AO is an upcoming artificial intelligence agent coordination platform, with the mainnet launch less than a month away, which is an important milestone for the Arweave and AI x Crypto communities. This article delves into the analysis of Arweave's permanent data storage design, unpacks the superparallel computing architecture of AO, and elucidates how the two networks will drive the next wave of on-chain autonomous agents.

We outline the challenges facing AR and AO, as well as the current dynamics of the AR token market - revealing that a whale has been offloading AR supply since September, and they have almost completed the sell-off. Finally, we will also introduce how to participate in the AR ecosystem and get involved in the upcoming AO launch.

Introduction

On February 8, 2025, the AO mainnet will officially go live - a significant event for the AI x Crypto community that will change the way everyone interacts with on-chain agents. AO brings a superparallel computing layer to the market, designed specifically for agent applications. This is also an important milestone for Arweave, the permanent data storage network that underpins AO, making the realization of AO possible.

This article will delve into the technical details behind Arweave and AO, explore their token economics, and dive into the emerging AO ecosystem.

Important Disclaimer: We were previously venture capital investors in Arweave and, as holders of AR tokens, we have also accumulated some AO tokens.

What is Arweave?

Arweave is a decentralized, permanent data storage network. Users pay a one-time upfront fee based on the required storage, and the data is guaranteed to be permanently available. Arweave has no centralized permission management mechanism, and fees are dynamically adjusted based on miners' storage requirements to ensure miners are continuously compensated for data storage. Arweave is a "pay once, store forever" solution. This is different from other popular data storage networks (such as Filecoin), which require users to pay ongoing fees for storage and have limited storage durations.

Arweave's architecture is based on a unique design called "blockweave". Many blockchains follow a linear chain structure of blocks, while Arweave connects each new block to the previous block and a randomly selected early block from the historical chain. This design forces miners to retain more historical data than a standard blockchain, as they must prove they hold the correct data fragments from the recent blocks and a randomly selected historical block to create each new block. This requirement ensures long-term data permanence - nodes must maintain the entire historical data set to mine new blocks and continue receiving rewards.

Arweave's token AR is used to pay fees and reward miners. When new data is published to the Arweave network and fees are paid, approximately 85% of the tokens will go into the Endowment, which is used to fund future miner reward payments. Miner rewards are calculated independently of network fees, ensuring miners are incentivized to participate in the network regardless of user activity. This smooth fee collection and distribution mechanism enhances confidence in Arweave's storage guarantees.

Growth Momentum

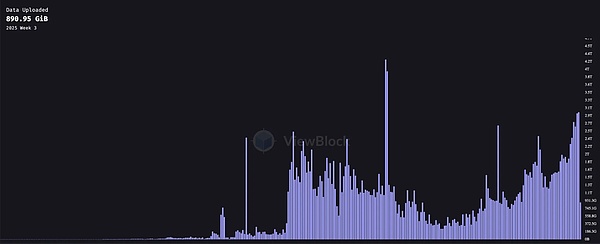

Although Arweave has been operational since its launch in June 2018, its true user growth began in 2021. The following chart shows the weekly data upload volume since the network's inception:

Source: https://viewblock.io/arweave/stat/dataUploaded?time=week

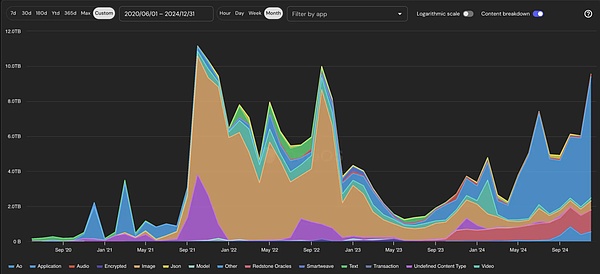

In September 2021, data storage volume spiked sharply, reaching a low point in June 2023 and has been steadily growing since then. The following chart shows the monthly upload volume of different data types.

Arweave's Usage Over Time (by Data Size)

Source: https://stats.dataos.so/arweave

In 2021, the global Non-Fungible Token (NFT) craze drove the first significant growth in Arweave data storage. Creators began storing their JPEG images and other media on Arweave instead of linking to centralized hosting providers, which was a major driver of the surge in Arweave usage during this period. Arweave is well-suited for storing NFT art data due to its permanence and decentralized nature.

