Followin' the past few trading days, the price of Bitcoin has risen above $98,000, strengthening the expectation of continued upward momentum.

However, the cryptocurrency subsequently pulled back to $96,611.89, losing the slight support of $97,000.

Due to resistance from a downtrend line and weakening demand, Bitcoin is facing a volatile trend.

VX: TTZS6308

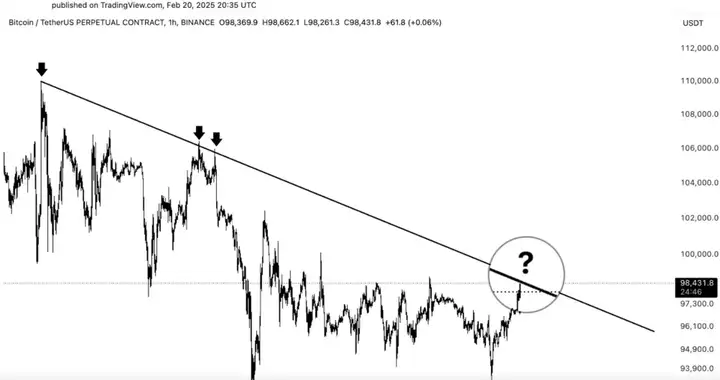

Bitcoin price struggles at a key resistance level

Bitcoin recently broke through $98,000, boosting the positive sentiment among traders and investors.

The breakthrough of this important price level has sparked speculation about when Bitcoin will reach $100,000.

However, the current price trend seems unable to maintain the high expectations built up in the market over the past few days.

Despite the recent price increase, Bitcoin is still struggling near the key resistance of the downtrend line on the hourly chart.

Bitcoin has attempted to break through this downtrend line three times in a row, but all have failed.

The current upward trend of Bitcoin may face risks, as if it fails to break through the resistance, it may lead to a stagnation of the bullish momentum.

If Bitcoin fails to break through the trend line, the market may enter an adjustment phase, which could hinder its ability to reach the $100,000 mark.

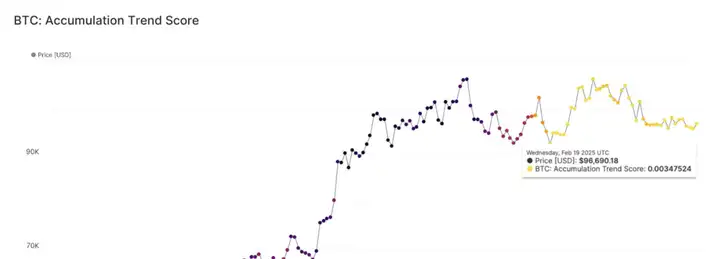

Cumulative index shows a decline in investment activity

Furthermore, the cumulative trend score also shows that the buying activity of large investors is declining.

Large institutions in the market have temporarily suspended their Bitcoin purchases, a signal that typically foreshadows a bearish trend.

The accumulation activity of institutional investors in Bitcoin peaked between HT 2024 and ONT 2025, after which they began to withdraw funds from the market.

This is in stark contrast to the early stages of the market cycle, when Bitcoin's purchase volume was higher.

Currently, both large institutional investors and retail investors are losing interest in Bitcoin.

Weak market demand is putting pressure on Bitcoin's price, undermining its ability to maintain new gains.

The slowdown in investment flow may make it more difficult for Bitcoin to break through key price levels, especially the $100,000 mark.

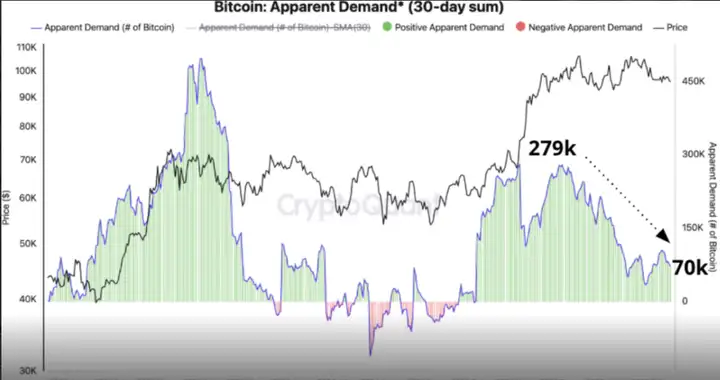

Plummeting Bitcoin demand

Data shows that market demand for Bitcoin has dropped significantly, from a peak of C98 in December 2024 to 70,000 in February 2025.

The decline in demand has a negative impact on Bitcoin's price, weakening trading volume and market momentum, and putting the price at risk of a correction.

Investors are facing increased economic volatility and inflation concerns, which are suppressing market demand.

The situation is further exacerbated by the fact that large institutions have also reduced their Bitcoin holdings, and retail investors lack the interest to support the market's upward momentum.

At the same time, due to the lack of positive momentum in the market, institutional investors are taking profits.

Pro-crypto policies in the US may only have an impact on the market in the second half of 2025.

As momentum funds reduce their holdings of Bitcoin and Ethereum, the momentum of both Bitcoin and Ethereum is weakening. Ethereum's technical indicators have already turned negative in particular.

Bitcoin's trading price is $96,621.42, and the cryptocurrency is facing resistance around $100,000 and has fallen below the critical $97,450 support area.

If Bitcoin can break through $100,000, the next target may be $102,000. However, whether Bitcoin can maintain its bullish momentum and escape the current weakness remains to be seen.