On February 20th, the official launch of the Kaito airdrop took place, a high-profile AI-driven crypto project valued at $1.7 billion and backed by top-tier VCs, which has garnered widespread attention from the global community. As a representative of the "Yap-to-Earn" model, Kaito aims to take the InfoFi concept to new heights by rewarding users through social media interactions.

According to the information released by Kaito, the core mechanism of this airdrop revolves around "Yap points." The token economics show that 10% of the tokens are initially distributed to the community (56.67% of the total supply is planned for the community and ecosystem, 19.5% for long-term incentives), with the remaining tokens allocated to the team (35%) and early investors (8.3%). The official emphasizes support for long-term holders and provides incentives through "HODLer badges" and Genesis NFT bonuses.

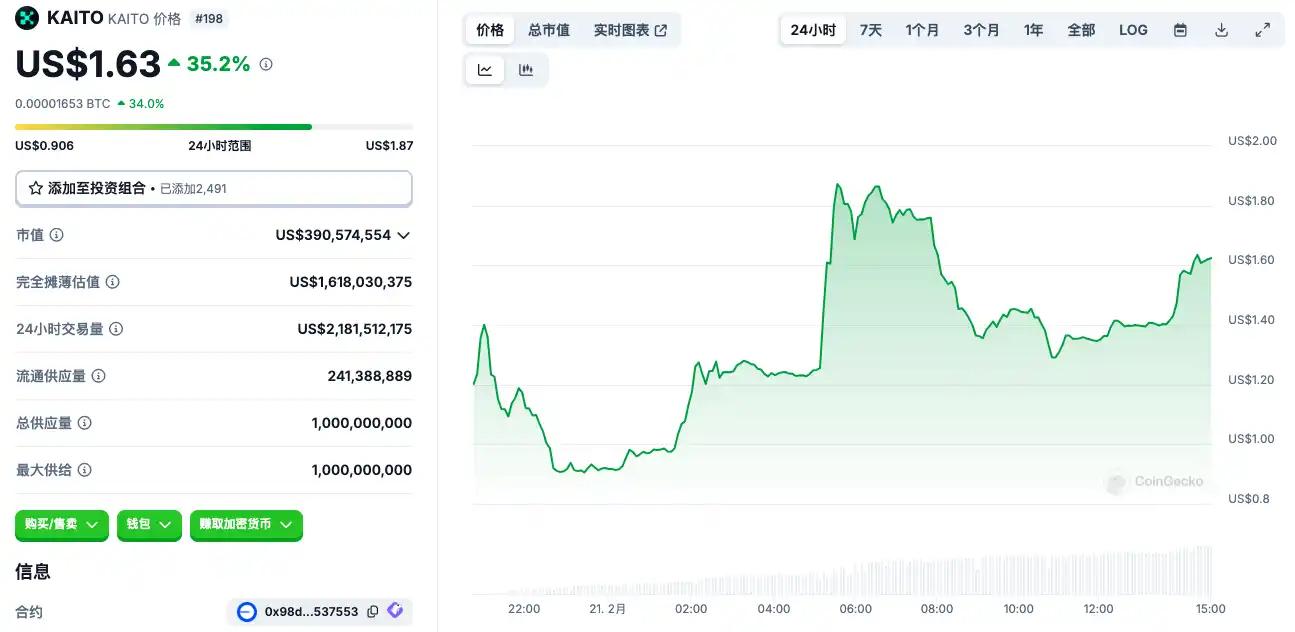

After the launch of KAITO, the market performance has been relatively stable. According to market data, compared to some airdrop projects that saw over 50% drops on the first day, the price fluctuation of the Kaito airdrop was around 30% on the day of the event.

However, the community has mixed opinions on the Kaito airdrop, with both positive comments on the project's generosity and potential, as well as strong dissatisfaction with the gap between expectations and the distribution rules.

What does the community think?

For many users, the biggest appeal of the Kaito airdrop lies in its "zero-cost, high-return" nature. X user @celiawan 2 mentioned that "most users got a four-to-six-figure airdrop without spending a dime," and therefore felt that the Kaito project team was quite sincere. Especially for ordinary retail investors and mid-tier users, rewards ranging from hundreds to thousands of dollars exceeded the expectations of many "zero-effort" projects, with some even believing that "it would be praised as a bold team if it were on other projects."

