Title: The bullish case for Solana (Re)staking

Author: tradetheflow_, crypto researcher

Translator: Ashley, BlockBeats

Editor's note: Currently, Ethereum is the main battlefield for restaking, but with Solana's rapid development in this bull market, its low cost, high throughput, and strong network effects make it a potential hot track for restaking. The author discusses the market opportunities for Solana restaking, including its ecosystem maturity, innovation potential, network scalability, and optimization of DeFi capital efficiency.

The following is the original content (the original content has been edited for easier reading):

Restaking is a simple but highly impactful concept: it allows staked assets to be reused across multiple decentralized services, or as Jito calls it, Node Consensus Networks (NCNs).

This approach brings multiple advantages. The most notable is that it enhances the security and integrity of decentralized services, allowing them to leverage the economic security of L1 without having to expend significant resources designing their own (often more fragile) security models. For stakers, it also improves capital efficiency, as a single asset can simultaneously provide security guarantees for multiple decentralized services, potentially earning higher capital returns.

In fact, many industry leaders believe that restaking is a disruptive innovation that can build a more secure, flexible, and scalable blockchain environment, accelerating the development of the industry. This has also garnered significant market attention, making restaking one of the largest TVL tracks on Ethereum.

However, so far, restaking has been primarily concentrated on Ethereum, as it is considered to have the highest economic security and the widest adoption among current PoS blockchains. But with Solana's strong growth in this bull market - especially against the backdrop of relatively stagnant Ethereum mainnet activity and a large migration of liquidity to L2s (such as Base) - a new question arises: does Solana have enough reasons to support restaking?

In this article, we will explore Solana's restaking potential from multiple angles and analyze the feasibility of this market opportunity. Let's dive in.

Solana's maturity is sufficient to support restaking

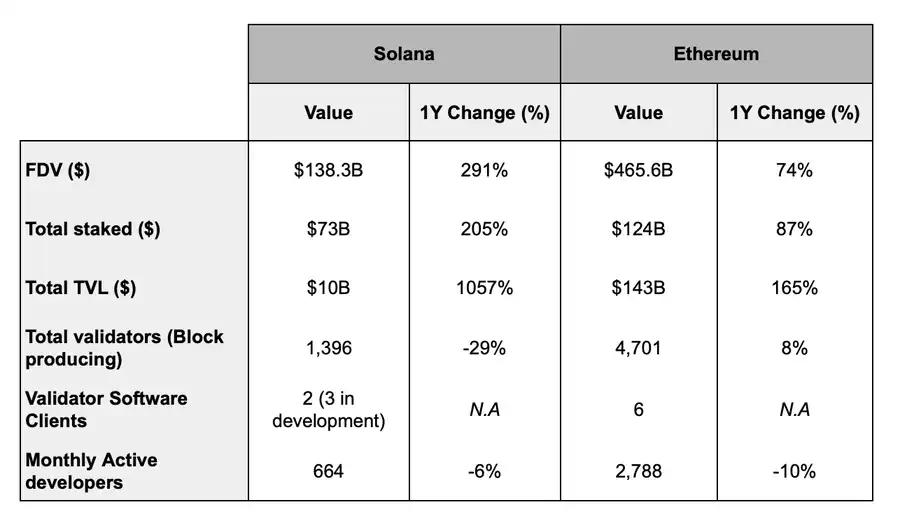

For restaking, the underlying blockchain must have robust economic security. This has been Ethereum's advantage all along: the Ethereum mainnet currently has 34.3 million ETH staked (worth about $124 billion), 4,701 block validator nodes, and six consensus client types, and as one of the oldest and most reliable public chains for application development, it has an extremely high industry reputation. Therefore, Ethereum has become the preferred platform for restaking.

However, humans often tend to extrapolate the current state into the future, assuming that Ethereum will forever maintain its dominance. But history tells us that technological revolutions are often driven by creative destruction. For example, Yahoo was once considered the hegemon in the search engine industry, only to be surpassed by Google. Similarly, IBM was once seen as the ultimate winner in the personal computer domain, but was eventually replaced by Apple.

Are we witnessing a similar moment in Ethereum's history? Is it still necessary to have the entire restaking stack completely dependent on Ethereum? Especially given the trend of new asset issuance on Ethereum mainnet shifting towards L1s like Solana or L2s like Base, and the increasing uncertainty around Ethereum's development direction, we need to rethink this question.

If we believe that restaking is indeed a game-changing technology, then we should consider expanding it to other L1s, not just Ethereum. This would allow developers to freely choose which consensus layer to derive trust from.

In this context, Solana is undoubtedly a strong candidate for restaking. Since the current bull market, Solana has become the fastest-growing L1, and its economic security and ecosystem maturity have significantly improved. As of now, about 65% of the circulating SOL supply is staked, with a total value of around $73 billion (compared to only $24 billion a year ago). Moreover, Solana has nearly 1,400 block validator nodes and supports two existing validator clients, with new clients like Firedancer, Sig, and Agave to be added in the future.