Starting in 2023, some new use cases have emerged. Among all application scenarios, the category using the most storage space is applications, primarily "bundler" applications that bundle multiple transactions and data together and publish them to the Arweave network. These applications include Bundlr (the team has since rebranded to Irys.xyz and launched their own data chain in addition to the bundler application). These bundling applications, which include content that would otherwise be classified as images, videos, or other blockchain data, are using Arweave for permanent storage. In addition to these bundler applications, some other projects are also leveraging Arweave's permanent storage capabilities. These projects include Lens' social applications, content publishing platforms, and some AI use cases.

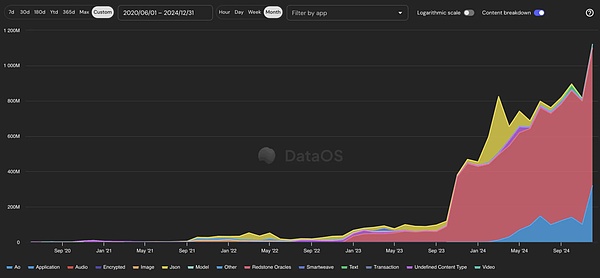

The following chart shows the activity breakdown by transaction volume. While Arweave charges fees based on the size of the stored data, the increasing use cases with growing transaction volumes may indicate the future direction of Arweave's development.

Arweave's Usage Over Time (by Transaction Count)

Source: https://stats.dataos.so/arweave

The two fastest-growing use cases by transaction count are Redstone and AO. Redstone is one of the fastest-growing oracle networks in the crypto industry, providing price data for all major assets across EVM chains. We have previously invested in Redstone's private round and are optimistic about their growth in expanding new partnerships and adding product features.

AO is a parallel computing and agent messaging layer built on top of Arweave. We will discuss AO in more detail later, but it is worth noting that AO is still in the early stages. AO is currently running on a testnet, with the mainnet expected to launch in February 2025. Arweave's current growth trajectory is encouraging, and we will closely monitor whether this growth trend can be sustained.

The latest Arweave metrics can be accessed through this link:

https://viewblock.io/arweave/stats

Criticism

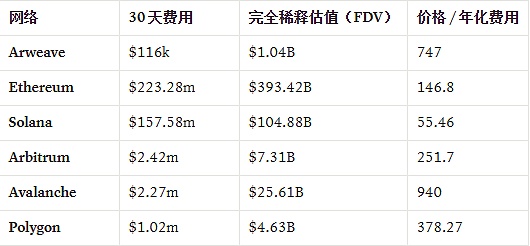

Perhaps the most common criticism of Arweave is its relatively lower fees compared to other similarly-sized Layer 1 blockchains.

Source: DeFiLlama, December 2024

Looking at the "Price / Annualized Fees" metric, Arweave ranks only above Avalanche among all L1s. A lower ratio indicates that the fees paid by users are higher relative to the network's fully diluted market value (FDV). These data reflect the total fees generated on the blockchain - i.e., the fees paid by users to transact on the blockchain. However, this does not account for miner rewards or, in Arweave's case, the contribution to the Endowment. Since Arweave allocates a large portion of fees to miners, its short-term profitability may appear smaller than some other blockchains.

AR Token Performance

2024 was a landmark year for AR. Particularly after the AO announcement, the price of the Arweave token skyrocketed from under $10 per token to over $40. The market was very excited about the potential of AO and the expected boost to Arweave's activity levels. Since February 2024, AR holders have started minting AO tokens just by holding AR in their wallets. Currently, 33% of newly minted AO tokens are being distributed to AO holders, and these tokens will become transferable after the AO mainnet launch in February 2025. After the mainnet launch, AR holders will continue to earn one-third of AO tokens until 21 million AO tokens are created. The rewards are distributed every 5 minutes, with a monthly issuance rate of 1.425% of the remaining supply. This means the token issuance will gradually decrease over time.

