Author: Ethena Labs Research

Abstract

● This is the largest nominal liquidation event in history and the largest drop in open interest in perpetual contracts.

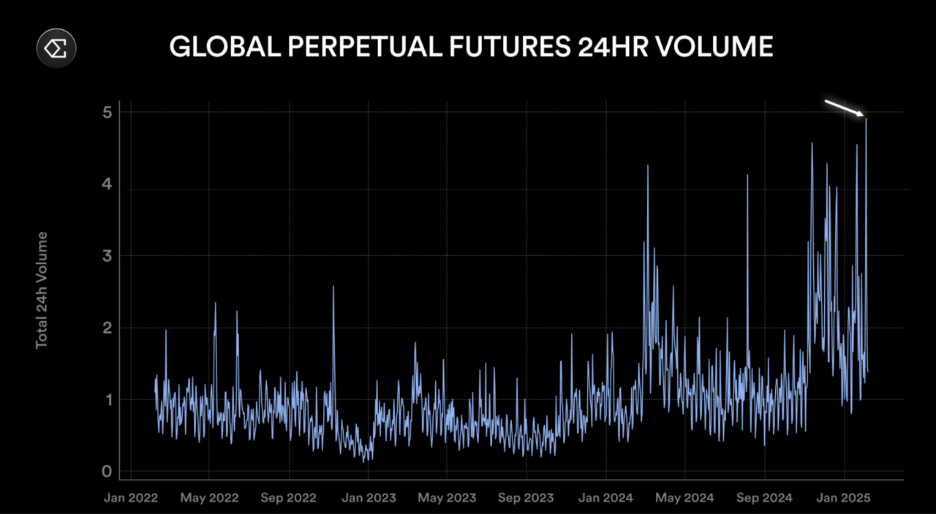

● The perpetual contract market set a new 24-hour trading volume record.

● Open interest decreased by $14 billion, largely confirming the estimated $10 billion in liquidations.

● Despite the market volatility, USDe remained stable, consistent with the performance of fiat stablecoins.

● During the sell-off, perpetual contract prices were up to 5.8% lower than the spot market.

● Ethena, through its short perpetual contract strategy, cleverly capitalized on this price differential. Last week, through closing positions and arbitrage, the protocol generated over $500,000 in profits.

● Ethena automatically closed underperforming contracts, helping to correct the funding rate, and reallocated over $1 billion from BTC and ETH contracts to high-yield stablecoins in its perpetual contract.

