The issuance of new Altcoins has grown by more than 12 times, with analysts warning that investors' funds are being diluted and the price trend is "chaotic".

The issuance of new Altcoins reached a historic high in January, with analysts expressing concerns about the lack of liquidity for market investors.

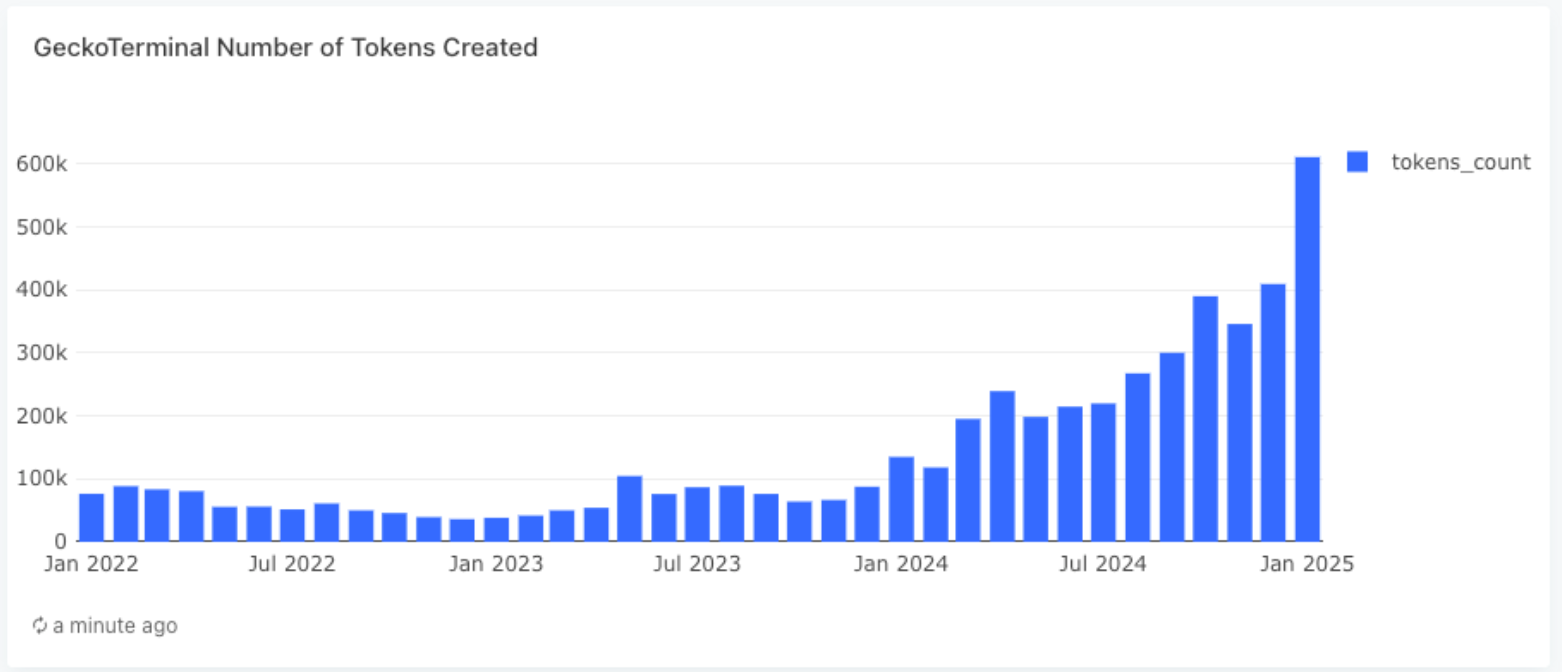

According to data shared by CoinGecko co-founder and COO Bobby Ong on the GeckoTerminal, more than 600,000 new Altcoins were launched in January, a 12-fold increase compared to the same period in 2024.

Ong wrote in a X post on February 14th: "In 2022-2023, we were minting around 50,000 new tokens per month."

"Fast forward to Q4 2024, we're seeing 400,000 new tokens per month, and in January 2025 we hit a record of 600,000 new tokens per month!" he added.

source:https://x.com/bobbyong/status/1890321440844439712

Ong said that platforms like Pump.Fun, which simplify token creation, have also contributed to this surge.

Gabriel Halm, a research analyst at crypto intelligence platform IntoTheBlock, said the growth in token issuance also reflects the "natural exuberance of the crypto market".

He told Cointelegraph: "As a result, the proliferation of tokens today has fragmented liquidity and investor attention, leading to more chaotic price trends."

Due to the lack of liquidity in the crypto market, even more mature Altcoins lack the momentum to recover to their 2021 highs. However, analysts predict that the Altcoin season may be delayed due to the proliferation of cryptocurrencies leading to token fragmentation.

Traditional financial institutions are changing the crypto liquidity rotation

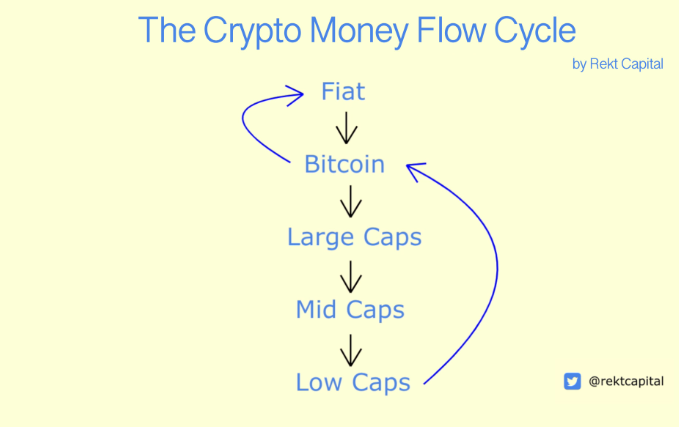

In previous crypto bull markets, profits from the rise of Bitcoin (BTC) would typically flow into Ethereum (ETH), and then into Altcoins and more speculative meme coins.

Crypto market liquidity. Source: Rekt Capital

However, Halm said the growing institutional participation is changing the dynamics of liquidity flow in the market:

"With the near-exponential growth of new crypto assets, the emergence of traditional financial institutions as participants in this space will inevitably alter the liquidity rotation that has occurred in previous cycles, reshaping the way capital flows in the crypto realm."

CoinGecko's Ong also pointed out that liquidity fragmentation is the problem behind the lack of momentum in the crypto market.

Ong said in a subsequent X post: "There are too many tokens, and each token will fragment the limited attention and liquidity of traders. That's why we haven't seen the great Altcoin rallies of previous cycles."

He added that at the current pace, the number of tokens in the crypto industry could exceed one billion within five years.