Author: Finish, Crypto KOL

Compiled by: Felix, PANews

This cycle is very difficult, worse than any previous cycle. Many even call it the "crime cycle" because the number of Rugs and projects scamming people has been growing.

The purpose of this article is to reflect on the past and try to predict what will happen next.

Birth of Pump.Fun

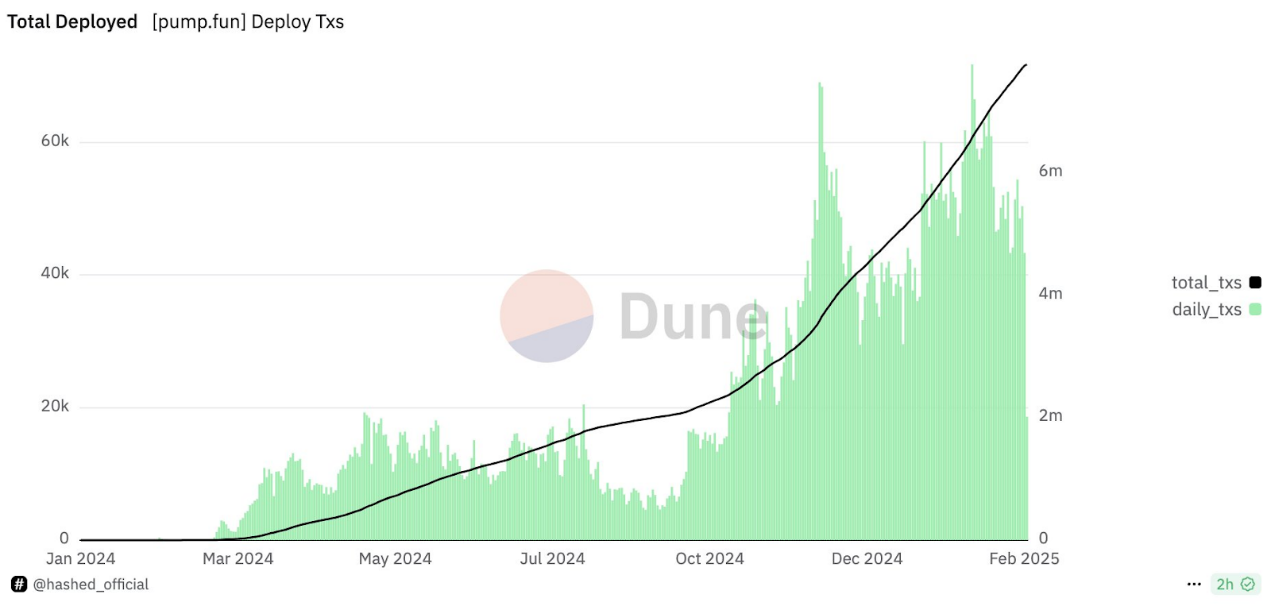

On January 19, 2024, Pump.fun was born, changing the well-known meme tokens forever. People of any age, occupation or nationality have the opportunity to issue tokens.

The hype was not that strong at the time, but eventually last March, with the emergence of tokens like MICHI and FWOG, Pump.fun began to rise. Almost anyone can publish a meme in just a few seconds, a phenomenon that has changed the entire crypto field.

Due to the bundling of many tokens, Pump.fun is a fair release opportunity without insider dumping. Although it looks good, it also charges a lot of fees.

Since its launch, Pump.fun has generated over $2.86 million in SOL, about $577 million. It may be one of the most successful startups ever.

This liquidity has been permanently extracted and captured by the Pump.fun developers, which is one of the key reasons that makes this cycle different.

