Solana appears to be in the early stages of recovery, and the network's sustained adoption can support long-term price growth.

Solana's native token SOL experienced an impressive 22% rebound after testing the $180 support level on February 3. However, despite SOL's recovery to $215, it is still 27% below its January 19 all-time high. This decline has put pressure on trader sentiment, as evidenced by a key sentiment indicator in the SOL futures market falling below the neutral threshold.

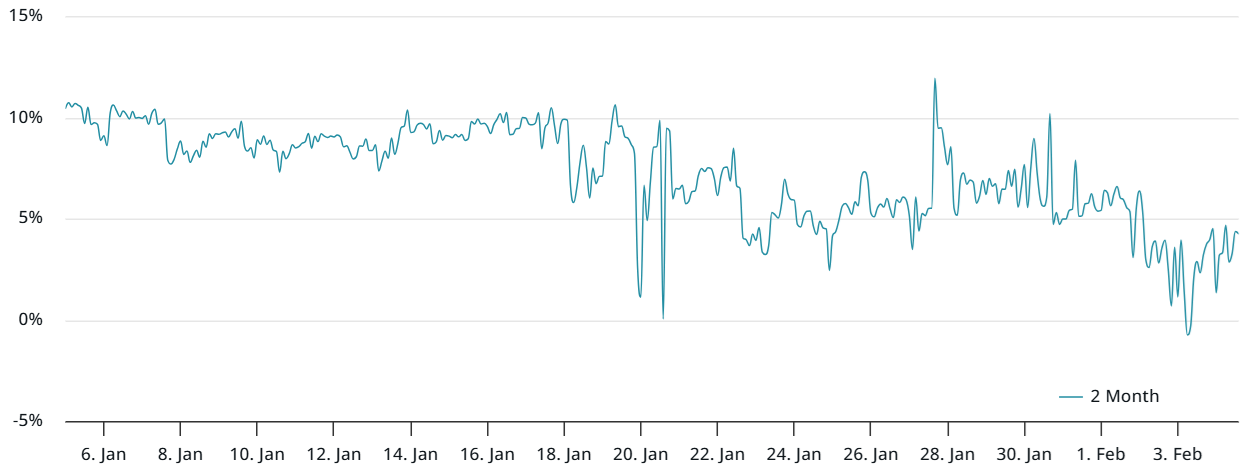

2-month SOL futures annualized premium.

Monthly SOL futures contracts typically trade at a premium to the spot price, reflecting the additional risk borne by sellers due to the extended settlement period. In neutral market conditions, this annualized premium ranges between 5% and 10%. Readings below this threshold indicate weakening demand for long positions (buyers).

SOL futures discount suggests skepticism, but historical data challenges accuracy

At first glance, the current futures discount may suggest that professional traders are skeptical about the bullish momentum in SOL. However, historical data shows that this positioning does not always accurately predict market direction.

In many cases, institutional investors (including whales and arbitrage platforms) misread trend reversals. Corrections tend to be more pronounced when the majority of the market is betting on the trend continuing, especially when market makers adjust their positions.

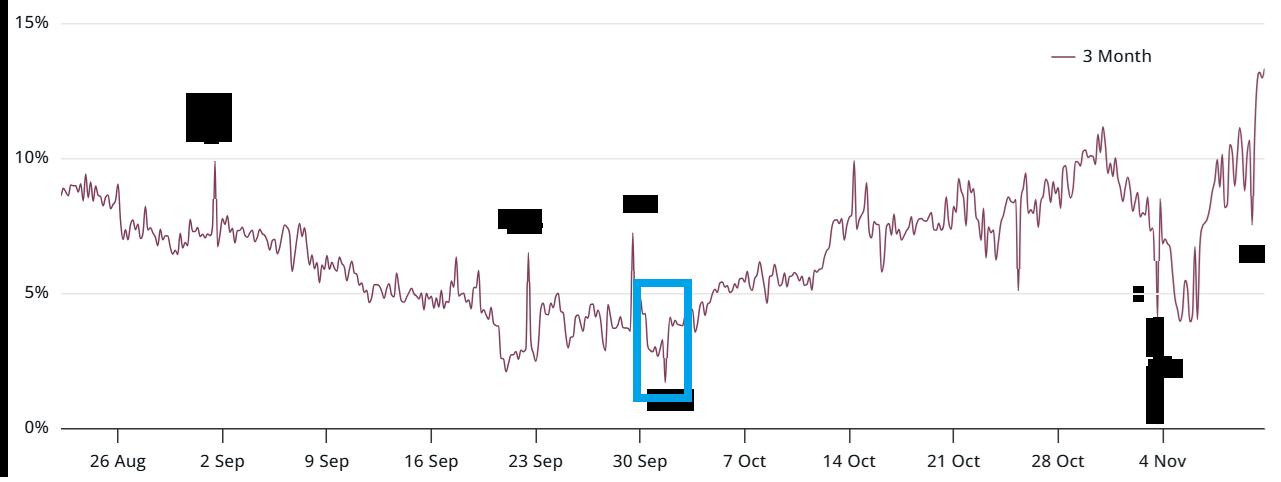

3-month SOL futures annualized premium, October 2024.

A similar situation occurred in early October 2024, when the SOL futures premium fell 13% to 2% within three days after dropping to $140. It turned out that this level was a local bottom, as SOL subsequently soared 58% to $222 over the next 40 days. This highlights that derivatives market sentiment is often a lagging indicator, rather than a reliable predictor of future trends.

To assess whether SOL has a chance of retesting $260 in the near term, investors should check key network metrics, including usage trends, transaction fees, and potential growth drivers. While some critics argue that the recent meme coin frenzy (exemplified by the official token launched by Trump (TRUMP) on Solana) is unsustainable, other revenue sources such as gaming, social networks, and gambling may provide sustained bullish momentum.

