On February 18, 2025, the crypto world witnessed a historic moment - the FTX exchange officially launched its user asset compensation program. After more than two years of turmoil, this financial disaster has finally entered the final stage. From the collapse of the FTX empire in just 72 hours in November 2022, to the founder SBF being sentenced to a heavy prison term, and now the creditors starting to receive actual compensation, the entire event is like a crypto version of "The Wolf of Wall Street" filled with human greed, technical vulnerabilities, and regulatory gaps. At the same time, an in-depth interview with a former senior executive of FTX revealed the unknown logic behind this collapse: when Alameda's huge losses collided with SBF's "god complex", the end of the capital game was already predetermined.

I. Implementation of the Compensation Plan: Redemption in the Digital Purgatory

On February 4, FTX creditor Sunil posted the latest announcement on the X platform, stating that users will receive the compensation funds at 3 PM UTC on February 18. This compensation will bring about $1.2 billion to the first batch of affected FTX users.

According to the final plan (Case No. 22-11068, 2024/11) published by the Delaware Bankruptcy Court:

1. Cash compensation as the main battlefield: Creditors can choose to receive fiat compensation based on the prices at the time of bankruptcy (BTC≈$16,000/ETH≈$1,200), or wait for the gradual payout of crypto assets over the next three years.

2. The "sleight of hand" of over-compensation: Individual users can receive up to 142% of the bankruptcy claim amount (calculation method: FTX bankruptcy management liquidation report, 2024/9), but if they choose fiat compensation, they will lose the 400% gain from BTC's rise from $16,000 to $63,000 over two years.

3. "Bleeding and sacrificing" for institutions: Hedge funds and other professional investors can only recover 75%-89% of their principal, and must accept a payment plan of up to five years. This "retail-first" compensation logic completely overturns the traditional bankruptcy settlement rules. (Data source: FTX institutional creditor agreement appendix, 2024/12).

This compensation is essentially a compromise of the crypto world to the traditional financial system. The FTX bankruptcy management team sold off assets including luxury properties in the Bahamas, venture capital portfolios, and even SBF's personal collection of "League of Legends" game skins, just to barely raise $17 billion for compensation. The most ironic part is that $3.2 billion of it came from the sale of FTX's SOL tokens - the project once seen as the "Ethereum killer" by SBF, which unexpectedly gained liquidity support after plummeting 95% in the bear market.

II. Dissecting the Truth Behind the Collapse: Alameda's Death Spiral and SBF's Cognitive Cage

"If we hadn't gone all-in when Luna collapsed, maybe we could have saved the exchange." The anonymous former FTX executive revealed in a Silicon Valley cafe, "But Sam (SBF) was convinced he could wipe out all the losses in three months, and the hole just kept getting bigger."

Alameda's "Death Sniper": The Billion-Dollar Gamble Behind the Luna Collapse

The Terra ecosystem collapse in May 2022 has now been proven to be the first domino that toppled the FTX empire. Alameda Research, as the largest market maker for the UST stablecoin, went on a frenzy of buying during the initial UST de-pegging, trying to maintain the peg through pool manipulation. On-chain data shows that in just three days from May 8-10, Alameda deposited $2.3 billion UST into the Anchor Protocol, accounting for 18% of the total UST circulation.

But this high-stakes gamble ultimately turned into a massacre. When UST fell below $0.9, Alameda was forced to sell its Bitcoin reserves at a rate of $300 million per day, triggering a chain of liquidations. Court documents (Case No. 1:22-cr-00673, 2023/4) show that by the time UST went to zero on May 12, Alameda had incurred $5.7 billion in net losses, leaving a gaping hole equivalent to 23% of the total FTX user deposits on its balance sheet.

SBF's "Cognitive Tyranny": When Effective Altruism Becomes a Fraud Disguise

"Sam always believed he was the only one who could see through the fog." The former executive sighed, "He even asked the engineers to set up a 'god mode' in the backend, which could transfer user assets without restriction." This cognitive bias evolved into disastrous decisions during the crisis:

- The race to misappropriate funds: To cover up Alameda's losses, the SBF team developed a "negative balance" system - when users withdrew, the system would first deduct funds from other user accounts instead of the exchange's reserves.

- The fatal temptation of regulatory arbitrage: FTX exploited regulatory loopholes in the Bahamas to deposit client funds into Alameda-controlled North Dimension company accounts, completely breaking the principle of user asset segregation.

- The alienation of effective altruism: In internal meetings, SBF repeatedly emphasized that temporarily misappropriating funds was to "save more crypto innovation projects", and this sense of moral superiority led to a bizarre self-justification of the fraudulent behavior.

The most dramatic part was the failure to respond to the crisis. According to the U.S. Attorney for the Southern District of New York, SBF had a chance on November 6, 2022 (48 hours before FTX stopped withdrawals) to plug the 90% funding gap through emergency financing, but his legal team misjudged the legal risks and insisted that SBF reject any contract terms that could expose the fund misappropriation, ultimately leading to the collapse of the rescue plan.

