In the past week, the Bitcoin ETF set a record for the largest weekly net outflow, with about $650 million in funds withdrawn from the market. This phenomenon not only shook the market, but also triggered a new round of discussion about the trend of cryptocurrency fund flows. So, is the capital outflow from the Bitcoin ETF a signal of market adjustment, or a potential positive for the Ethereum ETF? Meanwhile, has the ETH/BTC exchange rate already bottomed out and is it preparing for a rebound? Against the backdrop of a volatile market, the future trend of ETH/BTC is worth pondering.

This article will delve into the market performance of Bitcoin and Ethereum, explore the changes in the ETH/BTC exchange rate and the underlying technical signals, as well as the potential impact of these changes on the future market.

Bitcoin market fluctuations: Surge in capital inflows and decline in trading activity

In the past week, the price of Bitcoin has continued to fluctuate in the range of $98,600 to $95,000, with the latest quote at $96,300.

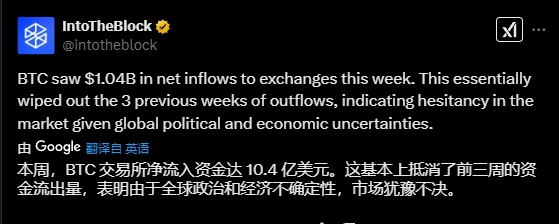

According to data from the on-chain analysis platform IntoTheBlock, in the past week, the net inflow of funds into cryptocurrency exchanges was about $1.4 billion, reflecting the polarization of market sentiment. The data shows that $1.04 billion in funds flowed into cryptocurrency exchanges last week, reflecting the deepening hesitation of investors, mainly due to the impact of global political and economic uncertainties.

This change in capital flow reverses the previous three-week trend of capital outflows, indicating that investors' sentiment is shifting towards risk hedging or cashing out. More worryingly, the transaction fees on the Bitcoin network have dropped significantly, with data showing a 10.74% decrease compared to the previous week, which is usually seen as a bearish signal for market activity.

In addition, the capital flow of spot Bitcoin ETFs has also become a focus of market attention. Although spot Bitcoin ETFs have been an important driver of the Bitcoin bull market this year, these ETFs saw an outflow of $650 million last week, setting a record for the largest weekly outflow since September 2024, indicating that some institutional investors may be withdrawing to cope with market uncertainties.

Ethereum whale activity: Large-scale accumulation suggests upside potential

In contrast to the record net outflow of the Bitcoin ETF, the Ethereum spot ETF saw a net outflow of only $26 million last week.