Review of the Largest Liquidation Event in History

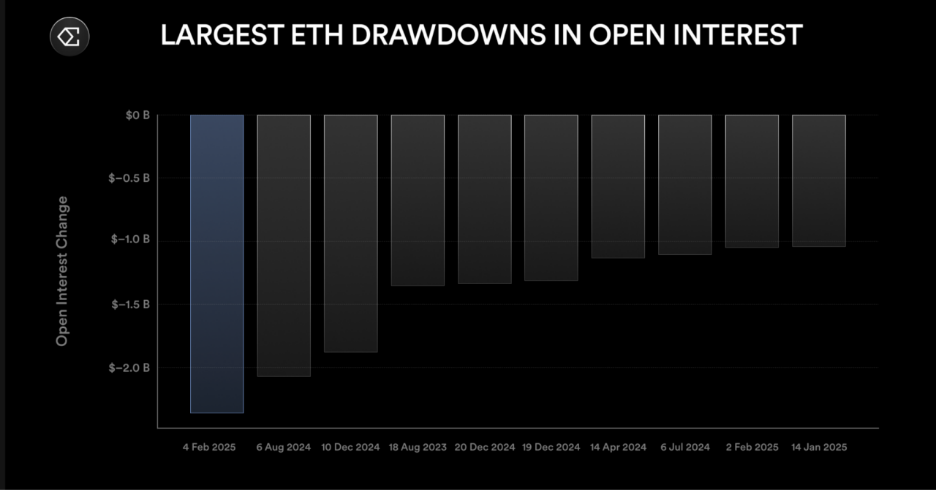

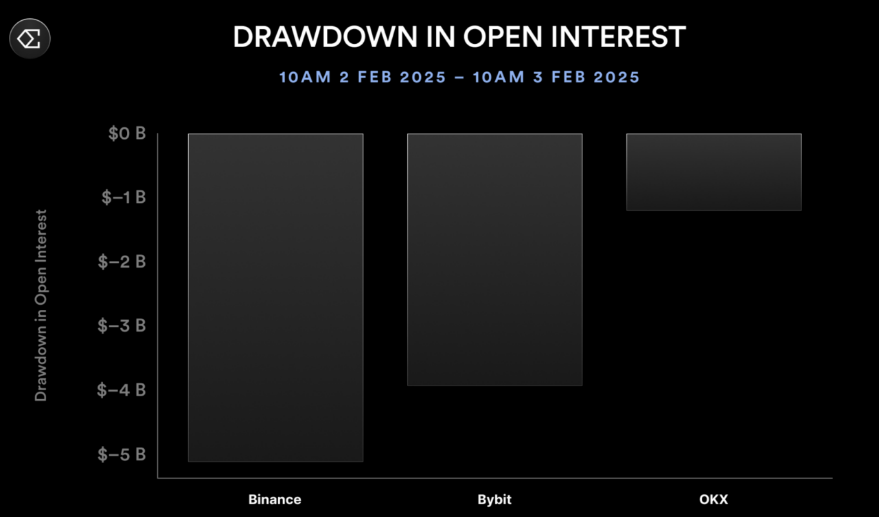

The perpetual contract market has just experienced the largest nominal liquidation event in history, with most of the volatility concentrated in the ETH market. Since the launch of Ethena, this is the ninth time that ETH open interest has decreased by at least $1 billion, and the second time it has decreased by more than $2 billion. In just 24 hours, ETH open interest decreased by $2.3 billion, setting a new record for the largest single-day decline.

24-hour decline in ETH open interest

Within a week, ETH open interest decreased by over $5 billion, a weekly decline of over 25%.

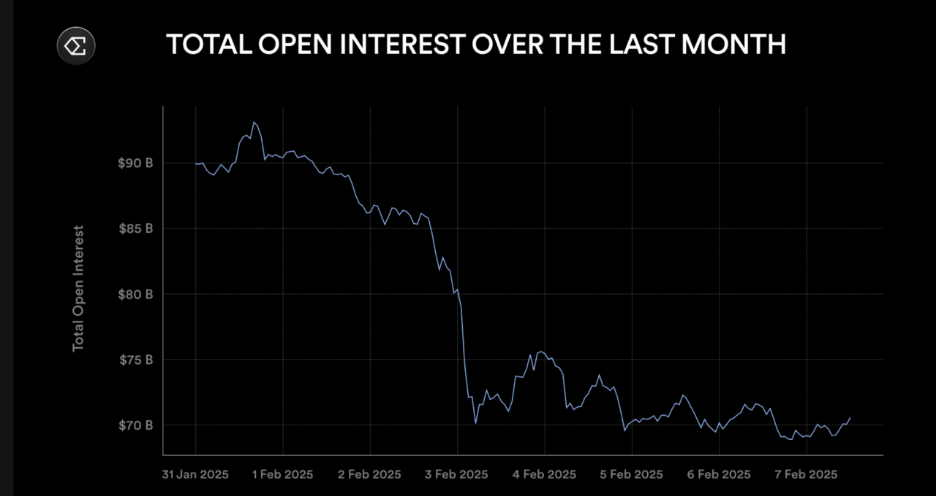

In the past week, the total open interest across all assets decreased by over $20 billion, and although the BTC market is nearly twice the size of the ETH market, the nominal losses in BTC contracts were less than ETH. Between February 2nd and 3rd, open interest decreased by $14 billion in 24 hours.

The violent sell-off led the perpetual contract market to set a new 24-hour trading volume record.

