Decentralized Autonomous Organizations (DAOs) are gaining popularity in Web3 as an alternative to traditional organizational structures. Top-down decision-making driven by token-based voting and executed by smart contracts aims to increase transparency and participation.

However, as DAOs grow beyond theoretical governance experiments, they face significant obstacles. BeInCrypto spoke with Danny Cooper, the team lead of the Vanguard team at the Venus Protocol, to understand how low voter turnout, large token holders, and decision paralysis hinder effective leadership.

Promising Alternatives

DAOs were once hailed as the future of governance that could operate without centralized control. Their structure was purely guided by code and community consensus. The vision was simple: a transparent and democratic system where all participants have a voice and make decisions through token-based voting.

These organizations leverage Block to facilitate their self-executing rules or protocols. The Block's smart contracts store these rules, and the network's Tokens incentivize users to protect the network and vote on regulations.

Since the first DAO was launched on Ethereum in 2016, these organizations have entered the realms of venture capital, social initiatives, and public goods funding. However, as their philosophy is now being implemented, their flaws are starting to emerge.

DAOs often struggle to balance decentralization and the need for effective leadership. This raises questions about whether they are truly an ideal governance model or just a stepping stone to something more refined.

Declining Voter Turnout

DAOs operate without central authority, distributing governance decisions among members through code-based mechanisms. This decentralized structure was designed to allow members to participate in decision-making through Token voting mechanisms.

However, there have been many cases where the equally distributed voting rights have not yielded the expected results. Frequent voting on all issues can discourage participation.

"As DAOs grow, decision-making can really become burdensome," Cooper said.

Since many DAOs use a referendum-style voting, they assume that members will thoroughly investigate proposals. But time constraints, lack of information, or simple disinterest can lead to low voter turnout or uninformed voting decisions.

Waiting for all DAO members to vote on proposals can delay the decision-making process, especially when urgent solutions are needed.

Segmenting voting issues by priority and topic, and delegating to specific proxies, can help address this problem.

"Decentralized decision-making can be scaled through the implementation of sub-DAOs and layered governance systems. This delegates decision-making to smaller, focused groups. This approach reduces operational complexity while allowing specialized teams to act autonomously within defined boundaries. Advanced governance tools and clear, codified processes ensure efficiency and consistency across the growing decentralized community," Cooper added.

Other options can address the participation decline, but they also come with risks.

Increased Centralization of Key Players

To address low voter turnout, some DAOs allow less active participants to delegate their voting rights to members they are more familiar with, in order to increase overall participation.

However, this system does not remove the influence of the original owners. They can still acquire the majority of transferable voting Tokens and manipulate decisions that may not align with the DAO's best interests.

As a result, the risk of centralization also increases. In December 2024, the Cambridge Centre for Alternative Finance, a research institution based at the University of Cambridge, published a study investigating the level of centralization in Decentralized Finance (DeFi) projects.