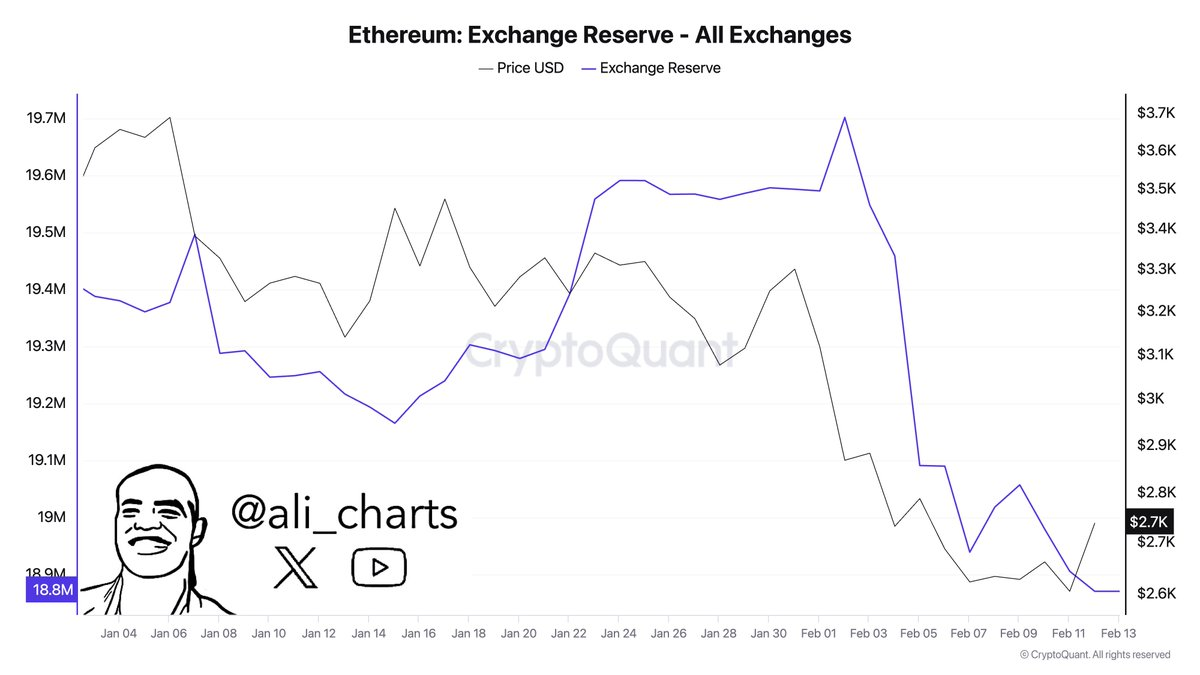

Crypto analyst Ali points out thatin the past 10 days, more than 900,000 Ethereum (ETH) have been withdrawn from exchanges, indicating that investors' accumulation sentiment has strengthened and selling pressure has gradually decreased. The value of 900,000 ETH tokens exceeds $2.457 billion, meaning that a large amount of capital has been locked up, reducing the supply available in the market.

Notably, the activity of ETH whales has increased significantly. ETH whales have purchased 280,000 ETH worth over $764 million in just three days. Such whale behavior usually has a strong price impact on the market, indicating that large investors are actively positioning in Ethereum, and the market may be poised for a new upward trend.