Additionally, some users recognize the value of Kaito, believing that Kaito's core value lies in its AI-powered information optimization. @BroLeonAus believes that "as a protocol that can already generate revenue and effectively change the behavioral patterns of a certain part of the industry ecology, it is much more meaningful to me than most of the wheel-reinventing ghost chains." "@bee 926 cn" also expressed optimism about Kaito's future in a tweet, despite the controversy surrounding the airdrop, and has already experienced its Kaito Pro product.

On the other hand, there is also significant negative feedback regarding the Kaito airdrop, mainly focused on "expectation management" and "distribution rules."

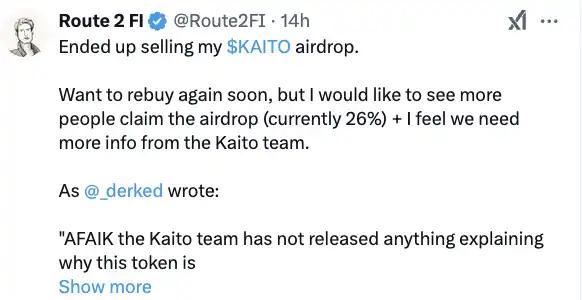

Many users felt that their expectations were inflated by the community hype before the airdrop. @Route 2 FI stated that they had expected to receive $50 to $120 from the airdrop, and although they might have been able to quickly buy back, they ultimately sold the KAITO airdrop.

@Cary_Zz mentioned that before the official token economics were published, there were rumors of "each Yap point being worth $100 or Genesis NFT holders receiving outsized rewards." However, the actual result was around $21 per Yap, with an overall 10% airdrop ratio, far below expectations, leaving the eager community greatly disappointed.

Regarding this, @zijingNFT stated that Kaito's expectations were overhyped, and many participating KOLs were mining Yaps for social purposes, "but now the coin price is too far from the ideal, and FUD is inevitable." @BroLeonAus shared a similar view, pointing out in a tweet that "more of the criticism stems from the gap in expectations," a sentiment that permeates most of the negative comments and has become the focus of community discussion.