More importantly, Solana is known for its extremely low transaction costs and lightning-fast transaction speeds, and its user and developer adoption continues to rise. Solana is currently the fastest-growing public chain for application development in the crypto industry, not only achieving true organic growth but also successfully overcoming the cold start problem and building a strong network effect. All of this indicates that Solana's ecosystem is mature enough for restaking to be practically feasible.

Restaking on Solana has greater potential than on Ethereum

Ethereum is a pioneer in smart contracts, but its high Gas fees limit the development scope of on-chain applications. Solana's architecture, on the other hand, allows developers to create richer application forms at the L1 layer. Therefore, we can argue that the design space for restaking on Solana is larger than on Ethereum.

First, Solana's low transaction and computation costs lower the entry barrier for Node Consensus Networks (NCNs). Unlike Ethereum, where high fixed costs limit participation, Solana supports more cost-effective and efficient NCN deployments at smaller scales, allowing them to be optimized for specific use cases. This not only allows more services to be outsourced, reducing the reliance on direct on-chain applications, but also expands the interoperability of the entire ecosystem.

Secondly, NCNs on Solana can handle more complex operations and deploy code at higher densities without impacting on-chain computational capacity - in contrast to the EigenLayer design on Ethereum. This makes on-chain verifiability, on-chain reward distribution, and on-chain data publication possible, enhancing the overall flexibility and robustness of restaking. While Ethereum has served as a testbed for restaking, Solana's restaking potential in real-world application scenarios seems greater in the long run.

Furthermore, in the area of Liquid Staking Derivatives (VRTs), Solana also has significant advantages over Ethereum. On the one hand, Solana's low costs can significantly reduce the operating costs for VRT providers. In a business model where every basis point is crucial, this cost optimization not only improves profitability but also fosters a more vibrant ecosystem, allowing different VRTs to offer diversified restaking strategies and more flexible slashing conditions.

On the other hand, liquid staking on Solana is also more affordable for users, as the low transaction costs lower the participation barrier, allowing them to conveniently use VRTs across various DeFi applications without constantly worrying about high fees. This is crucial for driving long-term capital inflows.

Restaking can drive innovation in the Solana network

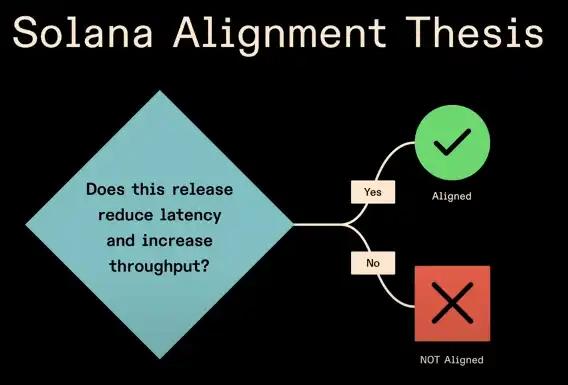

Solana's vision has always been to become a global computing interface, allowing everyone to build applications on it. To achieve this goal, Solana has consistently focused on improving the throughput and reducing the latency of the underlying chain.

This is a powerful and reasonable vision. However, the laws of physics cannot be violated, and we cannot increase throughput 10-fold or reduce latency 10-fold in a short period of time. To achieve an order of magnitude improvement, it requires a large amount of resources and long-term efforts. Therefore, although it is not achievable in the short term, people have gradually realized that not all computations must occur on L1. This is also reflected in the recent discussions on "network extensions".

From this perspective, reStaking can bring new design possibilities to Solana's network expansion and "network extension" plans. Its design space is extremely broad, and although it is not yet clear how this mechanism will be implemented, it is likely to evolve into a powerful infrastructure-level expansion tool. For example, the @SonicSVM project claims to be the first Layer 2 in the Solana ecosystem designed for sovereign gaming, built on HyperGrid, a horizontal scaling framework for the Solana Virtual Machine. The project plans to use Jito (Re)staking to enhance the security and efficiency of its SVM, supporting multi-functional applications in the Solana ecosystem, including games, DeFi, and other use cases.

In addition, the strong security guarantee provided by the reStaking mechanism can also effectively improve the reliability of the Solana network. For example, the Jito TipRouter NCN is under development, aiming to decentralize MEV tip distribution and enhance its security. Another example is Nozomi, a protocol launched by @temporal_xyz, which will use Jito (Re)staking to reshape the microstructure of Solana's transactions and solve problems such as sandwich attacks, slippage, and transaction timeouts. These innovations are in line with Solana's long-term vision and can significantly optimize the user experience, making Solana not only fast and low-cost, but also more secure, stable, and user-friendly.

In addition to high performance and strong on-chain data metrics, Solana also carries the spirit of startups. Over the past few years, we have witnessed the rise of a series of successful projects such as Jito, Kamino, Jupiter, and Helium. But this is just the beginning, and the number of projects choosing to build in the Solana ecosystem is still growing.

