Introduction

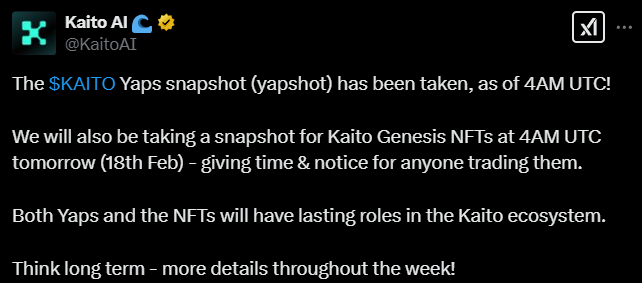

On February 17th, the AI-powered Web3 search engine Kaito AI announced the completion of the KAITO Yaps snapshot, followed by the Genesis NFT snapshot. In this long-planned airdrop, on-chain analyst Caneleo discovered that Kaito has deployed 1 billion tokens on the Base chain, of which 33.3% may be used for the airdrop.

In other words, the market is about to distribute 333 million $KAITO to NFT holders and Yap contributors. Based on Kaito's previous round of financing valuation of $87.5 million, and calculated at a 33.3% airdrop ratio, the theoretical total airdrop value is close to $28.875 million.

Kaito has designed a two-tier airdrop system:

- Genesis NFT holders: 1,500 NFTs will be allocated 15% of the airdrop pool (about $4.32 million), with each NFT expected to receive $2,880 in $KAITO;

- Yap contributors: The remaining 85% ($24.555 million) will be distributed proportionally based on Yap points, and based on the current release rate, each Yap is estimated to be worth about $13.

As the market becomes aware of the scale and return rate of this airdrop, the FOMO sentiment has quickly heated up. Hordes of "farming" troops are frantically rushing to the leaderboard, and Kaito's tweets on X (formerly Twitter) are being flooded, officially kicking off a "Web3 version of the airdrop hunger games".

Why has Kaito, after EigenLayer, quickly become the most closely watched airdrop project in Web3?

Valuation expectations ignite FOMO: Kaito was valued at $87.5 million in its Series A financing in June 2023. Benchmarked against Berachain, whose valuation grew 8 times after financing, if Kaito follows the same path, the airdrop value may be amplified 10 times.

Leveraging the ecosystem to amplify returns: Kaito adopts a "Yap to Earn" + "Genesis NFT" dual scoring system, and NFT holders may even receive over $13,000 in airdrop rewards.

Top-tier VC backing: Institutions like Sequoia Capital and Dragonfly have joined, enhancing the project's endorsement and boosting market confidence.

In the midst of the FOMO atmosphere, Kaito is not just an AI search engine, but more like an impending Web3 wealth-creation volcano.

Who is Kaito? - The "AI Rain Maker" of the Web3 Information Empire

If EigenLayer is the hottest "liquidity re-staking" project this year, then Kaito is the pioneer in the field of information finance (InfoFi), aiming to become the Google + Bloomberg Terminal of the crypto world.

Kaito was founded by former Citadel quantitative trader Yu Hu, focusing on solving the problem of information fragmentation in the Web3 world. Faced with massive scattered data from Twitter, Discord, governance forums, etc., Kaito uses AI large models to integrate and build MetaSearch - a smart search engine tailored for crypto investors.

Unlike traditional search engines, Kaito not only indexes various Web3 data sources, but also combines ChatGPT technology to generate in-depth analysis, allowing investors to obtain market intelligence and accurately capture on-chain Alpha opportunities with just one click. Therefore, Kaito is also known as the "Web3 version of the Alpha Catcher".

Over the past two years, Kaito has performed brilliantly in the capital market, attracting the attention of top-tier VCs:

Seed Round (February 2023): Led by Dragonfly, raised $5.3 million, valued at $40 million.

Series A (June 2023): Led by Superscrypt and Spartan, raised $5.5 million, with valuation directly soaring to $87.5 million.

Turning Point (June 2024): Kaito announced its first profitability, transitioning from a "money-burning startup" to a self-sufficient AI giant.

Top-tier VC investments not only mean recognition of Kaito's business model, but also further strengthen its ecosystem value, providing strong support for the future token economic model.

Kaito is not just a search engine, but has built an entire information economic system. Through the "Yap to Earn" model, users can earn Yap points in the following ways:

Content Contribution: Post on Twitter, tag @KaitoAI, and share crypto market analysis.

Social Virality: Invite friends to participate, and use multi-account tools (such as MoreLogin) to improve the efficiency of earning points.

NFT Empowerment: Hold a Genesis NFT (minting price 0.1 ETH), which can increase the airdrop weight, and even have the opportunity to receive up to $13,000 in token rewards.

This mechanism directly converts information attention into on-chain assets, making Kaito not just a tool, but a platform that can be "mined".

Valuation Game: The Value Code of the Airdrop Feast

In Kaito's airdrop frenzy, Yap points and Genesis NFTs have become the focus of market attention, and the discussion around their value has become increasingly intense. Multiple analysis models have tried to predict the reasonable valuation of Yaps and NFTs, and the conclusions under different assumptions have gradually transformed the market's expectations from rational gaming to FOMO frenzy.

