Author: Stella L (stella@footprint.network)

Data source:Footprint Analytics Public Chain Research Page

In January 2025, the total market capitalization of the crypto market grew by 7.2% to $2.8 trillion, with the performance of major blockchain platforms diverging. Under the dual impact of new regulatory policies and breakthroughs in artificial intelligence infrastructure technology, Bit strengthened its market dominance to 71.3%.

Market Overview

Bit rose from $94,577 to $102,180, an increase of 8.0%. Ethereum, on the other hand, performed weakly, falling from $3,353 to $3,292, a decline of 1.8%, with the ETH/BTC ratio hitting a new low since September 2024.

Data source:Bit and Ethereum price trends

Several important policy developments have significantly impacted the crypto market trend. The crypto regulatory executive order issued by the Trump administration provided the industry with unprecedented clear guidance, particularly emphasizing the protection of self-custody rights and supporting the development of stablecoins. However, Trump's remarks on international trade tariffs at the end of the month raised concerns about global economic growth, and market sentiment cooled somewhat.

The Trump family's launch of $TRUMP and $MELANIA tokens on Solana triggered a violent fluctuation in the Memecoin sector. This speculative frenzy significantly diverted market attention and capital from other crypto sectors, including the blockchain gaming sector.

The breakthrough progress of DeepSeek in the field of artificial intelligence also affected market dynamics. This progress accelerated the focus on decentralized AI infrastructure within the crypto ecosystem, and AI-related tokens saw an increase this month.

Layer 1

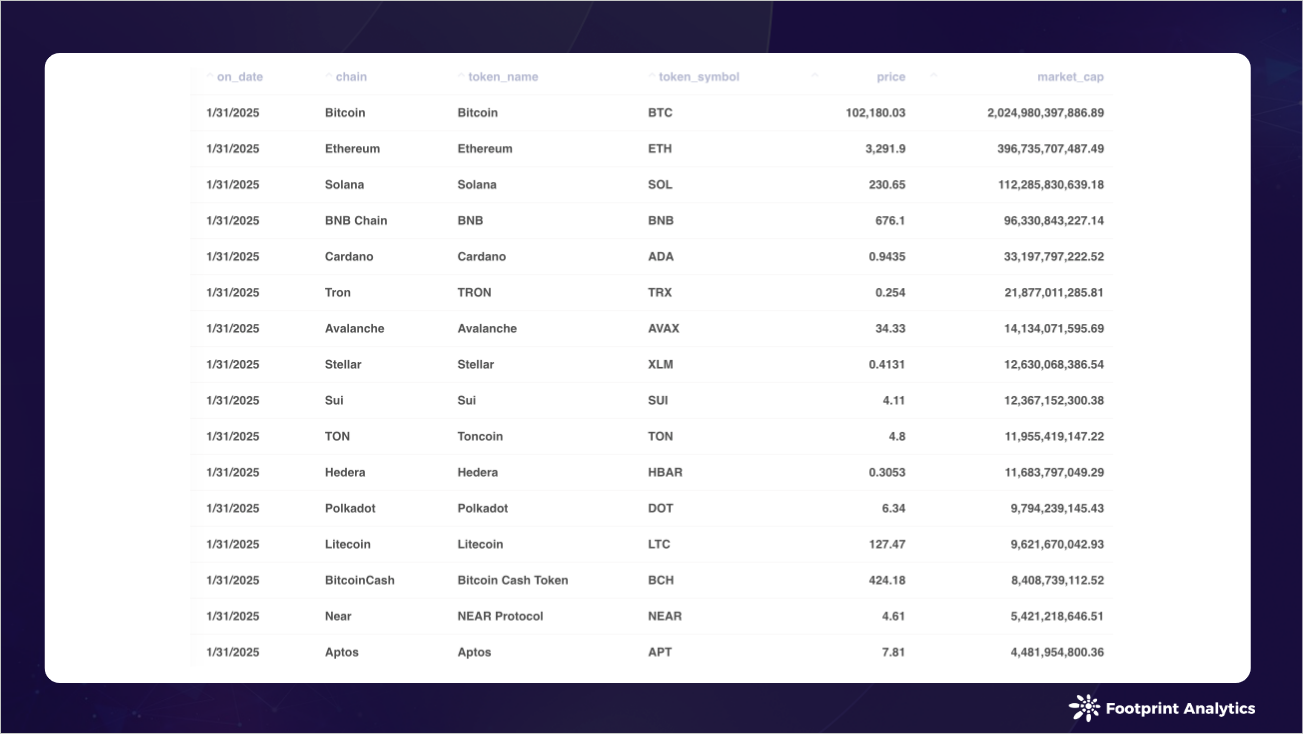

In January 2025, the total blockchain market capitalization rose by 7.2% to $2.8 trillion, with Bit's market dominance further increasing to 71.3%. Ethereum's share continued to decline to 14.0%, while Solana surpassed BNB Chain (3.4%) again with a 4.0% market share. Other public chains collectively accounted for 7.4% of the market share.

Data source:Public chain token prices and market capitalization

Solana continued its strong performance, with its market capitalization growing by 22.0% to $112.3 billion, consolidating its position as the third-largest blockchain by market value.

