Author | Sun Jun Law Firm

In early January 2025, the Ministry of Public Security held a special press conference in Beijing on January 10th, where the ministry's spokesperson Zhang Ming introduced that fraud groups are constantly upgrading their criminal tools by utilizing blockchain, virtual currencies, AI and other new technologies. In response to the severe and complex situation of virtual currency-related telecom fraud, the public security authorities will deeply advance special actions such as "Cloud Sword", "Cut Off the Flow", and "Pull Out the Nail", and maintain a high-pressure crackdown. Subsequently, at the National Procurators' Conference on January 13th, the Supreme People's Procuratorate emphasized that the procuratorial organs will increase the punishment of money laundering crimes and legally crack down on the criminal activities of illegally transferring assets abroad using virtual currencies.

It can be seen that although China has adopted strict supervision and crackdown on virtual currency platform transactions and investments in recent years, the related illegal financial activities have shifted from offline to online, and from domestic to overseas, developing in a more concealed form. At the same time, based on the anonymity and non-nationality of virtual currencies themselves, virtual currencies have rapidly developed into a new type of criminal tool. Against this background, virtual currency-related crimes have become the most typical problem in the field of cyber crimes.

As the year-end approaches, on the eve of the new year, our team has specially written this article to summarize and review the overall situation of virtual currency-related crimes in China in 2024, the latest developments in national supervision and crackdown on virtual currency-related illegal and criminal activities, as well as the latest trends in the legal nature of virtual currencies in practice.

I. Overall Situation of Virtual Currency-related Crimes in 2024

Regarding the virtual currency-related crimes that occurred in 2024, due to the proximity of the year and the fact that many cases are still in the trial stage, the overall data has not yet been published. However, our team searched the Weikexi platform using the keywords "virtual currency", "criminal", and "judgment", and obtained a total of 401 criminal judgments, including 386 first-instance judgments and 15 second-instance judgments. This article is based on these cases to conduct a preliminary analysis of the overall situation of virtual currency-related crimes in 2024. There may be inaccuracies in the data statistics and result analysis, please forgive us.

From the case data retrieved, Henan Province had the most cases, followed by Hunan Province and Shaanxi Province, and then Shanghai, Jiangxi, and Hebei.

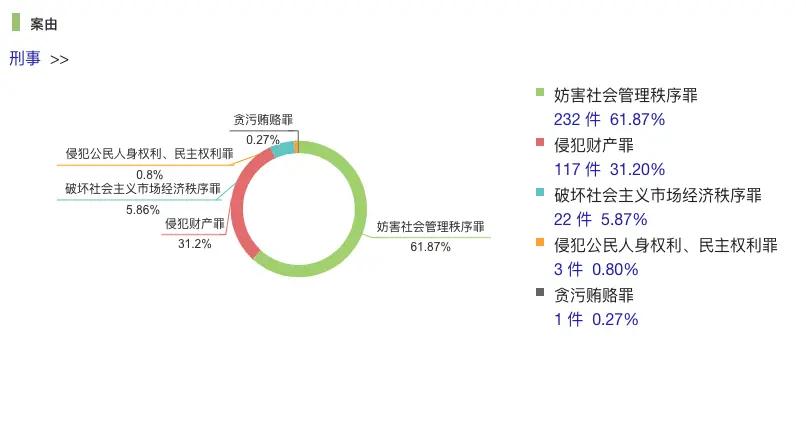

In terms of the nature of the cases, compared to the rampant ICO activities in previous years, virtual currency-related crimes are now mainly concentrated in the field of disrupting the socialist market economic order, with the main charges being illegal absorption of public deposits, fund-raising fraud, and organizing and leading pyramid selling activities. In 2024, virtual currency-related crimes were more concentrated in the field of crimes disrupting social management order, with the most prominent criminal behaviors being in this area, accounting for 61.87%. In addition, property crimes have always been a high-incidence area for virtual currency-related crimes, accounting for 31.2%.

