Author: @leo_escobar_, Compiled by: Sissi, Source: TEDAO

1. The Necessity of Change: Challenges and Opportunities for Aave

1.1 Background & Current Landscape

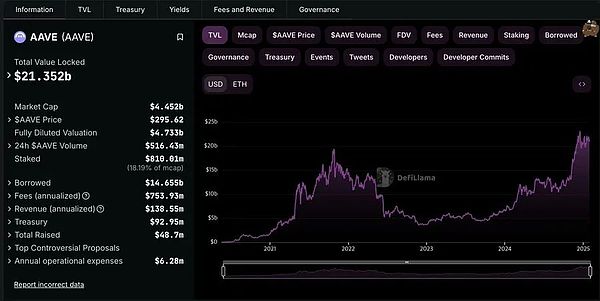

Aave is one of the leading decentralized lending protocols in the DeFi space, allowing users to deposit various crypto assets to earn interest or use their assets as collateral for borrowing. Since its inception, Aave has seen significant growth in its user base and TVL (Total Value Locked), demonstrating its reliability and innovative capabilities. However, as the DeFi ecosystem continues to evolve, Aave needs to adapt constantly to maintain its competitive edge and address emerging risks, such as sudden market downturns and potential vulnerabilities at the protocol level.

1.2 Why Fundamental Change is Necessary

Although Aave has performed exceptionally well in terms of liquidity provision and market adoption, its traditional safety module model still has certain limitations in effectively managing bad debts and incentivizing governance participation. The highly volatile and rapidly changing market environment can lead to unresolved liabilities, and the current staking framework sometimes struggles to motivate users to participate meaningfully. Therefore, a more robust mechanism is needed to ensure the protocol's stability, safeguard user funds, and create sustainable returns for investors and stakers.This fundamental transformation is at the core of the Umbrella upgrade and the new Aavenomics design.

2. Introducing Umbrella: A New Chapter in Aave's Risk Management

2.1 Limitations of the Existing Safety Modules

The existing safety modules (such as stkAAVE) aim to protect the protocol by potentially slashing the staked AAVE during market stress or liquidity crunch events. While this mechanism has played a crucial role in safeguarding the protocol, it also brings some challenges, such as:over-reliance on governance decisions to execute the slashing, which can lead to conflicts of interest for $AAVE holders, and the lack of a direct mechanism to manage bad debts in a more granular, asset-specific manner.

2.2 Key Features of Umbrella

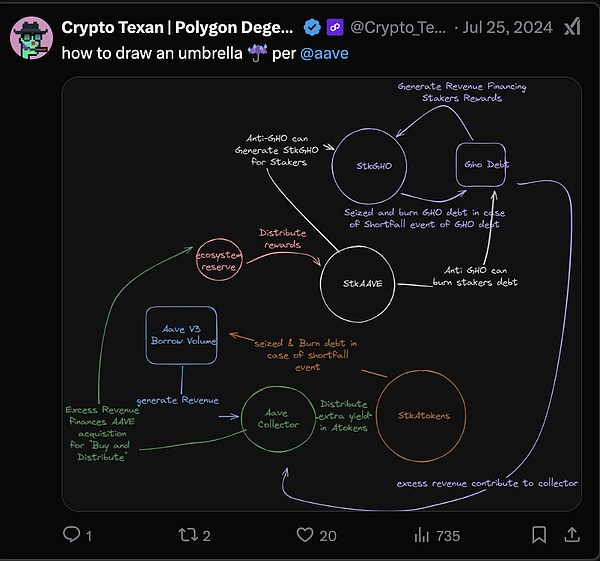

Asset-Specific Protection Mechanism

Umbrella adopts a more targeted approach, allowing stakers to pledge their aTokens (certificates of deposits on Aave) to different safety modules, each corresponding to a specific asset and blockchain.This setup enables the protocol to handle bad debts at the individual asset level, rather than relying on a one-size-fits-all solution.

Automated Bad Debt Coverage

A key innovation of Umbrella is the introduction of an automated mechanism, often referred to as the "Aave Robot", which can automatically slash and burn the pledged aTokens to cover bad debts.This automation eliminates the need to rely on governance proposals to decide whether to execute the slashing during liquidity crunch events, improving response time and reducing governance-related conflicts of interest.

Staker Incentive Structure

Under the Umbrella mechanism, stakers can receive multiple rewards, such as earning $AAVE from the protocol's net revenue, as well as additional token rewards linked to the performance of the specific asset reserve factors. By staking in the modules that directly protect their held assets, users can more clearly align their incentives with the protocol's health.

2.3 How Umbrella Enhances Overall Protocol Stability

By distributing the risk across independent asset pools, Umbrella significantly reduces systemic risk. If a specific asset incurs bad debts, the stakers in the corresponding safety module will be slashed to cover the losses, preventing the risk from spreading to other asset pools. This design not only strengthens the overall stability but also allows for more granular control of risk parameters and ensures that the incentive mechanisms always align with the market conditions of each asset.

3. New Aavenomics: The Fee Switch

3.1 Transitioning from stkAAVE to Umbrella Staking

With the introduction of Umbrella, the traditional model of staking $AAVE in a single safety module is undergoing a change. While $AAVE staking will still exist, its primary function will no longer be to bear all the protocol's risks, but rather to transform into an auxiliary component, focused on governance and benefiting from the protocol's net revenue distribution.Simultaneously, the asset-specific staking modules will directly take responsibility for the protocol's risk coverage.

3.2 Revenue Distribution and the "Buy & Distribute" Model

A significant change in Aavenomics is the redesigned distribution of the protocol's net revenue.The protocol generates net revenue through the spread between borrowing and lending rates, and it will adopt a "Buy & Distribute" mechanism, where a portion of the net revenue will be used to repurchase $AAVE on the open market and distribute it to the stakers, enhancing the value proposition of $AAVE. Additionally, the stakers in the Umbrella modules will also receive rewards in the form of aTokens and other tokens linked to the performance of the respective reserve assets.

3.3 Introducing $anti-GHO: A New Mechanism for GHO Borrowers

In the new Aavenomics system, the $AAVE staking discount mechanism for $GHO borrowers has been replaced by an "anti-GHO" mechanism. Borrowers who pledge $AAVE will accumulate non-transferable "anti-GHO" tokens over time, which can be used to offset or "burn" a portion of their $GHO debt. This system provides actual economic benefits for AAVE stakers while avoiding distortive effects on the broader market.

3.4 Governance and Decision-Making in the New Model

Although governance remains crucial, many risk management processes (such as slashing staked assets to cover bad debts) will be automated.The Aave DAO will still maintain control over parameter adjustments (such as reserve factors, incentive rates) and strategic decisions (such as protocol expansions, new asset listings, etc.). This approach strikes a balance between automation and decentralized governance, enhancing the efficiency and transparency of the protocol's operation.

The following two articles from @0xboca are also highly recommended for further reading on the Umbrella upgrade and the new Aavenomics.

https://x.com/0xboka/status/1878813433036169289

https://x.com/0xboka/status/1882568334908268893

4. Reflection

As one of the largest lending protocols in the DeFi space, Aave's decisive reforms in risk management and incentive mechanisms are not only a significant milestone for the protocol itself but also bring positive impacts to the entire DeFi ecosystem.

Aave's upgrade demonstrates that even the industry-leading platform can continuously evolve, striking a balance between stability and user returns, setting an important precedent for other protocols. If these initiatives can be successfully implemented, it will further prove how a strong governance framework, reasonable token economics, and active community participation can collectively drive the development of the boundaries of DeFi.

Original title: Aave's Umbrella and New Aavenomics