually emerging in the global economic chess game. As Wang Feng, founder of Linekong Interactive, said: "2025 will definitely be a big year for cryptocurrency in history. No matter whose meme it is, it is just an appetizer. The real wave around RWA and AI sectors will surely come violently." With the deep integration of encryption technology and the real world economy, digital currency is not only a tool for the financial market, but also an important driving force for the transformation of the global economy.

However, despite the opportunities, challenges cannot be ignored. Regulatory issues in the crypto market have not been fully resolved, and the contradiction between the speed and security of technological innovation often tests the sustainable development of the industry. The potential volatility and uncertainty of the macro economy may become a "reef" for market development. However, as the decentralized nature of crypto assets shows, its unique value and breakthrough innovation can enable it to transcend the limitations of the traditional financial system and become a new growth point for the global economy.

For the crypto industry, this is not just a node related to capital flow, it is also a battle between technology and regulation, and an important part of the global economic recovery that cannot be ignored. In this macro context, 2025 may be the moment when the crypto market truly "turns around". New market rules, new liquidity, and new innovative breakthroughs will jointly create the future of this industry. Are you ready to bet?