What is Dynamic TAO?

Dynamic TAO (BIT001) is a network upgrade proposal submitted by the Opentensor Foundation, aimed at mitigating the concentration of Root Validator power and potential collusion issues by reforming the Bittensor network staking mechanism and the distribution rules of $TAO block rewards, and empowering all $TAO holders to actively participate in the allocation of Bittensor block rewards.

What are the mechanisms of Dynamic TAO?

In broad terms, the most important points include:

- Each Subnet (SN) can issue its own Alpha Token, priced in $TAO. But any two Alpha Tokens cannot be traded or circulated directly, they must first be exchanged for $TAO.

- The price of the Alpha Token determines how much block reward the SN can allocate, but the allocation of block rewards does not affect the price of the Alpha Token.

- Only when Alpha Token holders sell, or $TAO holders buy, will the price of the Alpha Token be affected.

- The $TAO minted from block rewards will not be directly distributed to network participants, but will be injected into the unique liquidity pool of each Alpha Token and $TAO. Network participants can only receive the minted Alpha Tokens as incentives, and if they want to cash out, they must first sell the Alpha Tokens to exchange for $TAO.

- The Root network will be retained, staking to the Root network will not buy any Alpha Tokens, but can receive a portion of the minted Alpha Tokens as incentives.

The specific implementation details include:

1. Create a liquidity pool and set the initial price:

All SNs will create a unique liquidity pool and inject a certain amount of Alpha Tokens and $TAO as a trading pair. At this point, the price of the Alpha Token of any SN can be calculated:

2. Inject block rewards into the liquidity pool to enhance liquidity:

When the Bittensor network generates a new block, both $TAO and Alpha Tokens will be minted (Emissions) and distributed as block rewards to network participants. Among them, $TAO will have a fixed emission of one token per block (still subject to the previous halving mechanism), while Alpha Tokens will be slightly more than one, and not fixed.

The emission of $TAO will only be allocated to the liquidity pools of SNs, and the proportion that each SN can allocate depends entirely on the proportion of its Alpha Token price (EMA average price over a certain period of time) to the sum of all SN's Alpha Token prices:

The higher the price of an SN's Alpha Token, the higher its proportion, and the higher the proportion of $TAO it can allocate.

In order to achieve the goal of the block reward injection not affecting the price of the Alpha Token, a portion of the minted Alpha Tokens will also be injected into the liquidity pool, in an amount equal to the amount of $TAO allocated divided by the price.

The allocation of $TAO block rewards will not affect the price of the Alpha Token, but will only enhance the depth of liquidity in the liquidity pool of the Alpha Token, allowing for lower slippage when buying and selling Alpha Tokens, and increasing the actual amount of $TAO that Alpha Tokens can be exchanged for.

3. Trading Alpha Tokens causes price fluctuations

When $TAO holders buy Alpha Tokens, the price will rise, and when Alpha Token holders sell to exchange for $TAO, the price will fall.

In addition to directly buying Alpha Tokens with $TAO, Alpha Tokens can also be obtained through minting.

