Introduction: When the "Trump Effect" Meets the Ice and Fire of the Crypto Market

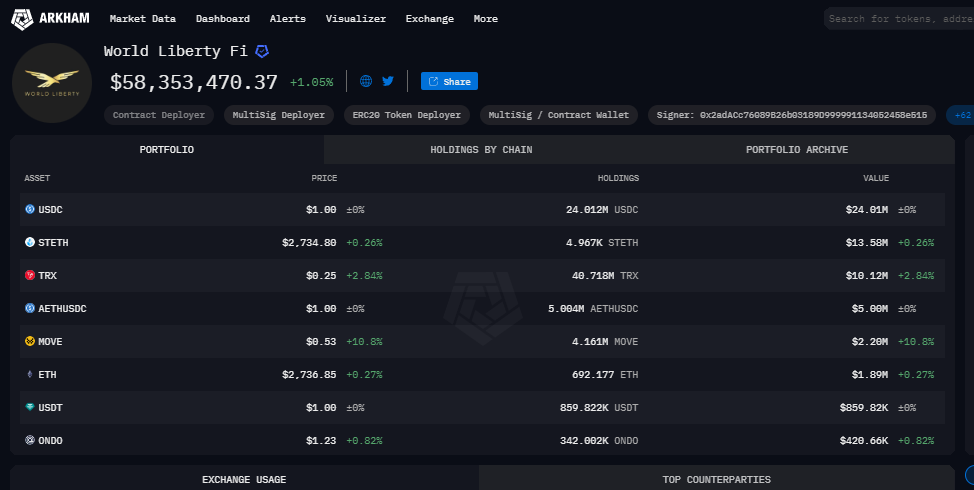

On January 20, 2025, Donald Trump officially began his second term as President of the United States, marking a historic moment for the Bit currency market - Bit reached a new high of $108,786 on the day of his inauguration, and the continuous increase in holdings of ETH, MAGA and other tokens by World Liberty Financial, Trump's company, is seen as a "weathervane" for the new government's Bit currency policy.

The cumulative on-chain holdings exceed $580 million, source: Arkham Intelligence

However, a survey report from the Independent Reserve Bit currency exchange in Australia reveals another side: only 31% of Australians believe Trump is beneficial to Bit currency (, reflecting the complex emotions of the global market towards the "Trump Bit currency New Deal". This article will delve into the dual impact of Trump's policies on the Bit currency industry, combined with global regulatory dynamics and market reactions, to reveal the deep-seated game behind this power transition.

Positive View: How Trump's Policies Reshape Bit Currency Hegemony

Regulatory Relaxation: From "Hostile Regulation" to "Innovation Sandbox"

In the first week of Trump's inauguration, he signed the "Digital Asset Competitiveness Executive Order", with core measures including:

- Weakening the SEC's enforcement power: The White House announced on January 25, 2025 that it will require the SEC to suspend enforcement actions against "non-securities tokens" and re-examine the attributes of tokens such as ETH and SOL;

- Establishing a federal Bit currency banking license: Allowing compliant exchanges to directly access the Federal Reserve payment system, with Coinbase already submitting an application;

- Tax relief: According to the 2025 tax reform draft of the U.S. Treasury Department, the capital gains tax for holders of Bit currency assets for more than 1 year will be reduced from 20% to 15%.

Market Reaction: Within 24 hours of the policy announcement, Coinbase's stock price soared 32%, and the trading volume of domestic U.S. exchanges jumped from 18% to 35%.

Institutional Participation: "Compliant Migration" of Traditional Capital

- Action of banking giants: JPMorgan Chase's technology white paper in February 2025 shows that JPMorgan Chase has launched the JPM Coin cross-chain settlement network, supporting institutional-level custody of BTC, ETH and SEI;

- Pension funds break the ice: The 2025 investment committee minutes of CalPERS show that the California Public Employees' Retirement System (CalPERS) has announced the allocation of 1% of its assets (about $40 billion) to a Bit coin ETF;

- Trump concept stock linkage: The correlation coefficient between the stock price of Digital World Acquisition Corp (Trump's media group shell company) and the price of MAGA tokens reaches 0.89.