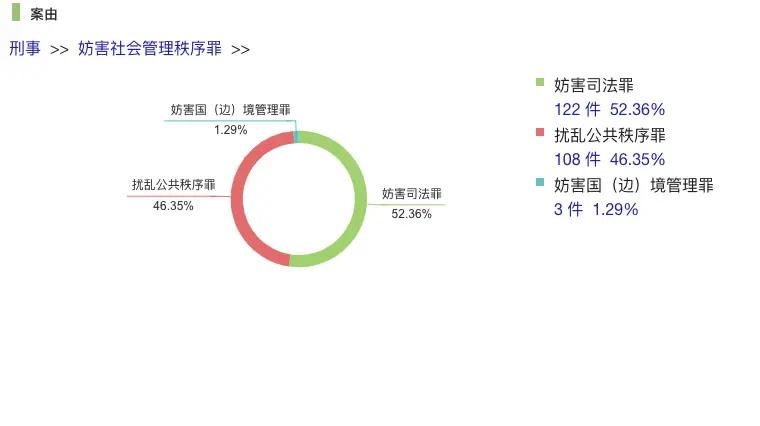

Among the crimes disrupting social management order, specifically, cases involving crimes of obstructing justice accounted for the highest proportion, with 122 cases, accounting for 52.36%, and all of these 122 cases involved the crime of concealing or hiding criminal proceeds and their proceeds.

In addition, among the crimes disrupting social management order, the number of cases involving the crime of disrupting public order ranked second, with 108 cases, including 57 cases of the crime of assisting in information network criminal activities, 39 cases of the crime of opening casinos, 10 cases of the crime of illegally using information networks, 1 case of the crime of gambling, and 1 case of the crimes of illegally obtaining computer information system data and illegally controlling computer information systems.

II. Latest Developments in China's Regulation and Crackdown on Virtual Currency-related Illegal and Criminal Activities in 2024

In 2024, China has mainly strengthened its focus and crackdown on criminal behaviors related to the use of virtual currencies as criminal tools in the fields of foreign exchange-related crimes and money laundering crimes. The following will combine the new regulations issued in the relevant illegal and criminal fields in 2024 and typical cases to understand how virtual currencies are used to carry out illegal foreign exchange and money laundering activities, and the key points for the establishment of crimes in judicial practice.

(I) Engaging in Illegal Foreign Exchange Criminal Activities Using Virtual Currencies

On December 11, 2023, the Supreme People's Procuratorate and the State Administration of Foreign Exchange jointly issued 8 typical cases of cracking down on foreign exchange-related crimes, mainly involving the crimes of (illegal buying and selling of foreign exchange) illegal business operations and fraudulent purchase of foreign exchange. The related charges also involve the crimes of assisting in information network criminal activities, fraudulent obtaining of export tax rebates, and issuing fake value-added tax special invoices. Among them, using USDT as a medium to realize the exchange of RMB and foreign exchange has become a frequently occurring and extremely prominent "counterpart exchange" model in the field of illegal foreign exchange criminal activities in recent years. In addition, in order to better coordinate development and security, ensure the facilitation of cross-border trade and investment, prevent and curb foreign exchange-related illegal and irregular activities, and maintain the order of the foreign exchange market, on December 27, 2024, the State Administration of Foreign Exchange issued the "Measures for the Management of Bank Foreign Exchange Risk Transactions (Trial)". Article 3 clearly lists illegal cross-border financial activities involving TRON as a foreign exchange risk transaction behavior, and requires banks to conduct risk monitoring and reporting on domestic/foreign institutions and individual clients involved in such activities.

In cases of illegal foreign exchange criminal activities using virtual currencies, the perpetrators usually collect the client's RMB in China, and then deposit the equivalent foreign exchange into the client's designated overseas bank account. The funds circulate unidirectionally between China and abroad, and the parties do not directly buy and sell foreign exchange, but essentially complete a foreign exchange transaction. A common practice is cross-border (boundary) payment, where criminals collude with overseas individuals, enterprises, and institutions, or use bank accounts opened overseas to assist others in cross-border remittances and fund transfer activities. This type of underground bank is also called a "counterpart exchange" underground bank, that is, the funds circulate unidirectionally between China and abroad, without physical flow, and "two-place balance" is usually achieved through reconciliation. In this model, RMB and foreign currency do not physically cross borders, so from the surface, the funds circulate unidirectionally domestically and abroad. However, such activities are essentially a disguised foreign exchange transaction and still have the danger of disrupting the normal order of the foreign exchange market.