If Solana is becoming the preferred public chain for developers, then reStaking will undoubtedly have a place in it. It can extend Solana's economic security to a series of critical services in the ecosystem, such as oracles, cross-chain bridges, and sequencers, which, although not directly running on L1, are still crucial components of the ecosystem.

Although smart contracts and their interactions benefit from Solana's security, these peripheral components often still require independent economic security guarantees. This means that they either need to raise a large amount of capital to incentivize validators, or compromise on security. This may lead to a paradox: the smart contract layer may be secure, and the computation results may be correct, but if the oracle provides incorrect data, the entire system still faces risks. From a security perspective, the security of the entire system ultimately depends on the weakest link.

Therefore, some of the critical services in the Solana ecosystem can use Solana's reStaking to enhance their security. For example, @switchboardxyz, a permissionless oracle network on Solana, is collaborating with Jito (Re)staking to ensure the reliability of its data sources. If this model is successfully implemented, it will simultaneously improve the security and stability of the Solana network.

reStaking Optimizes DeFi Users' Capital Efficiency

reStaking provides a higher annual percentage yield (APY) compared to regular staking on Solana. Since one of the core goals of DeFi users is to optimize capital efficiency, reStaking becomes an extremely attractive option. It allows DeFi users to unlock new yield opportunities on Solana without additional capital investment. For example, instead of buying liquid staking tokens to earn SOL staking rewards and use them in the DeFi ecosystem, users can choose to buy liquid reStaking tokens, which not only provide higher APY, but also allow them to continue operating freely in the DeFi ecosystem.

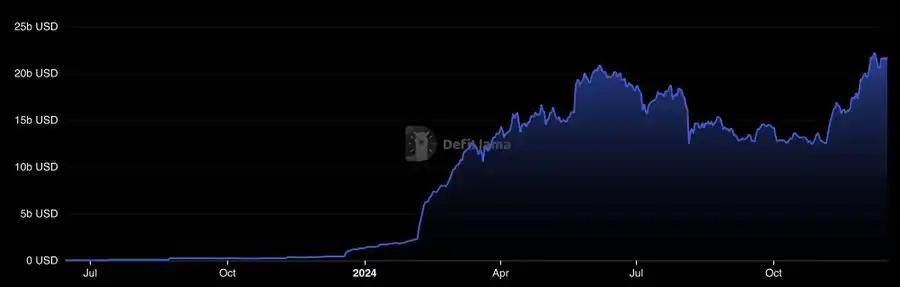

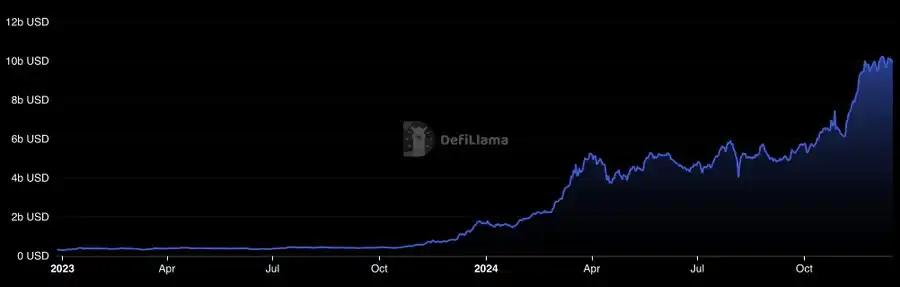

Looking at the rapid growth of DeFi in the Solana ecosystem, we can conclude that a mechanism that optimizes capital efficiency will help attract a large amount of liquidity in the long run. In fact, DeFi activity on Solana is surging, with the total value locked (TVL) in Solana DeFi growing from $1 billion to $10 billion over the past year, further demonstrating the market potential of Solana's reStaking.

Conclusion

reStaking on Solana is still in the early experimental stage, but it has already shown tremendous potential, and many interesting use cases are gradually emerging. If we assume that, in the long run, Solana can capture a market share comparable to Ethereum's reStaking market, the market opportunity will be very significant.

Currently, the Solana reStaking infrastructure is primarily dominated by two core protocols: Solayer and Jito (Re)staking. As a pioneer, Solayer has already built a complete reStaking stack and achieved over $350 million in TVL. However, in the long run, Jito is more likely to become the dominant player in this narrative. With a strong technical foundation, the highest TVL in the Solana ecosystem, and a clear vision, Jito has established its leadership position in the Solana ecosystem. Furthermore, Jito's reStaking stack design is highly flexible, and it has integrated liquid reStaking tokens from the beginning, supporting multiple assets, further enhancing its growth potential.

In any case, I would like to conclude with a quote from Freeman Dyson:

"When great innovations appear, they are almost always in a confused, incomplete, and perplexing form. Even their discoverers can understand only half of them; to others, they are a mystery. If an idea does not look crazy at the start, it has no hope."

This quote perfectly describes the current state of Solana's reStaking: early, full of potential, and nurturing new DeFi opportunities.