What is Dynamic TAO?

Dynamic TAO (BIT001) is a network upgrade proposal submitted by the Opentensor Foundation. It is a market-driven mechanism designed to replace Bittensor’s current emission allocation model.

It aims to reform Bittensor’s staking mechanics and the distribution rules for $TAO block rewards to mitigate centralization risks among Root Validators, address potential collusion, and empower all $TAO holders to actively participate in the allocation of Bittensor’s block rewards.

What are the mechanisms of Dynamic TAO?

A high-level summary:

- Each Subnet can issue its own Alpha Token, denominated in $TAO. However, direct trading or circulation between Alpha Tokens is prohibited, they must first be swapped to $TAO first.

- The price of an Alpha Token determines the share of block rewards allocated to its Subnet. However, block reward distribution does not directly impact Alpha Token prices.

- Alpha Token prices are solely influenced by trading. If $TAO holders buy Alpha Tokens, the price increases; if Alpha Token holders sell for $TAO, the price decreases.

- Newly minted $TAO from block rewards is not distributed directly to participants. Instead, it is injected into each Subnet’s unique Alpha Token-$TAO liquidity pool. Participants receive Alpha Token emissions as incentives. To realize value, they must sell Alpha Tokens for $TAO.

- The Root Network remains intact: staking to Root does not buy Alpha Tokens but grants a share of each Subnet’s Alpha Token emissions.

Execution Details:

1. Liquidity Pool Creation & Initial Pricing

Each Subnet initializes a unique liquidity pool by depositing its Alpha Token and $TAO. The initial price of an Alpha Token is determined by:

At the beginning, each SN will have the same amount of $TAO and Alpha Tokens injected, so they will have the same price and liquidity.

2. Block Reward Injection & Liquidity Growth

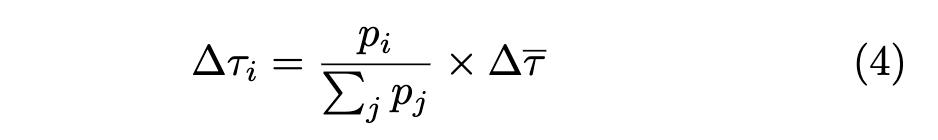

Each block mints 1 $TAO (subject to future halving) and a variable, slightly over 1 Alpha Token.

Newly minted $TAO is allocated to Subnets pool reserve based on their Alpha Token’s price relative to the sum of all Subnets’ Alpha Token prices:

To neutralize price impact from emissions injection, some Alpha Token will also be injected into the pool.

This injection deepens liquidity, reduces slippage, and increases redeemable $TAO per Alpha Token.

3. Alpha Token Price Dynamics

- Buy pressure ($TAO → Alpha Tokens) increases price.

- Sell pressure (Alpha Tokens → $TAO) decreases price.

Alpha Token emissions are distributed to Subnet Validators and Root Stakers (41%), Miners (41%), Owners (18%).

The split between Validators and Root Stakers depends on:

- Free-floating Alpha Tokens: The more Alpha Tokens are outside of the liquidity pool, the greater the rewards for Validators

