Why Focus on Fluid

On February 15, 2025, the Ethereum ecosystem witnessed a landmark event - the decentralized exchange Fluid became the second-largest DEX on the Ethereum mainnet with a 20% market share, and its total locked value (TVL) surpassed $9.2 billion. This achievement not only surpassed traditional protocols like Curve, but also redefined the capital efficiency of decentralized exchanges. Fluid's success stems from its innovation in integrating lending and trading depth. Through its "smart debt" and "smart collateral" mechanisms, it can convert every $1 of TVL into $39 of effective liquidity, breaking the bottleneck of traditional DEX capital efficiency and ushering in a new era of "super applications" in the DeFi field. This article will delve into Fluid's technical innovations, economic model, and its potential far-reaching impact on the entire industry.

What is Fluid

Fluid is an innovative DeFi super application developed by the Instadapp team, aiming to integrate lending protocols, decentralized exchanges (DEXs), and liquidity pools to improve the overall operational efficiency of the system through a unified capital pool. Fluid adopts a brand-new architecture, breaking down the barriers between traditional DeFi protocols and driving the deep integration of the three core modules: lending, trading, and liquidity. Its architecture includes the following three core components:

- Liquidity Layer: As the underlying infrastructure of Fluid, the liquidity layer aggregates the liquidity pools of multiple protocols (such as lending pools and DEX trading pairs), effectively avoiding the problem of market liquidity fragmentation. Its design concept is similar to the "unified liquidity layer" proposed by Aave v4, aiming to improve overall capital efficiency through cross-protocol liquidity aggregation and avoid unnecessary capital waste.

- Lending Protocol: Fluid's lending protocol supports the ERC4626 standard, allowing users to borrow stablecoins by collateralizing a single asset (such as ETH), and the system ensures that the collateral will not be re-collateralized, effectively reducing potential systemic risk. This design ensures the transparency and security of user lending, and also makes the returns for liquidity providers more predictable.

- DEX Protocol: Unlike traditional DEXs, Fluid deeply integrates lending and trading, allowing users' borrowing debts to be automatically converted into DEX liquidity. For example, after a user borrows stablecoins (such as USDC or USDT), this part of the debt will be automatically adjusted according to market demand, and the user can also earn trading fee income during this process, realizing a new business model of "debt productization".

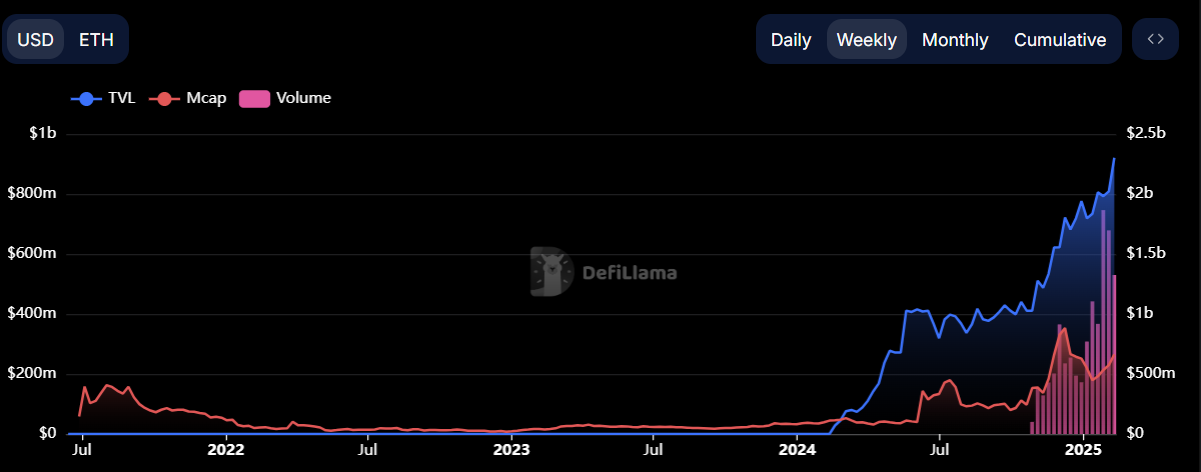

As of February 9, 2025, the total locked value (TVL) of the Fluid protocol has reached $9.2058 billion, and its market capitalization (Mcap) is $2.6523 billion. During this period, the trading volume (Volume) of the Fluid protocol also reached $1.325 billion, and the market capitalization to TVL ratio is 0.29, indicating its strong potential in capital efficiency in the DeFi field. These data not only reflect the emergence of Fluid as an innovative protocol in the market, but also demonstrate its tremendous success in improving capital utilization efficiency.