Typical Case One:

Here is the English translation of the text, with the specified terms preserved: From February 2019 to April 2020, Zhao and others organized Zhao Peng, Zhou Kaikai, and others to provide foreign currency Dirham and RMB exchange and payment services in the United Arab Emirates and domestically. The gang collected Dirham cash in Dubai, UAE, and at the same time transferred the corresponding RMB to the designated RMB accounts in China. They then used the Dirham to purchase "USDT" (a stablecoin pegged to the US dollar) locally, and then illegally sold the purchased USDT through the domestic gang to obtain RMB again, forming a cycle of cross-border fund circulation. Through exchange rate differences, the gang could obtain over 2% profit from each foreign currency trading business. It was found that Zhao and others exchanged over 37 million RMB from March to April 2019, with a total profit of over 870,000 RMB. On March 24, 2022, the Xihu District People's Court of Hangzhou, Zhejiang Province, sentenced Zhao to 7 years in prison and a fine of 2.3 million RMB for the crime of illegal business operations; Zhao Peng to 4 years in prison and a fine of 450,000 RMB; and Zhou Kaikai to 2 years and 6 months in prison and a fine of 250,000 RMB.Here is the English translation of the text, with the specified terms preserved:In early October 2020, the defendant Wang Moumou successively transferred about RMB 249 million worth of "USDT" obtained through fundraising fraud to the defendant Ma Mou. Ma Mou, knowing that the funds were the proceeds of a crime that disrupted the financial management order, changed the nature of the aforementioned virtual currency through investments on overseas foreign exchange platforms, and successively transferred more than 90 million yuan to multiple bank accounts designated by Wang Moumou through bank accounts under his actual control. Furthermore, from December 2020 to January 2021, Ma Mou repeatedly helped the defendant Xie Moumou convert "USDT" into RMB and transfer a total of more than 6.04 million yuan to Xie Moumou's wife's account. In December 2020, the fundraising participants successively filed a case with the public security organ, and the defendants Wang Moumou et al. were successively arrested.

After trial, the Chengdu Intermediate Court held that the defendants Wang Moumou, Yang Moumou, and Xie Moumou, for the purpose of illegal possession, used fraudulent means to publicly promote illegal fundraising of virtual currencies, with a huge amount, and the defendants Duan Moumou and Wang Mou et al. knew that Wang Moumou et al. were committing fundraising fraud and still actively provided assistance, their actions have constituted the crime of fundraising fraud. The defendant Wang Moumou concealed and hid the source and nature of the funds obtained from the fundraising fraud, and the defendant Ma Mou, knowing that Wang Moumou et al. were engaged in crimes that disrupted the financial management order, helped them conceal and hide the source and nature of the proceeds of the crime, their actions have constituted the crime of money laundering. Therefore, Wang Moumou was sentenced to life imprisonment for the crimes of fundraising fraud and money laundering, and Ma Mou was sentenced to 8 years' imprisonment for the crime of money laundering and a fine of RMB 500,000.

After the first instance judgment was announced, the defendants Wang Moumou, Ma Mou and others appealed.

After review, the Sichuan High Court ruled to dismiss the appeal and uphold the original judgment. The judgment has taken legal effect.

In judicial practice, there are certain difficulties in distinguishing the application of the crime of money laundering and the crime of concealing or hiding the proceeds of crime. It is generally believed that the crime of money laundering stipulated in Article 191 of the Criminal Law and the crime of concealing or hiding the proceeds of crime and the income from the proceeds of crime stipulated in Article 312 of the Criminal Law are in the relationship of special provision and general provision in the Criminal Law. The main difference is that the predicate crime of the crime of money laundering is drug-related crime, organized crime of a mafia nature, terrorist activity crime, smuggling crime, bribery and corruption crime, crime of disrupting financial management order, and financial fraud crime, and it requires the perpetrator to have subjective knowledge of the type of predicate crime. The knowledge of the predicate crime can be general, that is, to know the type of the predicate crime, without the need to know the specific nature and crime name. The crime of concealing or hiding the proceeds of crime and the income from the proceeds of crime does not limit the type of predicate crime, and only requires the perpetrator to have a general understanding that the income is illegal.

