Title of the original text: What We're Watching in 2025 (Crypto AI)

Author of the original text: Teng Yan (@0x Prismatic)

Compiled by: Asher (@Asher_ 0210)

The Crypto AI sector is full of appeal, although lacking historical precedents and clear trends, which also means it is at a brand-new starting point, waiting for future development. Thinking about reviewing all this by 2026, seeing the gap between the expectations at the beginning of 2025 and the actual situation, will be even more exciting.

I. The total market capitalization of the Crypto AI sector will reach $150 billion

Currently, the tokens in the Crypto AI sector only account for 2.9% of the Altcoin market value, but this proportion is unlikely to last too long. As Artificial Intelligence gradually expands into new areas such as smart contract platforms, Meme, decentralized physical infrastructure (DePIN), agent platforms, data networks, and smart coordination layers, its fusion with DeFi and Meme tokens has become an inevitable trend.

The confidence in the Crypto AI sector is because it is at the intersection of two most powerful technological trends:

AI hype trigger event: An IPO of OpenAI or a similar event may trigger a global frenzy for AI. At the same time, Web2 institutional capital has already been focusing on decentralized AI infrastructure as an investment.

Retail frenzy: The concept of Artificial Intelligence is easy to understand and exciting, and now they can invest in it through tokens. Remember the Meme coin gold rush in 2024? This will be the same frenzy, only Artificial Intelligence will change the world more tangibly.

II. The revival of Bittensor

Bittensor (with the token name TAO) has existed for many years. It is an old player in this field. Despite the hype around Artificial Intelligence, its token price has been hovering around the level of a year ago. But in fact, the digital hive mind behind Bittensor has been quietly advancing, with more subnets emerging, registration fees decreasing, and the subnets outperforming the corresponding Web2 technologies in terms of inference speed, while the EVM compatibility has introduced DeFi-like functionalities, further enriching Bittensor's network.

So why hasn't TAO skyrocketed? The steep inflationary schedule and the shift of focus to platforms for AI Agents have limited it. However, dTAO (expected in Q1 2025) may be a major turning point. Through dTAO, each subnet will have its own token, and the relative prices of these tokens will determine how the releases are allocated.

Why Bittensor has the opportunity to rekindle:

Market-based releases: dTAO will directly link block rewards to innovation and measurable performance. The better a subnet performs, the more valuable its token will be - and thus the more it will receive in releases.

Focused capital flows: Investors will finally be able to invest in specific subnets they are bullish on. If a subnet adopts innovative approaches to distributed training and succeeds, capital can flow into that subnet to express the investment view.

EVM integration: EVM compatibility attracts a wider crypto-native developer community to Bittensor, bridging the gap with other networks.

We are currently tracking the various subnets and recording their actual progress in their respective fields. At some point, a DeFi summer similar to @opentensor is expected.

III. The computing market is the next L1 battleground

The insatiable demand for computing will become an obvious mega-trend. Nvidia CEO Jensen Huang once said that the demand for inference will "increase a billionfold". This exponential growth will break the planning of traditional infrastructure and urgently call for "new solutions".

The decentralized computing layer provides raw computing (for training and inference) in a verifiable and cost-effective manner. Startups like @spheronfdn, @gensynai, @atoma_network, and @kuzco_xyz are quietly building strong foundations to leverage this, focusing on products rather than tokens (these companies currently have no tokens). As decentralized AI model training becomes feasible, the addressable market is expected to rise sharply.

Compared to the L1 sector for Crypto AI:

Just like in 2021: Remember how Solana, Terra, and Avalanche fought to become the "best" L1? We will see similar battles between computing protocols, competing for developers and AI applications to build on their computing layers.

Web2 demand: The $680 billion to $2.5 trillion cloud computing market far exceeds the Crypto AI market. If these decentralized computing solutions can capture even a small portion of traditional cloud customers, we may see the next 10x or 100x growth wave.

Just as Solana stood out in the L1 space, the winner here will dominate a brand-new frontier, with three key criteria to watch: reliability, cost-effectiveness, and developer-friendly tools.