Technical Advantages: The Core of Explosive TVL Growth

Fluid's TVL has achieved more than 3-fold growth between November 2024 and February 2025, behind which lie some technological innovations that traditional lending platforms and DEXs cannot match. Fluid's core advantages can be summarized as follows:

Dynamic Debt Mechanism: Turning Debt into Liquidity

In the traditional lending market, debt is usually a burden - if borrowers cannot repay on time, the system faces liquidation risk. However, Fluid has broken this convention by introducing a dynamic debt mechanism. In simple terms, Fluid allows users' debts to be automatically adjusted according to changes in market demand. For example, when the market needs USDT, the borrowed USDC may be converted to USDT, and the debt structure is dynamically rebalanced. This design is like adding "flexible wings" to the debt, not only reducing liquidation risk, but also creating additional trading fee income for users, significantly improving capital efficiency.

Ultra-High Capital Efficiency: $39 of Effective Liquidity per $1 of TVL

Another killer feature of Fluid is its ultra-high capital efficiency. Through the perfect combination of smart collateral and smart debt, Fluid can leverage $1 of TVL to create $39 of effective liquidity, a miracle comparable to leveraged investment. Traditional DEXs like Uniswap rely on liquidity providers to invest more capital, while Fluid, through its ingenious technical design, allows every penny to play the maximum role. For example, users can mix WBTC and cbBTC as collateral, utilizing leverage and smart risk management systems to steadily advance in market fluctuations, achieving higher capital utilization than traditional platforms.

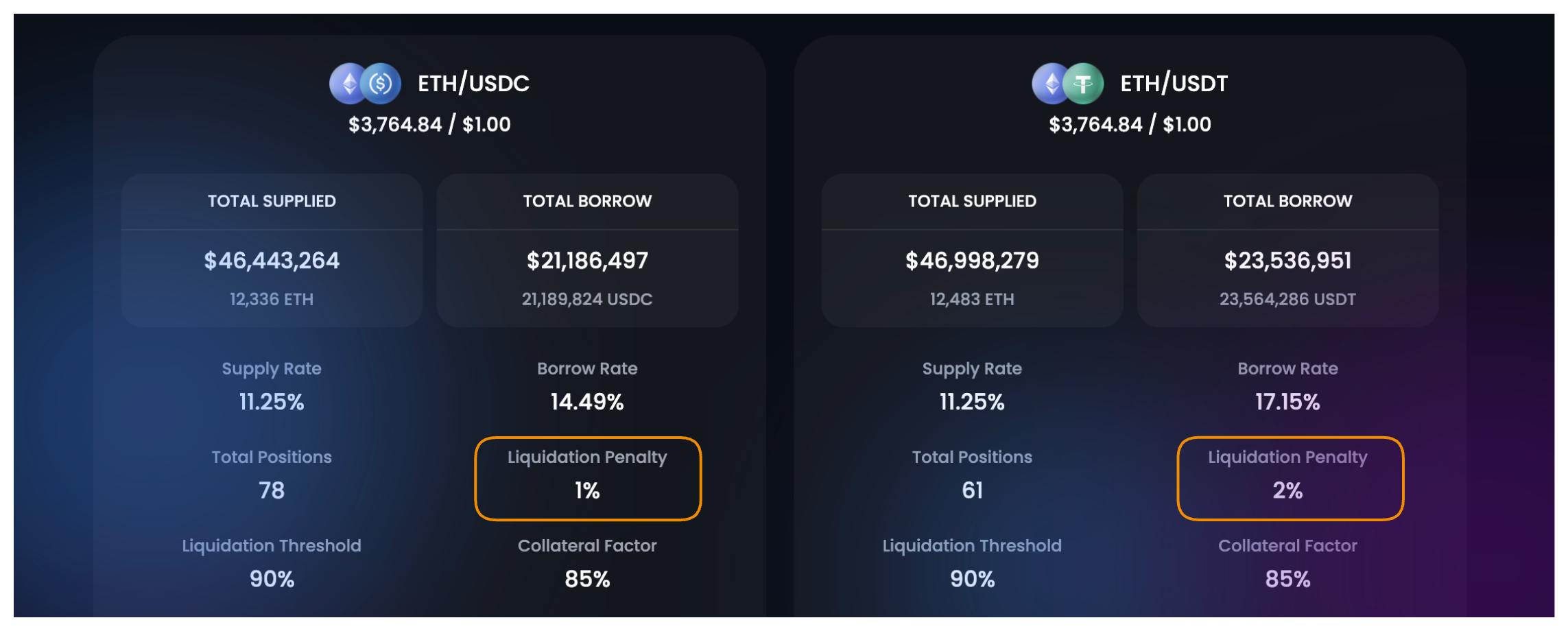

Advanced Liquidation Mechanism: Optimizing Capital Utilization, Reducing Market Impact

Fluid protocol's liquidation mechanism is a highlight of its technology. Compared to traditional DeFi protocols, it not only improves liquidation efficiency, but also greatly reduces the costs associated with liquidation. Based on a time-slot method, Fluid aggregates the debts and collaterals of all vaults within each time slot, and when the debt ratio exceeds the liquidation threshold, the protocol will complete the liquidation through a single transaction. This design is inspired by the slot-based liquidity of Uniswap v3, allowing Fluid to efficiently liquidate multiple positions, reducing gas fees and market impact during the liquidation process.