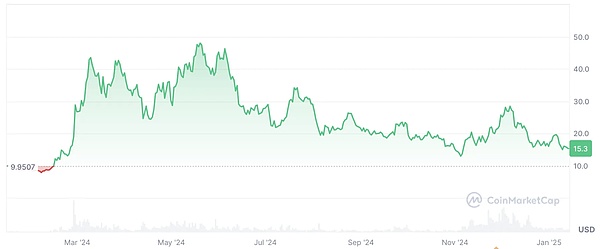

AR Token Price Performance:

Source: https://coinmarketcap.com/currencies/arweave/

Amidst the broader market downturn, the AR price has seen some decline during the summer months. However, AR has underperformed compared to other tokens with AI value propositions, such as RENDER, TAO, and NEAR. We believe on-chain capital flows have played a role in this narrative.

Since September, a whale has started selling a considerable amount of AR tokens. We believe we know who is selling, but this has not yet been confirmed. The wallet address dRFuVE-s6-TgmykU4Zqn246AR2PIsf3HhBhZ0t5-WXE received over 10 million AR tokens (the current total supply of AR is less than 66 million) in November 2021. There were transfers prior to 2023, and by 2024, this wallet still had 5 million tokens left (worth $80 million at today's price of $16).

On September 6, 2024, the wallet transferred the remaining 5 million tokens to two addresses:

i3gk39KyYCEjiylhBO9lM8DQVRtwaIG59llf2QL14Fg and

jcRNRYfbIfaj_YrjN8he864KBT_4D13DL7fmj6txZgA. These two addresses subsequently sent the tokens to exchanges, suggesting they are market maker addresses. Of these 5 million tokens, around 1.35 million are still in the hands of these (possibly) market makers, ready to be transferred to exchanges.

These two addresses transferred the tokens to the same two exchange addresses, indicating that they are likely the same market maker. This selling pressure accounts for a very large portion of the circulating AR tokens, over 7%. Once the remaining tokens are sold, the AR market may see a reduction in downward price pressure.

AO Overview

AO is a decentralized, "hyperparallel" (massively parallel computing) network that breaks the scale and type limitations of on-chain computation while maintaining the verifiability of all content. The core of AO is a message passing layer for independent and concurrent processes. AO utilizes Arweave for permanent data logging, so any updates or interactions with processes are permanently recorded. The name AO stands for "actor oriented", meaning you can build and run modular programs (actors), each with their own virtual machine (VM), consensus method, and payment model, while still being able to communicate with other actors using standardized message formats. In fact, this means that cloud applications like Amazon EC2 can plug into AO's decentralized network and collaborate with decentralized smart contracts, all working towards a common goal.

There are already some AO actors running in production. One actor continuously searches for the best yields across various lending protocols, while another automatically dollar-cost averages on decentralized exchanges (DEXes) based on user-defined parameters. These actors utilize Trusted Execution Environments (TEEs) to protect user privacy and allow users to delegate their private keys, enabling the actors to act fully autonomously without further instructions or commands.

An important difference between AO and other Layer 1 blockchains is that AO's programs can "wake up" automatically at scheduled times, without waiting for external function calls. This makes truly autonomous services possible, without relying on centralized triggers. They can run on their own schedules, and the applications that depend on them do not need to rely on centralized participants to ensure their liveness. In the example of the yield optimization actor we mentioned earlier, this means the actor can wake up while you're sleeping and reallocate your investments to higher-yielding strategies without any prompting.

AO Architecture

Processes

Processes are like individual "actors" on AO. Each process starts from an initial state and then records every message it receives. All of this data is stored on Arweave, so it is never lost or censored. By separating data logging from actual computation, AO can scale to handle much larger tasks than traditional blockchains.

Messages

Messages are the way processes interact with users. Messages are sent over the network and have a unique ID for tracking. If a message is not properly forwarded, it will not be delivered -- this provides flexibility in the flow of traffic while still ensuring that all successfully delivered messages are permanently recorded.

Scheduler Units

Scheduler Units (SUs) attach incremental slot numbers to messages to ensure they are uploaded to Arweave, maintaining consistency in message ordering. Scheduler Units can be centralized or decentralized, depending on the needs of the actual application.