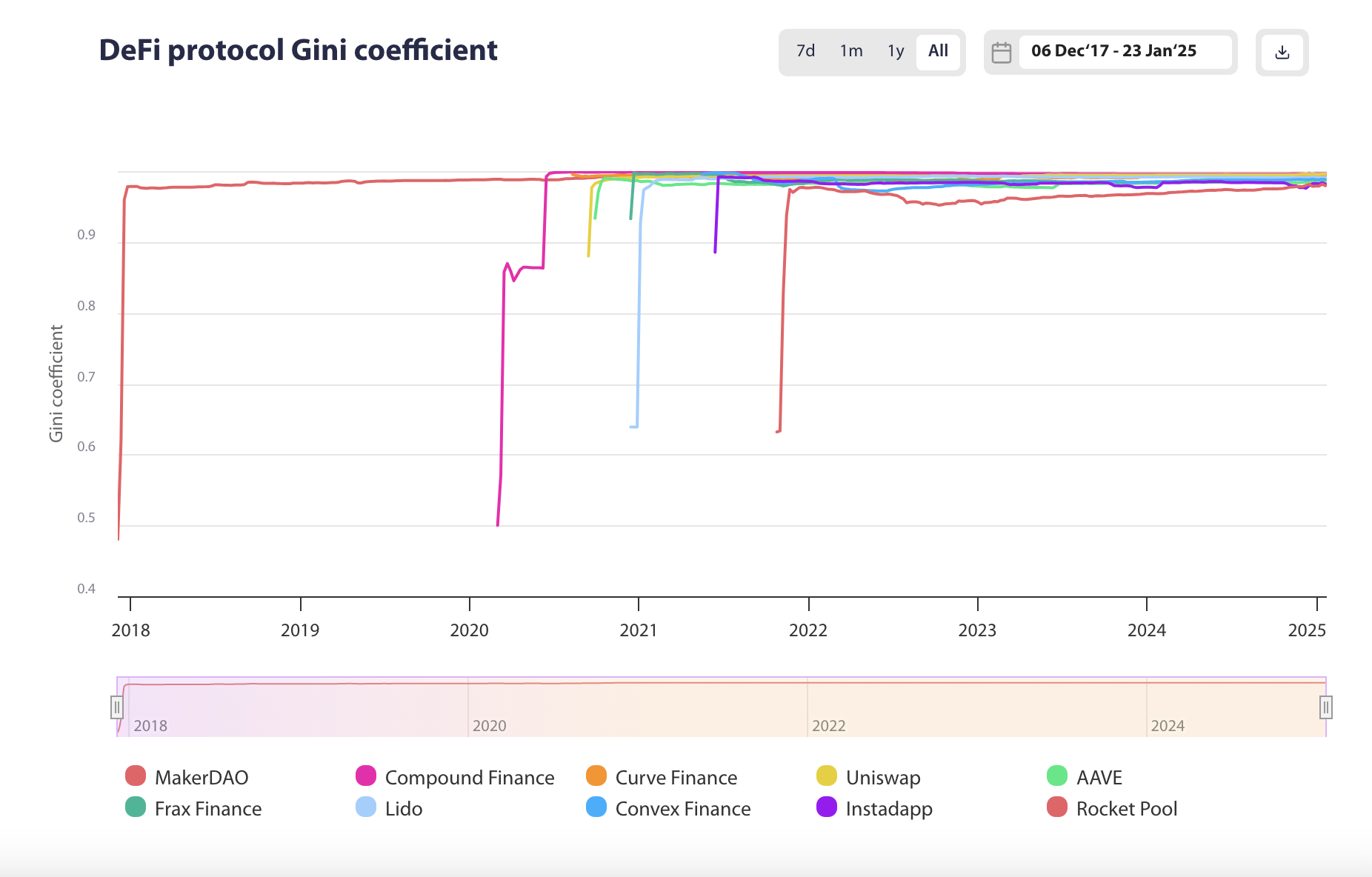

The analysis focused on the following DAOs: Aave, Compound Finance, Convex Finance, Curve Finance, Frax Finance, Instadapp, Lido, MakerDAO, Rocket Pool, and Uniswap.

The research found that power is highly concentrated within several key players in multiple leading DeFi DAOs, and governance is often dominated by a few influential players.

The researchers used the Gini coefficient to measure the distribution of governance Tokens and voting within these protocols. This coefficient measures the inequality of Token distribution in these protocols, with 1 representing maximum inequality and 0 representing perfect equality.