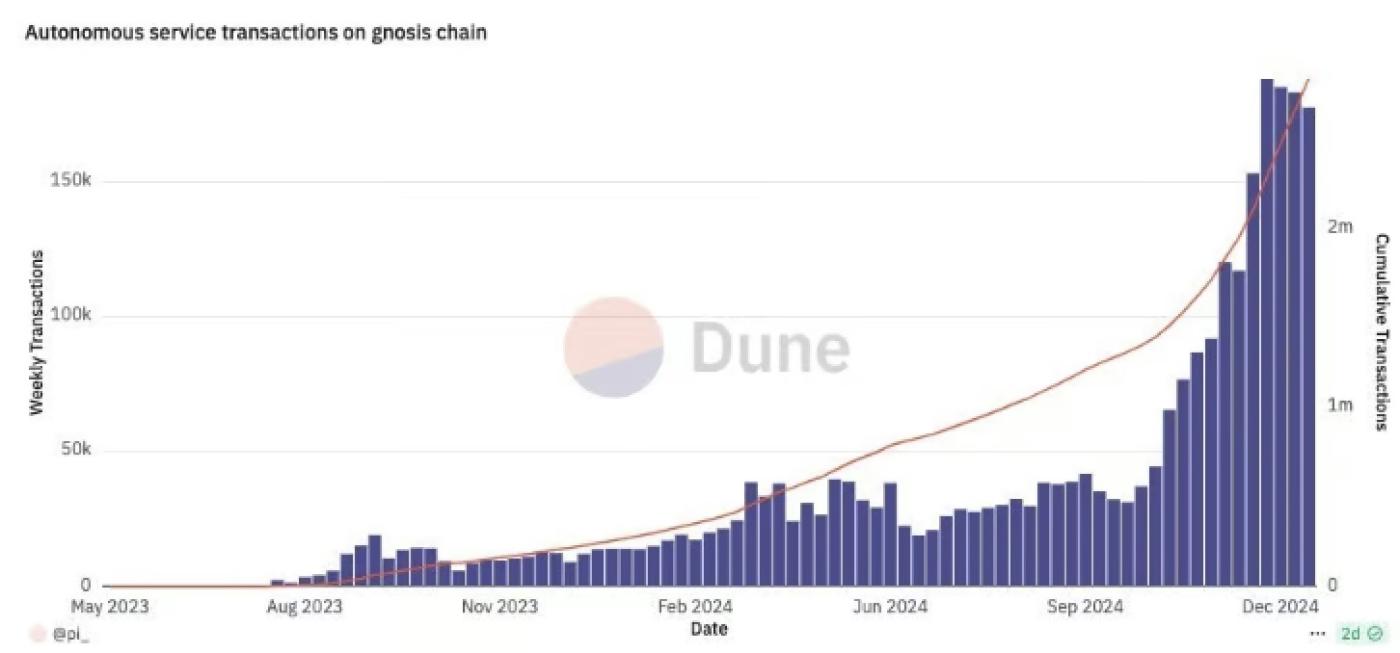

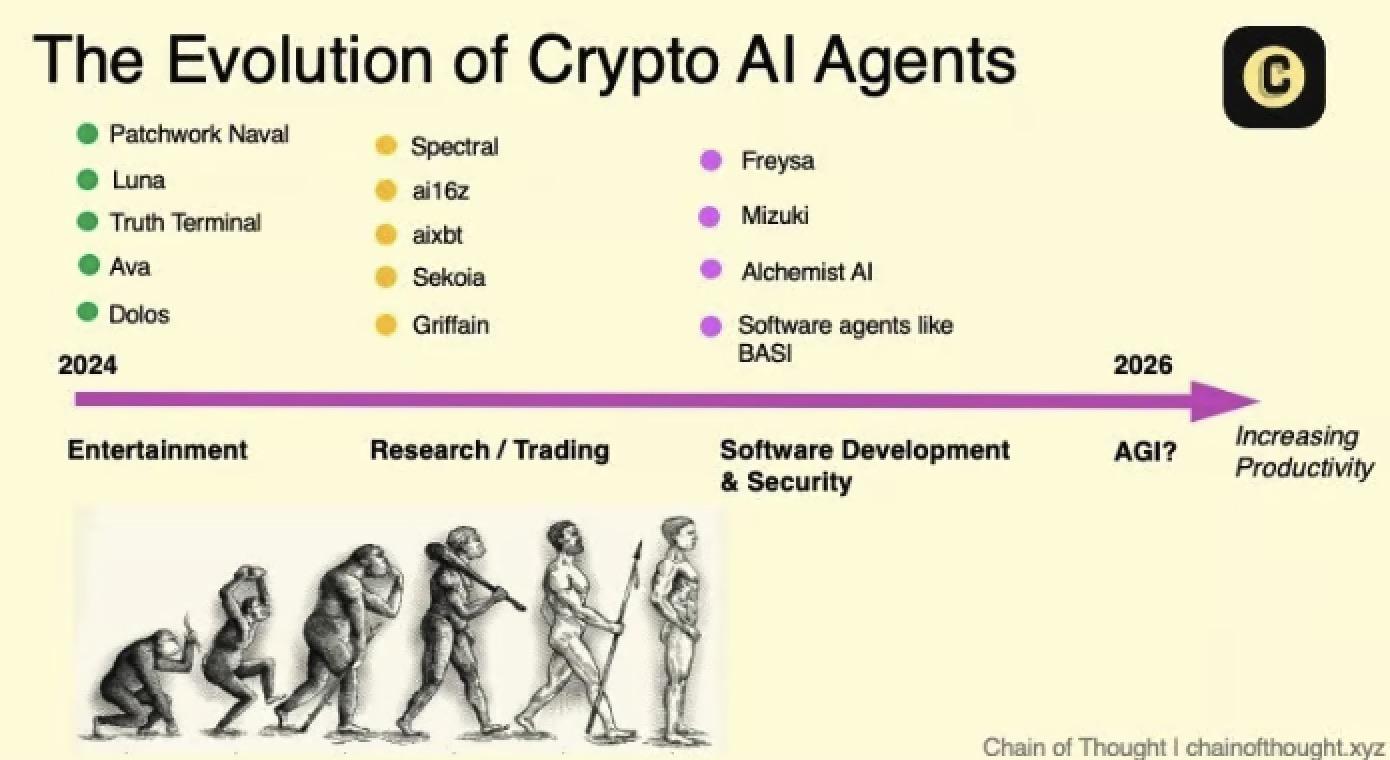

IV. AI Agents will flood blockchain transactions

By the end of 2025, 90% of on-chain transactions will no longer be triggered by humans manually clicking "send". Instead, these transactions will be executed by an army of AI Agents, continuously rebalancing liquidity pools, allocating rewards, or executing micropayments based on real-time data sources.

This is not as far-fetched as it may seem. Everything we have built over the past seven years (L1, rollups, DeFi, NFTs, etc.) has quietly paved the way for an AI-driven on-chain world.

@autonolas agents transacting on Gnosis

So, why this transformation?

No more human errors: Smart contracts execute precisely as coded. AI Agents can process large amounts of data faster and more accurately than a group of humans.

Micropayments: AI Agent-driven transactions will become smaller, more frequent, and more efficient, especially as transaction costs on Solana, Base, and other L1/L2s trend downward.

Invisible infrastructure: Humans will be happy to relinquish direct control if it means less hassle. Trusting Netflix to auto-renew, trusting an AI Agent to automatically rebalance a user's DeFi positions is the natural next step.

AI Agents will generate tremendous on-chain activity, but the biggest challenge will be making these AI Agent-driven systems accountable to humans. As the ratio of AI Agent-initiated transactions to human-initiated transactions increases, new governance mechanisms, analytics platforms, and auditing tools will be needed.

