Jupiter, a leading decentralized exchange (DEX) on Solana, has acquired a majority stake in Moonshot, a platform designed to simplify the trading of meme coins.

This transaction reflects Jupiter's strategy to capitalize on the growing popularity of meme coins.

Jupiter Acquires Moonshot and SonarWatch

Jupiter announced the acquisition on January 25, 2025, with Meow, the founder, emphasizing the creative team of Moonshot.

"The [Moonshot] team is one of the smartest and most passionate I've ever met & I'm thrilled to be discussing the future of meme with them,"

Meow said.

Although the specific details have not been disclosed, this move is expected to enhance Jupiter's services in the meme coin market. Moonshot's unique capability of allowing users to purchase meme coins using Apple Pay complements Jupiter's expertise in token trading on Solana.

Moonshot's user base has grown significantly in the past week, particularly after the launch of the official Trump meme coin. During the token launch, Moonshot processed nearly $400 million in trading volume, cementing its position as a rising force in the cryptocurrency space.

Meanwhile, the acquisition also aligns with Jupiter's efforts to improve the user experience. The DEX has integrated portfolio tracking through the recent acquisition of SonarWatch. This tool will allow users to monitor their Solana activity directly on the DEX platform.

"While we've had a very successful product, now we're fully focused on covering Solana. Our goal is to create the best portfolio tracking tool! So our platform will be shutting down in the coming months. During this time, we'll continue to add new protocols, but the tool will no longer be available after the transition period,"

SonarWatch announced.

The SonarWatch team has announced plans to discontinue the platform's native SONAR token and burn the remaining supply. They have also notified SONAR holders that they can exchange their tokens for JUP.

Jupiter Introduces New Features

Jupiter is also rolling out new features to expand its capabilities. A proposed lending system will allow users to deposit JLP tokens as collateral to borrow USDC. This will provide higher yields for JLP holders and improve USDC utilization. Liquidation will occur seamlessly, releasing the collateral assets from the liquidity pools.

"Today, we're announcing an idea that allows you to deposit JLP and borrow USDC. This could drive higher USDC utilization and improve the APY for JLP holders. Liquidation will be handled by naturally exchanging the JLP, freeing up their collateral,"

Jupiter wrote on X.

Furthermore, the trading platform currently offers an "Ultra Mode," optimizing the trading process by automatically adjusting slippage, prioritizing gas fees, and enhancing overall efficiency. The DEX is also preparing to launch Jupiter Shield, a security tool to protect user assets.

"There will be a comprehensive upgrade to Manual Mode, including completely new Routing and Broadcast options to make it the most powerful,"

Jupiter added.

All these developments come after Jupiter's recent JUP token airdrop. The Solana-based DEX distributed 700 million tokens worth over $500 million to more than 2 million wallets. Although the initial distribution led to price volatility, the JUP price has shown signs of recovery, increasing 10% to $0.92 at the time of writing.

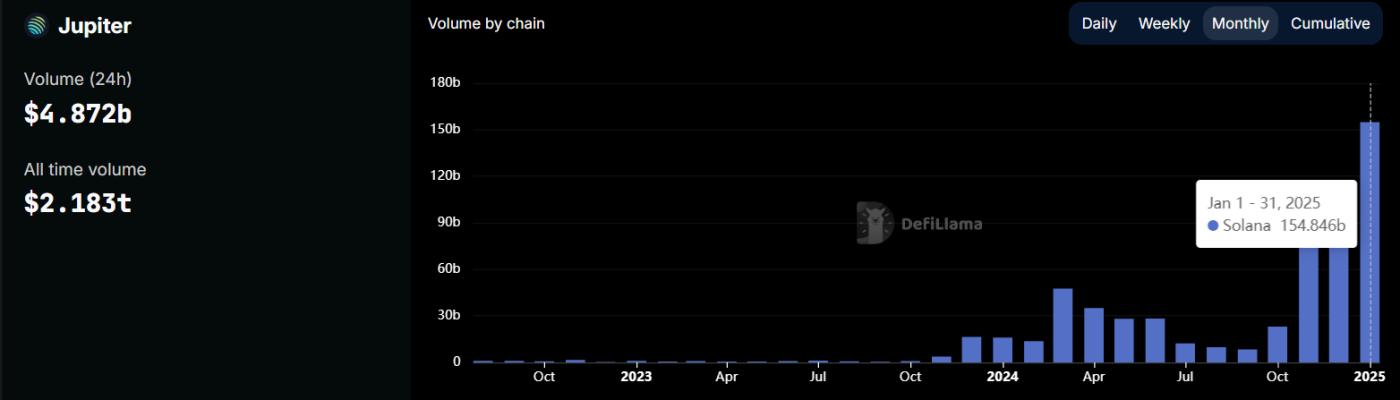

Jupiter DEX on the Solana platform. Source: defillama

Jupiter DEX on the Solana platform. Source: defillamaJupiter remains one of the leaders in Solana's DEX ecosystem. The platform has processed $4.87 billion in trading volume in the past day and has a lifetime trading volume of $2.18 trillion, according to data from defillama. January 2025 was particularly notable, with the platform executing $155 billion in transactions.

Join the BeInCrypto community on Telegram to stay updated on the latest analysis and news about the financial markets and cryptocurrencies.