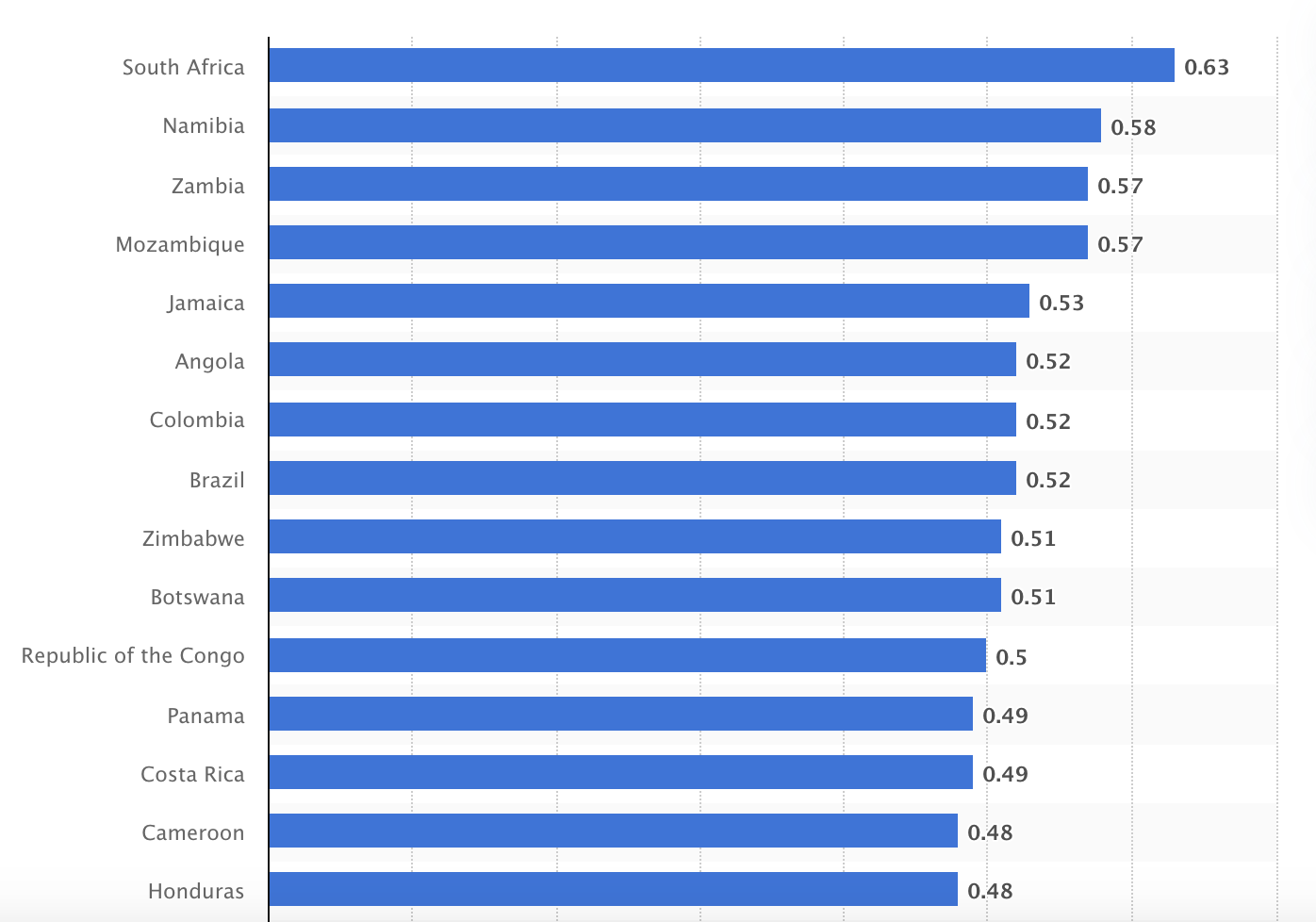

According to the Cambridge research, as of October 2024, the Gini coefficients for these 10 DAOs ranged from 0.97 to 0.99. For comparison, South Africa, the country with the highest income inequality in the world, had a Gini coefficient of 0.63 in 2024, according to Statista data.

MakerDAO recorded the highest coefficient at 0.99, while Rocket Pool had a coefficient of 0.97.

Whale Activity, a Threat to DAO Governance

The concentration of voting power among high-net-worth individuals can marginalize small token holders, potentially leading to a situation where a few influential actors effectively control governance decisions.

"The influence of whales can distort the governance outcomes of DAOs." - Cooper

The concentration of power within some DAOs raises concerns about potential rent-seeking behavior and conflicts of interest. If token holders are involved in multiple projects, their interests may influence decisions within a particular DAO, which could result in outcomes that do not align with the best interests of the DAO.