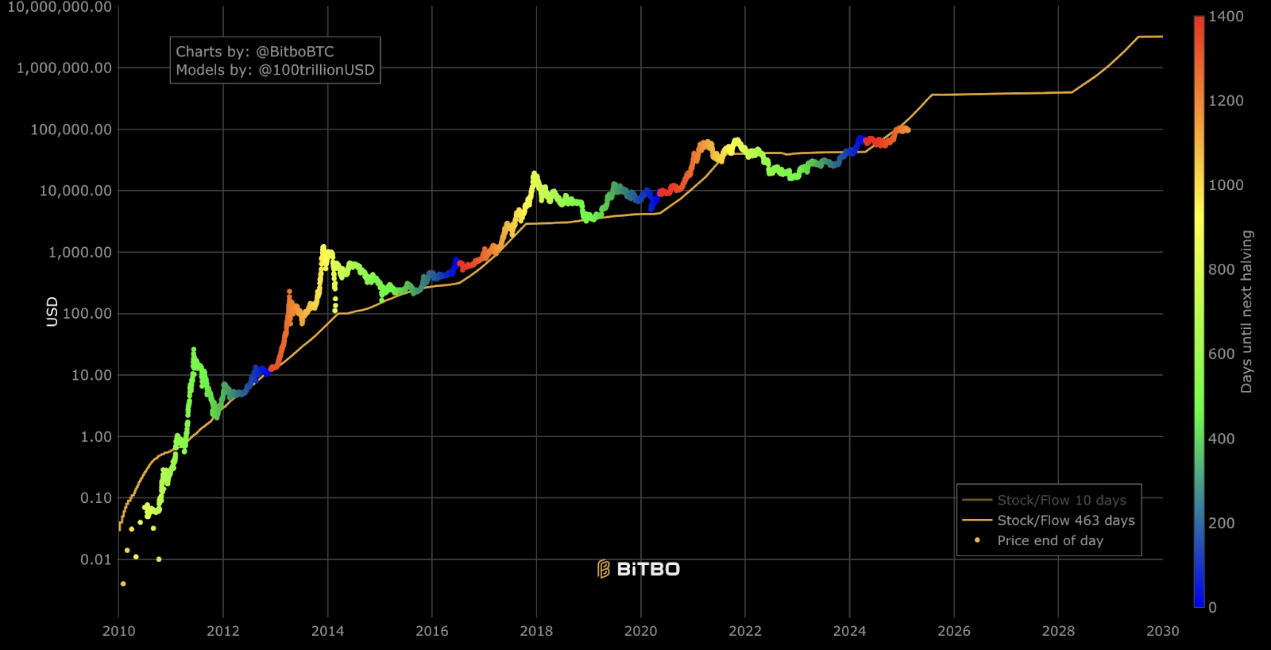

Bitcoin Halving

Next is one of the most critical moments in the current cycle. On April 20 last year, the reward for mining BTC blocks decreased from 6.25 to 3.125. With the first ETF approved on January 10, many thought the halving was a "sell the news" event, but instead new ATHs emerged.

ETF + Bitcoin halving is the most bullish setup, as many have been waiting for institutional liquidity to start flowing in, which is exactly what happened next. Fidelity, BlackRock and MicroStrategy have been buying daily, injecting more and more liquidity.

This gave traders hope. Many traders thought this cycle would be similar to the previous one, but this time, everything is different. The market's direction always seems to go against the "masses".