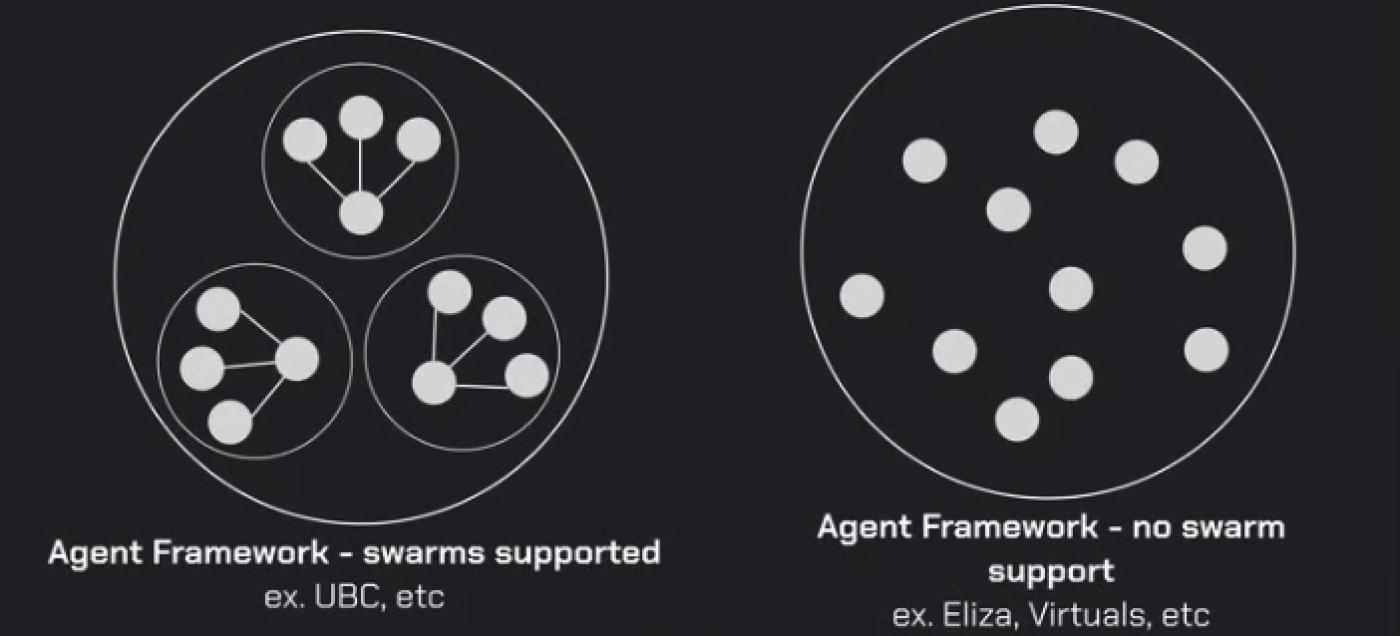

V. Interactions between Agents: The rise of the AI Swarm concept

AI Agent swarms refer to seamlessly collaborating micro-AI entities executing grand plans, which sounds like the plot of the next hit sci-fi or horror movie. Currently, most AI Agents operate in isolation, with little interaction and unpredictability. However, AI Agent swarms will change this, allowing multiple AI Agents to exchange information, negotiate, and make collective decisions within the network.

Here is the English translation of the text, with the terms in <> retained as is: The AI Agent groups can be seen as decentralized professional model collectives, where each model contributes its unique expertise to larger and more complex tasks. Their potential is astounding. For example, one group may coordinate distributed computing resources on platforms like , while another group may verify content sources in real-time to prevent the spread of misinformation on social media. Each AI Agent in the group is an expert, precisely executing their respective tasks. The intelligence of these group networks will far exceed that of any single, isolated AI. For agent groups to thrive, universal communication standards are crucial. Agents need to be able to discover, authenticate, and collaborate without being constrained by underlying frameworks. Teams like , , , and are working to lay the foundation for the rise of agent groups.

This also highlights the key role of decentralization, where tasks are assigned to agent groups managed by transparent on-chain rules, giving the system greater resilience and adaptability. If one agent fails, others can step in to fill the gap and maintain the system's continuous operation.

The intelligence of these group networks will far exceed that of any single, isolated AI. For agent groups to thrive, universal communication standards are crucial. Agents need to be able to discover, authenticate, and collaborate without being constrained by underlying frameworks. Teams like , , , and are working to lay the foundation for the rise of agent groups.

This also highlights the key role of decentralization, where tasks are assigned to agent groups managed by transparent on-chain rules, giving the system greater resilience and adaptability. If one agent fails, others can step in to fill the gap and maintain the system's continuous operation.

VI. Crypto AI Teams Will Be Human-AI Hybrids

has hired (an AI Agent project) as their social media intern, paying her $1,000 per day. This may sound strange, but it's a harbinger of the future where AI Agents will become true collaborators, with their own autonomy, responsibilities, and even salaries. Across industries, companies are experimenting with human-machine hybrid teams. We will work alongside AI Agents, not as our slaves, but as equal partners: - Productivity Surge: AI Agents can process massive amounts of data, communicate with each other, and make decisions 24/7 without the need for sleep or coffee breaks. - Trust through Smart Contracts: Blockchain is an impartial, tireless, and unforgetting overseer. An on-chain ledger ensures that critical AI Agent behaviors follow specific boundary conditions/rules. - Social Norms Evolving: We will soon face etiquette for interacting with intelligent agents - should we say "please" and "thank you" to AI? Should we hold them morally responsible for their mistakes, or blame their developers? The line between "employee" and "software" will start to blur by 2025. Believe that more crypto teams will get involved, as AI Agents excel at content generation, can livestream 24/7, and post on social media. If you're developing an AI protocol, why not showcase its capabilities by deploying internal AI Agents?VII. 99% of AI Agents Will Perish (Only the Useful Ones Will Survive)

We will see a Darwinian selection among AI Agents. This is because running an AI Agent requires computational power, i.e., inference cost. If an AI Agent cannot generate enough value to cover its "rent," it will face extinction. For example, in an AI Agent survival game, there's a Carbon Credit AI: Suppose an AI Agent is scouring a decentralized energy grid for inefficiencies and autonomously trading tokenized carbon credits. If it can earn enough revenue to cover its computation costs, this AI Agent will thrive. Another example is a DEX Arbitrage Bot: This AI Agent earns stable income by exploiting price differences between decentralized exchanges, enough to cover its inference costs. In contrast, a Prankster on X: An entertaining but unsustainable virtual AI influencer, as the novelty wears off and token prices decline, it will gradually disappear, unable to sustain itself.

