Author: Michael Nadeau, The DeFi Report; Translator: Jinse Finance xiaozou

In this article, we will focus on the Altcoin market, through the organic combination of a dual analysis framework, aiming to provide more convincing evidence for market judgment.

1. Market Sentiment Analysis

Crypto market native investors maintained an optimistic mood around a week after the election and before Trump's inauguration. However, with the president launching a memecoin, market liquidity was almost drained by this single memecoin, followed by a series of negative events:

The market perceived the statements/commitments related to strategic BTC reserves as lacking substantive content

The "Monday Deepseek/AI Panic Event" broke out

The "Tariff Panic Weekend" in early February, which reportedly set a record for the largest liquidation event (220 million USD forced liquidation, some estimates even higher)

Although BTC has maintained a relatively stable performance in the range of $90,000 to $108,000 over the past three months, the market sentiment has clearly deteriorated, exposing the impatience, inexperience and emotionality that generally characterize the Altcoin market dominated by retail investors.

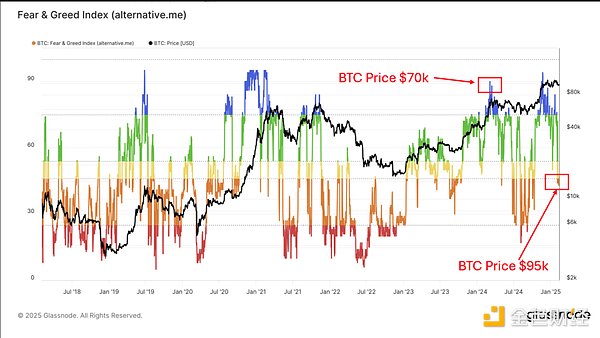

From the data, we can observe the following phenomena: less than a year ago, when the BTC price was $70,000, the market sentiment was in a "extreme greed" state. Now the BTC price has reached $95,000, but the market sentiment has turned to "fear". The last time a similar sentiment level occurred was in early October last year, when the BTC price was $62,000.

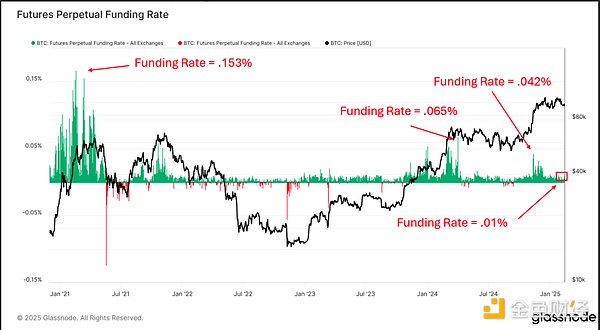

The data below shows the trend of the funding rate - this indicator measures the cost paid by long positions to short positions every 8 hours. This data provides us with an important window into traders' leverage usage intentions, and can be considered an excellent barometer of market sentiment and momentum.

The data shows a mutual confirmation with the trend of the Fear/Greed Index. So why are investors so panicked?

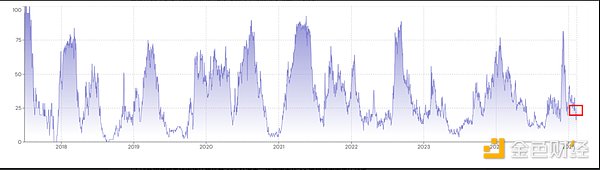

The main reason is that market funds are mainly concentrated in Altcoins and memecoins - as the BTC dominance index has returned above 60%, these coins have fallen 50-75%. With the market at a low point, investors are beginning to question whether the "Altcoin season" can really come.

*The data above focuses on the top 200 assets by market cap, whose 90-day returns are higher than BTC.

In short, when the market is volatile, you always want to stay volatile.

We believe now is a good time to consider Altcoins again (we'll share some popular Altcoins later).

2. BTC On-Chain Data Analysis

If you plan to invest in Altcoins, we believe you need to have a view on the direction of BTC. This is why we focus on BTC in our on-chain data updates.

In this section, we will introduce some of our favorite "cycle" indicators and share our current position relative to the peaks of past cycles.

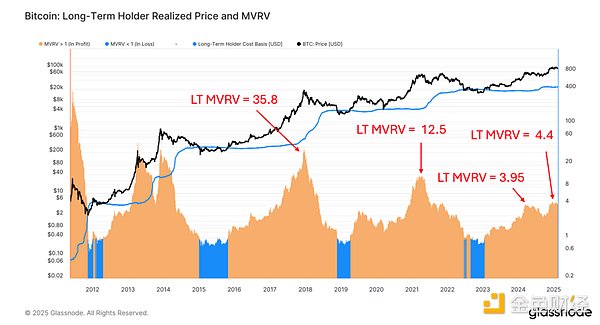

● MVRV - Long-term Holders

MVRV (Market Value to Realized Value Ratio) helps us understand the relationship between the current market value and the "cost basis" (realized value) of the BTC in circulation.

