In the new era of encryption, Safe will continue to consolidate its position as a key industry infrastructure, and its value will continue to be highlighted in the future.

With Trump's inauguration on January 20, officially becoming the 47th President of the United States, his governing journey has officially begun. In fact, during the presidential election, Trump clearly stated that he would embrace cryptocurrencies and include them in his governing policies. Now, with his inauguration, he has also begun to gradually fulfill these promises.

On January 23, the third day after Trump took office, he signed the Executive Order "Strengthening America's Leadership in Digital Asset Technology". The order proposed the establishment of a "President's Digital Assets Working Group" to explore federal regulatory measures for stablecoins and national digital asset reserve plans. At the same time, the order explicitly prohibits the "establishment, issuance, circulation or use" of central bank digital currencies (CBDCs). On the same day, the U.S. Securities and Exchange Commission (SEC) issued SAB 122, formally rescinding the previous SAB 121 (guidance issued by the SEC in 2022 requiring regulated entities to record cryptocurrency assets on their balance sheets and disclose risks).

Although it is unclear whether the U.S. President's implementation of certain policies through executive orders will face court challenges, Trump has already begun to fulfill the promises he made at the Bitcoin conference last July. These measures are expected to completely overturn the previous cryptocurrency regulatory model, marking a profound change in the policy direction of the United States in the digital asset field.

Of course, Trump's enthusiasm for cryptocurrencies is no secret. Even two years before he issued the Meme token $TRUMP, he had already begun to embrace cryptocurrencies. In fact, after the end of his previous term, Trump and his team have repeatedly turned to cryptocurrencies to seek breakthroughs in the face of political challenges, successfully using them as a strategic tool to deal with difficulties.

Trump's Path to Cryptocurrency Breakthrough

In fact, since Trump left the presidency, he has not been doing well in a series of political competitions. As early as 2021, Twitter announced the permanent suspension of his "@realDonaldTrump" account and the official accounts of his team "@TeamTrump", which made the social media-savvy Trump passive, depriving him of a voice and the traditional fundraising channels. To this end, Trump's team released his first NFT series "Trump Digital Trading Cards" and "Trump Cards 2.0" on Polygon in December 2022 and April 2023 respectively.

These two NFT sales raised $14.1 million in primary sales and $4.4 million in royalties. This not only shows that Trump is trying to counter traditional social media platforms through Web3, but also becomes a new way for him to raise funds for his political brand and interact with his supporters.

In 2022, New York Attorney General Letitia James sued Trump, accusing him of long-term financial fraud by overstating asset values to obtain loans and reduce tax burdens. The lawsuit demanded that Trump and his family company provide more information about their assets and finances, and freeze their bank accounts and other assets. This event prompted Trump to accelerate the process of asset on-chain, and he and his team subsequently launched the DeFi protocol World Liberty Financial on the Ethereum network, which provides lending services and establishes a credit account system based on Aave and the Ethereum blockchain.

The well-known KOL @Web3Mario once pointed out that the core value of World Liberty Financial and its token WLFI lies in finding new fundraising channels and helping Trump alleviate the dilemma of fundraising for the 2024 election. Of course, the launch of World Liberty Financial not only accelerates the integration of DeFi and politics, but also further raises the attention of DeFi in the political field.