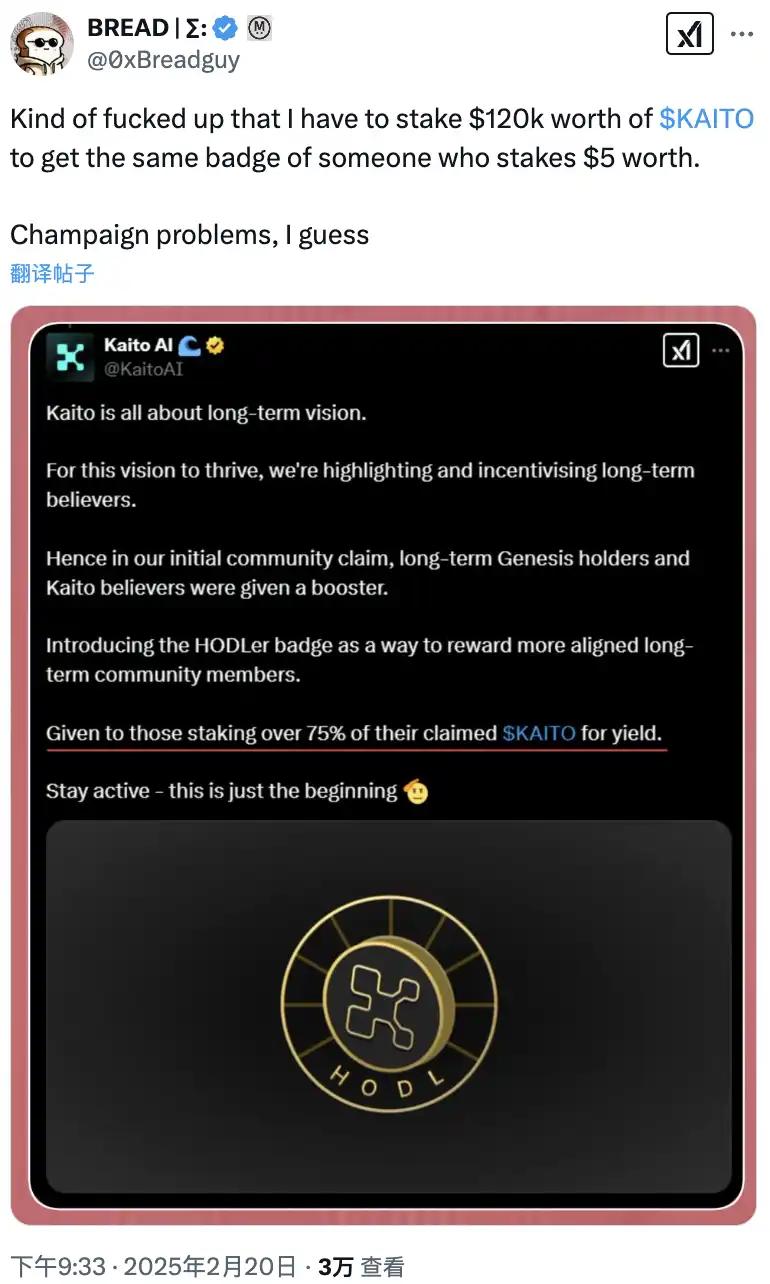

Not only did the returns fall short of expectations, but the "value alignment" requirement set by the project team in the airdrop distribution rules also sparked discontent.

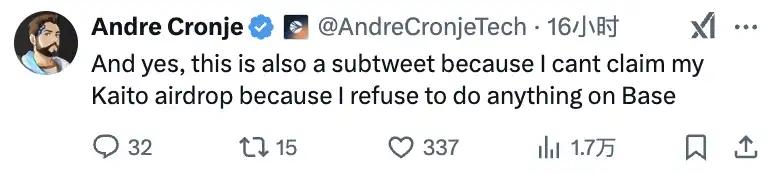

First, Sonic Labs founder Andre Cronje posted on social media that "for reasons I will never understand, Coinbase has refused to list S for 8 years. And since I refuse to do anything on Base, I am unable to claim the Kaito airdrop."

@hellosuoha pointed out that "value alignment is a very interesting behavior, and only you know whether you are aligned or not. In the end, those who got more are not satisfied, and those who got less are even more dissatisfied, only those who just registered and got the airdrop are satisfied." Some netizens even joked in the comments: "I never thought they could play with the concept of value alignment."

Not only the value alignment issue, but the specific distribution ratios of the airdrop also caused dissatisfaction in the community.

@yuyue_chris posted that "the reputation of top-tier and mid-to-low-tier KOLs is clearly polarized: the top-tier ones are generally not very satisfied; the mid-tier and low-tier ones are very grateful for $KAITO." @mdzzi shared a similar view, believing that "it's the victory of mid-tier KOLs, with the influence of top-tier KOLs being harvested."

Regarding this, a KOL listed their own data. @0x Breadguy mentioned that "it's a bit outrageous that I have to stake $120,000 worth of $KAITO to get the same badge as someone who staked $5."

@0x0funky speculated that "the Yaps score is not proportional to the Kaito given," with one Yap being around 7.5 Kaito, and many 20-Yap allocations being calculated as 20 Kaito, "it should be a minimum guarantee, and then additional Kaito based on the Yaps score."

@CyberPhilos combined the alignment with the Kaito project's values and the distribution ratios, speculating that "those who flattered Kaito, the Yap:Kaito ratio is 1:20 or even higher; the neutral ones, the Yap:Kaito ratio is 1:10; those who have criticized Kaito before, the Yap:Kaito ratio is 1:2."