Glassnode calculates the cost basis of all BTC on the network by tracking the latest moving price of each UTXO on-chain.

It does not consider BTC held in exchanges or ETFs (about 18% of the supply).

In this analysis, we separate long-term holders (wallets that haven't moved BTC in at least 155 days) from short-term holders (wallets that have moved BTC within 155 days).

Summary: The MVRV of long-term holders reached a high of 4.4 on December 17, and is now at 3.96. This tells us that on average, long-term holders are sitting on 296% gains. In the previous cycle, this group saw gains of 1150%, and in the 2017 cycle, gains of 34800%.

● MVRV - Short-term Holders

It's worth noting that short-term holders tend to chase the market. They enter the game later and tend to buy tokens from long-term holders.

Summary:

*The MVRV (Market Value to Realized Value Ratio) of short-term holders is currently 1.06, meaning they are nearly at the breakeven point, whereas last March this ratio reached 1.45.

*Looking back at the previous cycle, at the market peak, short-term holders' unrealized gains reached 74%.

*Currently, 20% of the circulating supply is held by short-term holders (16.4% a year ago), not including exchange or ETF holdings. It's worth noting that at the market peak in the previous cycle, short-term holders controlled 24% of the supply (there were no ETFs at the time). This data is quite revealing, as it suggests that compared to a year ago, there is more new money entering the current market, and from a percentage perspective, we are gradually approaching the level seen at the peak of the previous cycle.

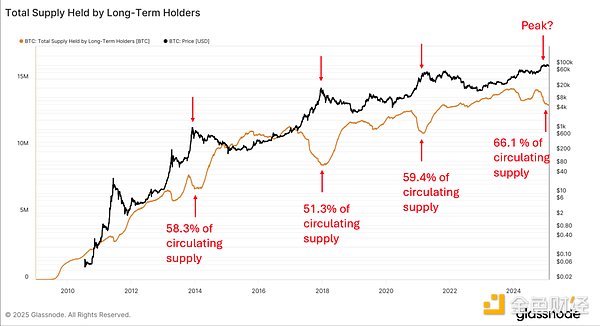

● Long-term Holder Supply

Summary:

*At the start of this cycle, 73.3% of the circulating tokens were held by long-term holders. This proportion has now dropped to 66.1%, a decrease of 7.2%.

*Looking back at the previous cycle, initially 67.2% of the supply was held by long-term holders. When the market reached its peak, this proportion had dropped to 59.4%, a decrease of 7.8%.

*Following the trend of the previous cycle, both the short-term and long-term holder data indicate that we are currently in the late stage of the cycle.

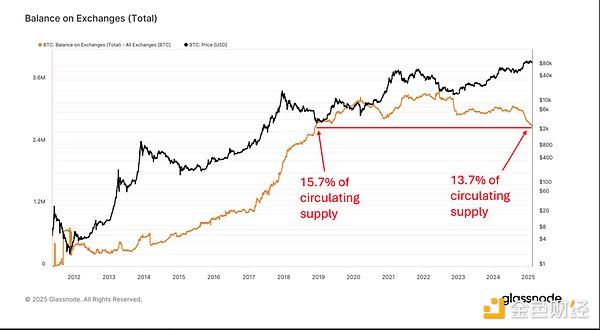

● BTC on Exchanges

Summary:

*Compared to the end of 2018, the amount of BTC on exchanges has decreased, but the market size is much larger now - most institutions are now able to purchase BTC.

*We usually see the yellow line rise towards the end of a cycle, as investors send their BTC back to exchanges to cash out. We haven't seen any strong signs of this yet. ETFs may have played a role in this.

● Pi Cycle Top Indicator

The Pi Cycle Top Indicator has historically been an accurate tool for identifying the peaks of the BTC market. It is composed of a 111-day moving average and twice the 350-day moving average.

When the market is overheated, the shorter 111-day moving average will cross above the longer 350-day moving average.

We can see in the chart that there is still a healthy gap between the two moving averages - this suggests the market has not reached extreme levels yet.