Geopolitics: Bit currency Dollarization and "De-Chinafication"

- Tool for sanctions evasion: The U.S. Treasury Department's sanctions update list in February 2025 shows that the U.S. Treasury Department has approved the compliant conversion channel between the Venezuela Petro token and USDT, weakening the position of the renminbi in Latin American settlements;

- Miners returning: Cambridge Bit coin Electricity Consumption Index data shows that the share of Bit coin computing power in Texas has increased from 14% to 29%, while the share of mining pools with Chinese backgrounds has decreased from 21% to 9%.

Negative View: The "Dangerous Alliance" of Power and Capital

Policy Uncertainty: When "Twitter Governance" Meets the Bit currency Market

- Risk of speech manipulation: Trump's private Twitter account on February 10, 2025 said "considering a 50% tariff on Chinese miners", causing Bit coin to plummet 10% in 1 hour;

- Slow progress of legislation: The "Digital Commodity Consumer Protection Act" has been shelved due to partisan wrangling in Congress, and key provisions such as stablecoin audit standards have not yet been implemented.

Excessive Commercialization: Bit currency Bundled with Political Speculation

- Meme coin chaos: Etherscan's holdings analysis shows that the market value of the TRUMP token issued by the Trump family has exceeded $50 billion, but on-chain data shows that the top 10 addresses control 87% of the supply, leading to the collapse of most on-chain tokens;

- Expansion of lobbying groups: Coinbase, a16z and other companies spent $230 million on political lobbying in 2025, exceeding the total of the military-industrial and tobacco industries.

Global Regulatory Fragmentation: The "Resistance Sample" of Australia

- Escalation of bank blockades: The National Australia Bank (NAB) has frozen transfers to exchanges like Binance, causing fiat currency deposits to be delayed for more than 72 hours;

- Intensification of political party games: The leader of the center-right opposition party, Peter Dutton, has promised to overturn the Labor Party's Bit currency tax reform if elected, causing severe market volatility.

Case Study: The "Trump Paradox" in the Australian Market

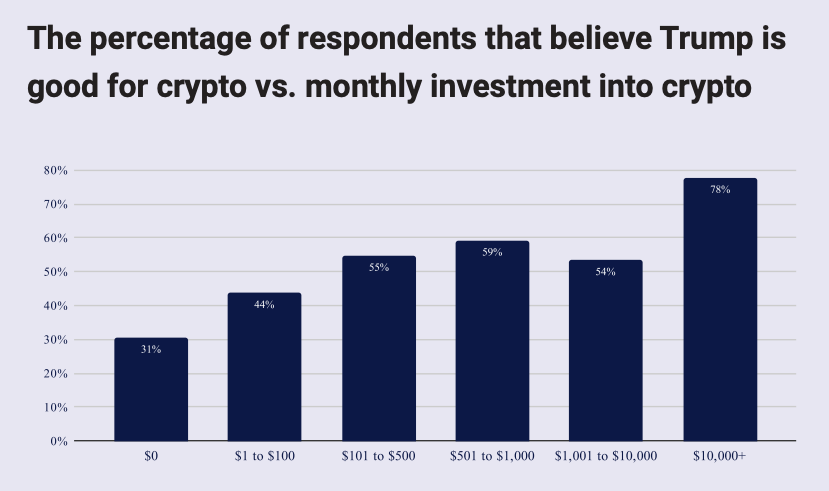

A recent survey by the Australian Bit currency exchange Independent Reserve reveals that although Trump's election victory had previously driven the Bit currency market upward, local Bit currency holders are divided on his influence in this field.

According to the survey, about 31% of Australians believe Trump is beneficial to Bit currency, 8% believe he is detrimental, and 60% are neutral. The survey included 2,100 Australian adults, showing that Bit currency investors have a relatively positive view of Trump.

Specifically, 50% of Bit currency investors believe Trump supports the industry, while only 20% of non-investors hold a positive view.