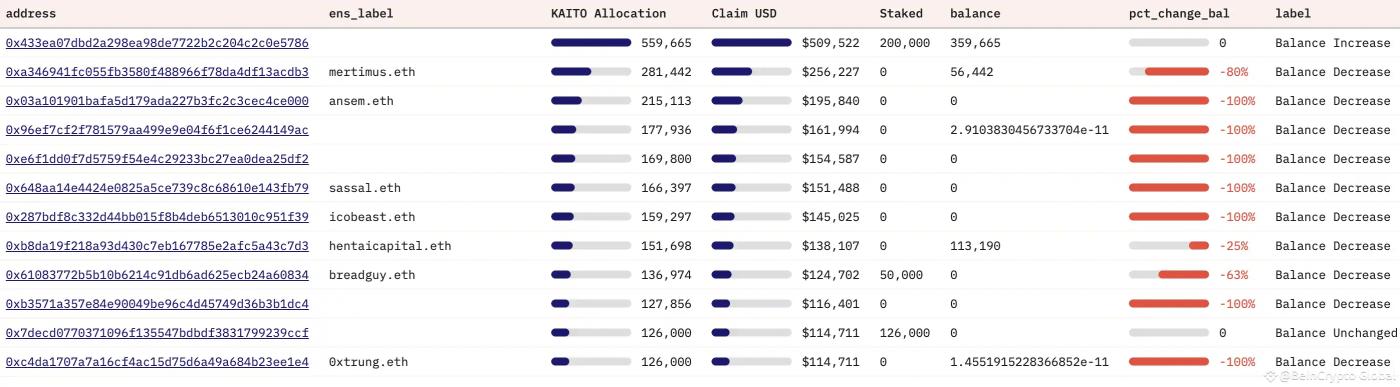

Additionally, the rapid sell-off by large airdrop recipients (on-chain data shows that 7 out of the top 12 addresses cleared their holdings) and the lack of a lock-up period have also raised concerns in the community about the project falling into a cycle of "hype-surge-dump" short-term speculation.

How did the AI data tool project perform after launching its token?

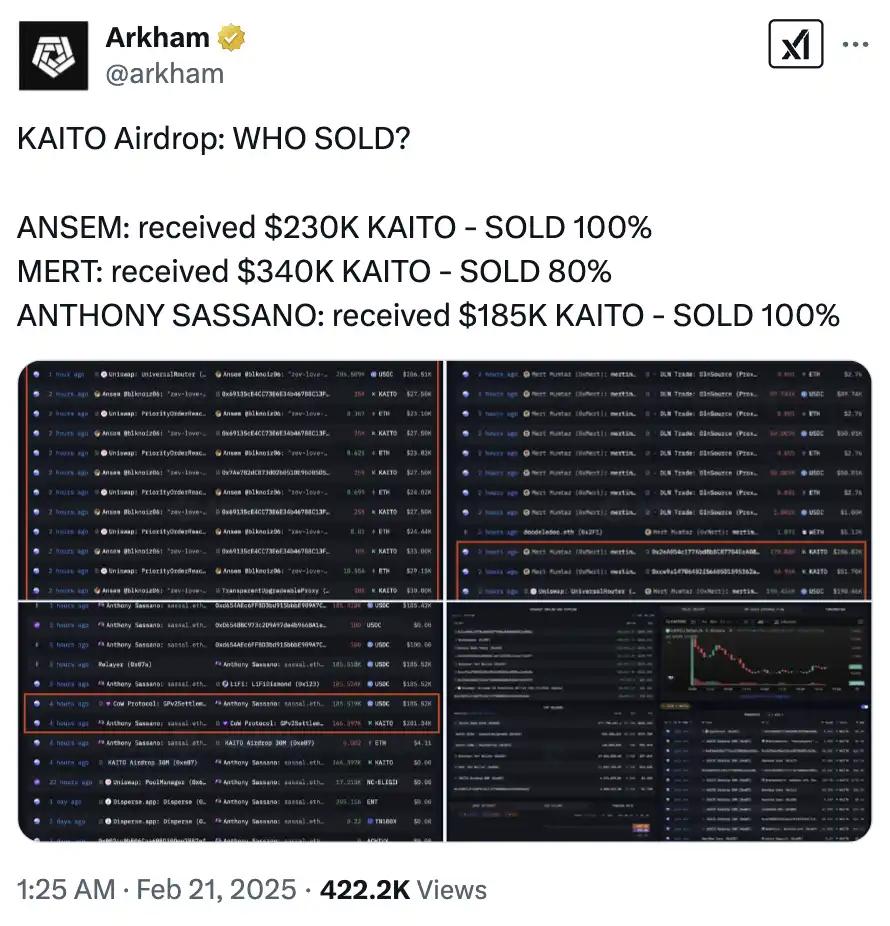

While the community was engaged in heated discussions around the Kaito airdrop, another AI data tool project launched its token on the 21st, showcasing a list of KOLs who received Kaito airdrops and using its own AI tool to analyze the KOLs' sell-off ratios. This was not the first time a data tool project has launched a token. Previously, Binance Launchpad had also hosted the launch of Arkham (ARKM), a blockchain data intelligence platform that uses AI (the Ultra engine) to associate blockchain addresses with real-world entities and provide insights and analysis on transaction behaviors.

Related reading: After Arkham, which other data tools have not yet launched their tokens?