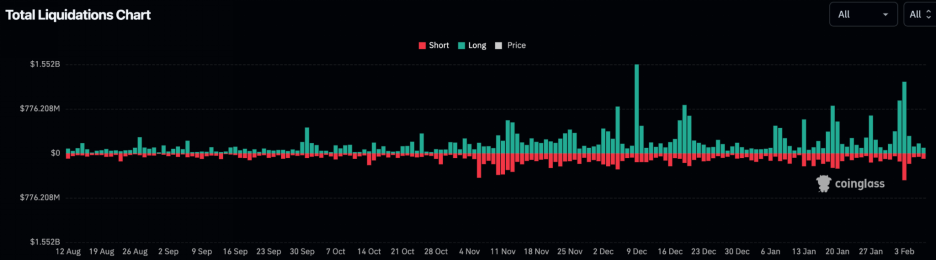

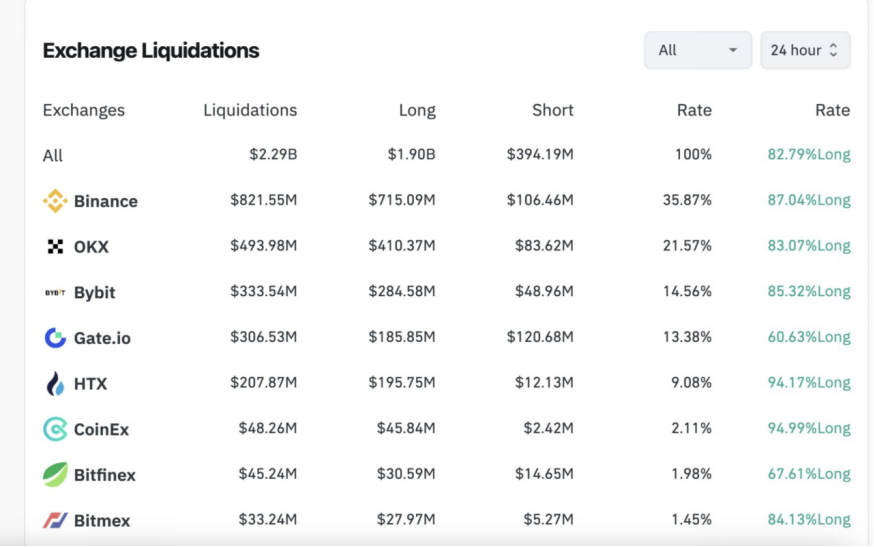

It is difficult to accurately determine how much trading volume and open interest was caused by liquidations - due to API rate limits, exchanges often underreport liquidation data, and third-party data providers present underestimated figures as a result. Of the approximately $14 billion decrease in open interest on February 3rd, only $2.3 billion is said to have been caused by liquidations.

As the Bybit founder and CEO tweeted after the sell-off, Bybit alone caused $2.1 billion in liquidations, while the Coinglass report data was only $333 million.

Coinglass data

He estimates the total liquidation amount to be between $8 billion and $10 billion. This is more consistent with the decreases in open interest observed across exchanges within 24 hours, with Bybit's open interest decreasing by $4 billion from February 2nd to 3rd, and Binance alone decreasing by $5 billion.

If this logic holds true, this would be one of the largest liquidation events in the history of cryptocurrency.

USDe Stability

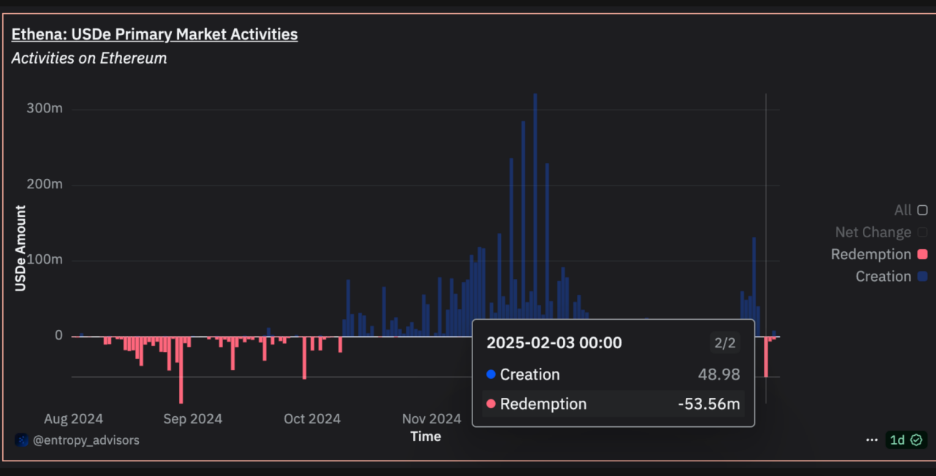

Despite this being the largest nominal liquidation event in the history of cryptocurrency derivatives, everything ran as expected, and the liquidation of perpetual contracts (then trading below the spot market) caused virtually no losses.

