After a few days of struggle, Ethereum has finally regained its footing, breaking through the $2,800 mark, and the current trading price has fallen below the $2,700 mark. The bulls have been unable to gain momentum, and the selling pressure has kept ETH below the key resistance level.

On Friday, the market was hit by negative news, as one of the top cryptocurrency exchanges, Bybit, was hacked, resulting in the loss of $1.4 billion worth of ETH. This event triggered a panic sell-off, causing the price of Ethereum to drop to a relatively low demand level, adding more uncertainty to its short-term outlook.

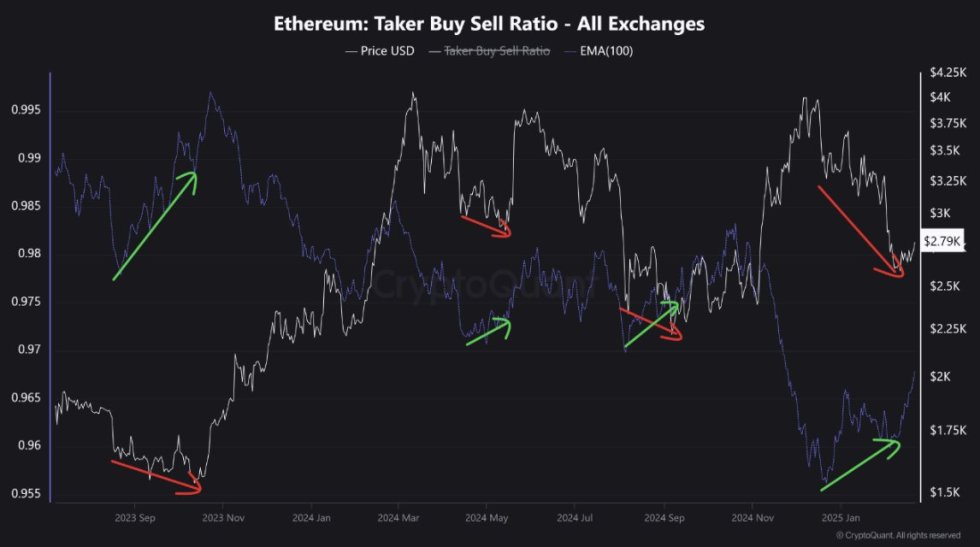

However, data from CryptoQuant shows that the market may be about to reverse. Their latest analysis shows that Ethereum's buy-side volume is exhibiting a bullish divergence - a key indicator that suggests that despite the price decline, buy-side pressure is increasing. Historically, this divergence has signaled the start of a recovery rally, as traders and institutions accumulate ETH at lower levels in anticipation of a rebound.

As ETH consolidates and bullish signs emerge, the next few days will be crucial in determining whether Ethereum can reclaim the $2,700-$2,800 range or if further downside to $2,600 is in store. Traders are now focused on key breakout levels to confirm a strong recovery rally.

Ethereum Prepares for a Comeback

Ethereum has been struggling as investors grow increasingly impatient with the massive selling pressure and negative sentiment surrounding the second-largest cryptocurrency. Since late December, ETH has been steadily declining, with no clear signs of recovery. The bulls have failed to reclaim key resistance levels, and the bears have continued to control the market, pushing the price lower with each failed breakout attempt.

Despite this bearish trend persisting for a long time, on-chain data suggests a potential turnaround may be in the works. CryptoQuant shared key data from X, revealing an interesting pattern that, historically, has marked the end of a bearish trend and the start of a bullish phase.

Ethereum Taker Buy-Sell Ratio | Source: CryptoQuant on X

According to their analysis, when a bullish divergence occurs (Ethereum price declining, but taker buying volume increasing), the historical trend suggests that selling pressure is starting to wane. This typically indicates that buying momentum is gaining strength, as traders begin to accumulate ETH in anticipation of a trend reversal.

Today, Ethereum is exhibiting a bullish buy-side divergence, similar to previous instances that led to bullish breakouts. While the market remains uncertain, this could be an early sign of a new bullish phase. If Ethereum can maintain above current demand levels and reclaim $2,800, a strong rebound may be in the cards.

ETH Tests Short-Term Demand

Ethereum is currently trading at $2,760, with a flat performance last Friday, affected by the Bybit hack news and overall market uncertainty, with Ethereum price declining by 4%. The bulls are struggling to reclaim the key resistance level, and the current level lacks strong demand, raising concerns about Ethereum's recovery potential.

For Ethereum to confirm a bullish breakout, it must regain the $2,800 mark and break above $3,000 to gain sustained upward momentum. However, the lack of significant buying pressure suggests that unless buyers step in soon, ETH may continue to consolidate in a narrow range.

Despite the lack of direct strength, ETH remains above the $2,600 support level, which has been a critical demand zone in recent weeks. As long as Ethereum holds above $2,600 and begins to reclaim the key $2,800+ levels, the possibility of a bullish reversal remains. If demand increases and ETH can firmly establish itself above $2,800, a bullish phase could start at any time. However, if Ethereum fails to defend the support, it may face further downward pressure in the coming days.