Author: Stella L (stella@footprint.network)

Data source: Footprint Analytics Blockchain Game Research page

Although the crypto market as a whole remained strong, the game sector's market capitalization declined by 19.3% to $22.3 billion. This month, the market's main focus was on social platforms, with TON receiving exclusive authorization for Telegram's blockchain infrastructure, while LINE launched a Mini Dapps ecosystem through Kaia.

Macro Market Review

Bitcoin rose from $94,577 to $102,180, an increase of 8.0%. However, Ethereum performed weakly, falling from $3,353 to $3,292, a decline of 1.8%, and the ETH/BTC ratio reached a new low since September 2024.

Several important policy developments significantly impacted the crypto market. The Trump administration's executive order on cryptocurrency regulation provided the industry with unprecedented clear guidance, particularly emphasizing the protection of self-custody rights and supporting stablecoin development. However, Trump's remarks on international trade tariffs at the end of the month raised concerns about global economic growth, dampening market sentiment.

The Trump family's launch of $TRUMP and $MELANIA tokens on Solana triggered a violent fluctuation in the Memecoin sector. This speculative frenzy significantly diverted the market's attention and capital from other crypto sectors, including the blockchain gaming sector.

DeepSeek's breakthrough progress in the field of artificial intelligence also influenced market dynamics. This development accelerated the focus on decentralized AI infrastructure within the crypto ecosystem, and AI-related tokens saw an increase this month.

Blockchain Gaming Market Overview

In January, despite the overall strength of the crypto market, the Web3 gaming sector faced headwinds. The market capitalization of blockchain gaming tokens declined from $27.6 billion to $22.3 billion, a decrease of 19.3%.