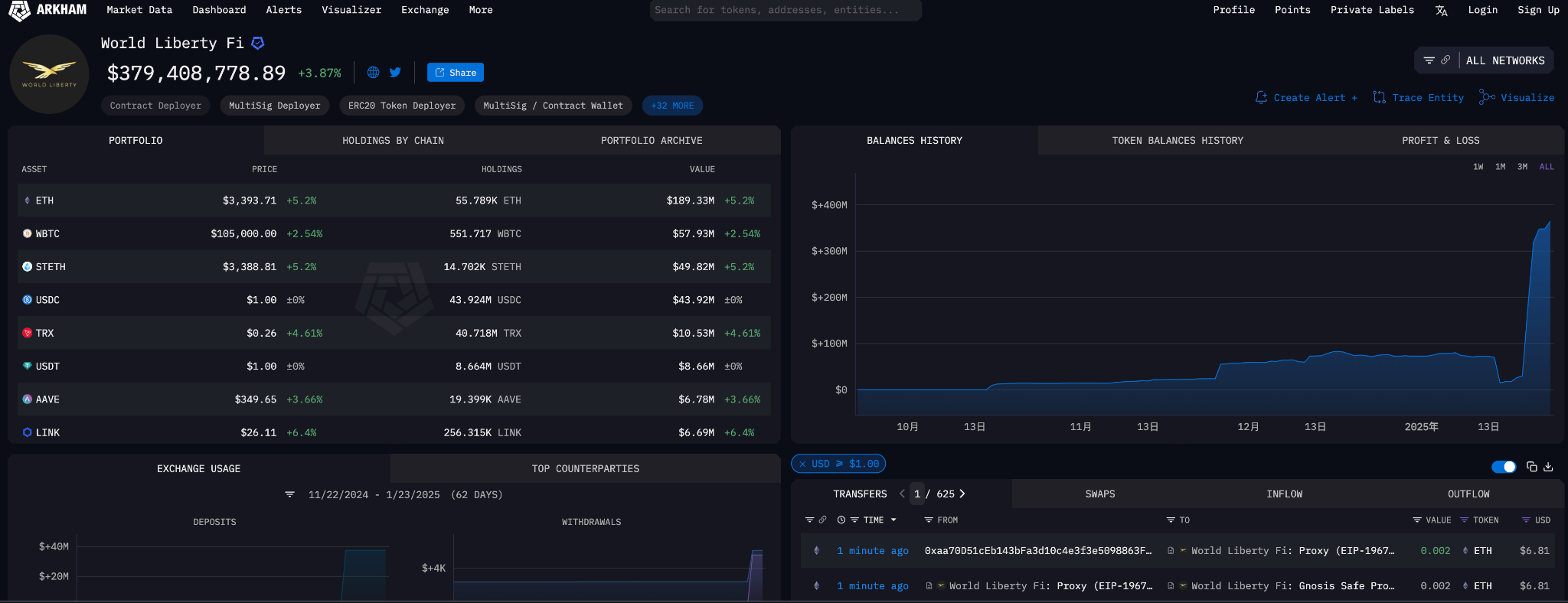

In fact, since World Liberty Financial was launched, its treasury has continued to purchase various cryptocurrency assets as protocol reserves, including ETH, USDC, USDT and WBTC. Currently, its total holdings are worth about $379 million. To ensure asset security, World Liberty Financial has integrated Safe's smart account infrastructure and uses the Safe wallet as the core financial management tool of the platform.

It is worth mentioning that so far, the Smart Account infrastructure of the Safe protocol has executed more than 84 Safe multi-signature transactions for the institutional wallets of World Liberty Financial, processing over $995 million in transaction volume. In addition, Trump himself has also purchased a large amount of ETH and, like World Liberty Financial, has stored his cryptocurrency assets in the Safe wallet. This fully demonstrates the high level of trust and widespread application of the Safe wallet in Trump and his team.

Why is the Safe Smart Account Worthy of Trust?

Safe itself is a set of smart account infrastructure, which not only has an account abstraction protocol, but also has a multi-signature wallet, aimed at managing digital assets on Ethereum, Polygon, Arbitrum Optimism and other EVM-compatible chains.

As an infrastructure, Safe modularizes and stacks the smart contract wallet toolkit to achieve broader accessibility and usability. Safe{Core} is the flagship development product of the Safe team, as an open-source and modular account abstraction stack that can integrate Safe smart accounts into any digital platform and provide the necessary tools and infrastructure to ensure the core parts are tested and have flexible and secure innovative application capabilities.

In fact, most users who hold cryptocurrencies like ETH or BNB are accustomed to using single-key wallets, which are often called Externally Owned Accounts (EOAs), such as MetaMask, Trustwallet, and Exodus. The security of these accounts depends on a "seed phrase" consisting of 12 words, which can be converted into the user's private key. If this private key is compromised in any way, the assets in the wallet will be at risk.

On the other hand, Multisig.Safe accounts are a type of smart contract wallet that spans more than 15 chains, requiring a certain number of users to approve a transaction before it occurs (M-of-N). For example, if your business has 3 key stakeholders, you can set up a wallet that requires at least 2 out of 3 or all 3 people to approve when sending a transaction, ensuring there is no single point of failure. In addition, Safe allows users to have full self-custody of their funds, the deployed smart contracts are trustless, and are controlled by the users.

Benefiting from the programmability, security, privacy and convenience of the Safe smart wallet system, it has been widely applied and integrated in the DeFi field and the cryptocurrency industry, and has become the core infrastructure for many large cryptocurrency platforms and projects.

Continuously Expanding Ecosystem

In addition to the previously mentioned World Liberty Financial, the Ethereum Foundation, World (formerly Worldcoin), El Dorado, Cobo and Headquarters (HQ.xyz) are also important collaborators and loyal users of the Safe smart wallet.