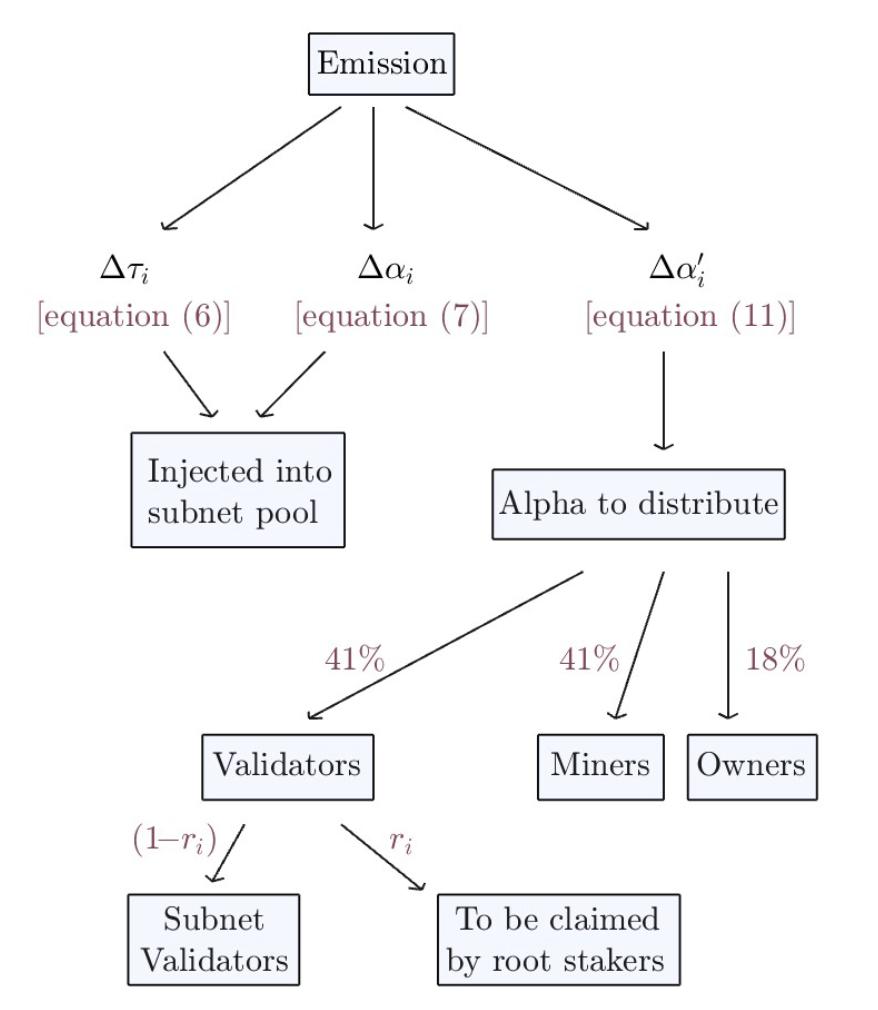

The minting of Alpha Tokens will be distributed to the SNs' Validators, Miners, Owners and Root Stakers. Among them, Miners get 41%, Owners get 18%, and Validators and Root Stakers get 41% together.

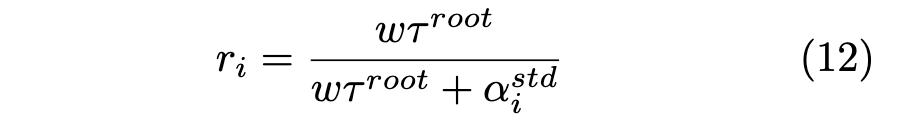

How specifically the Validators and Root Stakers are divided depends on the amount of freely circulating Alpha Tokens and the setting of the "tao weight" constant:

When the "tao weight" is unchanged, the higher the amount of Alpha Tokens outside the liquidity pool, i.e. the freely circulating Alpha Tokens, the higher the proportion of minted Alpha Tokens that Validators can receive, and the lower the proportion for Root Stakers.

The "tao weight" is a constant used to adjust the proportion of minted Alpha Tokens that Root Stakers can receive. Its purpose is to smooth out the violent price fluctuations of Alpha Tokens in the early days of DTAO launch. When the "tao weight" takes different values, the trend of the proportion held by Root Stakers over time is as shown in the following figure:

What changes does Dynamic TAO bring to network participants?

The price of the Alpha Token is the sole factor determining how much $TAO Emissions an SN can receive, so the Validators, Miners and Owners of the SN must consider the impact on the Alpha Token price when cashing out their incentives.

If the price of the Alpha Token can maintain an upward trend for a period of time, the situation of the SN participants can enter a virtuous cycle:

The price of the Alpha Token rises, the net inflow of $TAO to the SN increases ➡️ The $TAO Emissions received increase, the liquidity of the Alpha Token is enhanced, and the slippage when exchanging for $TAO is reduced ➡️ The actual amount of $TAO that Alpha Token holders can exchange for increases ➡️ More users are attracted to buy Alpha Tokens ➡️ The price of the Alpha Token continues to rise

But if the price of the Alpha Token enters a downward trend, it may enter a vicious cycle:

The price of the Alpha Token falls, the net inflow of $TAO to the SN decreases ➡️ The actual amount of $TAO that Alpha Token holders can exchange for decreases ➡️ Alpha Token holders rush to sell their Alpha Tokens ➡️ The price of the Alpha Token continues to fall

How does Dynamic TAO make the Bittensor ecosystem more competitive and the incentives more fair?

- Price becomes the only KPI for SN participants, and SNs that cannot maintain the price will be gradually eliminated.

- Newly launched SNs can more easily obtain a higher proportion of $TAO Emissions, but whether they can sustain it depends on whether they can always maintain a net inflow of $TAO.

- It weakens the ability of a small number of leading Validators to directly decide how to allocate $TAO Emissions.

- It solves the problem of Validators, Miners and Owners being able to sell $TAO Emissions without any burden.

- It transfers a portion of the selling pressure brought by $TAO emissions to the traders of Alpha Tokens.

How should $TAO holders participate?

1. For conservative holders

If you don't want the $TAO base to suffer any losses, holders should stake all their $TAO to the Root Network.

$TAO staked in the Root Network can "freely" receive Alpha Tokens from all Subnets, ensuring that the $TAO base can grow without any drawdown. However, the better the price performance of an Alpha Token, the smaller the proportion that Root Stakers can receive.

2. For stable holders

If you want to pursue a higher rate of return, and can accept a certain drawdown in the $TAO base, holders can adopt a barbell strategy, staking the majority of $TAO to the Root Network, and buying a small portion of Alpha Tokens that are likely to rise in the short term.

3. For aggressive holders

If you want to maximize your returns and can accept greater volatility, you can actively participate in the price game of Alpha Tokens, capturing the growth dividends of Subnets and market sentiment fluctuations through strategic operations. Specific strategies can include:

- Bet on high-growth Subnets

Screen promising tracks: Focus on Subnets with strong technical innovation, active ecosystem cooperation (integrated with leading protocols) or impressive team background (proven development capabilities).

Capture early dividends: Quickly buy Alpha Tokens in the early days of a new Subnet, build positions before the price fully reflects the value, and quickly sell to other followers.

- Capture market sentiment cycles

Uptrend cycle: In the early stages of a price uptrend, when Alpha Tokens are rising consecutively and trading volume is amplified, increase positions and delay selling the minted Alpha Tokens to push up the price and attract follow-up funds.

Downtrend cycle: When the Subnet shows negative signals, take the lead in selling Alpha Tokens or even short-selling, and buy back at the bottom to capture the price difference.