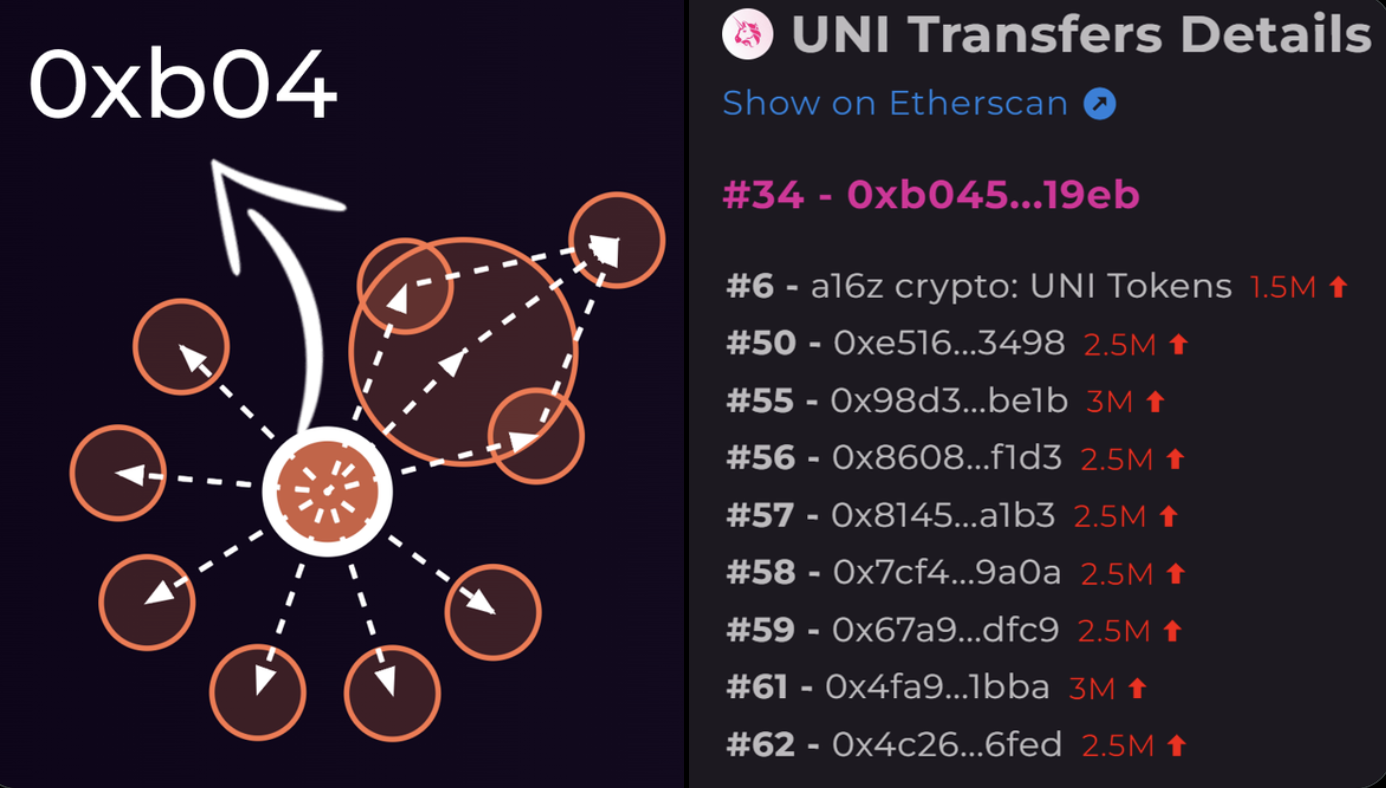

A notorious example of whale risk in DAOs was revealed in February 2023. According to a Bubblemaps investigation, Andreessen Horowitz controlled over 4% of the UNI token supply of Uniswap.

Uniswap requires 4% of the vote to pass any proposal, and the wallets owned by a16z collectively have the ability to change the outcome of all governance votes. This challenges Uniswap's claims of decentralized governance.