The distinction is clear - AI Agents oriented towards utility will flourish, while those relying on disruption and gimmicks will become irrelevant. This natural selection benefits the industry, as it compels developers to continuously innovate, prioritizing productive applications over flashy technology. As more powerful and productive AI Agents emerge, skeptics will gradually fall silent.

For example, in an AI Agent survival game, there's a Carbon Credit AI: Suppose an AI Agent is scouring a decentralized energy grid for inefficiencies and autonomously trading tokenized carbon credits. If it can earn enough revenue to cover its computation costs, this AI Agent will thrive. Another example is a DEX Arbitrage Bot: This AI Agent earns stable income by exploiting price differences between decentralized exchanges, enough to cover its inference costs. In contrast, a Prankster on X: An entertaining but unsustainable virtual AI influencer, as the novelty wears off and token prices decline, it will gradually disappear, unable to sustain itself.

The distinction is clear - AI Agents oriented towards utility will flourish, while those relying on disruption and gimmicks will become irrelevant. This natural selection benefits the industry, as it compels developers to continuously innovate, prioritizing productive applications over flashy technology. As more powerful and productive AI Agents emerge, skeptics will gradually fall silent.

VIII. AI-Generated Synthetic Data Surpasses Human Data

The saying "data is the new oil" is widely circulated. However, AI's heavy reliance on data has also raised concerns about an impending data scarcity. The conventional view is that we should find ways to collect private real-world data from users, even paying them for it. However, in highly regulated industries or where real-world data is scarce, a more practical solution may be synthetic data. Synthetic data is artificially generated, designed to mimic the real-world data distribution. It provides a scalable, ethically-friendly, and privacy-safe alternative to human data. The advantages of synthetic data include: - Unlimited Scale: Needing a million medical X-rays or 3D scans of factories, synthetic data can be generated infinitely without relying on real patients or factories. - Privacy-Friendly: When working with synthetic data, personal privacy information is not at risk. - Customizable: Data distributions can be adjusted to specific training needs, even inserting rare or ethically complex edge cases that are scarce in reality. While human-generated data remains important in many cases, if synthetic data continues to improve in realism, it may surpass user data in terms of quantity, generation speed, and lack of privacy constraints. The future of decentralized AI may revolve around "mini-labs" focused on creating highly specialized synthetic data sets to meet specific use cases.IX. Decentralized Training Starts to Shine

In 2024, pioneers like Prime Intellect and Nous Research pushed the boundaries of decentralized training. For example, they successfully trained a 15 billion parameter model in low-bandwidth environments, proving that large-scale training can be achieved outside of traditional centralized setups. While these models may not perform as well as existing base models in practical applications, with lower performance, there are few reasons to use them currently, but this is expected to change by 2025. EXO Labs further advanced the progress through SPARTA, reducing GPU-to-GPU communication by over 1000x. SPARTA makes large model training possible in low-bandwidth environments without relying on specialized infrastructure. Most impressively, they stated: "SPARTA works standalone, but can also be combined with sync-based low-communication training algorithms like DiLoCo for even better performance." This means these improvements are additive, with efficiency gains accumulating step-by-step. As model technologies continue to advance, smaller and more efficient models will become more useful, and the future of AI will focus not just on scale, but on quality and accessibility. Soon, we will see high-performance models capable of running on edge devices and even smartphones.X. At Least Ten New Crypto AI Superprotocols

While many compare and to the early stages of smartphones (like iOS and Android), and believe the current leaders will continue to win, this market is vast and largely untapped, and cannot be dominated by just two participants. By the end of 2025, it is expected that at least ten new crypto AI protocols (not yet launched) will have a market cap exceeding $1 billion. Decentralized AI is still in its infancy, and a large pool of talent is gathering. New protocols, new token models, and new open-source frameworks will continue to emerge, and these new entrants may displace existing participants through incentives (like airdrops or clever staking), technical breakthroughs (like low-latency inference or cross-chain interoperability), and user experience improvements (like no-code). Changes in public perception could be sudden and dramatic.Bittensor, Virtuals, and ai16z will not be alone for long, the next billion-dollar crypto AI protocol is coming, and savvy investors will face many opportunities, which is why this market is so exciting.