Among the top 20 chains by market capitalization, Stellar stood out with a significant increase in market value to $12.6 billion, while Litecoin and Monero rose by 23.5% and 21.6%, respectively. Cardano's market capitalization grew by 11.9% to $33.2 billion.

Emerging platforms maintained their development momentum, with Sui stabilizing its market capitalization at $12.4 billion in a highly competitive environment. TON, although its market capitalization fell by 14.0% to $12.0 billion, still maintained its position in the top ten. Hedera exhibited good growth, with its market capitalization increasing by 14.2% to $11.7 billion.

Traditional Layer 1 platforms such as Polkadot, Near, and Aptos faced pressure, with their market capitalizations declining by 3.7% to 7.5%.

Bit Layer 2 & Sidechains

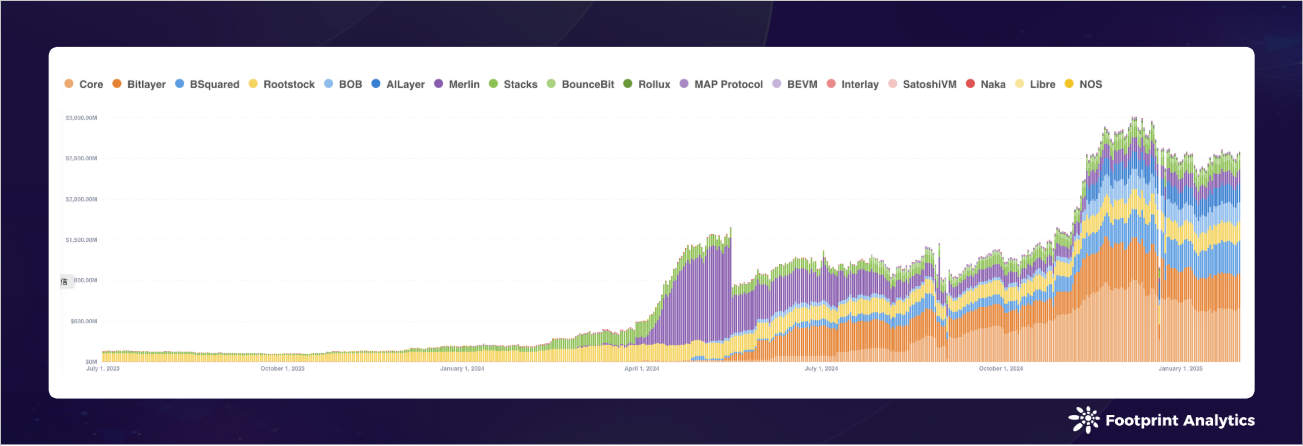

In January 2025, Bit Layer 2 and sidechains maintained a growth trend, with a total locked value (TVL) of $2.6 billion, an increase of 5.2% from December.

Data source:Overall trend of Bit ecosystem public chain TVL

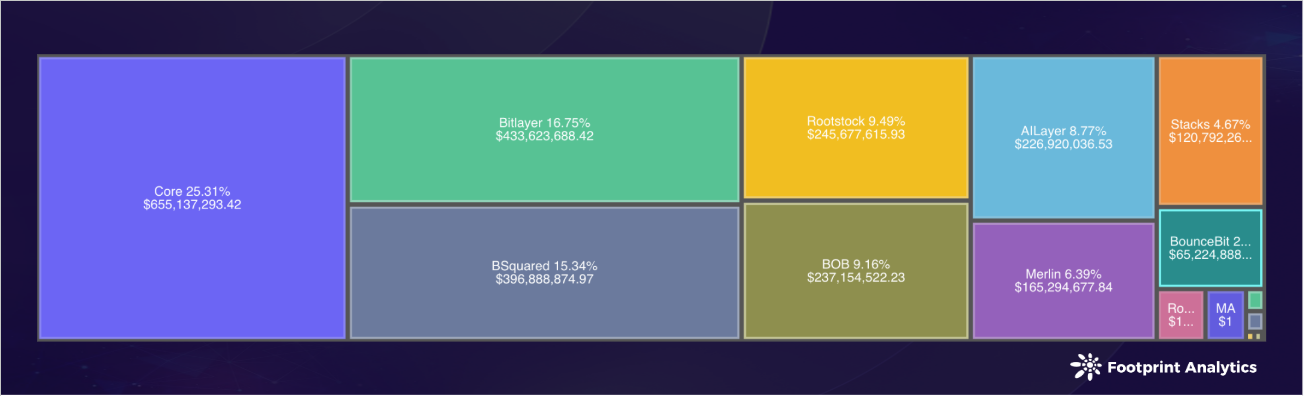

Core maintained its market leadership with a TVL of $660 million, although it declined by 9.3% compared to December, accounting for 25.3% of the market share. Bitlayer saw strong growth, with its TVL increasing by 15.2% to $430 million (16.8% market share), while BSquared performed well, with its TVL surging by 19.7% to $400 million (15.3% market share).