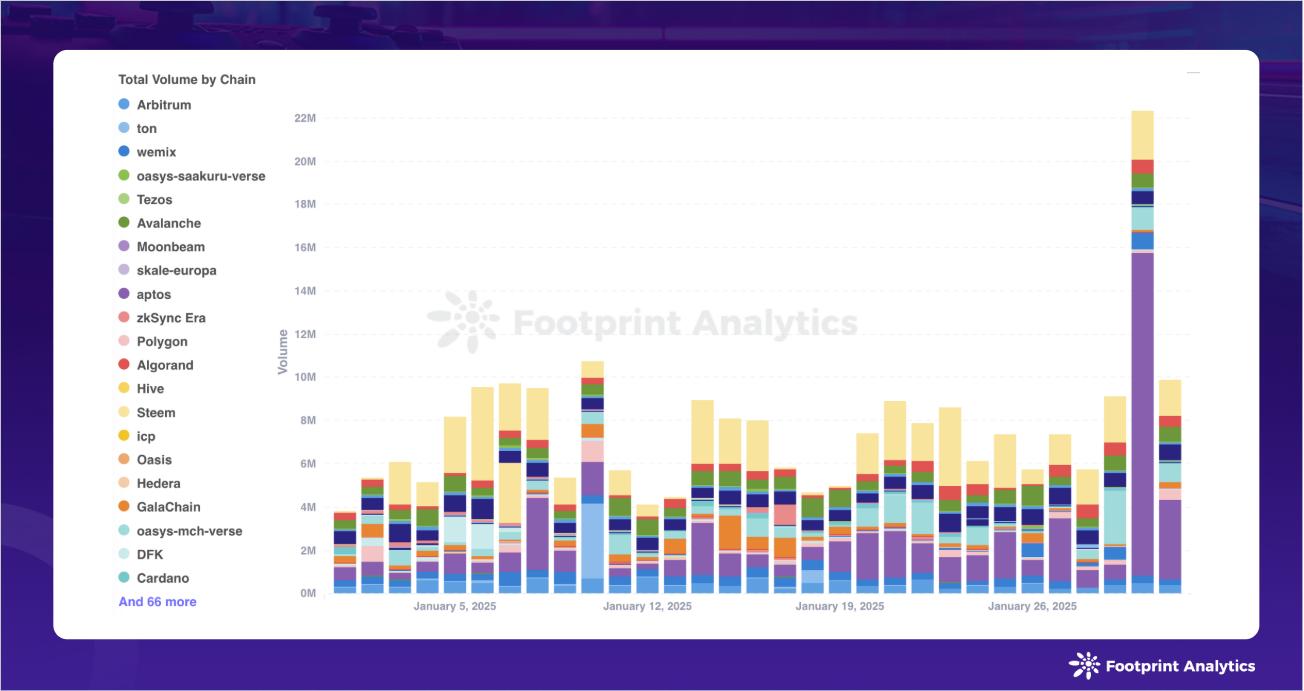

On-chain activity indicators also performed weakly, with monthly transaction volume declining by 7.2% to 550 million transactions and transaction volume declining by 12.4% to $230 million.

On January 21, the TON Foundation announced that it had received exclusive authorization for Telegram's blockchain infrastructure, marking a significant turning point for the ecosystem. This exclusive partnership requires all Telegram-based applications to migrate to TON within 30 days, putting pressure on projects built on other chains. Although the TON Foundation will provide incentives for early adopters who complete the blockchain migration by February 21, this has posed substantial technical and community challenges for the affected gaming projects.

The day after the above announcement, LINE launched Mini Dapps and a Dapp Portal through LINE NEXT, reflecting the emerging competitive landscape in the social platform gaming sector. Kaia Wave plans to launch 32 Mini Dapps in the initial batch, showcasing a more controlled, ecosystem-oriented approach compared to Telegram's relatively open development environment.

These platform-level changes, combined with the decline in market indicators, suggest that the Web3 gaming sector is entering a consolidation phase, where platform integration and user experience may take priority over token economics. The approaches of Telegram and LINE may significantly influence how blockchain gaming projects handle user acquisition and retention strategies in 2025.

Blockchain Gaming Chains Overview

In January 2025, the number of active blockchain games increased slightly by 1.4% to 1,697. Traditional market leaders maintained their positions in game distribution: BNB Chain (24.2%), Polygon (15.6%), and Ethereum (13.1%). However, this stability in game distribution contrasts sharply with the significant changes in on-chain activity.

Transaction activity exhibited a clear concentration trend, with three chains dominating. WAX led with 180 million transactions, accounting for 32.4% of all gaming activity. opBNB recorded 87.2 million transactions, ranking second with a 15.9% share, while Aptos recorded 37.5 million transactions (6.8% share). These three chains collectively accounted for over 55% of all gaming transactions in January.

In terms of transaction volume, Aptos led with $51.9 million (22.1% share), followed by Ronin with $49.5 million (21.1% share). Immutable X ranked third with $19 million (8.1% share).

The competition for developers among chains has intensified, with various aggressive incentive programs. Sonic SVM and Galaxy Interactive's multi-million dollar funds are targeting the intersection of Web3 gaming and AI, reflecting the market's growing focus on AI-enhanced gaming experiences. Meanwhile, Ronin Network's $10 million grant program has expanded beyond gaming to consumer applications and DeFi protocols, aiming to build a more comprehensive ecosystem.

Blockchain Gaming Investments and Fundraising

In January 2025, Web3 gaming investment activity continued its downward trend, with 6 fundraising events raising a total of $31.2 million. The decline in fundraising activity reflects the broader market dynamics. The surge in speculative activity has significantly diverted the market's attention and capital from other crypto sectors, including the blockchain gaming sector.

Pixion Games led the month's fundraising activities, raising $4 million in a strategic funding round led by Delphi Ventures, with participation from Spartan Capital, Sky Mavis, and Animoca Brands. The studio's flagship game, Fableborne, combines ARPG mechanics with strategic base-building elements. Its success on Ronin is particularly noteworthy. Other notable gaming fundraising events include Drift Zone, BeraTone, and Nakamoto Games.

Infrastructure development remains a focus for investors, with two important funding rounds: ZKcandy raised $4 million for its game-specific Layer 2 chain based on ZKsync, after successfully completing the open testnet phase. Additionally, Hyve Labs raised $2.75 million to develop its core infrastructure, such as launching a testnet chain, its first game, and other on-chain assets.