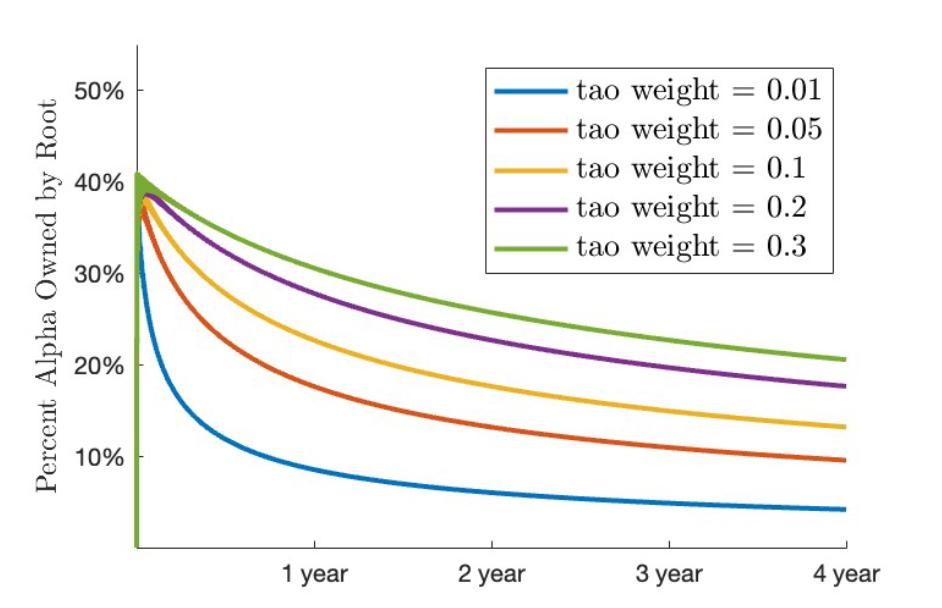

- Tao Weight: A constant that smooths early price volatility. Adjusting the Tao Weight alters the Root Stakers’ share over time.

What changes does Dynamic TAO bring to network participants?

The price of the Alpha Token is the only factor determining how much $TAO Emissions a Subnet can receive. Validators, Miners, and Owners in SNs must consider the impact on the Alpha Token price when cashing out incentives.

If the price of the Alpha Token can maintain an upward trend over time, SN participants can enter a positive feedback loop:

The price of the Alpha Token rises, increasing the net inflow of $TAO into the SN ➡️ more $TAO Emissions are obtained, liquidity of the Alpha Token increases, and slippage when exchanging for $TAO decreases ➡️ Alpha Token holders can exchange more $TAO ➡️ attracting more users to buy Alpha Token ➡️ price of the Alpha Token continues to rise.

However, if the price of the Alpha Token enters a downward trend, a negative feedback loop may form:

The price of the Alpha Token falls, decreasing the net inflow of $TAO into the SN ➡️ Alpha Token holders can exchange fewer $TAO ➡️ Alpha Token holders rush to sell their Alpha Tokens ➡️ price of the Alpha Token continues to fall.

How does Dynamic TAO make the Bittensor ecosystem more competitive and incentivize more fairly?

- Price becomes the only KPI for SN participants, and those unable to maintain the price will gradually be eliminated.

- Newly launched SNs can more easily obtain a higher proportion of $TAO Emissions, but their sustainability depends on whether they can continue to secure a net inflow of $TAO.

- It weakens the ability of a few top Validators to directly control how $TAO Emissions are distributed.

- It addresses the issue of Validators, Miners, and Owners being able to sell $TAO Emissions without any burden.

- It shifts part of the selling pressure from the increased issuance of $TAO onto the speculators of Alpha Tokens.

How should $TAO holders participate?

- For conservative holders:

If holders wish to avoid any loss in $TAO value, they should stake all their $TAO in the Root Network.

Staked $TAO in the Root Network can “freely” receive all Alpha Tokens from Subnets, ensuring the growth of $TAO value without any drawdown. However, the better the price performance of the Alpha Token, the smaller the proportion that Root Stakers can claim. - For moderate holders:

If holders seek higher returns and are willing to accept some fluctuation in $TAO value, they can adopt a barbell strategy by staking the majority of their $TAO in the Root Network and using a small portion to buy Alpha Tokens with short-term price potential. - For aggressive holders:

If holders want to maximize returns and are willing to accept larger volatility, they can actively participate in the price speculation of Alpha Tokens, strategically capturing the growth potential of Subnets and market sentiment fluctuations. Specific strategies could include:

- Betting on high-growth Subnets:

Focus on Subnets that are technically innovative, have active ecosystem collaborations (with top protocols integrated), or have a strong team background (proven development capabilities). - Capturing early-stage rewards:

Buy Alpha Tokens quickly when a new Subnet launches, before the price fully reflects the value, build up positions, and sell quickly to other followers. - Capturing market Upward cycle: In the early stages of a positive price cycle, as Alpha Tokens rise continuously and trading volume expands, increase positions and delay selling the newly issued Alpha Tokens to push the price up and attract momentum traders.

- Capturing marketDownward cycle: When negative signals appear for the Subnet, sell Alpha Tokens in advance or even short them, then repurchase them after the price bottoms out to profit from the price difference.