Recently, the Ethereum Foundation has migrated its fund operations to the Safe protocol's RWA smart account, and adopted a new 3/5 multi-signature wallet to manage approximately $160 million (50,000 ETH) in funds for DeFi-related support. After completing the asset migration, the Ethereum Foundation stated: "We will use the Safe wallet to participate in the DeFi ecosystem, and we have already tested transactions on Aave. Safe has proven its security and has an excellent user experience, and we will move more funds into it over time."

El Dorado is a well-known cryptocurrency service provider in Latin America, serving over 400,000 users across Argentina, Bolivia, Brazil, Colombia, Panama, Peru, and Venezuela, and has completed 3 million peer-to-peer USDT transactions. El Dorado provides users with a self-custodial wallet by integrating the Safe smart contract infrastructure, ensuring unparalleled security and reliability for their stablecoin transactions and savings.

Cobo, a trusted leader in digital asset custody and wallet technology, has integrated Safe into its smart contract wallet architecture, providing enhanced security, flexibility, and enterprise-level features. Through the new Cobo Safe solution, Cobo has successfully managed over $390 million in liquidity. Meanwhile, HQ.xyz, by leveraging the Safe secure wallet framework, has helped businesses with on-chain revenue and treasury management, processing nearly $1 billion in transactions for projects including Mantle, Pixelmon, and Ocean Protocol.

The collaboration with World (formerly Worldcoin) has brought significant growth to Safe. Through their deep integration, Safe added 14 million new accounts in Q3 2024, with 93% associated with the newly created World IDs on World Chain and Optimism. Additionally, the ecosystem creates around 330,000 new Safe smart accounts per week, providing World users with a convenient crypto asset management solution and significantly improving their operational efficiency and security.

Leveraging its deep ecosystem integration and extensive partnerships, Safe has demonstrated strong influence in the blockchain industry. To date, Safe has deployed nearly 30 million accounts, storing over $100 billion in assets and executing 127 million transactions worth $785 billion. These figures not only reflect Safe's technical capabilities but also its crucial position in the crypto ecosystem.

In terms of asset distribution, Safe accounts hold 6.8% of the global USDC supply. Additionally, on major EVM chains such as Ethereum, Polygon, Optimism, Arbitrum, Base, and Worldcoin, Safe accounts have initiated 5.2% of the total transaction volume, with 13.88% of the outbound TVL on Ethereum coming from Safe accounts. These numbers showcase Safe's core role in asset management and trading activities, further validating its strong competitiveness and wide-ranging applications across multi-chain ecosystems.

More than 200 ecosystem projects have been built on the Safe smart account standard, covering areas such as automation (DeFiSaver, Brahma), financial management (Coinshift, Den), DAO tools (Hedgey, Palmera), Non-Fungible Tokens (Lore, Castle), and wallets (Rabby, Metamask Institutional). Safe also has significant applications in identity verification (Worldcoin) and prediction markets (PolyMarket).