In the primary market, $50 million in USDe redemptions were processed within 24 hours without any issues. The secondary USDe market saw over $350 million in 24-hour trading volume, with the USDe price spread to USDT remaining within 10 basis points.

During the market volatility, the USDe price moved in line with USDC and DAI, with market makers intervening to dampen any arbitrage opportunities between the primary and secondary markets.

Comparison of USDe, USDC (red), and DAI (purple) prices

Within the DeFi ecosystem (such as Aave, Morpho, Fluid, Curve, Pendle), sUSDe and USDe functioned normally as collateral, with no major liquidations, closures, or liquidity issues.

As prices declined, many perpetual contracts traded at a discount to their corresponding spot market prices, providing Ethena with an opportunity to profit from closing perpetual contract positions.

Profiting from the Sell-off

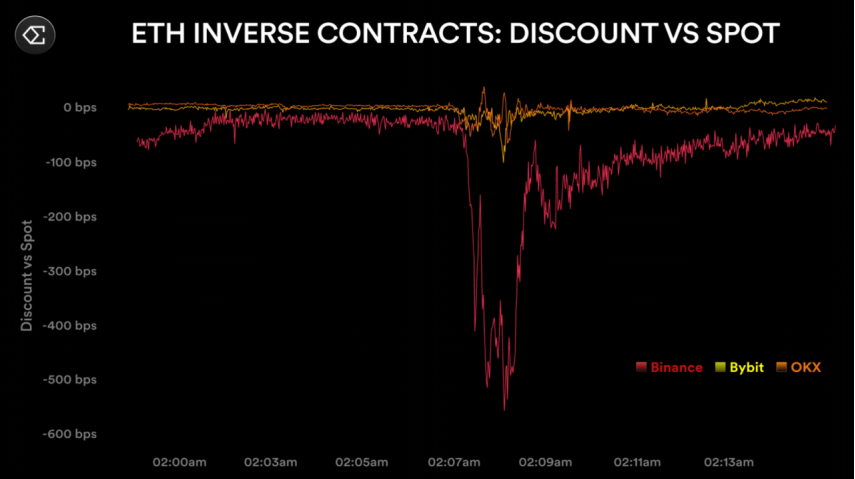

Ethena's design has an often underestimated advantage: in a market downturn, Ethena is on the "right" side of the trade - short perpetual contracts and long the underlying spot. During market sell-offs, perpetual contract prices often trade at a discount to their corresponding spot prices due to liquidations and general panic in the futures market. This discount has previously exceeded 5% in past market sell-offs, and this time was no exception.

Shorting a perpetually discounted perpetual contract leads to an increase in unrealized profit/loss, which in turn increases the collateral margin, buffering Ethena's already deleveraged positions. Since Ethena's system automatically closes perpetual contracts, Ethena's positions naturally benefit from these price differentials, putting the protocol on the stronger side of the market.

By closing perpetual contracts at discounted prices, the protocol can realize these discounts as profit and use that revenue to benefit sUSDe holders.

For example, during the sell-off, Binance's ETH-denominated perpetual contract price was 5.8% lower than the spot market. Ethena's short position in this contract was around $200 million, and at the peak of the discount, the theoretical unrealized profit/loss exceeded $11 million - if the entire position was closed, this profit could be converted into protocol revenue.

On other exchanges like Bybit and OKX, this discount was not as pronounced, with ETH contracts trading around a 1% discount. The BTC contracts performed better than ETH across the three exchanges, as the sell-off was primarily concentrated in ETH contracts, especially the coin-margined (inverse) contracts.

Binance's perpetual contracts had the largest discounts across all exchanges.

