Followin' the long-awaited six-year wait, the Pi Network officially opened its mainnet this (20th) afternoon at 4 o'clock, and was simultaneously listed on well-known exchanges such as OKX, Pionex, and MEXC.

VX: TTZS6308

Registration links for various exchanges: https://pub.vlinkx.cn/bzjc

According to data from the OKX exchange, the price of Pi coin surged to $2.2 upon opening, but then experienced volatile fluctuations, at one point plummeting by half to below $1, and is currently oscillating around $1.42. Calculated based on the fully diluted valuation (FDV), the market cap is around $142 billion, making it the 4th largest token by FDV market cap, surpassing USDT and BNB.

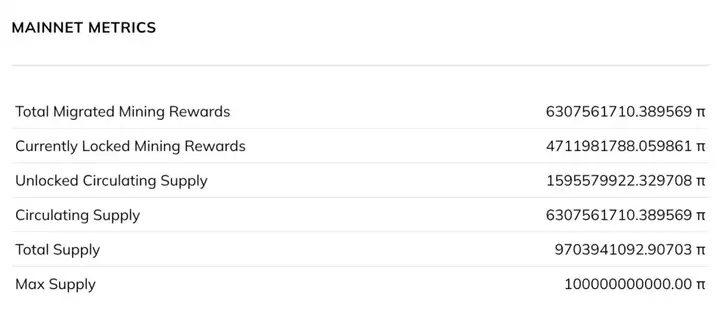

Current Circulating Supply of Pi Coins

Total Mining Rewards (Migrated): 6.307 billion

Currently Locked Mining Rewards: 4.711 billion

Unlocked Circulating Supply: 1.595 billion

Circulating Supply: 6.307 billion

Total Supply: 9.703 billion

Maximum Supply: 100 billion

The listing of PI on OKX has not completely eliminated all doubts. Investors still need to be aware of the volatility in the cryptocurrency market, and the adjusted prices may reflect initial instability. Additionally, liquidity issues and the trading environment outside of official exchanges still require cautious attention.

The OKX listing also creates an opportunity to re-evaluate Pi Network's development strategy in the highly competitive cryptocurrency landscape. Metrics such as trading volume, community engagement, and the project roadmap will be key factors in determining the long-term success of the PI token.

What is the Outlook for PI?

One of the biggest risks for Pi coin comes from the initial miners. These miners have accumulated a large amount of Pi coins at virtually no cost, and they may view the mainnet launch as the true opportunity to realize their asset gains. Selling a portion of their tokens could be a strategic move, especially if they believe the initial market price will be higher due to market enthusiasm and speculation. If a large number of these initial miners decide to sell simultaneously, the market may experience a sudden increase in supply, leading to a decline in demand and potentially a significant drop in price.

History has shown that cryptocurrencies launched through airdrops often experience significant price declines. When tokens are distributed for free or at a low cost, many recipients are eager to sell their assets at the start of trading. Pi Network may follow a similar pattern, and the influx of a large number of tokens into the market could drive down the price.

The valuation of Pi coin is in disarray, but it is certain that short-term volatility will be extremely high. We suggest focusing on the following indicators to assess the price trend of Pi coin:

Trading volume and turnover rate in the first week of launch (reflecting market sentiment)

Mainnet unlocking progress (pace of supply release)

Pi ecosystem application deployment (determining long-term demand)

Most importantly, the overall cryptocurrency market sentiment. In a bullish environment, speculative capital is abundant, and Pi coin can more easily achieve a higher valuation; conversely, in a bearish market, even the best projects can't escape the downward trend, and the recent lack of liquidity in the market also makes the valuation outlook less optimistic than before.