More importantly, Fluid's minimum impact liquidation method only liquidates the necessary part of the debt to restore the account's health status, rather than liquidating a large number of positions at once like traditional systems. This not only minimizes market shocks, but also avoids the chain liquidation effect, keeping the market more stable during turbulence. Moreover, Fluid's liquidation system allows any trader to participate as a liquidator, no longer relying on a dedicated liquidation bot network. Traders can participate in the liquidation process through regular DEX platforms (such as 1inch, Paraswap, and 0x), and receive discounted collateral from the liquidation, while liquidating Fluid's debt, making the entire liquidation process more decentralized and efficient.

Anti-Liquidation Risk: Successfully Weathering Market Crashes

Fluid has adopted a 97% liquidation threshold and a 0.1% penalty mechanism, successfully handling the largest liquidation event in history during the market crash in February 2025, avoiding the accumulation of bad debts. The advantage of this mechanism is that by setting an appropriate liquidation threshold, the system can make timely adjustments during severe market fluctuations, avoiding the uncontrolled liquidation of a large amount of capital, while ensuring the safety of liquidity providers and borrowing users.

Here is the English translation of the text, with the specified terms translated as requested:The Evolution of the Instadapp Team Behind Fluid

Instadapp, founded in 2019, is an innovative digital finance service platform dedicated to simplifying users' investment operations in the decentralized finance (DeFi) field. Instadapp provides a simple and intuitive interface, allowing users to seamlessly operate across multiple DeFi protocols without relying on traditional financial intermediaries such as banks or brokers. Based on blockchain technology, Instadapp utilizes the DeFi Smart Layer (DSL) protocol to aggregate multiple DeFi protocols on a scalable smart contract layer, enabling cross-protocol interaction and management. This innovation has made asset management, lending, trading, and liquidity provision operations more efficient and user-friendly, driving the adoption and development of DeFi.

In 2021, Instadapp launched the governance token INST, marking an important step for the team in the realm of decentralized autonomous organizations (DAOs). The INST token not only serves a governance role in the protocol but also provides an incentive mechanism for users, further promoting the development and optimization of the platform.

As the DeFi market has grown rapidly, the Instadapp team has keenly captured the increasing demand for capital efficiency and liquidity. In this context, the team launched the Fluid Protocol in February 2024 and released a brand refresh and growth plan later that year. The Fluid protocol aims to redefine the models of decentralized lending and trading, breaking down the traditional barriers between lending and trading, and enhancing capital fluidity and market efficiency by integrating these two functions on a single platform.

The core product of the Fluid protocol is USDF, an over-collateralized stablecoin designed to provide higher capital security for the decentralized lending market and reduce the impact of market volatility on lending activities. The introduction of this stablecoin not only enhances the platform's appeal but also provides new financial security guarantees for the DeFi market.

With the launch of the Fluid Protocol, the Instadapp team continues to deepen its innovation in the DeFi field, driving the protocol's ongoing development. In October 2024, Fluid completed a $3.9 million seed funding round, with the funds to be used for accelerating the development of USDF, enhancing the protocol's security, and expanding the team. This round of funding was participated in by investment institutions such as Bloccelerate, Animoca Ventures, and CMS Holdings, and angel investors like Meltem Demirors and Kartik Talwar also provided strategic support for Fluid.

The success of the Fluid protocol has garnered widespread attention in the DeFi community. In November 2024, the Aave community decided through an ARFC proposal to invest in the INST token and establish a strategic partnership with Instadapp. Through this collaboration, the Aave DAO will provide support for the GHO trading pair on Fluid and promote the development of more cross-protocol products based on Aave and Fluid. This move not only brings more liquidity to Fluid but also further consolidates Fluid's position in the DeFi ecosystem.

Within the next 12 months, Fluid plans to launch a series of important upgrades, including a DEX v2 version, lending and trading support for more assets, optimization of the ETH Lite Vault, and the deployment of a new DEX on Layer 2 networks. These initiatives will further improve transaction efficiency and capital utilization, driving Fluid's continued growth in the DeFi market.

To strengthen the market demand and governance structure of the token, the Instadapp team has decided to rename the INST token to FLUID and implement a revenue buyback plan of up to 100%. This plan will further enhance the token's liquidity and promote the long-term development of the Fluid protocol.