The more people invest in Bit currency, the more positive their view of Trump - those who invest $6,400 (10,000 AUD) per month in Bit currency have no negative views about him. Source: Independent Reserve

The survey also found that investors who invest more funds have a more positive view of Trump, especially those who invest $6,400 (10,000 AUD) per month, who have almost no negative views.

Another survey also shows that 59% of existing Bit currency investors are more inclined to vote for candidates who support Bit currency, indicating that about 2 million Australians may vote based on their Bit currency stance.

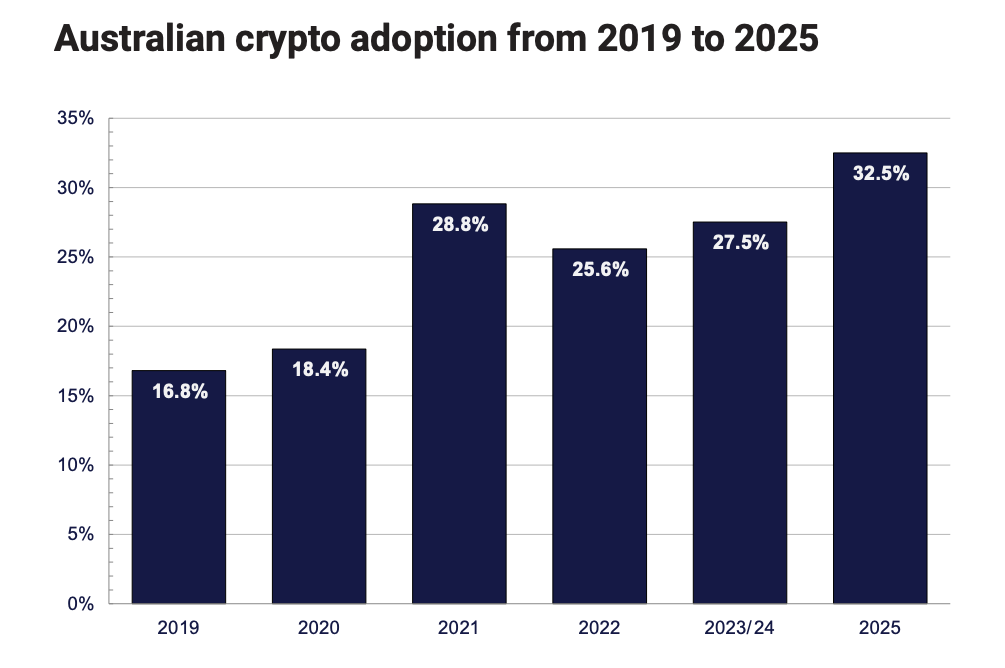

Over the past six years, the percentage of Australians who have or have had Bit currency has increased by nearly 16 percentage points. Source: Independent Reserve

Since 2019, the adoption rate of Bit currency in Australia has continued to grow, with about one-third of respondents currently or previously holding Bit currency, an increase of nearly 16 percentage points over the past six years.

However, about 20% of respondents said their banks had prevented or delayed their Bit currency purchases. Przelozny noted that while the Bit currency industry is developing rapidly, lack of clear regulatory policies and market volatility remain challenges.

Bit currency regulation in Australia remains unclear. Although the Labor government completed consultations on the Bit currency framework at the end of 2023, it is unclear when the legislative draft will be released. The opposition party's representative said that if elected, they would quickly introduce appropriate regulatory laws to ensure Australia's competitiveness in the global Bit currency market.

Conclusion: The "Trump Imprint" and Long-term Cost in the Bit currency World

Trump's Bit currency policy is like a double-edged sword: in the short term, regulatory relaxation and institutional participation have brought market euphoria, with Bit coin expected to hit $150,000 (Grayscale forecast report); but in the long run, regulatory arbitrage under political entanglement, capital monopoly, and global fragmentation may stifle the decentralized essence of Bit currency technology.

As Australian investors struggle with bank blockades and tax recoupment, perhaps we need to be more vigilant: the true victory of the Bit currency industry should not be to become a vassal of the power game, but to establish a new digital civilization order that transcends national borders.