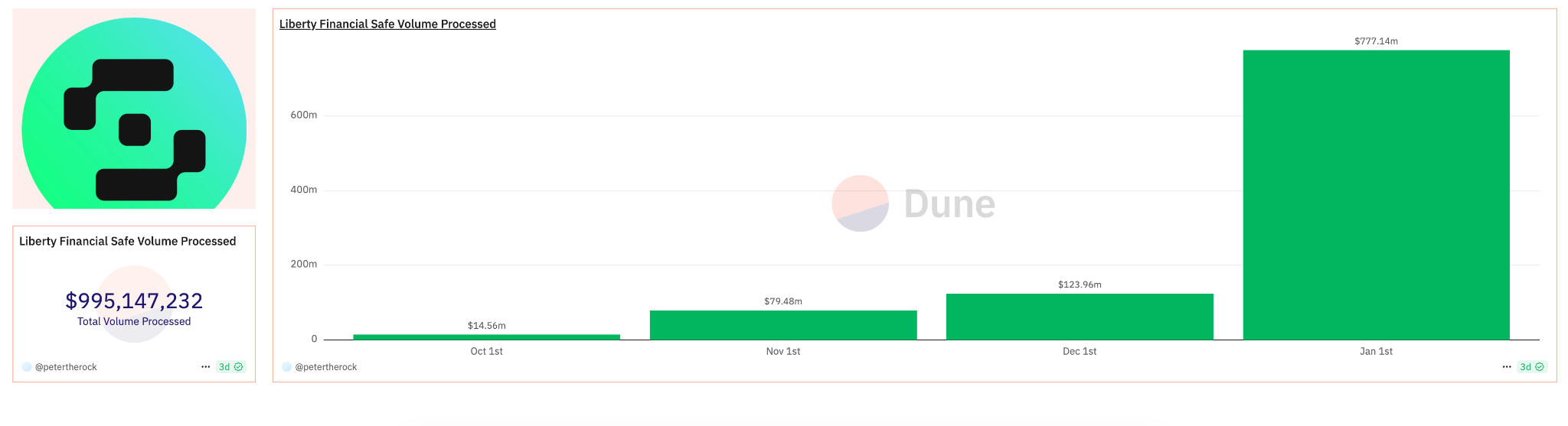

Notably, Safe's transaction volume has grown rapidly, from $14.56 million in October 2023 to $195 million in January 2024, demonstrating its strong market appeal and growth potential. Recently, Safe has implemented a new token strategy, using the fees generated from its trading function (Swaps) to buy back Safe tokens (revenue-sharing mechanism), directly linking the platform's growth to the value of the Safe token, which is expected to be continuously empowered as the Safe ecosystem expands rapidly. Safe has also been ranked as one of the most promising crypto assets in the Rekt Fencer 2025 list, further solidifying its leading position and development prospects in the crypto industry.

Exploring the Safe Ecosystem's Expansion: Penetrating the RWA Market

Safe has recently launched the innovative "Safenet", a transaction processing network aimed at overcoming the interoperability barriers between on-chain and off-chain domains, supporting the on-chaining of the $100 trillion global GDP. This milestone innovation is seen as a crucial step in driving blockchain technology towards large-scale commercial applications.

Inspired by VisaNet, Safenet is designed as a decentralized transaction processing network, providing a more unified and seamless transaction experience across different blockchain ecosystems. As a powerful collaborative processing platform, Safenet consists of thousands of specialized application co-processors that can efficiently process transaction inputs from various industries, including AI, RWA (Real-World Assets), DeFi, PayFi, and DEXs, ensuring transaction security and execution speed. Through this distributed architecture, Safenet simplifies complex on-chain interactions into a fast and reliable transaction flow.

Safe co-founder Lukas Schor stated: "Safenet is not just a new Layer 2 container, but a decentralized transaction processing platform that redefines blockchain interactions. With Safenet, users only need one account to seamlessly connect to any network or Layer 2, which will fundamentally change the DeFi game, solving the long-standing issue of liquidity fragmentation and providing users with a seamless, secure, and fast transaction experience." He further emphasized that Safenet's ultimate mission is to support the full on-chaining of the global GDP, paving the way for the global adoption of blockchain technology.

In addition to technological innovation, Safenet also creates significant business value for transaction co-processor participants. As an integral part of the Safe RWA protocol, Safenet offers these co-processors millions of dollars in revenue-sharing opportunities. By assisting in transaction processing, these participants not only receive direct economic benefits but also contribute to the healthy development of the entire network ecosystem.

Safenet also introduces a dedicated liquidity network, allowing anyone to provide the necessary liquidity to support the operation of the processors. This liquidity network is built on top of the existing DeFi infrastructure, including decentralized exchanges, lending markets, and other liquidity sources, providing users with high-quality transaction services. This design not only addresses the traditional blockchain interaction's liquidity bottleneck but also enhances the overall efficiency and scalability of the network.

Through Safenet, Safe not only solves the long-standing interoperability challenges in the blockchain industry but also provides an efficient, decentralized, and secure transaction processing solution. The launch of this groundbreaking product will further solidify Safe's leading position in blockchain technology innovation and commercial applications, while laying a solid foundation for the future on-chaining of the global economy.

Overall, Safe is gradually becoming the core infrastructure for asset management by various large crypto platforms and teams, including the Trump team, the Ethereum Foundation, and World, and has gained widespread trust. With the former President Trump taking office as the new US President, the crypto industry is about to enter a new era. Driven by a series of friendly policies, the adoption of cryptocurrencies will further increase, not only injecting strong momentum into the entire industry but also bringing important benefits to the development of the Safe ecosystem. It can be foreseen that in the new crypto era, Safe will continue to consolidate its position as a critical industry infrastructure, and its value will continue to be demonstrated in the future.

Learn more:

Website: https://safe.global/

Twitter: https://twitter.com/safe

Discord: https://discord.com/invite/nrQVY2566v

Blog: https://safe.mirror.xyz/

Github: https://github.com/safe-global

Docs: https://docs.safe.global/

Join the Safe Chinese Telegram: t.me/safechina_group