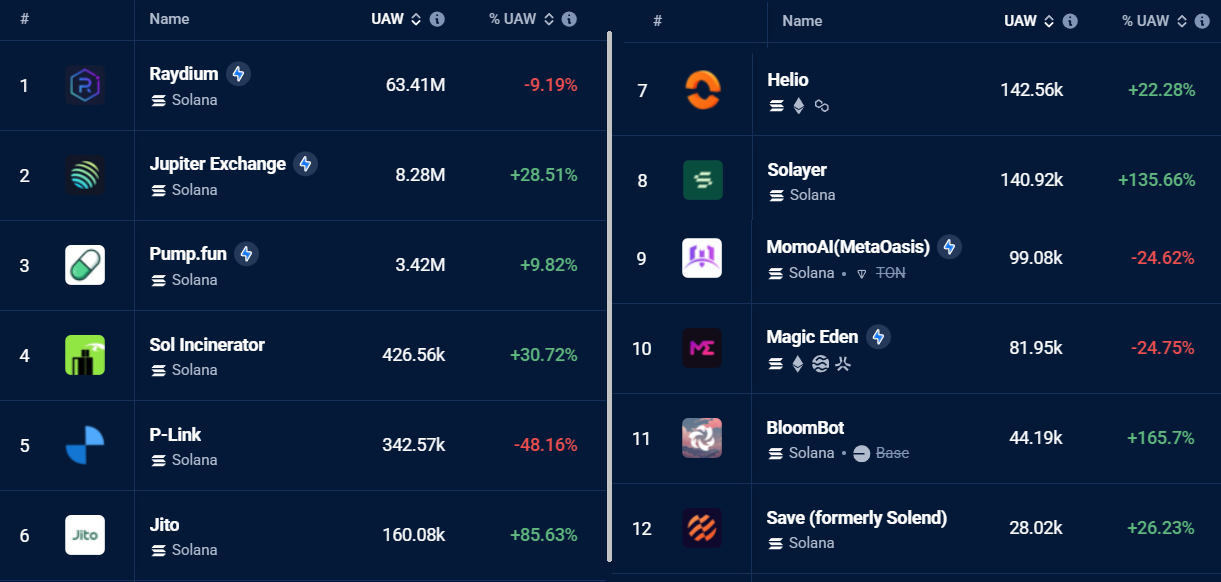

Solana DApps 30-day active addresses.

The number of active addresses associated with the top 10 Solana decentralized applications (DApps) grew 21% month-over-month. In comparison, DApp activity on the Base network declined 27% over the same period, while Polygon and Ethereum declined 17% and 15%, respectively, according to DappRadar data.

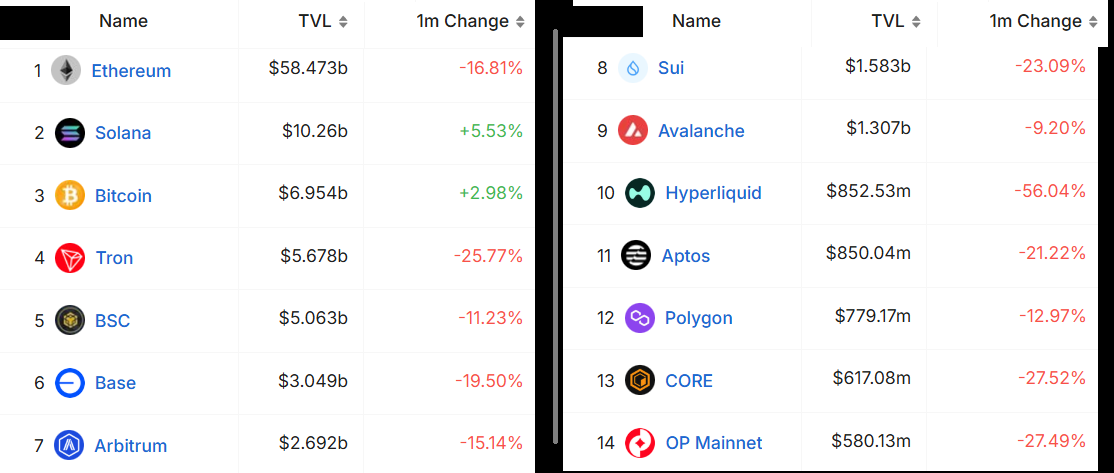

Solana's TVL grew 5.5%, while competitors face resistance

Measured by total value locked (TVL), the total deposits in Solana DApps grew 5.5% in 30 days, narrowing the gap with Ethereum. Solana's market share expanded from 6.7% in October 2024 to the current 9.5%, consolidating its position as the second-largest blockchain by TVL.

Top blockchains ranked by total value locked (TVL), in US dollars.

The main contributors to Solana's TVL growth include Meteora (up 162% in 30 days), Binance Staked SOL (up 23%), and Marinade Finance (up 15%). These inflows helped Solana generate $246 million in monthly network fees — far exceeding Ethereum's $133 million over the same period. Notably, three of the five most profitable DApps belong to the Solana ecosystem: Jito, Raydium, and Meteora.

Attributing SOL's success solely to meme coin speculation, while ignoring the widespread applications in areas such as gaming, staking, liquidity provision, payments, AI, algorithmic trading, and token distribution, would be a mistake. However, challenges remain, as users continue to report transaction failures, highlighting ongoing concerns about the network's reliability.

Scalability issues are not unique to Solana, as maximum extractable value (MEV) practices (where validators prioritize transactions to profit) have impacted multiple blockchain ecosystems. Nevertheless, Solana's growing adoption, compared to other DApp-focused blockchains, strengthens its long-term prospects and provides a solid foundation for further appreciation in the SOL price.