Rootstock and BOB ranked fourth and fifth with TVLs of $250 million and $240 million, respectively, growing by 10.8% and 8.9%. It is worth noting that AILayer's TVL grew by 13.2% to $230 million.

Data source:Bit ecosystem public chain TVL - January 2025

Among the medium-sized platforms, Merlin's TVL saw a moderate decline of 3.7% to $170 million, while Stacks maintained stable growth, increasing by 4.0% to $120 million. The performance of small platforms was mixed, with BounceBit growing by 7.3%, while newcomers like SatoshiVM and Naka declined by 11.6% and 14.9%, respectively.

Ethereum Layer2

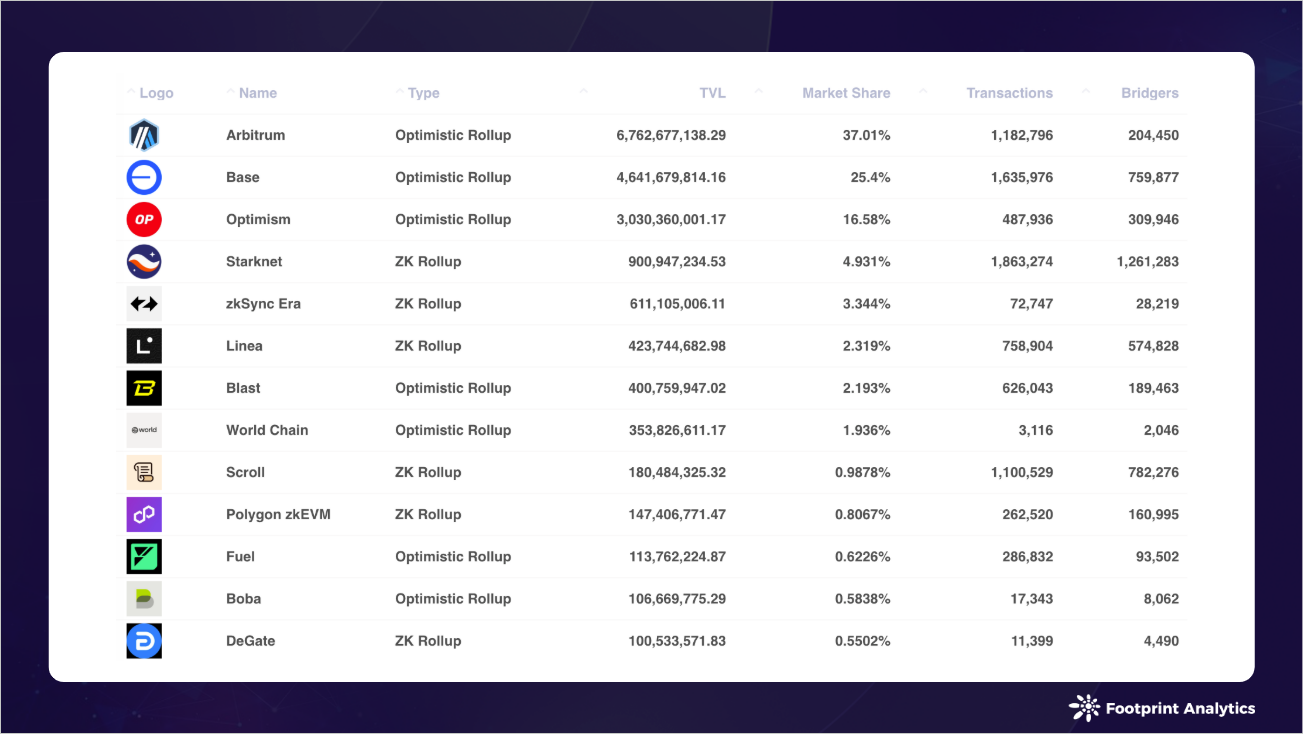

In January 2025, the Ethereum Layer 2 ecosystem underwent significant changes, with the total locked value (TVL) declining to $18.3 billion, a 6.7% decrease from December. The market leaders showed divergent performance.

Data source:Ethereum Layer 2 overview - November 2024 - Rollups (bridge-related metrics)

Arbitrum, despite a significant 20.4% drop from December, maintained its leading position with a TVL of $6.8 billion. Base continued its strong momentum, with its TVL growing by 14.0% to $4.6 billion, consolidating its second place. Optimism remained third with a TVL of $3.0 billion, declining only slightly by 0.5%.

Among the best-performing platforms, World Chain performed well, with TVL growing 27.6% to $350 million, while Paradex surged 50.3% to $37.2 million. ZK Rollups demonstrated resilience, with Starknet and zkSync Era growing 7.4% and 12.2% respectively, reaching TVLs of $900 million and $610 million.

Some mature platforms faced challenges, with Blast TVL declining 33.8% to $400 million and Fuel declining 47.3% to $110 million. Linea and Scroll also declined 5.7% and 5.2% respectively.

The competitive dynamics in the ecosystem continue to evolve, with Optimistic Rollup and ZK Rollup exhibiting varying degrees of success. As new entrants join the ecosystem, mature platforms are focusing on strengthening their market position through enhanced functionality and user experience.