Your Expectations Are Your Problem

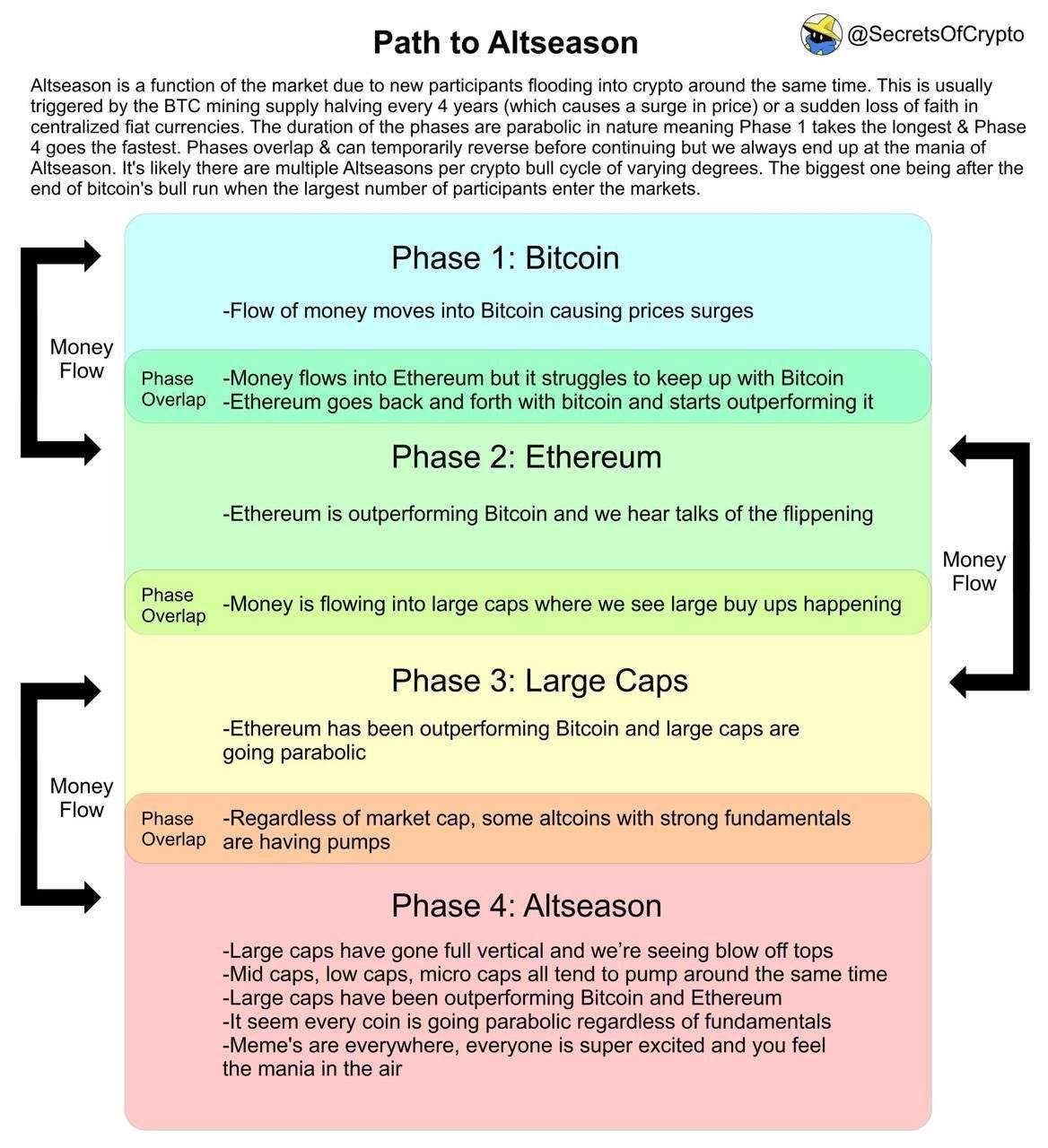

Looking back at the 2017 and 2021 cycles, these two cycles were actually very similar. Making money was not difficult and did not require any special knowledge. Back then, there were 10-20 Altcoins that everyone knew about and kept accumulating.

First BTC went up, then ETH as the cycle's beta play followed closely, often with higher returns. Then the transition from ETH to Altcoins, from high cap coins to low cap coins.

This is why many decided to skip the BTC phase in 2024 and go straight to ETH or Altcoins. If ETH can go up 5x, large Altcoins can even go up 10x, why wait for the 2-3x return of BTC?

The logic is simple, but the "masses" did not consider that this cycle might be different. The number of projects, tokens, and memes is a hundredfold compared to the past, and people buy familiar tokens like DOT, ATOM, ADA, expecting 10x returns.

It turned out that when liquidity shifted to Altcoins, due to the abundance of Altcoins, especially the emergence of new Altcoins, all the old Altcoins were left behind.

Scams Different from 2021

Crypto KOL OverDose mentioned a reasonable point. In 2021, to "Rug", the scammers were creative, and users could only hold back if they were not too greedy.