III. Judicial Crackdown and Regulatory Revolution: Reconstructing Order in the Post-FTX Era

As the first batch of compensation funds arrived, SBF was writing his crypto memoir in the Metropolitan Detention Center in Brooklyn, New York. The former crypto wunderkind was sentenced to 47 years in prison for charges including wire fraud and money laundering, even exceeding the sentence of Bernie Madoff, the mastermind of the Ponzi scheme. More importantly, the global regulatory system has responded to the FTX incident with systemic reforms:

Penetrating Regulation's "Surgical Reform":

- On-chain asset transparency: The U.S. SEC introduced the "Proof of Reserve 2.0" rule in 2024, requiring exchanges to update their cold wallet addresses hourly and use zero-knowledge proof technology to verify the 1:1 correspondence between user assets and reserves.

- Complete ban on proprietary trading: The EU's "Crypto Asset Markets Act" (MiCA) prohibits exchanges from operating affiliated hedge funds, with violators facing global business bans.

- Lifetime accountability for executives: The Monetary Authority of Singapore launched the "Crypto Executive License", requiring core exchange members to pay a risk deposit of 500% of their annual salary, and still be held responsible for violations even after leaving their positions.

The Unexpected Rise of Decentralized Finance

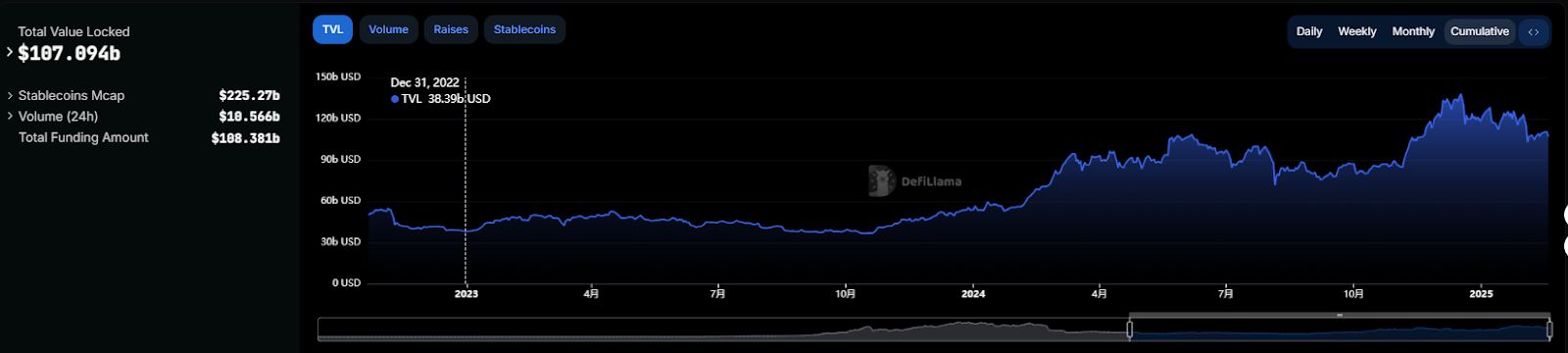

The FTX incident has accelerated the compliance process of DeFi. Centralized exchanges like Coinbase and Binance have been forced to transfer most of their user assets to on-chain protocols like Compound and Aave for transparent management. According to DefiLlama data, as of February 2025, the total value locked in DeFi has surpassed $107 billion, a 180% increase from the time of the FTX collapse. This trend is bringing the vision of "code is law" financial democratization closer to reality.

IV. The Next Repayment: Hope and Challenges for Rebirth

According to the latest announcement on February 18, the next round of repayment by FTX will be launched on May 30, 2025. This repayment will cover the holders of "Class 5 Customer Equity Claims" and "Class 6 General Unsecured Claims". Specifically, this group of creditors includes users who held assets on the FTX platform at the time of the platform's collapse, as well as other creditors such as suppliers and trading partners.

The key date for this round of compensation is April 11 - creditors need to verify and confirm their claim eligibility before this date.

FTX creditor and lawyer Sunil Kavuri stated that the repayment starting in May will include claims worth more than $50,000. Creditors must choose a distribution agent by April 11 to facilitate the corresponding asset distribution.

According to FTX's recovery plan, it is estimated that about 98% of creditors will receive at least 118% of the value of their claims in cash.FTX also estimates that the total value of the next round of compensation will be between $14.5 billion and $16.3 billion. This round of repayment will mark further progress in the FTX compensation process, bringing tangible returns to more creditors, although it will also be accompanied by complex settlement and liquidity challenges.

Historical Spiral: From Tulip Bubble to Algorithmic Bubble

The FTX incident is not an isolated case, but a digital variant of the periodic frenzy in human financial history:

- The Mississippi Bubble of 1719: John Law used a paper money game to cover France's fiscal deficit, similar to SBF's "dynamic reserve".

- The Great Depression of 1929: Goldman Sachs set up a shadow fund to short clients, just as Alameda used FTX user funds to hedge.

- The 2008 Subprime Mortgage Crisis: Lehman Brothers' Repo 105 transactions and FTX's "negative balance system" were both accounting magic.

The difference is that blockchain technology has permanently etched all the evils of this farce on the distributed ledger. When future researchers access the transaction records of the FTX bankruptcy address (0x34912b3903b2632e145f3a9bAba3), they will see not only a string of hash values, but also the eternal struggle between human greed and technological alienation.