Nightmare of Data: The Battle Between Bulls and Bears in the Face of Unexpected CPI

On the evening of February 12, 2025 at 9:30 PM, the U.S. Bureau of Labor Statistics announced that the seasonally adjusted CPI year-over-year for January was 3%, higher than the expected 2.9%. Immediately after the data release, Bit plummeted, dropping from $96,500 to $94,000 within 15 minutes, with over $150 million in liquidations, as the bears cheered the "return of the inflation specter".

On-chain Data Dashboard:

- Exchange Net Inflows: In the 24 hours before the data release, Coinbase saw a large inflow of 12,000 BTC, suspected to be institutions hedging in advance.

- Plunge in Long-Short Ratio: Binance BTC perpetual contract funding rate fell from +0.03% to -0.12%, indicating bear market dominance.

- Fear Index: Crypto Fear & Greed Index plunged from 78 (Extreme Greed) to 42 (Fear).

Against the backdrop of inflation data exceeding expectations, market participants expect the Federal Reserve to only cut rates once in 2025, and subsequent rate hikes to be paused until 2026. This expectation has led to a short-term correction in Bit and other top cryptocurrencies.

Due to persistent inflation and the Federal Reserve's likely reluctance to cut rates in the near term, this may dampen investors' optimism for the cryptocurrency market in 2025. However, if President Trump continues to push pro-crypto policies, despite the lower likelihood of Fed rate cuts, this could still boost investor confidence and drive a market rebound.

Just a month after taking office, President Trump signed an executive order, fulfilling his promise to the crypto industry and creating a more favorable regulatory environment for digital assets. At the same time, he has shifted his attention to resolving international issues and taking steps to ease the conflict between Russia and Ukraine. According to Trump's posts on the social media platform Truth Social, he has had dialogues with Putin and Zelensky to discuss the possibility of ending the Russia-Ukraine war.

The cryptocurrency market has responded positively to these initiatives by President Trump, with Bit and major Altcoins rebounding.Looking back at the history of cryptocurrencies, the Russia-Ukraine war was one of the key factors that triggered the 2022 bear market.

Therefore, with the potential end of the war, Bit and other cryptocurrencies are expected to recover from the market correction on February 3 and present new growth opportunities.

State-Level Legislative Race: 27 States Enter, Generating $23 Billion in Purchasing Power

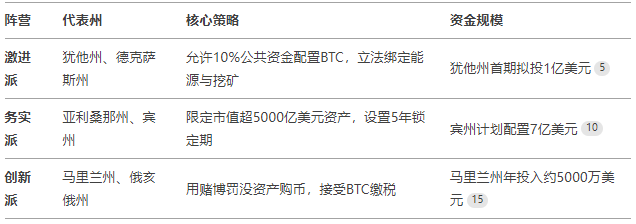

As of February 13, 27 states in the U.S. have introduced Bit reserve-related bills, forming three major camps:

VanEck estimates that if 20 key bills are passed, it will trigger $23 billion in Bit purchase demand (about 247,000 BTC), equivalent to 1.2% of the current circulating supply.

"This is not just the states' self-indulgence, but a race to reshape fiscal sovereignty." Dennis Porter, CEO of the Satoshi Nakamoto Action Fund, posted on the X platform, "When Utah fired the first shot, other states either follow suit or be abandoned by capital."

The Power Struggle Between Federal and State: Trump's "Million Bit" Gamble Stuck in Deadlock

Although Trump has boldly promised to "establish a million Bit reserve within five years", the federal-level progress is far behind the states:

Three Major Bottlenecks:

- Legal Ceiling: Using the seized 198,000 BTC requires Congressional approval, but the Democrats control key Senate seats.

- Gold Swap Controversy: The proposal to sell $455 billion in gold reserves to buy Bit has been strongly opposed by the Federal Reserve.

- Custody Dilemma: The BTC held by the Department of Justice is related to the rights of unresolved victims, and unauthorized use could lead to class-action lawsuits.

"Trump's promise is like the 'Star Wars program' of cryptocurrencies," said Arthur Hayes, former CEO of BitMEX, with sharp criticism, "State-level reserves are pragmatic innovations, while federal plans are political gimmicks - the former buys Bit with real money, the latter only wants to use paper narratives to win votes."

Market Impact: Paradigm Shift from "Policy Narrative" to "On-chain Footprint"

Short-term Shocks:

- Amplifier of Volatility: The divergence between state legislative processes and federal policies will exacerbate price fluctuations, with key milestones including:

- February 14: Utah State Senate vote (67% chance of passing)

- May 7: If the Utah bill takes effect, it may trigger follow-up legislation in states like Texas

- New Institutional Arbitrage Strategy: ProShares has launched a "State Policy Volatility Index Futures" to hedge legislative risks

Long-term Restructuring:

- Battle for Dollar Hegemony: The reality of 95% stablecoins being pegged to the U.S. dollar makes Bit reserves a "decentralized U.S. debt"

- Breeding Ground for Regulatory Arbitrage: Texas, with its cheap electricity and lax legislation, is attracting companies like MicroStrategy

- Driving Technological Revolution: ZK-Rollup scaling solutions have reduced Bit on-chain settlement costs to $0.01, paving the way for fiscal applications

"This is not just a simple asset allocation, but a sovereign financial experiment in the digital age." Meltem Demirors, Chief Strategy Officer of CoinShares, pointed out, "When state governments start paying civil servants in Bit, the definition of money will be permanently redefined."

Viewpoint: Beware of the "Policy Liquidity Trap"

- Short-term Bullish Logic: The $23 billion in purchase demand from state-level legislation is real money, far exceeding the average daily inflow of ETFs (about $300 million). If the Utah bill is passed, Bit may challenge the $105,000 resistance level.

- Medium-term Risk Warning:

- Most state bills set a 10% holding cap, and when the Bit market cap exceeds $2 trillion, the passive selling pressure could exacerbate volatility

- After the 2026 election, if the Democratic Party takes power, they may overturn the existing policies, leading to "legislative cycle fluctuations"

Ultimate Battleground Focus: Pay attention to the correlation between Bit and U.S. Treasury yields - if the 10-year Treasury yield breaks above 4.5%, institutions may sell Bit to raise liquidity.

Investment Guidance for Investors:

- Offensive and Defensive Strategy: Hold spot positions + buy $94,000 put options to lock in downside risk

- Policy Event Arbitrage: Go long on volatility (e.g., buy straddle option strategies) before key legislative votes

- Long-term Value Anchoring: Screen for "legislation-friendly" targets (e.g., Texas miners, custody service providers)