The company used its 15 million UNI token voting bloc that month to vote against a proposal to deploy Uniswap V3 on the BNB Chain using a wormhole bridge. a16z has made significant investments in the competing bridge platform LayerZero and preferred its deployment.

According to Cooper, DAOs need to implement mechanisms to protect the organization from such governance attacks.

"Enhancing transparency through auditable voting records and introducing reputation-based deterrents punish malicious actors, while tiered safeguards like quorum requirements prevent collusion and vote buying, maintaining the integrity of governance." - Cooper

Ensuring these mechanisms are in place is crucial to avoid serious threats such as vote buying, whale activity, and collusion.

Scalability Challenges

Many of the issues faced by DAOs are directly or indirectly related to the limitations of their scalability. These challenges pose significant risks to long-term growth and development.

As the number of participants and transaction volumes increase, the infrastructure of DAOs may struggle to keep up, leading to transaction processing delays and other inefficiencies.

Balancing the diverse interests of DAO's various stakeholders while simultaneously incentivizing the desired behaviors and outcomes presents substantial operational challenges.

"Setting long-term goals without central authority requires clear structure and incentive alignment. A clear roadmap, collaboratively built and tied to measurable milestones, ensures DAOs are focused and integrated across the decentralized community." - Cooper, speaking to BeInCrypto.

Similarly, the ongoing maintenance and upgrades of DAO's technical infrastructure, including smart contracts, voting mechanisms, and communication channels, are essential for smooth and effective operations.

To improve user experience and accessibility, the development and maintenance of user-friendly tools are necessary. This may include intuitive voting platforms, efficient proposal management systems, and accessible decision-making interfaces.

One of the core principles of DAOs is contribution-based merit. The organization should reward individuals based on the value they contribute.

Therefore, the successful operation of DAOs requires careful consideration and management of economic incentives. Initiatives can take the form of effective token distribution models, staking mechanisms, and reward structures.

Compliance with applicable regulations is also of utmost importance.

Legal and Regulatory Challenges

The legal status of DAOs remains ambiguous in most jurisdictions. Their decentralized and autonomous nature presents challenges to the traditional legal structures, which are generally designed for centralized entities with clear legal frameworks.

Consequently, most governments lack specific regulations and legal frameworks to address the unique legal and operational characteristics of DAOs.

The challenges include difficulties in designating legal entity status, ensuring transparency in registration, and resolving the complexities of decentralization, anonymity, and borderless operations. This ambiguity can undermine investor confidence, hinder innovation, and pose significant challenges in ensuring compliance with relevant regulations.

However, some jurisdictions have made progress. For example, Wyoming has passed legislation that provides a framework for DAOs with at least 100 members to be recognized as unincorporated nonprofit associations.

In 2021, the state passed the Decentralized Autonomous Organization Supplemental Act, incorporating DAO provisions into Wyoming's LLC law and providing the first legal framework for their creation and governance within the state.

"New solutions include DAO-specific legal entities like Wyoming's DAO LLC and regulatory sandbox programs, which allow DAOs to operate with legal clarity while maintaining their decentralized ethos. Auditable self-regulation backed by consistent community oversight strengthens accountability and trustworthiness." - Cooper, speaking to BeInCrypto.

The United Arab Emirates (UAE) also introduced a structured legal framework for DAOs through the RAK Digital Assets Oasis (RAK DAO) last October.

These movements indicate a growing recognition of the potential that DAOs offer.

Problem Solving, the Key to a Sustainable Future

Overall, DAOs offer an alternative to traditional corporate structures and the potential to transform the paradigm of corporate governance. This decentralized model, which emphasizes transparency and fair participation, has the potential to significantly impact the formation, management, and regulation of companies in the long term.

However, while their potential remains significant, a few key challenges need to be addressed to facilitate the widespread adoption of DAOs.

"To thrive in these areas, a hybrid governance model that integrates an expert advisory board and community oversight is crucial. This ensures technological precision alongside distributed values." - Cooper, concluded.

To ensure the success of these governance models, stakeholders must address critical issues such as the need for greater regulatory clarity, the development of sustainable technological infrastructure, and the elimination of centralization risks.