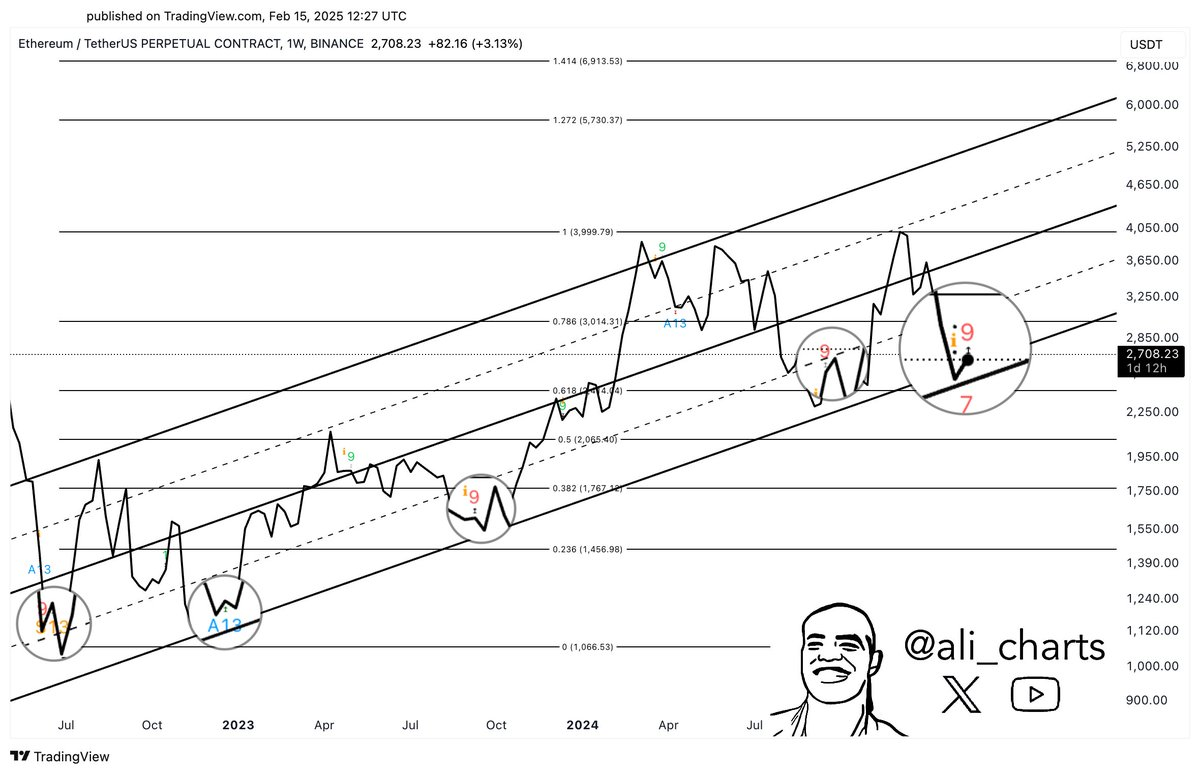

From a technical perspective, Ethereum is emitting bullish signals. According to the Tom DeMark (TD) Sequential indicator, which is used to measure the potential reversal points of an asset, Ethereum is approaching the support of the ascending channel diagonal, and the TD Sequential indicator is flashing a buy signal near the support. Historical data shows that when such signals appear, ETH prices usually experience a strong rebound, so the market may be on the verge of a similar rebound.

ETH/BTC exchange rate: Potential bottom signal

The ETH/BTC exchange rate of 0.027 has recently shown signs of potentially bottoming out.

With the continuous accumulation of ETH whales and against the backdrop of Bitcoin price fluctuations, the price of Ethereum relative to Bitcoin has begun to show rebound potential. From a long-term trend perspective, the low point of ETH/BTC may have been reached, and as the fundamentals of Ethereum are strengthened and market confidence in Ethereum's future potential is restored, ETH/BTC may enter a new upward cycle.

Institutional divergence on the current crypto market: Short-term profit-taking vs. long-term allocation narrative

1. Bear case: Overheating signals and policy risks

Institutions like Advantrade believe that after Bitcoin broke through $100,000 at the beginning of the year, the market has shown signs of "excessive optimism": the market capitalization of the Trump concept coin $TRUMP once soared to $75 billion before plummeting 80%, reflecting the speculative bubble of meme coins3. Coupled with inflationary pressures and economic weakness in the US, some institutions have chosen to lock in profits and wait for a pullback to $75,000 before re-entering.

2. Bull case: Institutional adoption and policy catalysts

Traditional asset management giants entering the market: BlackRock CEO Larry Fink predicts that if institutions allocate 2%-5% of their assets to Bitcoin, the price could reach $700,000. The Czech central bank has recently proposed allocating 5% of its foreign exchange reserves (about $7.3 billion) to Bitcoin, which, if implemented, would become the first "national-level holder" case.

Policy catalysts expected: The US government is proposing to establish a Bitcoin reserve (though not involving new purchases), which, if implemented, could potentially reshape market confidence.

Conclusion: "Stress test" of the bull-bear dividing line

The challenges currently faced by Bitcoin and Ethereum are not only technical barriers, but also a "stress test" of market confidence. In the short term, the selling pressure from Grayscale, the decline in on-chain activity, and the uncertainty of the macroeconomic environment have brought the risk of a pullback. However, from a medium to long-term perspective, the institutional adoption process, the approaching Bitcoin halving cycle, and the expected policy changes may provide greater upside potential for the market.

As Ethereum whales continue to accumulate and the market gradually recognizes the potential of Ethereum, the fundamentals of Ethereum are gradually strengthening. In comparison, Bitcoin faces macroeconomic uncertainties and technical barriers, which may limit its short-term upside. It is expected that in the coming period, the upside of ETH relative to BTC may outperform Bitcoin.