III. The Latest Trends in China's Judicial Practice on the Legal Attributes of Virtual Currencies

In determining the establishment of various crimes committed with virtual currencies as tools, a prerequisite that cannot be avoided is the issue of the legal attributes of virtual currencies themselves, that is, the property attributes of virtual currencies. Obviously, if the property attributes of virtual currencies are denied, not only in the case of illegally obtaining virtual currencies, the application of property crimes such as theft and fraud will be denied, at most the establishment of the crime of illegally obtaining computer information system data can be affirmed based on the underlying technical characteristics of virtual currencies. It will also deny the application of relevant crimes in many criminal scenarios such as illegally absorbing virtual currencies from the public and defrauding others of virtual currencies in the form of a pyramid scheme.

In this regard, although there has been some controversy over the property attributes of virtual currencies in both civil and criminal judicial practice in the past, in recent years, with the widespread recognition and extensive application of the property value of virtual currencies abroad, the judicial practice in China has also gradually shown a trend of recognizing the property attributes of virtual currencies.

In this regard, in the past year of 2024, there have been several highly representative cases and important articles published in the People's Court News, reflecting the latest trends in China's judicial practice on the legal attributes of virtual currencies, which will be reviewed as follows.

1. Criminal Case Involving a Post-00s Student Issuing Virtual Currencies

Post-00s university student Yang Qichao issued a virtual currency called BFF on a public blockchain overseas, and was sentenced to prison for withdrawing liquidity. The procuratorate accused him of issuing fake virtual currencies, and that others were misled to recharge 50,000 USDT, after which Yang Qichao quickly "withdrew funds", causing others to lose 50,000 USDT, constituting the crime of fraud. On February 20, 2024, the Nanyang High-tech Industrial Development Zone People's Court in Henan Province convicted Yang Qichao of the crime of fraud and sentenced him to 4 years and 6 months in prison and a fine of 30,000 yuan.

In this case, the defense lawyer argued that according to the current laws and regulations in China, virtual currency investment activities are not protected by law, and both parties are engaged in illegal financial activities, so even if the investors suffer losses, they should not be protected by law. The conviction of the first instance court amounts to "indirectly supporting the exchange between virtual currencies and legal tender", which is contrary to the provisions of national laws.

However, the first instance court held that "according to the relevant policies in China, the virtual currency in question does not have the attributes of currency, but in real life, based on its stability, it can be traded on many international trading platforms and bring economic benefits, and its property attributes cannot be denied", and recognized the 50,000 USDT involved in the case as a sentencing factor calculated based on its RMB value. The first instance judgment also stated that "as for whether the victim subsequently traded the BFF coins, and whether the coins still have value according to the trading rules of the gambling platform, it does not affect the consummation of Yang Qichao's fraudulent crime." During the first instance trial, the judge explicitly required that Luo could not engage in buying and selling before the judgment took effect.

2. An Article Titled "Analysis of the 'Criminal Law Property Theory' of Virtual Currencies" Published in the People's Court News on May 16, 2024

On May 16, 2024, the People's Court News published a theoretical article titled "Analysis of the 'Criminal Law Property Theory' of Virtual Currencies", in which the author, Associate Professor Ye Zhusheng of the School of Law of South China University of Technology, argued that "recognizing virtual currencies as criminal law property violates the principle of unity of the legal order". His reason is: "China's civil laws and financial policies do not protect virtual currency-related activities, and even discourage and crack down on virtual currency-related activities, while civil law generally deems virtual currency activities as void civil legal acts that violate public order and good morals. If criminal law protects virtual currencies as property, it indirectly guarantees the safety of virtual currency transactions and indirectly promotes virtual currency transactions and other activities, which is inconsistent with the goals of civil law and financial policy."

3. A Contract Dispute Case Involving the Validity of a Virtual Currency Issuance Financing Service Contract Tried by the Songjiang District People's Court in Shanghai

Here is the English translation of the text, with the specified terms retained:On November 18, the official public account of the Shanghai High Court published an article titled "What is the end of high-amount financing through the issuance of virtual currencies?", which introduced a service contract dispute case adjudicated by the Songjiang District People's Court of Shanghai regarding the validity of a virtual currency issuance and financing service contract. Regarding this case, the judge stated, "As a virtual commodity, virtual currency has property attributes and is not prohibited by law." Based on this, the judge analyzed the reasons why virtual currency-related business activities are subject to strict restrictions and are considered illegal financial activities.