1. Capital-Driven Model: Theoretical Extremes Derived from the FDV Formula

The valuation of the crypto market has always been based on narratives and capital flows, so the first model starts directly from Kaito's future fully diluted valuation (FDV) to try to calculate the potential value of Yaps.

KOL Ren_gmi used the formula of FDV × Airdrop Ratio / Total Circulation, assuming:

- Kaito's FDV is $1 billion;

- 30% of the tokens are used for the airdrop;

- The Yapper plan runs for 90 days, releasing a total of 2.275 million Yaps.

Based on this, the model calculates that the Yap value is $131, far exceeding the mainstream market expectations.

But this derivation has obvious flaws:

- The additional NFT airdrop is not included, which may affect the actual earnings of Yappers;

- The assumption of the total Yap supply is too ideal, and the actual circulation may be affected by factors such as exchange listings and project distribution pace.

Nevertheless, this model still provides the extreme value of the market's optimistic expectations, providing theoretical support for the attractiveness of Kaito's airdrop.

2. NFT Voting Rights Model: The Game of Web3 Community Governance

Compared to the simple FDV derivation, KOL DeFiTeddy2020 adopted a NFT Voting Rights Model that is more in line with Kaito's ecosystem.

In Kaito's design, Genesis NFTs give holders greater voice in ecosystem governance, and these NFTs also have airdrop weight. Therefore, this model assumes:

- The market price of a single Genesis NFT is 9.3 ETH;

- The corresponding voting weight is 1,162 Yaps;

Based on this, the theoretical value of each Yap is about $22.

This method starts from the market pricing of NFTs, trying to establish the relative valuation relationship between Yaps and NFTs, but its limitations are:

- ETH price fluctuation risk, the market price of NFTs itself may be affected by liquidity;

- Voting rights weight may not directly reflect token value, the valuation of governance power is still not fully transparent.

Although this model yields a value far lower than the FDV derivation, it provides a new perspective from the NFT ecosystem to understand the valuation of Yaps.

3. Competitive Benchmarking Model: Comparability of Kaito and Hyperliquid

In the Web3 track, valuations often depend on the market's benchmarking of similar projects. KOL Steve_4P used a competitive comparison approach to draw parallels between Kaito and Hyperliquid, aiming to derive a valuation range more aligned with market logic.

From a PMF (Product-Market Fit) perspective:

- Hyperliquid: Based on a mature decentralized exchange (DEX) model, optimizing a proven trading market;

- Kaito: Exploring a new InfoFi (Information Finance) paradigm, without a stable market demand loop yet.

In terms of comparable valuations:

- Hyperliquid can be benchmarked against DEXs like dYdX and Drift, with clearer market recognition;

- Kaito currently has no direct competitors, with the closest case possibly being Friend.tech, but the latter's social finance model has significant flaws.

From the perspective of token value capture:

- Hyperliquid has a clear token burning mechanism, which helps maintain long-term value;

- Kaito's revenue distribution mechanism is not yet closed-loop, and its token value still faces significant uncertainty.

Based on these factors, the model believes that Kaito's token earnings expectations will not exceed Hyperliquid, and therefore Yap's valuation ceiling may be far lower than some market's extreme predictions.

4. Real Valuation Model: Deriving Market Expectations from Financing Data

Compared to theoretical deduction, the market prefers real data support. Kaito's Series A financing valuation was $87.5 million, and combined with the 33.3% token airdrop plan that has been announced, we can derive a relatively reasonable value range:

- NFT Valuation Derivation: The total cost of 1,500 Genesis NFTs is $540,000, and based on the financing valuation, the total airdrop is estimated to be around $4.32 million, with each NFT worth about $2,880;

- Yap Point Valuation Derivation: The remaining $24.55 million will be distributed to Yap point holders, and based on the current release rate, 1 Yap is worth about $13.

However, the financing valuation is not the final market pricing, so this model further uses Story Protocol and Berachain as benchmarks to derive a reasonable market range:

- Story Protocol: The valuation is amplified 16 times, with a current FDV of about $173 million, and based on its market performance, Kaito's NFT airdrop value may be $2,218-$2,880, and Yap value $10-$13.

- Berachain: The financing valuation is amplified 8 times, with a current FDV of about $280 million, and if Kaito follows the same path, the NFT airdrop value may be $5,357, and Yap value $24.

Under extreme FOMO market sentiment, Berachain's highest FDV once reached $675 million, and if Kaito replicates this model, its NFT may soar to $13,000, and Yap value may surge to $59.

Conclusion: Valuation Variables and Market Frenzy

Based on the above four models, we can see the different possibilities of Kaito's airdrop value:

Ultimately, the actual value of Kaito's airdrop will depend on the following key factors:

- Market feedback after token launch: If liquidity is sufficient, the valuation may surge significantly;

- The project's long-term development strategy: If the InfoFi ecosystem can be closed-loop, the token's value capture will be more stable;

- The evolution of market sentiment: The duration of the FOMO atmosphere will affect short-term value fluctuations.

What is certain is that Kaito is stirring up a new airdrop storm in the crypto market, and how this storm will end remains to be answered by the market.