Maximum spread between perpetual contracts and spot markets (in basis points)

The differences in contract and asset performance further highlight the importance of execution quality, which Ethena's automation ensures can capitalize on these price differentials.

Over the past week, more than $500,000 of Ethena's $5.5 million in protocol revenue was attributed to capturing the price differentials between perpetual contracts and spot, as well as closing the contracts with the lowest funding rates, adding around 50 basis points to sUSDe's weekly APY. This realized profit also provided an additional buffer for any negative funding rate periods Ethena experienced over the weekend.

Adapting to Low Funding Rates

With increased volatility and significant performance differences between exchanges and assets, Ethena must quickly adapt to any structural changes in the perpetual contract market. Last week, the funding rates for ETH contracts were significantly lower than BTC, with both lower than the start-of-year levels.

The structural changes in funding rates signaled to Ethena to start adjusting its support for USDe asset allocations. With high-yield stablecoins like USDS being eligible collateral, there is an opportunity to shift more collateral into yield-bearing stablecoins yielding up to 8.75%, reducing the reliance on underperforming perpetual contracts. As Ethena began closing its ETH short positions, the funding rates have started to improve.

As Ethena reduces its short positions, funding rates have recovered

Over the past week, Ethena has demonstrated its ability to quickly adapt to market changes, reallocating over $1 billion from BTC and ETH contracts to stablecoins during the low funding rate environment.

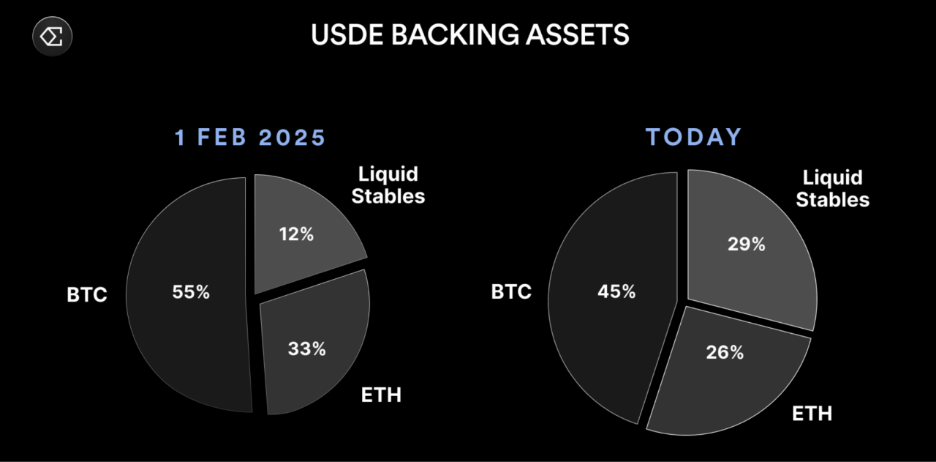

Followin' the dynamic asset allocation method of Ethena, the collateral assets as of early February and today are compared. USDe is now collateralized by nearly $1.8 billion in liquid stablecoins, accounting for 29% of the collateral assets, some of which have higher yields than the funding rates of perpetual contracts. As long as these perpetual contracts do not perform well enough, Ethena will continue to allocate to liquid stablecoins and optimize the assets supporting USDe.

Summary

Despite experiencing the largest nominal liquidation event in history, USDe has once again proven its stability and successfully completed redemptions, maintaining its peg to the US dollar. Ethena's ability to profit during the market sell-off further demonstrates the structural design advantages of Bit'in perpetual contracts, and how sUSDe holders can benefit when the market declines.

Each stress test proves that USDe is one of the most stable assets in the crypto space, and Ethena will continue to work hard to earn everyone's trust.

Original link: https://mirror.xyz/0x4bE0E8922aE2e40f1E7bCbDBA517946eb7268c62

About Ethena

Ethena is a decentralized stablecoin protocol launched on the Ethereum blockchain by the Ethena Labs project team, featuring the stablecoin USDe. Its operating mechanism is different from traditional stablecoins like USDT and USDC, as it achieves value stability through collateralized crypto assets and Bit' positions. Ethena has already reached a strategic cooperation with the WLFI project of the Trump family.