Do Kwon's Terra $LUNA

Sam Fried's FTX

3AC had long-term investments before the collapse

Alameda pushed different narratives and manipulated the market

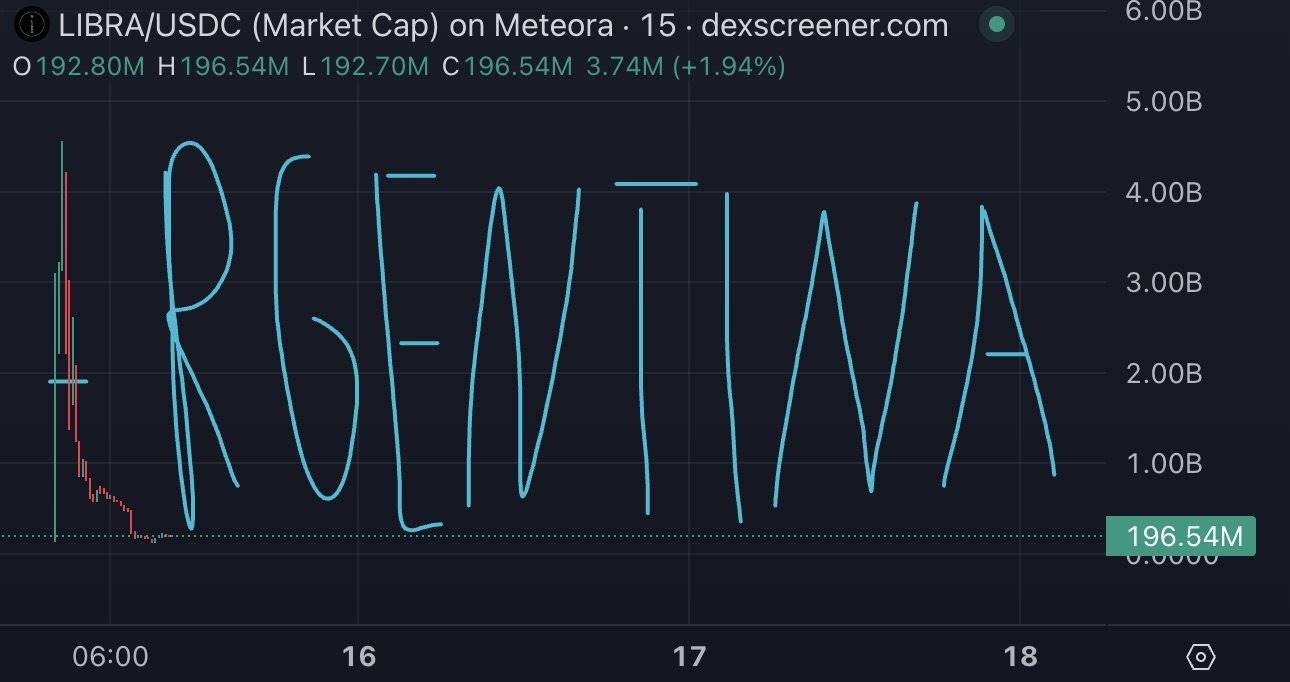

Scams are now difficult, requiring a certain level of intelligence, while now they just use big names, celebrities, even presidents to promote their junk projects.

Players have gotten used to gambling, starting to FOMO into TRUMP and MELANIA, and wanting to make money on CAR or LIBRA, only to suffer heavy losses.

Personally, I know of 10-15 excellent traders who have invested heavily (up to $1 million) in LIBRA, while insiders have dumped over $100 million on them.

Time for a Change

It's time to understand that the cycle will never be the same, Altcoins are not just the "beta version" of BTC or ETH, it is a completely different niche market with more risks and opportunities.

You can't expect DOT or ATOM to rise just because BTC broke a new high in 2021 and drove Altcoins.

Undoubtedly, I still remain bullish on BTC and believe it will continue to be one of the best compounding assets over the next 10-20 years, but the returns will be similar to stocks, no longer easily achieving 200% annual growth.

The key lessons you need to learn from this cycle:

Holding is cowardly behavior, if you don't sell at the right time, you will face losses. Murad has been advocating hold, and almost all of his memes have dropped 80-90% from ATH.

You need to have a strategy for when to sell. This may sound harsh, but that's how the market is, you need to have a specific exit strategy before trading.

Narrative rotation. We've recently experienced crazy rotations from memes to AI agents to TRUMP. If you fall behind at any point, most of the gains may be wiped out. Always follow the narrative and remember that liquidity is limited.

Better be timely than early. Don't overthink, rotate when the timing is right.

No matter how much you believe in the protocol, make sure to lock in stable profits and keep accumulating BTC, BTC is still better than most stock or real estate opportunities.

Hopefully this cycle is not over yet, the current BTC consolidation will determine what will happen in the next 2-3 months.