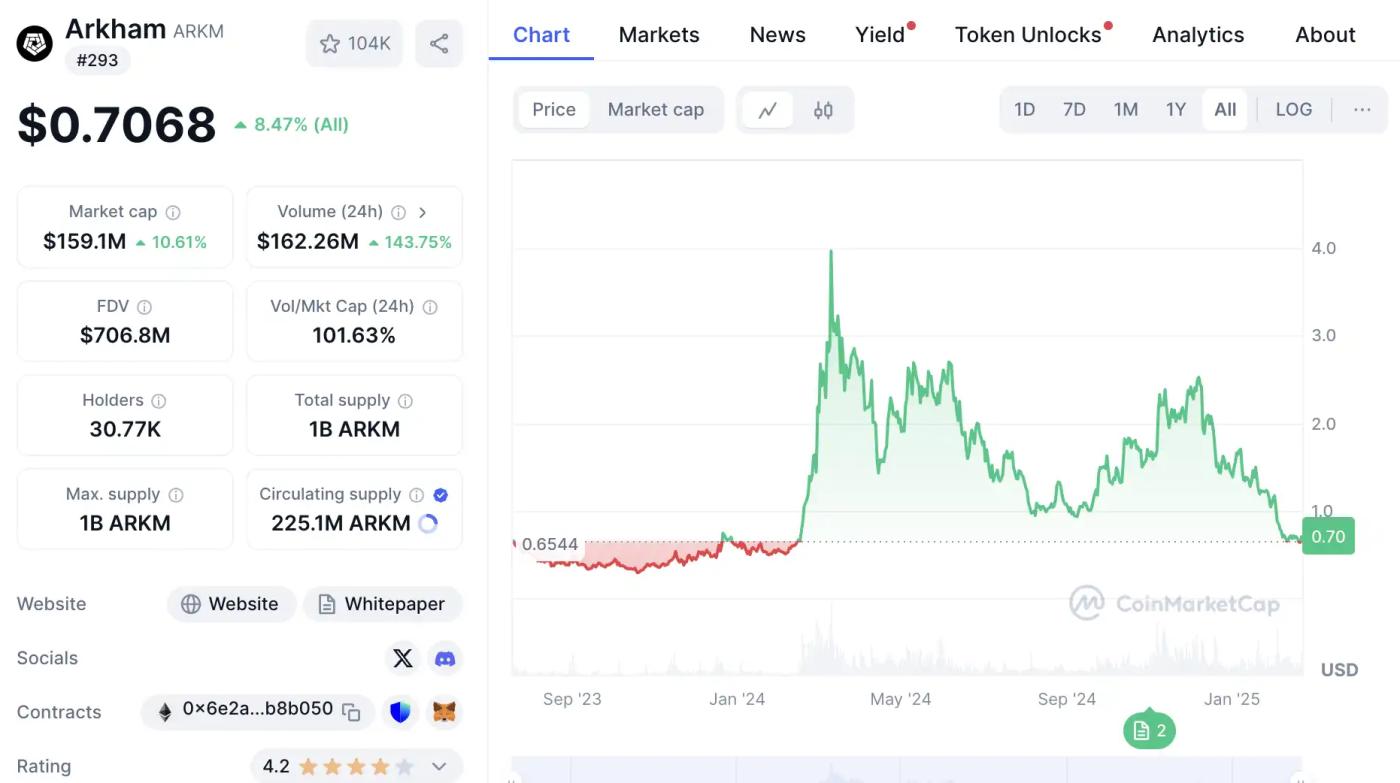

Similar to Kaito, Arkham is also classified as an AI data tool, with the goal of using technical means to analyze the fragmentation of information in the encrypted world and provide users with "Alpha opportunities". The difference is that Kaito is more inclined towards social data, while Arkham focuses on on-chain data. So how is the current status of Arkham, the first to issue a token for a data tool? In terms of price, according to market data, the current price of $ARKM is $0.71, with a historical high of $3.12 on March 10, 2024, a drop of nearly 80% from the current price, indicating high volatility. Perhaps due to being classified as an AI project, the price has fluctuated with the rise and fall of the entire AI sector.

In the current market environment where the AI sector is performing averagely, can Kaito's token issuance break the dormant state of various AI projects and bring the market heat back? Or will it follow the path of Arkham, fluctuating with the entire sector? Or will it compete with Arkham for the ecological position of AI tools? We will have to wait and see.