4. On December 5, 2024, the People's Court Daily published an article titled "Criminal Law Characterization of Illegal Theft of Virtual Currencies"

In early February 2023, the defendants Chen Moumou, Jing Moumou, Huang Mou, and Luo Mou, after consultation, agreed that Huang Mou and Luo Mou would jointly invest to use contract codes to steal USDT (Tether). On March 20, 2023, at around 3 pm, the defendants Chen Moumou, Jing Moumou, Huang Mou, and Luo Mou went to the company where the victim Hu Mou was located in a certain community in Lianshui County. Huang Mou and Jing Moumou met with the victim Hu Mou to scan the code, Chen Moumou was responsible for the background operation, and Luo Mou was responsible for driving. Through the previously purchased contract code, they stole a total of 57,307.11 USDT from the victim Hu Mou, worth RMB 393,665.461434. The above-mentioned defendants then traded part of the USDT and illegally obtained more than RMB 240,000.

The author points out that the "Notice on Further Preventing and Addressing the Risks of Virtual Currency Trading and Speculation" issued on September 15, 2021 clearly stipulates that virtual currencies do not have the same legal status as legal tender, and virtual currency-related business activities are illegal financial activities, and the resulting losses shall be borne by themselves. However, this notice only denies the legal tender status of virtual currencies, but does not deny their property attributes as virtual currencies.

It is generally believed that as economic property, it must have value, including utility, scarcity, and disposability.

In this regard, the property attributes of virtual currencies are reflected in:

① The scarcity of virtual currencies is reflected in their fixed total supply, and they are not infinitely available.

② Disposability is reflected in the use of asymmetric encryption technology for virtual currencies, which exist in "wallets" (i.e., addresses), and after obtaining the address and private key, the virtual currency can be controlled.

③ Utility is reflected in the fact that virtual currencies, as specific data encodings, must be generated through "mining", which condenses social abstract labor.

④ At the same time, in real life, virtual currencies can be transferred and traded, and obtain calculable economic benefits, having use value and exchange value. Therefore, virtual currencies have property attributes, and the defendants' theft of virtual currencies constitutes the crime of theft.

In addition, the author believes that in this case, the defendants' illegal theft of the victim's USDT using the contract code was actually a means for the defendants to illegally obtain the management rights of the server, invade the computer information system to obtain electronic data, and then transfer the possession of USDT. Therefore, virtual currencies have data attributes, and the illegal theft of virtual currencies constitutes the crime of illegally obtaining computer information system data.

Therefore, based on the facts of this case, the author believes that the four defendants' actions have respectively violated the crimes of illegally obtaining computer system data and theft, which constitute a concurrent offense, and according to the principle of choosing the more serious crime in a concurrent offense, they should be convicted of the crime of theft.

IV. Conclusion

In the above, the author's team has summarized and introduced the overall situation of virtual currency-related crimes in China in 2024, the latest developments in national supervision and crackdown on illegal virtual currency activities, as well as the latest trends in the judicial recognition of the legal attributes of virtual currencies themselves. It can be seen that the property value of virtual currencies has been greatly recognized in China's judicial practice, and the current focus of regulating virtual currency-related crimes is on cracking down on illegal foreign exchange, money laundering, and other criminal activities using virtual currencies as tools.

From this perspective, the crackdown on such criminal activities will be further strengthened in the future, and in such crimes, whether in terms of the return of the victim's legitimate property, the confiscation or order to pay compensation, the judicial disposal of virtual currencies has become a practical need. In fact, the Central Political and Legal Work Conference held on January 12-13, 2025 emphasized: For key areas and emerging fields, the Ministry of Justice should actively research and propose legislative recommendations. For example, it is necessary to study new issues such as unmanned driving, low-altitude economy, artificial intelligence, virtual currencies, and data ownership rights. Then, as a direction for the improvement of virtual currency legislation in the future, the judicial disposal of virtual currencies is very likely to become a focus of future legislation, and the author's team will conduct an in-depth analysis on this in the next article.