Compute Units

Compute Units (CUs) are responsible for executing the actual computation tasks. They are free to choose which processes to execute, forming a competitive market for computation services. After completing the work, Compute Units return signed proofs of the process state changes -- as well as any new messages or new processes triggered by that state update.

Messenger Units

Messenger Units (MUs) are responsible for delivering messages across the network. They first send each message to a Scheduler Unit to ensure it is recorded on Arweave, and then forward the message to Compute Units. If a process generates more messages in response, the Messenger Units continue to forward these messages until all operations are complete.

Challenges Facing AO

AO is not without its challenges. Every network ultimately defines itself by excelling in certain domains. For example, Arbitrum has emerged in DeFi, Solana has focused on memecoins and DePin, and IMX has specialized in gaming. But Arweave's main focus has traditionally been on content storage, blockchain archiving, and the persistence of oracle data. While AO aims to redefine decentralized content storage and DeFi, particularly in driving the application of AI agents in DeFi, it faces many challenges.

The application of AI agents in DeFi has been slow to develop elsewhere. We have not yet seen a breakthrough application that effectively integrates AI into the DeFi space. So far, the closest examples have been to introduce machine learning models on-chain to optimize yields in liquidity pools. However, these machine learning models are often very simple algorithms, primarily used for yield prediction and comparison with trading costs. These models are simple and linear, which helps mitigate overfitting and "hallucination" issues. In contrast, models like large language models (LLMs) are highly nonlinear, nondeterministic, and often struggle with basic computations (such as numerical operations). It may take some time before we see true AI agents managing our finances, rather than just packaged user-defined intentions.

Arweave has not historically been a DeFi chain. While there have been some attempts to build decentralized exchanges (DEXes) on Arweave, none have achieved breakthrough growth. Given that Arweave's original use case was for storing content like images, this is not entirely surprising. As AO tries to attract Arweave's existing community and users, as well as new users from other chains, its future development will be very interesting to watch. The team has clearly considered this challenge, as reflected in AO's token economics. Participants who bridge DAI and stETH to the AO mainnet will receive AO token rewards, and they can also earn yields on these bridged tokens within the AO mainnet. As of now, AO has attracted around $578 million in TVL (Total Value Locked). Maintaining this capital and interacting with emerging DeFi applications will be crucial.

Airdrop Mechanics

Token Supply: A total of 21 million AO tokens, to be issued on a pre-determined halving schedule.

Eligibility to Mint AO Tokens:

AR token holders will receive AO tokens proportional to their AR balances.

Users who bridge DAI and stETH will also receive token allocations.

Distribution:

1.03 million AO tokens will be retroactively distributed to holders and bridgers since February 27, 2024. All AO tokens minted during this period have been distributed to AR token holders based on their respective balances every 5 minutes.

How to Participate

If you've read this far, you may be interested in participating in the AO ecosystem. Here are some of the best ways to get started:

Hold AR Tokens: Since one-third of the new AO tokens will be allocated to AR holders, simply holding AR tokens is a good way to gain exposure to AO tokens.

Bridge DAI or stETH: Currently, two-thirds of the AO tokens will be allocated to users who bridge DAI or stETH to AO. This is also a good way to earn AO tokens without taking the risk of AR price fluctuations.

Use the AO mainnet application: The AO mainnet will be launched in February, at which time there will be multiple trading and lending platforms available for use. You can check out the AO ecosystem to learn more.

Provide computing resources: Anyone can provide computing resources for various processes in the AO network without permission. For those with a strong technical background, this may be one of the best ways to understand the AO ecosystem and directly participate in it.

Future Outlook/Summary

The AO mainnet will be launched in February 2025, at which time anyone can provide computing resources or set up their own processes and agents. The token bridge function will also be opened, allowing any token to enter the AO network. As more people join and build advanced AI or automation services, the decentralization and large-scale parallel architecture of AO will unlock a series of new possibilities - especially in areas that require de-trust and efficient computing.

The launch of the AO mainnet will be an important milestone for the Arweave and AI x Crypto communities. We will closely follow this ecosystem.