The success of the Fluid protocol is not a coincidence but the result of the Instadapp team's years of dedication to the DeFi market and their precise grasp of industry trends and user needs. With its innovative design and strong technical foundation, Fluid is expected to occupy an increasingly important position in the future DeFi landscape, bringing new opportunities and challenges to the decentralized finance field.

Token Economic Model and Governance Structure

INST Token Total Supply

- Total Supply: 1 billion INST (1,000,000,000 INST).

- This is the maximum total supply of the token, meaning that the platform will not issue more than this amount of INST tokens.

Initial INST Token Distribution

Instadapp's initial token distribution is based on multiple factors, including the platform's ecosystem development, team incentives, and investor support. The following is a general distribution plan, with the specific percentages subject to adjustment based on the project's development and community needs:

- Team and Advisors: Approximately 20% (200,000,000 INST)

- These tokens are typically subject to a vesting period to ensure the long-term participation of the team and advisors.

- Community Rewards: Approximately 40% (400,000,000 INST)

- This portion of tokens is usually used to incentivize liquidity providers, lending protocol participants, and other ecosystem contributors.

- This includes liquidity mining, platform user rewards, governance rewards, and more.

- Investors and Strategic Partners: Approximately 20% (200,000,000 INST)

- This includes the token allocation for early investors and strategic partners, which are often subject to vesting periods.

- Foundation and Ecosystem Development: Approximately 10% (100,000,000 INST)

- This part of the tokens is typically used to support the expansion of the platform's ecosystem, including community building, marketing, and protocol upgrades.

- Public Sale and IDO (Initial DEX Offering): Approximately 10% (100,000,000 INST)

- These tokens are distributed to public investors through open sales or IDOs, allowing Instadapp to raise funds to support its development.

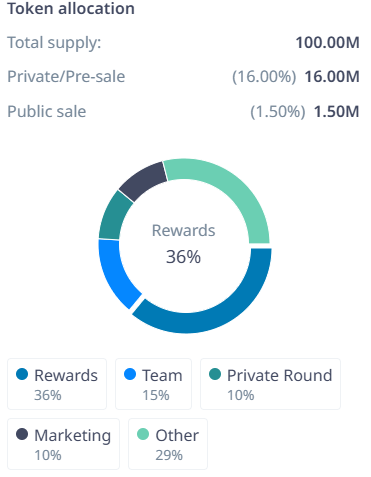

As an integral part of the Fluid protocol, the $INST token will be converted to the $FLUID token at a 1:1 ratio, and all existing holders will not need to take any action. Through this conversion, the Fluid protocol has successfully achieved a brand refresh and enhanced the token's liquidity, without diluting the holders. The total supply remains the same (100 million), and the token addresses remain unchanged.

Fluid also plans to launch an algorithmic buyback program once the protocol reaches $10 million in annualized revenue. The core of this buyback plan is based on the x * y = k model, with the buyback volume dynamically adjusted according to the fully diluted market value (FDV) of the $FLUID token. Up to 100% of the earnings will be used for buybacks, with the buyback ratio fluctuating based on market conditions - higher during market downturns and lower when prices are high. All the repurchased tokens will be held in the governance treasury, with the governance deciding whether to burn, distribute to holders, or use them for user rewards.

To drive the Fluid protocol to reach a market size of $10 billion by the end of 2025, the team has proposed the following growth incentive measures:

- A monthly 0.25% of the token supply will be used to incentivize stable lending.

- A monthly 0.25% of the token supply will be used to incentivize DEX activities.

- The governance will allocate 5% of the total supply to ensure the liquidity and market stability of $FLUID through the creation of DEX pools.

Additionally, 12% of the governance treasury will be used to fund key growth initiatives, with the following breakdown:

- 2% for exchange listings

- 2% for market making

- 5% for fundraising programs

- 3% for team expansion and new initiative implementation

These funds will provide a solid resource guarantee for the rapid expansion of the Fluid protocol.

Summary

At the end of 2024, Fluid experienced a significant surge, with a growth rate of 8 times, which invigorated the market. Although Fluid is currently in a correction phase following the ETH series projects, its market resilience remains stronger compared to mature competitors such as CRV and UNI. This not only reflects the potential of its protocol architecture and innovative design, but also demonstrates Fluid's unique positioning in the market.

This strong corrective performance reflects Fluid protocol's unique competitiveness in the DeFi field, particularly in terms of capital efficiency, liquidation mechanisms, and decentralized trading functions. As the market environment gradually recovers, Fluid is expected to maintain its growth momentum and achieve further breakthroughs in the coming months. For investors and ecosystem participants, Fluid provides an opportunity worth paying attention to and participating in, and its future development potential is worth looking forward to.