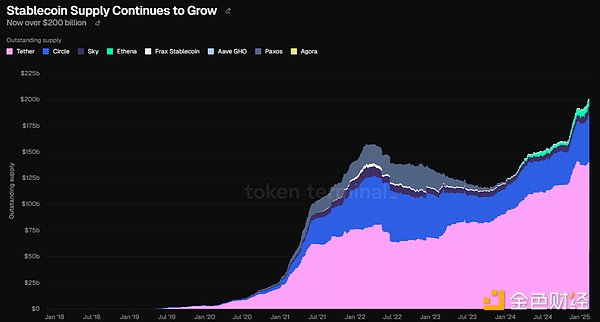

● Stablecoins

Summary:

*From the US presidential election day to the end of the year, Tether's supply grew by over $20 billion. It has stagnated since then (zero growth in the past two months).

*USDC is now the leader (mainly on Solana). It has grown 22% over the past two months (over $7 billion).

*We are closely monitoring stablecoin growth, as on-chain liquidity is correlated with crypto prices. A new stablecoin bill (which could be the first legislation we see) may fundamentally change the trajectory of this chart.

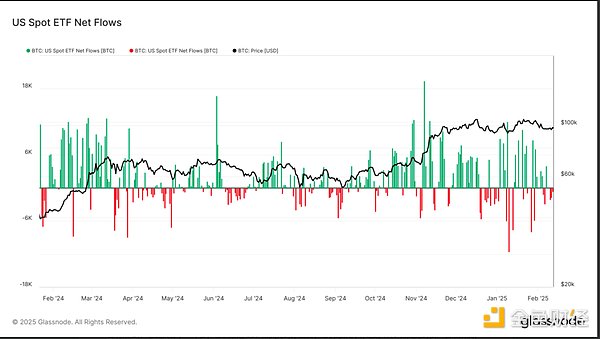

● ETFs

Summary:

*Over the past two weeks, the net flow of Bitcoin has actually been negative, indicating that investors are taking profits. Nevertheless, the net capital inflow to ETFs increased by over $3.6 billion last month. For those curious, the ETH ETF has added $735 million in the past month, surpassing BTC in the past two weeks.

*Bitcoin ETFs have been trading for over a year and have accumulated nearly $38 billion in net inflows. They hold a total of over $114 billion in assets under management.

*Bitwise's ETF experts will tell you that we are more likely to see more capital flow into ETFs this year than last year. Why? ETFs tend to have a pattern where, in the 2nd, 3rd year, etc., as liquidity generates more liquidity, the flow of funds will increase. Additionally, there are still large institutions that have not yet received the green light to start allocating to Bitcoin.

3. New Market Buyers

In addition to on-chain data, we have to mention several large new buyers that have appeared in the market. For example:

* The Abu Dhabi sovereign wealth fund Mubadala, which manages over $1 trillion in assets, recently announced a $436 million investment in Bitcoin.

*According to VanEck's Matthew Sigel, there are currently 20 state-level Bitcoin reserve bills. If these bills are passed, they could drive $23 billion in purchases.

*The repeal of SAB121 means that banks can now custody crypto assets.

*New FASB rules stipulate that companies can now hold Bitcoin at fair value on their balance sheets, marking its held value as unrealized gains for the first time. Previously, Bitcoin was recorded as an intangible asset and only impaired.

We haven't even mentioned strategic Bitcoin reserves yet. A newly formed committee plans to make a decision before July. We believe other central banks may already be moving ahead.

What's the conclusion? Bitcoin has now matured. It has always traded like a risk asset driven by retail FOMO. This is changing. Investors should expect that if central banks start holding this asset, it may transform into a "safe haven" asset, with volatility decreasing over time. We believe we have already seen this impact, with ETF buyers bringing more stable demand.

4. Final Thoughts and Portfolio Management

Combining our past and current analysis, our conclusion is that Bitcoin (and the entire crypto market) still has some upside potential. But this does not mean there is no risk. Some on-chain indicators suggest caution is warranted. Not to mention, we have seen many "top" behaviors in this cycle. At the same time, from a macro and on-chain data perspective, we find it difficult to be consistently bearish. Remember, the biggest volatility in the crypto market often occurs at the end of a cycle.

As for portfolio management? In the current cycle, we like to employ a barbell strategy. This means we hold core assets like BTC, ETH, SOL, and other projects with strong fundamentals (cash flow and buybacks). These include HYPE and Raydium. We also like TIA and SUI as other L1 choices. This is one end of the barbell (which we believe should be more tilted towards BTC/ETH/SOL). Then, we pair these core assets with small allocations to high-beta and sufficiently liquid blue-chip meme coins. SPX6900, GIGA, PEPE, and BONK are our favorites - all of which have fallen over 50% from their highs as of the time of writing.